A travel fund goal concentrates on saving money specifically for short-term, enjoyable trips, ensuring dedicated finances for vacations without disrupting daily expenses. In contrast, a mini-retirement goal involves accumulating a larger sum to support extended breaks or lifestyle changes, offering freedom from work for months or years. Prioritizing these goals depends on your financial timeline and desired travel frequency, helping manage money effectively for both immediate enjoyment and long-term relaxation.

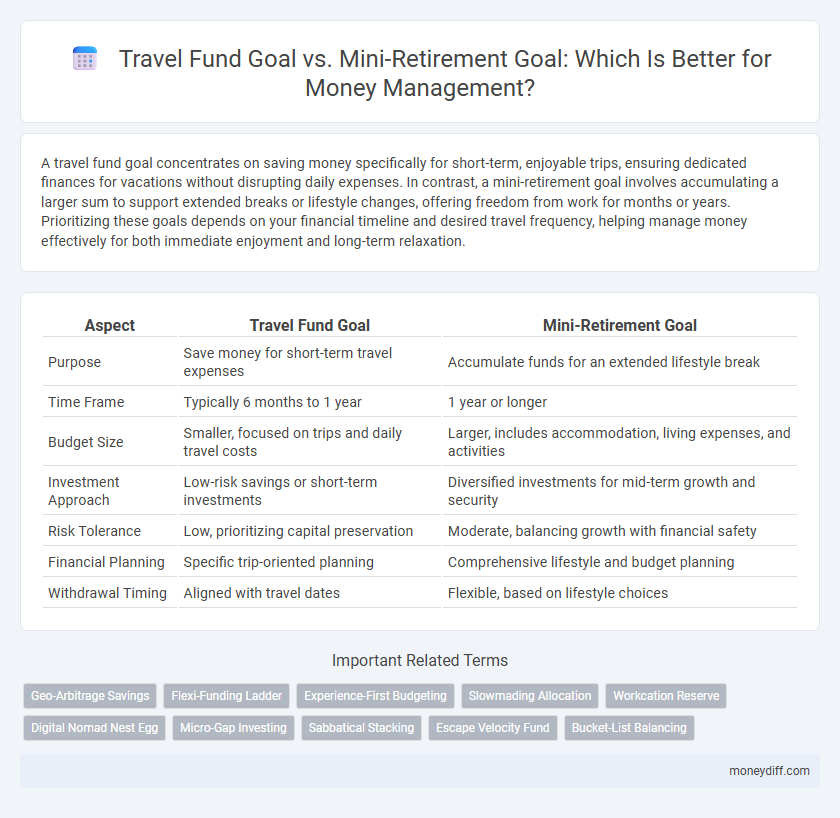

Table of Comparison

| Aspect | Travel Fund Goal | Mini-Retirement Goal |

|---|---|---|

| Purpose | Save money for short-term travel expenses | Accumulate funds for an extended lifestyle break |

| Time Frame | Typically 6 months to 1 year | 1 year or longer |

| Budget Size | Smaller, focused on trips and daily travel costs | Larger, includes accommodation, living expenses, and activities |

| Investment Approach | Low-risk savings or short-term investments | Diversified investments for mid-term growth and security |

| Risk Tolerance | Low, prioritizing capital preservation | Moderate, balancing growth with financial safety |

| Financial Planning | Specific trip-oriented planning | Comprehensive lifestyle and budget planning |

| Withdrawal Timing | Aligned with travel dates | Flexible, based on lifestyle choices |

Defining Travel Fund and Mini-Retirement Goals

A Travel Fund goal involves setting aside money specifically for vacations or trips, ensuring funds are available without impacting daily expenses. A Mini-Retirement goal emphasizes saving for extended breaks from work, often lasting several months, enabling a more immersive and long-term travel experience. Both goals require disciplined budgeting and clear timelines to align with personal financial management strategies.

Purpose and Motivation: Leisure vs Lifestyle Design

Travel fund goals emphasize short-term leisure, motivating individuals to save specifically for vacations or trips that provide immediate relaxation and adventure. Mini-retirement goals focus on long-term lifestyle design, inspiring sustained savings to enable extended breaks from work for personal growth, exploration, and work-life balance. Both approaches align financial planning with distinct motivations: immediate enjoyment versus transformative life experiences.

Time Horizon and Planning Differences

Travel fund goals typically have a short-to-medium time horizon, requiring focused monthly saving plans and budgeting for specific trip dates, while mini-retirement goals involve long-term financial planning with more flexible timelines that accommodate extended breaks from work. Travel fund management emphasizes accumulating a finite amount quickly, often prioritizing liquidity and immediate expense forecasting, whereas mini-retirement planning integrates sustainable income streams, investment growth, and risk management to support multiple years of financial independence. Understanding these time horizon distinctions guides tailored saving strategies and informed allocation of resources to align with individual lifestyle objectives.

Budgeting Approaches for Each Goal

Travel fund goals require dynamic budgeting that allocates funds for fluctuating expenses like airfare, accommodation, and daily activities, emphasizing short-term savings bursts. Mini-retirement goals demand a more structured, long-term budgeting approach, focusing on steady contributions to investment accounts and emergency reserves to sustain periods of reduced income. Tailoring budgeting strategies to the time horizon and expense predictability of each goal ensures optimal financial preparation and resource allocation.

Investment Strategies: Short-Term vs Long-Term

Investment strategies for travel fund goals prioritize liquidity and low risk, favoring short-term options like high-yield savings accounts or money market funds to ensure funds are readily available. Mini-retirement goals require long-term investment approaches, such as diversified stock portfolios or index funds, to maximize growth and compound returns over several years. Balancing short-term stability with long-term growth is essential for effective money management across varying financial objectives.

Flexibility and Adaptability in Goal Setting

Travel fund goals prioritize flexibility by allowing adjustments based on changing trip plans, destination costs, and duration, enabling better alignment with real-time circumstances. Mini-retirement goals emphasize adaptability by incorporating longer-term financial planning and phased withdrawals, supporting extended breaks without disrupting overall financial stability. Both approaches require dynamic budgeting strategies to respond effectively to evolving personal needs and market fluctuations.

Risk Management in Travel Fund vs Mini-Retirement

Travel fund goals prioritize liquidity and low-risk investments to ensure immediate access to money for unforeseen travel expenses. Mini-retirement goals involve longer time horizons, allowing for diversified portfolios with moderate risk to maximize growth while managing potential downturns. Effective risk management in travel funds emphasizes capital preservation, whereas mini-retirement planning balances risk and return to achieve sustainable financial flexibility.

Measuring Success and Tracking Progress

Measuring success in a travel fund goal involves regularly tracking contributions against the target amount and monitoring travel deals or price trends to optimize spending. For mini-retirement goals, progress is gauged by assessing savings growth, passive income streams, and lifestyle expenses to ensure sustainable funding over the retirement period. Utilizing budgeting apps and financial dashboards can enhance accuracy in tracking and provide real-time insights for both financial objectives.

Psychological and Lifestyle Impacts

Travel fund goals enhance motivation by offering short-term rewards that reduce financial stress and increase the willingness to save consistently. Mini-retirement goals promote long-term lifestyle changes, encouraging strategic planning and fostering a sense of freedom that improves overall well-being. Prioritizing either goal influences psychological resilience and shapes sustainable money management habits aligned with personal values.

Which Goal Suits Your Financial Situation?

Choosing between a travel fund goal and a mini-retirement goal depends on your current financial stability and long-term plans; a travel fund suits those with limited savings aiming for short-term experiences, while a mini-retirement requires substantial savings and steady income to support extended time off work. Assess your monthly cash flow, emergency savings, and debt levels to determine which goal is realistic and sustainable. Prioritize clear budgeting and financial discipline to align your money management strategy with the chosen goal.

Related Important Terms

Geo-Arbitrage Savings

Geo-arbitrage savings significantly boost travel fund goals by leveraging lower living costs abroad to stretch budgets for extended trips. Mini-retirement goals prioritize long-term financial independence through strategic geo-arbitrage, enabling sustained living off passive income in affordable locations.

Flexi-Funding Ladder

The Flexi-Funding Ladder optimizes money management by allocating resources between a Travel Fund goal for short-term adventures and a Mini-Retirement goal for extended life breaks, enhancing cash flow flexibility and goal-specific savings. This structured approach adapts to varying time horizons and financial priorities, maximizing the effectiveness of each fund's designated purpose.

Experience-First Budgeting

Experience-First Budgeting prioritizes allocating funds toward travel goals to enhance life experiences, whereas mini-retirement goals focus on saving for extended breaks from work. Allocating money strategically between immediate experiential travel and long-term mini-retirement ensures balanced financial planning for both short-term adventure and future lifestyle freedom.

Slowmading Allocation

Travel fund goals prioritize regularly setting aside smaller amounts to cover future vacations without disrupting daily finances, while mini-retirement goals require more substantial, slowmading allocation to build a larger nest egg supporting extended breaks from work. Slowmading allocation balances consistent, gradual contributions across both goals, optimizing cash flow and long-term financial stability.

Workcation Reserve

Workcation Reserve prioritizes allocating funds specifically for blending work and leisure travel, unlike traditional travel funds aimed solely at vacations, ensuring seamless financial support during extended stays abroad. Mini-retirement goals focus on accumulating enough savings to pause full-time work for months or years, making Workcation Reserve an ideal strategy for ongoing work-life balance without depleting long-term retirement savings.

Digital Nomad Nest Egg

A Digital Nomad Nest Egg prioritizes sustainable travel fund goals by allocating money specifically for ongoing location flexibility, contrasting with mini-retirement goals which focus on a lump sum for extended, temporary breaks. Effective money management for a Digital Nomad involves balancing short-term travel expenses and long-term savings to maintain constant mobility without financial instability.

Micro-Gap Investing

Micro-Gap Investing strategically allocates small, incremental funds toward specific goals like travel funds or mini-retirement, optimizing cash flow without major lifestyle disruptions. Prioritizing a travel fund targets short-term, experiential spending, while mini-retirement goals require larger, long-term capital accumulation, making micro-investments a flexible method to bridge financial gaps efficiently.

Sabbatical Stacking

Sabbatical stacking maximizes financial efficiency by combining travel fund goals with mini-retirement objectives, allowing individuals to accumulate savings for extended breaks without compromising short-term plans. This strategy optimizes cash flow and leverages compound interest to support prolonged sabbaticals while maintaining regular financial commitments.

Escape Velocity Fund

The Escape Velocity Fund is specifically designed to accelerate financial independence by creating a sufficient travel fund that supports extended trips without derailing long-term mini-retirement goals. Prioritizing this fund ensures travelers maintain momentum toward sustaining lifestyle freedom while enabling spontaneous adventure opportunities.

Bucket-List Balancing

Prioritizing a travel fund goal allows for structured saving towards specific trips, enabling regular, achievable experiences without depleting long-term savings. In contrast, a mini-retirement goal emphasizes accumulating a larger sum to fund extended breaks, requiring disciplined budgeting to balance immediate travel desires with future financial security.

Travel fund goal vs Mini-retirement goal for money management. Infographic

moneydiff.com

moneydiff.com