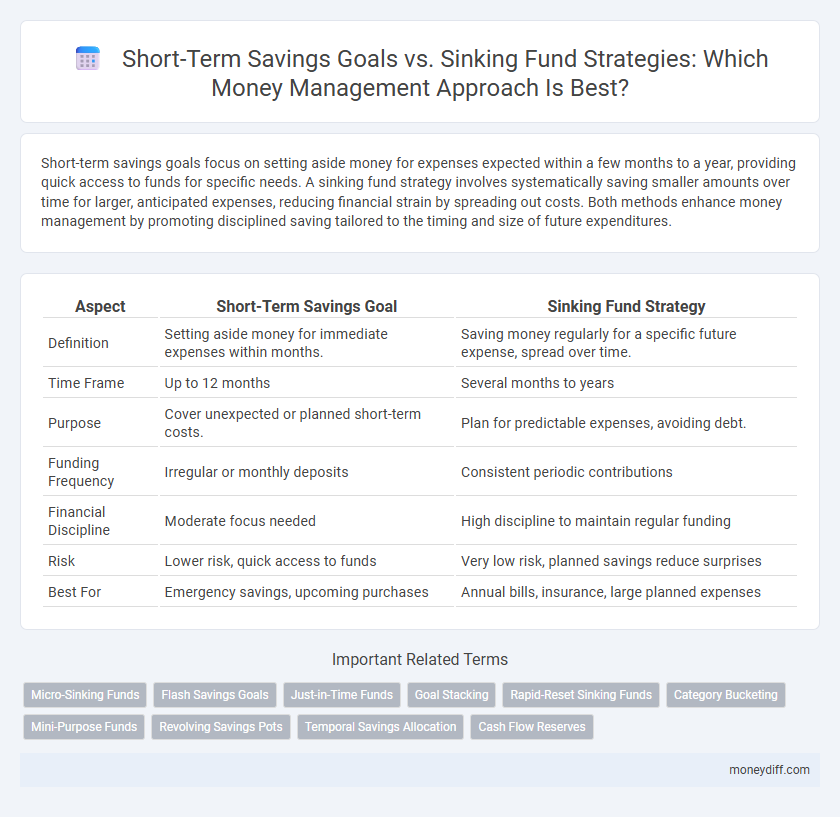

Short-term savings goals focus on setting aside money for expenses expected within a few months to a year, providing quick access to funds for specific needs. A sinking fund strategy involves systematically saving smaller amounts over time for larger, anticipated expenses, reducing financial strain by spreading out costs. Both methods enhance money management by promoting disciplined saving tailored to the timing and size of future expenditures.

Table of Comparison

| Aspect | Short-Term Savings Goal | Sinking Fund Strategy |

|---|---|---|

| Definition | Setting aside money for immediate expenses within months. | Saving money regularly for a specific future expense, spread over time. |

| Time Frame | Up to 12 months | Several months to years |

| Purpose | Cover unexpected or planned short-term costs. | Plan for predictable expenses, avoiding debt. |

| Funding Frequency | Irregular or monthly deposits | Consistent periodic contributions |

| Financial Discipline | Moderate focus needed | High discipline to maintain regular funding |

| Risk | Lower risk, quick access to funds | Very low risk, planned savings reduce surprises |

| Best For | Emergency savings, upcoming purchases | Annual bills, insurance, large planned expenses |

Understanding Short-Term Savings Goals

Short-term savings goals are financial targets set to be achieved within a few months to a year, such as building an emergency fund or saving for a vacation. These goals require disciplined budgeting and consistent contributions to a dedicated account to ensure funds are available when needed. Understanding short-term savings goals helps individuals prioritize expenses and avoid unnecessary debt by planning for immediate financial needs.

What is a Sinking Fund Strategy?

A sinking fund strategy involves setting aside small, regular amounts of money over time to cover a specific future expense, ensuring funds are available without incurring debt. This approach contrasts with traditional short-term savings goals by promoting disciplined, incremental saving for planned purchases or bills. Utilizing sinking funds enhances financial stability by preventing large, unexpected financial burdens and improving budget management.

Key Differences Between Short-Term Savings and Sinking Funds

Short-term savings goals are typically used for expenses expected within a few months to a year, focusing on accessibility and quick accumulation of funds. Sinking funds, on the other hand, are designated for specific future expenses with a longer timeline, involving regular contributions spread over time to avoid financial strain. The key difference lies in the planning horizon and allocation: short-term savings aim for quick availability, while sinking funds emphasize systematic saving for predictable, planned costs.

Pros and Cons of Short-Term Savings Goals

Short-term savings goals offer quick financial wins and enhance motivation by setting achievable targets within months, improving cash flow management and providing a buffer for unexpected expenses. However, their limited timeframe may encourage impulsive spending and overlook long-term financial stability, leading to potential gaps in emergency funds. Unlike sinking funds that allocate money systematically for known future expenses, short-term goals can lack structured discipline, risking inconsistent savings habits.

Advantages and Disadvantages of Sinking Funds

Sinking funds offer precise budgeting advantages by allocating specific amounts regularly toward future expenses, reducing debt reliance and financial stress. However, sinking funds may limit financial flexibility as funds are reserved for predetermined goals, potentially restricting resources for unexpected needs or emergencies. This strategy fosters disciplined savings habits but requires consistent commitment and accurate forecasting of expenses to avoid shortfalls.

When to Use a Short-Term Savings Goal

Use a short-term savings goal when you need to accumulate funds for expenses occurring within the next three to twelve months, such as emergency funds or planned purchases. This strategy helps maintain liquidity and minimizes the risk of tapping into long-term investments prematurely. Ideal for managing predictable, imminent expenses without incurring debt, short-term savings goals support financial stability and budgeting discipline.

Ideal Scenarios for Sinking Fund Strategies

Sinking fund strategies are ideal for managing predictable expenses such as annual insurance premiums, holiday gifts, or vehicle maintenance, allowing for gradual savings without financial strain. This method reduces reliance on credit and enhances budget stability by allocating small, consistent amounts over time. It works best in scenarios where expenses are fixed and recurring, ensuring funds are available when needed without disrupting monthly cash flow.

How to Set Up Short-Term Savings for Quick Wins

Establishing short-term savings goals involves identifying specific financial objectives achievable within a few months to a year, such as emergency funds or minor purchases. Allocate a dedicated savings account and automate regular transfers to build funds steadily, tracking progress to maintain motivation. Prioritize high-interest accounts to maximize growth while maintaining liquidity for quick access during urgent needs.

Steps to Build Effective Sinking Funds

Establishing effective sinking funds requires clear identification of specific expenses, setting realistic savings targets, and determining a consistent contribution schedule. Tracking progress through detailed budgeting tools ensures timely adjustments and prevents overspending. Prioritizing multiple sinking funds for different goals enhances financial stability and reduces reliance on credit during unexpected costs.

Choosing the Right Strategy for Your Financial Goals

Selecting between a short-term savings goal and a sinking fund strategy depends on the nature and timeline of your financial objectives. Short-term savings goals typically address immediate expenses within a year, offering quick access to funds, while sinking funds allocate money gradually for predictable future costs, reducing financial strain. Aligning your choice with specific expenses and cash flow patterns ensures efficient money management and goal attainment.

Related Important Terms

Micro-Sinking Funds

Micro-sinking funds optimize short-term savings goals by breaking large expenses into smaller, manageable amounts set aside regularly, ensuring disciplined money management and avoiding financial strain. This strategy enhances cash flow control and reduces reliance on credit by targeting specific purchases through incremental contributions.

Flash Savings Goals

Flash savings goals provide a rapid, targeted approach to short-term savings by setting aside small, frequent amounts for immediate expenses or emergencies, enhancing financial agility. This strategy contrasts with sinking funds by emphasizing quick accumulation for specific flash goals, optimizing cash flow without long-term commitment.

Just-in-Time Funds

Short-term savings goals focus on accumulating funds quickly for immediate expenses, while a sinking fund strategy breaks down large future costs into manageable payments over time, ensuring just-in-time availability of money without disrupting overall budgeting. Utilizing sinking funds allows precise timing of expenditures and reduces financial strain by aligning savings with upcoming obligations.

Goal Stacking

Goal stacking enhances money management by integrating short-term savings goals with sinking fund strategies, allowing multiple financial objectives to be pursued simultaneously without disrupting overall budget flow. Prioritizing and aligning contributions to various sinking funds optimizes cash flow, prevents debt accumulation, and ensures systematic progress toward interconnected financial targets.

Rapid-Reset Sinking Funds

Rapid-Reset Sinking Funds prioritize frequent, smaller contributions targeting specific short-term expenses to enhance cash flow flexibility and prevent budget disruptions. This strategy outperforms traditional short-term savings goals by maintaining consistent fund availability, minimizing financial stress during unexpected costs.

Category Bucketing

Category bucketing in short-term savings goals organizes funds by specific expenses like emergencies, vacations, or holiday gifts, ensuring clear financial priorities and avoiding overlap. The sinking fund strategy enhances this approach by setting aside smaller amounts regularly for known future expenses, creating dedicated buckets that improve budgeting accuracy and prevent overspending.

Mini-Purpose Funds

Mini-purpose funds, a key component of sinking fund strategy, allocate specific amounts of money to distinct short-term savings goals, enhancing financial discipline and clarity. This method contrasts with broad short-term savings goals by providing targeted, segmented funds that reduce impulse spending and improve budgeting accuracy.

Revolving Savings Pots

Revolving savings pots enable flexible allocation of funds toward short-term savings goals and sinking fund strategies, allowing for dynamic adjustments based on changing financial priorities. This method enhances money management by maintaining liquidity while systematically reserving money for upcoming expenses or emergency funds.

Temporal Savings Allocation

Short-term savings goals require allocating funds for immediate expenses within months, while sinking fund strategies distribute money over longer periods for upcoming large purchases, optimizing temporal savings allocation by balancing liquidity and planned expenditure. Prioritizing separate accounts for each short-term goal enhances tracking efficiency and prevents fund commingling, ensuring disciplined financial management.

Cash Flow Reserves

Short-term savings goals prioritize immediate cash flow reserves to cover unexpected expenses within a few months, ensuring liquidity without disrupting regular finances. The sinking fund strategy allocates specific amounts regularly for planned future expenses, promoting systematic cash flow management and preventing debt accumulation.

Short-Term Savings Goal vs Sinking Fund Strategy for money management. Infographic

moneydiff.com

moneydiff.com