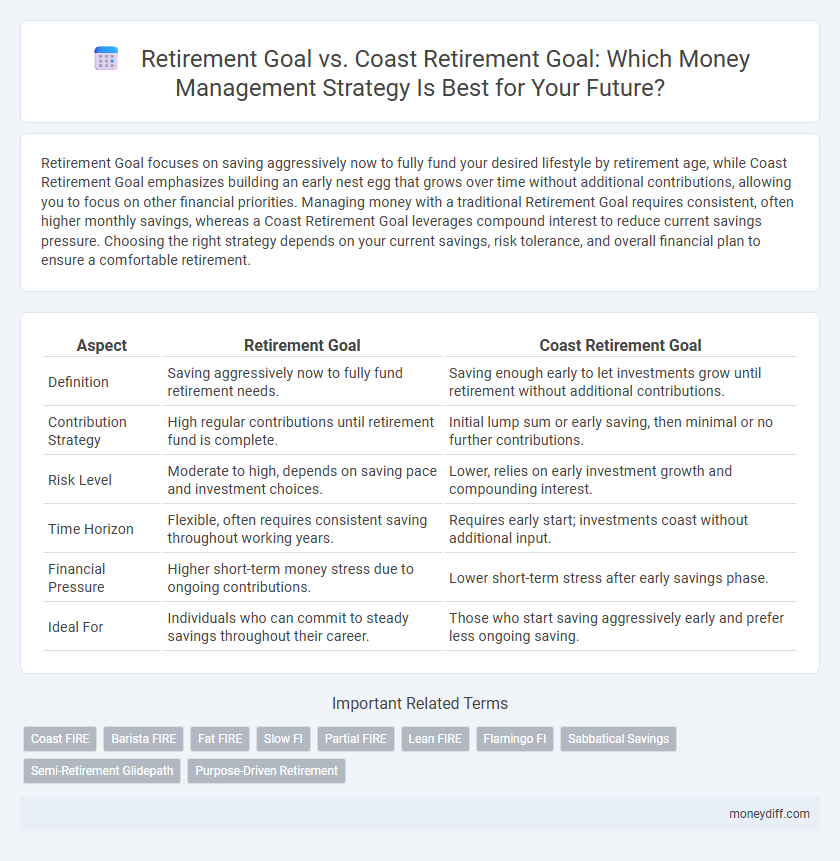

Retirement Goal focuses on saving aggressively now to fully fund your desired lifestyle by retirement age, while Coast Retirement Goal emphasizes building an early nest egg that grows over time without additional contributions, allowing you to focus on other financial priorities. Managing money with a traditional Retirement Goal requires consistent, often higher monthly savings, whereas a Coast Retirement Goal leverages compound interest to reduce current savings pressure. Choosing the right strategy depends on your current savings, risk tolerance, and overall financial plan to ensure a comfortable retirement.

Table of Comparison

| Aspect | Retirement Goal | Coast Retirement Goal |

|---|---|---|

| Definition | Saving aggressively now to fully fund retirement needs. | Saving enough early to let investments grow until retirement without additional contributions. |

| Contribution Strategy | High regular contributions until retirement fund is complete. | Initial lump sum or early saving, then minimal or no further contributions. |

| Risk Level | Moderate to high, depends on saving pace and investment choices. | Lower, relies on early investment growth and compounding interest. |

| Time Horizon | Flexible, often requires consistent saving throughout working years. | Requires early start; investments coast without additional input. |

| Financial Pressure | Higher short-term money stress due to ongoing contributions. | Lower short-term stress after early savings phase. |

| Ideal For | Individuals who can commit to steady savings throughout their career. | Those who start saving aggressively early and prefer less ongoing saving. |

Understanding Traditional Retirement Goals

Traditional retirement goals typically involve saving a specific amount of money to maintain a desired lifestyle after leaving the workforce. A retirement goal requires ongoing contributions until retirement age, whereas a coast retirement goal assumes existing savings will grow independently without additional contributions. Understanding the distinction helps in creating tailored money management strategies that align with long-term financial security.

Defining Coast Retirement Goals

Defining Coast Retirement Goals involves determining the amount of money needed to invest today so that future savings can grow to retirement targets without additional contributions. This strategy leverages compound interest, allowing individuals to "coast" towards retirement by focusing on essential current savings and letting time do the rest. Properly setting a Coast Retirement Goal ensures efficient money management by reducing pressure on ongoing savings while maintaining long-term financial security.

Key Differences Between Retirement and Coast Retirement

Retirement goals focus on accumulating sufficient funds to sustain a desired lifestyle post-retirement, requiring continuous contributions and investment growth until retirement age. Coast retirement goals, conversely, aim to save enough early so investments can grow passively to cover retirement needs without further contributions. The key difference lies in the timing and funding strategy: traditional retirement goals demand ongoing savings, while coast retirement goals rely on early savings and compounding to minimize future financial effort.

Pros and Cons of Standard Retirement Planning

Standard retirement planning allows consistent contributions toward a targeted savings goal, ensuring steady growth through compound interest over time. It offers flexibility to adjust savings rates based on income changes but requires disciplined budgeting to avoid shortfalls. However, unforeseen expenses or market volatility can jeopardize projections, and it may not fully optimize the benefits of early financial independence strategies like the Coast Retirement Goal.

Advantages of Coast Retirement for Financial Freedom

Coast Retirement empowers individuals to achieve financial freedom by allowing investments made early to grow without additional contributions, reducing stress on future savings. This strategy leverages time and compound interest, enabling a more flexible and less aggressive savings plan compared to traditional Retirement Goals. By prioritizing Coast Retirement, individuals can enjoy greater control over their financial future and enhanced lifestyle choices during retirement.

Calculating Your Retirement Target Number

Calculating your retirement target number involves estimating the total savings needed to maintain your desired lifestyle without additional contributions, which is central to both traditional retirement goals and Coast Retirement Goals. The Coast Retirement Goal focuses on the amount of savings required today that, given compounding growth, will grow to your desired retirement fund by the time you retire, eliminating the need for future contributions. Understanding the differences in these calculations enables precise financial planning and effective money management strategies tailored to individual retirement timelines and risk tolerance.

How to Determine Your Coast Retirement Milestone

Determining your Coast Retirement milestone involves calculating the age at which your existing retirement savings, invested with expected returns, will grow to cover your desired retirement expenses without additional contributions. Start by estimating the total nest egg required at retirement based on your targeted annual withdrawals and life expectancy. Use a retirement calculator to find the age when your current savings, compounded annually, will reach that amount, marking the point at which you can "coast" to retirement without further saving.

Impact on Investment Strategies: Retirement vs. Coast Retirement

Retirement goals prioritize aggressive investing to maximize growth and reach target savings by retirement age, focusing on higher risk tolerance and longer time horizons. Coast retirement goals emphasize achieving a sufficient initial nest egg early, allowing future contributions to grow passively with lower risk and stable investments. This shift impacts asset allocation, with retirement strategies favoring growth stocks, while coast strategies lean towards bonds and dividend-paying equities to preserve capital.

Risk Management in Both Retirement Approaches

Retirement Goal strategies focus on actively managing investment risk to ensure sufficient growth and income during retirement, emphasizing portfolio diversification and regular risk assessment. Coast Retirement Goal prioritizes minimizing risk early by saving enough to let investments grow passively until retirement, reducing the need for aggressive contributions later. Both approaches require tailored risk management frameworks to balance growth potential and capital preservation based on individual timelines and risk tolerance.

Choosing the Right Path: Retirement Goal or Coast Retirement Goal

Choosing between a Retirement Goal and a Coast Retirement Goal depends on your current savings rate and time horizon; a Retirement Goal requires consistent contributions to reach a target nest egg by retirement age, while a Coast Retirement Goal lets your existing savings grow without additional inputs, relying on compounding interest over time. Evaluating your cash flow, risk tolerance, and retirement timeline helps prioritize the strategy that maximizes wealth accumulation with minimal financial stress. Financial advisors recommend aligning goal choice with personal circumstances to optimize asset growth and secure a comfortable retirement lifestyle.

Related Important Terms

Coast FIRE

Coast Retirement Goal focuses on saving enough early to let investments grow passively until retirement, minimizing future contributions while maintaining financial independence. This strategy contrasts with traditional Retirement Goals that require consistent, often aggressive, savings throughout one's career to achieve a targeted nest egg.

Barista FIRE

Retirement Goal centers on accumulating sufficient funds to fully retire, while Coast Retirement Goal emphasizes saving aggressively early to let investments grow, allowing for minimal contributions later. Barista FIRE blends these by achieving enough savings to cover basic expenses and working part-time to enhance income and benefits without stressing financial independence timing.

Fat FIRE

Fat FIRE requires accumulating substantial wealth to maintain a luxurious lifestyle without working, while a Coast Retirement Goal focuses on building enough savings early so investments grow independently until retirement. Prioritizing Fat FIRE demands aggressive savings and investment strategies to exceed standard retirement benchmarks and achieve financial freedom with enhanced spending power.

Slow FI

Retirement Goal focuses on accumulating sufficient wealth to maintain a desired lifestyle during retirement, while the Coast Retirement Goal emphasizes reaching a financial milestone early enough to allow investments to grow passively without additional contributions. In Slow FI strategies, the Coast Retirement Goal enables gradual saving and investing, leveraging compounding returns over time to reduce immediate financial pressure.

Partial FIRE

Retirement Goal focuses on accumulating sufficient savings to fully retire by a target age, while Coast Retirement Goal emphasizes reaching a savings milestone early enough to let investments grow passively, enabling Partial FIRE by reducing work hours without fully retiring. This strategy optimizes financial independence through strategic saving rates and compounding growth, allowing gradual lifestyle adjustments toward early retirement.

Lean FIRE

A traditional Retirement Goal requires aggressive saving and investment to fund full living expenses, whereas a Coast Retirement Goal focuses on early aggressive saving until a certain point, after which minimal contributions allow savings to grow solely through compounding interest. Lean FIRE emphasizes achieving financial independence with reduced expenses, making the Coast Retirement Goal a practical strategy to minimize ongoing savings pressure while still ensuring adequate retirement funds.

Flamingo FI

Retirement Goal focuses on accumulating a specific savings target to fund retirement, while the Coast Retirement Goal emphasizes reaching a point where future contributions are unnecessary because current savings will grow sufficiently to fund retirement. Flamingo FI promotes the Coast Retirement Goal strategy to reduce financial stress by allowing early investment freedom once the coast point is achieved.

Sabbatical Savings

Retirement Goals focus on accumulating sufficient funds for full retirement, while Coast Retirement Goals emphasize saving aggressively early on to let investments grow, allowing for minimal contributions later. Prioritizing Sabbatical Savings within these strategies ensures financial flexibility during career breaks without hindering long-term retirement objectives.

Semi-Retirement Glidepath

Retirement Goal focuses on accumulating sufficient savings to fully fund a traditional retirement lifestyle, while the Coast Retirement Goal emphasizes reaching a savings milestone early enough to allow investments to grow passively until retirement, reducing future contributions. The Semi-Retirement Glidepath strategically shifts from aggressive growth to capital preservation, optimizing wealth management to balance income needs and risk tolerance during the transition to partial retirement.

Purpose-Driven Retirement

A Retirement Goal focuses on accumulating sufficient funds to fully support your desired lifestyle by the time you retire, ensuring financial independence and security. In contrast, a Coast Retirement Goal requires reaching a specific savings milestone early, after which your investments grow passively to fund retirement, allowing you to prioritize purpose-driven activities without aggressive saving later.

Retirement Goal vs Coast Retirement Goal for money management Infographic

moneydiff.com

moneydiff.com