Financial independence allows individuals to completely stop working by accumulating sufficient assets to cover living expenses, while Coast FIRE focuses on saving aggressively early on so investments grow over time to fund retirement without additional contributions. Choosing between financial independence and Coast FIRE depends on risk tolerance, time horizon, and desired lifestyle flexibility. Both strategies aim to achieve financial goals but differ in the level of ongoing work and savings required.

Table of Comparison

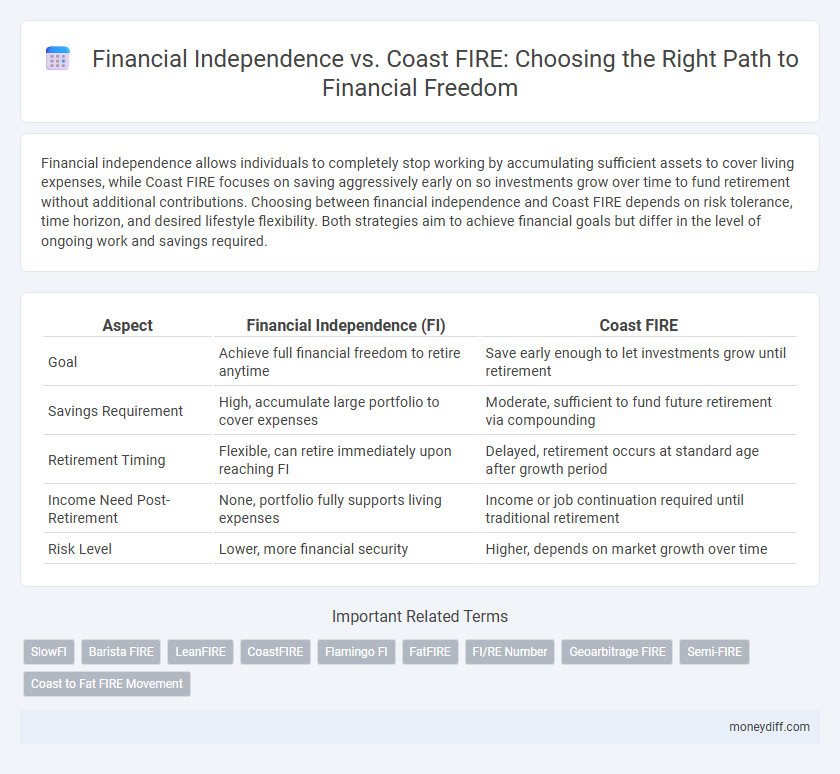

| Aspect | Financial Independence (FI) | Coast FIRE |

|---|---|---|

| Goal | Achieve full financial freedom to retire anytime | Save early enough to let investments grow until retirement |

| Savings Requirement | High, accumulate large portfolio to cover expenses | Moderate, sufficient to fund future retirement via compounding |

| Retirement Timing | Flexible, can retire immediately upon reaching FI | Delayed, retirement occurs at standard age after growth period |

| Income Need Post-Retirement | None, portfolio fully supports living expenses | Income or job continuation required until traditional retirement |

| Risk Level | Lower, more financial security | Higher, depends on market growth over time |

Understanding Financial Independence: Definition and Goals

Financial Independence means accumulating enough assets to cover living expenses without relying on traditional employment income, emphasizing long-term sustainability and freedom of choice. Coast FIRE refers to having saved sufficient capital early on so that investments can grow to fund retirement without additional contributions, allowing reduced work intensity while still progressing financially. Understanding these concepts helps set clear goals: Financial Independence aims for complete income replacement, whereas Coast FIRE targets a balance between early saving and work-life flexibility.

What is Coast FIRE? Key Concepts Explained

Coast FIRE is a financial independence strategy where you save aggressively early on, allowing your investments to grow over time without additional contributions. The key concept involves reaching a savings target that, when compounded at a reasonable rate, will cover retirement expenses by your desired retirement age. This approach contrasts with traditional Financial Independence by enabling more work-life balance and reducing pressure to save continuously throughout your career.

Comparing Financial Independence and Coast FIRE Strategies

Financial Independence (FI) requires aggressive saving and investing to achieve the ability to retire immediately, while Coast FIRE involves accumulating enough savings early to let investments grow passively until traditional retirement age. FI demands higher current cash flow and disciplined budgeting, whereas Coast FIRE allows more financial flexibility by minimizing present savings after the initial investment milestone. Comparing these, FI provides earlier freedom but with stricter lifestyle constraints, whereas Coast FIRE offers a balanced approach prioritizing long-term growth with reduced current financial pressure.

Pros and Cons of Pursuing Financial Independence

Pursuing Financial Independence (FI) offers complete control over your time and the freedom to choose work or leisure without financial constraints, but it often requires aggressive saving rates and lifestyle sacrifices that can be difficult to sustain. Achieving FI early demands mastering investment strategies, managing market risks, and maintaining consistent income streams, which can add complexity and pressure. On the other hand, the intensive effort toward FI may limit short-term enjoyment and increase stress compared to Coast FIRE, where the goal is to invest a solid financial base and let compound growth finance future retirement without ongoing high saving rates.

Advantages and Drawbacks of the Coast FIRE Approach

Coast FIRE allows individuals to stop contributing to retirement savings early while relying on compound growth to reach financial independence, reducing current financial stress and increasing lifestyle flexibility. The approach's drawback includes potential vulnerability to market volatility and missed opportunities for additional savings that could boost retirement funds. Unlike traditional Financial Independence, Coast FIRE requires disciplined early savings and confidence in long-term investment growth to ensure eventual financial security.

Key Milestones on the Path to Each Goal

Achieving Financial Independence requires key milestones such as building a robust emergency fund, eliminating high-interest debt, and maximizing retirement account contributions to ensure sustainable income. Coast FIRE emphasizes reaching a milestone where current investments are sufficient to grow to retirement goals without additional contributions, allowing financial freedom through reduced active saving. Tracking net worth growth, investment returns, and living expenses forms critical benchmarks on the path to both Financial Independence and Coast FIRE.

Investment Strategies for Financial Independence and Coast FIRE

Investment strategies for Financial Independence prioritize maximizing active contributions to build a robust portfolio through diversified assets like stocks, bonds, and real estate with a focus on high growth and compound returns. Coast FIRE emphasizes reaching a critical savings threshold early, relying primarily on long-term passive growth through index funds and low-cost ETFs to allow investments to mature without further contributions. Tailoring investments to risk tolerance and timeline ensures efficient progress toward either aggressive early retirement or steady financial self-sufficiency.

How to Choose the Right Goal for Your Lifestyle

Choosing between Financial Independence and Coast FIRE depends on your long-term aspirations and current financial commitments. Financial Independence requires aggressive saving and investing to quit working early, ideal for those seeking complete freedom from job constraints. Coast FIRE suits individuals who can accumulate a sufficient nest egg early, allowing them to reduce active savings while their investments grow to support retirement, aligning well with a balanced lifestyle and moderate risk tolerance.

Common Misconceptions About FIRE Strategies

Financial Independence and Coast FIRE are often misunderstood as identical paths, but they differ significantly in timing and effort required. Financial Independence demands immediate self-sufficiency without further contributions, while Coast FIRE allows early savings growth to cover future expenses without additional savings. Misconceptions arise from assuming Coast FIRE means full financial freedom, leading to underestimating the need for disciplined investment strategies and long-term planning.

Steps to Start Your Journey Toward FIRE or Coast FIRE

Begin your journey toward Financial Independence or Coast FIRE by calculating your target retirement number based on annual expenses multiplied by 25 to 30 years. Prioritize maximizing contributions to retirement accounts such as 401(k)s and IRAs while maintaining a disciplined savings rate of at least 20% of your income. Track your investment portfolio's growth through low-cost index funds or ETFs, focusing on consistent compounding and minimizing fees to reach your financial independence goals efficiently.

Related Important Terms

SlowFI

Financial Independence emphasizes accumulating enough assets to retire early with a fully self-sustaining income, while Coast FIRE focuses on saving aggressively early on and letting investments grow passively over time without additional contributions. SlowFI promotes a balanced approach, encouraging steady saving and mindful spending to achieve financial security at a more relaxed pace, aligning with long-term sustainability rather than rapid accumulation.

Barista FIRE

Financial Independence requires accumulating enough assets to sustain living expenses without work, while Coast FIRE focuses on saving early to let investments grow without additional contributions, allowing for reduced work years. Barista FIRE blends these by maintaining part-time work for healthcare and partial income, offering a flexible path between full independence and traditional Coast FIRE strategies.

LeanFIRE

LeanFIRE emphasizes achieving financial independence by maintaining a frugal lifestyle with minimized expenses, allowing earlier retirement compared to traditional Coast FIRE, which focuses on saving aggressively early on to let investments grow passively until retirement. Prioritizing LeanFIRE enables individuals to retire sooner by balancing reduced spending with steady income streams, optimizing long-term financial freedom.

CoastFIRE

Coast FIRE enables achieving financial independence by accumulating enough savings early to let compound interest grow without additional contributions, allowing more flexibility in lifestyle and career choices. It contrasts with traditional Financial Independence by emphasizing early investment milestones rather than immediate full funding of retirement expenses.

Flamingo FI

Flamingo FI emphasizes achieving Financial Independence through Coast FIRE by maximizing early savings and investments to allow compounding growth to cover future expenses without additional contributions. This strategy prioritizes cash flow flexibility and long-term wealth accumulation, enabling individuals to retire comfortably without needing full funding upfront.

FatFIRE

FatFIRE offers a higher annual spending budget compared to Financial Independence and Coast FIRE, targeting those who desire financial freedom with luxury and comfort. Achieving FatFIRE often requires aggressive savings and higher investment returns to support a lavish lifestyle without employment income.

FI/RE Number

Financial Independence (FI) requires accumulating a FIRE number that covers all living expenses indefinitely, typically 25-30 times annual spending. Coast FIRE, by contrast, reaches a smaller initial FIRE number, allowing investments to grow passively to full FI while maintaining a current lower spending level.

Geoarbitrage FIRE

Financial Independence requires accumulating enough assets to cover all living expenses indefinitely, whereas Coast FIRE focuses on saving early to let investments grow over time without additional contributions. Geoarbitrage FIRE leverages lower cost-of-living locations to accelerate reaching either goal by maximizing investment returns and minimizing expenses.

Semi-FIRE

Semi-FIRE represents a strategic balance between full Financial Independence and Coast FIRE, allowing individuals to partially rely on passive income while maintaining some active earnings. This approach enables a more flexible timeline for complete independence, optimizing savings rates and investment growth to secure long-term financial goals with reduced stress.

Coast to Fat FIRE Movement

Coast FIRE strategy enables individuals to invest early and grow their retirement savings without additional contributions, allowing financial independence with minimal ongoing effort compared to traditional Financial Independence approaches. This approach aligns with the Coast to Fat FIRE movement, emphasizing gradual wealth accumulation and flexible retirement timelines.

Financial Independence vs Coast FIRE for goal. Infographic

moneydiff.com

moneydiff.com