Investment goals prioritize long-term capital growth by allocating funds to assets with the potential for appreciation, while dividend snowball goals focus on generating a steady stream of income through reinvested dividends to accelerate wealth accumulation. Balancing these approaches can optimize money management by combining asset appreciation with compounding income. Adopting a strategy that integrates both goals enhances financial stability and maximizes portfolio returns.

Table of Comparison

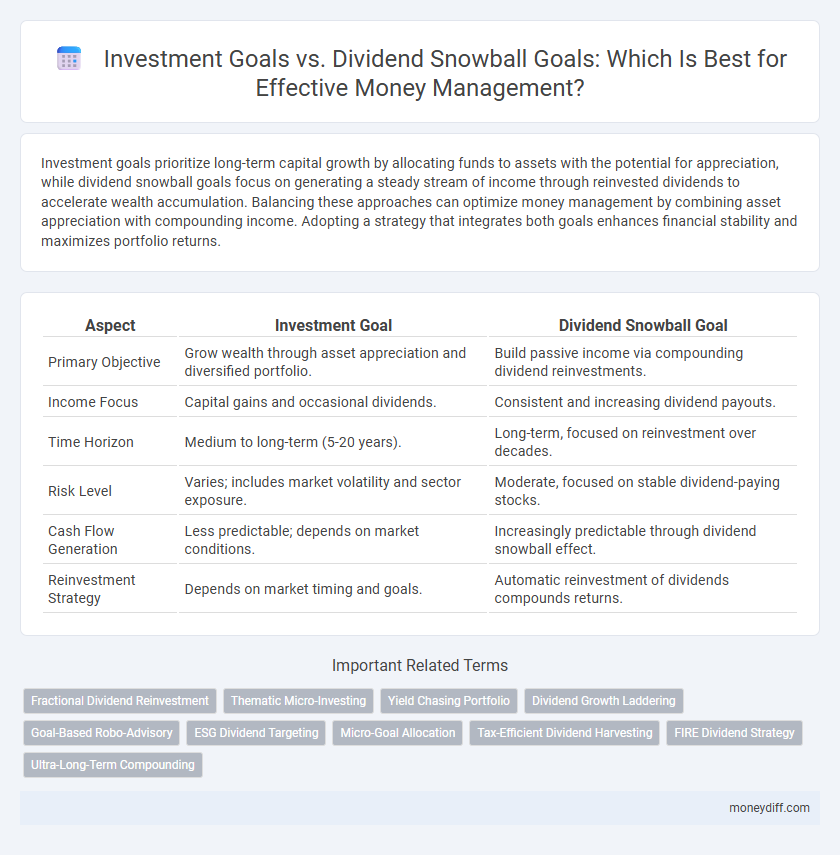

| Aspect | Investment Goal | Dividend Snowball Goal |

|---|---|---|

| Primary Objective | Grow wealth through asset appreciation and diversified portfolio. | Build passive income via compounding dividend reinvestments. |

| Income Focus | Capital gains and occasional dividends. | Consistent and increasing dividend payouts. |

| Time Horizon | Medium to long-term (5-20 years). | Long-term, focused on reinvestment over decades. |

| Risk Level | Varies; includes market volatility and sector exposure. | Moderate, focused on stable dividend-paying stocks. |

| Cash Flow Generation | Less predictable; depends on market conditions. | Increasingly predictable through dividend snowball effect. |

| Reinvestment Strategy | Depends on market timing and goals. | Automatic reinvestment of dividends compounds returns. |

Understanding Investment Goals vs Dividend Snowball Goals

Investment goals typically focus on capital appreciation, aiming to increase the overall portfolio value through strategic asset allocation and market growth. Dividend snowball goals prioritize generating a steady and increasing stream of passive income by reinvesting dividends to compound returns over time. Understanding these distinct objectives helps investors tailor their money management strategies to either build wealth or create sustainable income sources.

Defining Your Financial Priorities

Defining your financial priorities starts with distinguishing between an investment goal, which focuses on capital appreciation and long-term wealth growth, and a dividend snowball goal, which emphasizes reinvesting dividend income to generate compounding returns over time. Investment goals typically involve balancing risk and return across diversified asset classes, while dividend snowball goals prioritize steady cash flow and incremental dividend increases. Clarifying these objectives helps tailor your money management strategy to align with your desired financial outcomes and risk tolerance.

Risk Tolerance: Growth Investments vs Dividend Stability

Investment goals aligned with growth typically embrace higher risk tolerance, favoring assets like stocks and mutual funds that offer potential for capital appreciation. In contrast, dividend snowball goals prioritize stable income streams through reliable, dividend-paying stocks to manage risk and provide steady cash flow. Balancing these approaches depends on individual risk tolerance, with growth investments suited for long-term wealth accumulation and dividend strategies favoring conservative income-focused portfolios.

Time Horizons: Long-Term Wealth vs Passive Income

Investment goals centered on long-term wealth prioritize capital appreciation over extended periods, often spanning decades to maximize compound growth. Dividend snowball goals target generating increasing streams of passive income through reinvested dividends, accelerating income growth on a shorter to medium time horizon. Balancing these strategies depends on individual time horizons, risk tolerance, and financial objectives, optimizing either wealth accumulation or sustainable income generation.

Capital Appreciation vs Cash Flow Strategies

Investment goals centered on capital appreciation prioritize long-term growth through asset value increase, targeting significant wealth accumulation over time. Dividend snowball goals focus on generating steady cash flow by reinvesting dividends to compound income, creating a sustainable income stream. Balancing these strategies depends on individual risk tolerance and financial objectives, with capital appreciation suited for growth-oriented portfolios and dividend snowball ideal for income-focused investors.

Portfolio Construction for Each Goal

Investment goals prioritize capital appreciation through diversified asset allocation, emphasizing growth-oriented securities like stocks and real estate to maximize portfolio value over time. Dividend snowball goals focus on generating increasing passive income streams by reinvesting dividends, selecting high-yield, stable dividend-paying stocks and ETFs to build a compounding income portfolio. Portfolio construction for investment goals typically involves higher risk tolerance and longer time horizons, while dividend snowball portfolios prioritize income stability and dividend growth metrics to sustain cash flow.

Tax Implications: Reinvesting Gains vs Receiving Dividends

Investment goals that prioritize reinvesting gains typically benefit from tax deferral, as capital gains are only taxed upon the sale of assets, allowing for compounded growth without immediate tax liability. Dividend snowball goals generate regular income through distributions, subject to income tax rates in the year received, potentially reducing net returns due to higher tax burdens. Understanding the distinct tax treatments of capital gains versus dividend income is crucial for optimizing after-tax wealth accumulation strategies.

Measuring Progress Toward Money Management Objectives

Investment goals focus on capital appreciation by targeting asset growth through strategic allocation and market performance, while dividend snowball goals emphasize accumulating and reinvesting dividend income to generate compounding cash flow. Measuring progress toward investment goals involves tracking portfolio value, return on investment (ROI), and benchmark comparisons, whereas dividend snowball progress requires monitoring dividend yield, payout growth rate, and cumulative reinvested dividends. Effective money management balances both metrics to optimize wealth accumulation and passive income streams over time.

Adjusting Strategies as Life Changes

Investment goals often focus on long-term capital growth through diversified assets, while dividend snowball goals prioritize reinvesting dividends to create a compounding income stream. Adjusting strategies is crucial as life changes, such as career shifts, family expansion, or retirement plans, requiring a reassessment of risk tolerance and cash flow needs. Tailoring the balance between growth-oriented investments and dividend reinvestment ensures financial stability and goal alignment throughout varying life stages.

Choosing the Right Goal for Your Financial Future

Selecting the appropriate financial goal hinges on individual priorities, where investment goals emphasize capital growth and portfolio diversification to build long-term wealth. In contrast, the dividend snowball goal focuses on reinvesting dividends to create a compounding income stream, accelerating passive income generation. Evaluating risk tolerance, time horizon, and income needs ensures aligning your money management strategy with either capital appreciation or steady dividend growth for a secure financial future.

Related Important Terms

Fractional Dividend Reinvestment

Fractional Dividend Reinvestment accelerates the Dividend Snowball Goal by enabling precise reinvestment of dividends into additional shares, compounding wealth more efficiently than traditional lump-sum investments aligned with the broader Investment Goal. This strategy maximizes portfolio growth through continuous, incremental asset accumulation, optimizing capital deployment for long-term financial objectives.

Thematic Micro-Investing

Thematic micro-investing aligns with the dividend snowball goal by enabling small, consistent investments focused on specific themes, which compound dividends to accelerate portfolio growth. Unlike traditional investment goals that prioritize capital appreciation, this strategy emphasizes reinvested income to build wealth through targeted, sustainable dividend streams.

Yield Chasing Portfolio

Yield chasing portfolios prioritize high dividend returns to accelerate income growth, often at the expense of long-term capital appreciation. While investment goals typically balance growth and income, dividend snowball strategies focus on reinvesting dividends to compound returns, making yield chasing a critical factor for maximizing passive income generation.

Dividend Growth Laddering

Investment goals focus on achieving long-term capital appreciation through diversified asset allocation, while dividend snowball goals emphasize building a reliable income stream by reinvesting growing dividends. Dividend Growth Laddering optimizes cash flow by systematically acquiring stocks with staggered dividend increases, enhancing compounding returns and minimizing risk in money management.

Goal-Based Robo-Advisory

Goal-based robo-advisory platforms prioritize personalized investment goals by optimizing portfolio allocations to align with users' financial objectives, risk tolerance, and time horizons. Unlike dividend snowball strategies that emphasize reinvesting dividends for compound growth, these platforms offer adaptive management focused on achieving specific milestones such as retirement, education funding, or wealth accumulation through diversified assets and continuous goal tracking.

ESG Dividend Targeting

ESG dividend targeting aligns investment goals with sustainable and responsible growth, emphasizing companies with strong environmental, social, and governance practices that consistently pay dividends. Unlike traditional investment goals that prioritize capital appreciation, the dividend snowball strategy focuses on reinvesting ESG dividends to compound returns while supporting ethical enterprises.

Micro-Goal Allocation

Micro-goal allocation in money management emphasizes splitting funds between investment goals aimed at capital growth and dividend snowball goals focused on generating passive income streams. Prioritizing smaller, specific targets within each category enhances disciplined financial planning and accelerates wealth accumulation through compounding returns and reinvested dividends.

Tax-Efficient Dividend Harvesting

Tax-efficient dividend harvesting maximizes after-tax returns by strategically timing and selecting dividend-paying investments to minimize tax liabilities, enhancing overall portfolio growth. Prioritizing an investment goal emphasizes capital appreciation and risk management, while a dividend snowball goal focuses on reinvesting dividends to generate compounding income streams with tax-aware strategies.

FIRE Dividend Strategy

Investment goals prioritize capital appreciation and wealth accumulation over time, whereas Dividend Snowball goals emphasize reinvesting dividends to accelerate compound growth. The FIRE Dividend Strategy leverages consistent dividend payouts to create a self-sustaining income stream that supports financial independence and early retirement.

Ultra-Long-Term Compounding

Ultra-long-term compounding significantly enhances wealth accumulation when prioritizing an investment goal focused on capital growth over a dividend snowball goal that emphasizes immediate income reinvestment. Targeting capital appreciation fuels exponential growth through reinvested earnings and market value increases, surpassing the slower income escalation associated with dividend snowball strategies.

Investment goal vs Dividend snowball goal for money management. Infographic

moneydiff.com

moneydiff.com