Choosing between retirement savings and a sabbatical fund depends on your long-term financial priorities and lifestyle goals. Retirement savings provide security and growth potential for your future, while a sabbatical fund offers flexibility for extended breaks to recharge or pursue personal interests. Balancing contributions to both ensures financial stability while allowing for meaningful life experiences.

Table of Comparison

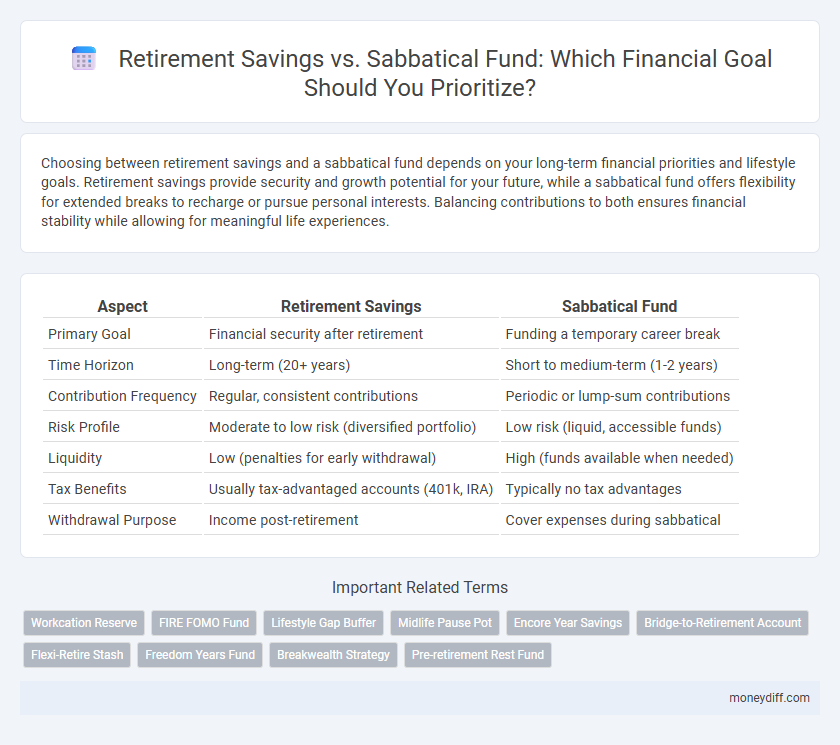

| Aspect | Retirement Savings | Sabbatical Fund |

|---|---|---|

| Primary Goal | Financial security after retirement | Funding a temporary career break |

| Time Horizon | Long-term (20+ years) | Short to medium-term (1-2 years) |

| Contribution Frequency | Regular, consistent contributions | Periodic or lump-sum contributions |

| Risk Profile | Moderate to low risk (diversified portfolio) | Low risk (liquid, accessible funds) |

| Liquidity | Low (penalties for early withdrawal) | High (funds available when needed) |

| Tax Benefits | Usually tax-advantaged accounts (401k, IRA) | Typically no tax advantages |

| Withdrawal Purpose | Income post-retirement | Cover expenses during sabbatical |

Understanding Retirement Savings Goals

Retirement savings goals require consistent contributions to build a secure financial future and ensure income stability during retirement years. Prioritizing retirement savings over a sabbatical fund helps leverage compound interest and long-term growth for essential expenses such as healthcare and housing. Understanding the importance of early and disciplined retirement savings contributes to achieving financial independence and mitigating risks of outliving assets.

Defining the Sabbatical Fund Objective

The sabbatical fund objective centers on accumulating sufficient savings to finance an extended career break without compromising long-term financial stability. Unlike retirement savings, which prioritize wealth growth for post-career life, the sabbatical fund targets short-term liquidity to cover living expenses, travel, and personal development during the sabbatical period. Clear definition of this fund's purpose ensures effective allocation of resources and prevents the premature use of retirement assets.

Key Differences Between Retirement and Sabbatical Goals

Retirement savings focus on long-term financial security, targeting expenses after ceasing full-time work often decades later, while sabbatical funds are designed for short-term breaks, typically lasting months to a year, to cover living costs during temporary leave. Retirement goals emphasize growth and compounding returns through investments like 401(k)s or IRAs, whereas sabbatical funds prioritize liquidity and accessibility. The risk tolerance for retirement accounts is generally higher due to the extended time horizon, contrasting with the lower risk and immediate availability required for sabbatical funding.

Assessing Your Financial Priorities

Assessing your financial priorities requires distinguishing between retirement savings and a sabbatical fund to align with long-term and short-term goals. Retirement savings focus on building a substantial nest egg through tax-advantaged accounts like 401(k)s or IRAs to ensure financial security after retirement. A sabbatical fund demands liquid, accessible savings earmarked for temporary unpaid leave, emphasizing immediate cash flow management over growth.

Timeline Considerations: Long-Term vs Short-Term

Retirement savings prioritize long-term growth through consistent contributions and compounding interest over decades, making them ideal for goals 20 to 40 years away. Sabbatical funds require short-term liquidity and flexibility, as the goal is typically planned within a few years and demands accessible cash for extended leave periods. Balancing these timelines ensures appropriate investment strategies, with retirement funds invested in growth assets and sabbatical funds held in more liquid, low-risk accounts.

Risk Tolerance for Each Savings Goal

Retirement savings require a conservative risk tolerance due to the long-term horizon and the need for capital preservation to support financial stability in later years. Sabbatical funds, typically earmarked for short- to medium-term use, allow for a moderate risk tolerance to balance growth potential with liquidity and accessibility. Aligning investment strategies with the distinct risk profiles of each goal ensures optimal asset allocation and financial readiness.

Optimizing Your Investment Strategy

Maximizing retirement savings requires consistent contributions to tax-advantaged accounts like 401(k)s and IRAs, ensuring long-term growth through diversified portfolios. Allocating a dedicated sabbatical fund with liquid, low-risk investments provides financial flexibility for career breaks without jeopardizing retirement goals. Balancing both funds strategically optimizes overall financial health and supports immediate lifestyle choices alongside future security.

Tax Implications for Retirement vs Sabbatical Funds

Retirement savings benefit from tax-advantaged accounts like 401(k)s and IRAs, allowing contributions to grow tax-deferred or tax-free, which maximizes long-term wealth accumulation. Sabbatical funds, typically held in regular savings or investment accounts, do not offer these tax benefits, leading to potential tax liabilities on interest, dividends, or capital gains during the saving period. Prioritizing retirement funds leverages compound growth and tax efficiency, while allocating separate taxable accounts for sabbaticals ensures liquidity and flexible access without early withdrawal penalties.

Balancing Dual Savings Goals

Balancing retirement savings and a sabbatical fund requires strategic allocation of income to secure long-term financial stability while enabling periodic career breaks. Prioritizing contributions to retirement accounts like 401(k)s or IRAs ensures growth through compound interest, while setting up a high-yield savings or investment account for sabbatical expenses provides liquidity and flexibility. Establishing clear timelines and specific funding targets for both goals promotes disciplined saving and prevents one objective from undermining the other.

Actionable Steps to Achieve Both Goals

Establish separate accounts for retirement savings and sabbatical funds to track progress clearly and avoid fund commingling. Automate monthly contributions based on prioritized percentages aligned with your income and timeline goals; for instance, allocate 70% to retirement and 30% to sabbatical if retirement is the longer-term priority. Regularly review and adjust contributions as income changes or financial goals evolve, ensuring both funds grow steadily and remain attainable.

Related Important Terms

Workcation Reserve

Allocating a dedicated Workcation Reserve balances long-term retirement savings while funding periodic sabbaticals, ensuring financial security without compromising planned time off. Prioritizing this fund enhances work-life balance and prevents dipping into retirement assets for extended breaks.

FIRE FOMO Fund

Prioritizing a FIRE FOMO Fund balances retirement savings with a sabbatical fund by addressing both long-term financial independence and short-term lifestyle flexibility. Allocating funds to this strategy ensures sustained wealth accumulation while enabling occasional extended breaks without jeopardizing overall financial goals.

Lifestyle Gap Buffer

Retirement savings primarily secure long-term financial stability, while a sabbatical fund acts as a lifestyle gap buffer, covering income interruptions during extended time off. Allocating funds for a sabbatical ensures seamless maintenance of lifestyle standards without depleting retirement assets.

Midlife Pause Pot

Prioritizing a Midlife Pause Pot supports both long-term retirement stability and a flexible sabbatical fund, enabling financial security while embracing career breaks. Balancing contributions between retirement savings and sabbatical funds ensures readiness for early career pauses without compromising future retirement goals.

Encore Year Savings

Encore year savings demand a strategic balance between bolstering retirement funds and allocating resources for potential sabbatical periods, ensuring financial stability during extended career breaks. Prioritizing encore year savings enhances long-term wealth accumulation while preserving liquidity for sabbatical experiences that rejuvenate personal and professional growth.

Bridge-to-Retirement Account

A Bridge-to-Retirement Account is strategically designed to provide financial support during a sabbatical without compromising long-term retirement savings, ensuring liquidity for short-term breaks while maintaining growth potential for retirement funds. Prioritizing this account balances immediate sabbatical needs with future retirement security by optimizing contributions and withdrawals aligned with career transition timelines.

Flexi-Retire Stash

Flexi-Retire Stash offers a flexible approach to balance retirement savings with a sabbatical fund, allowing users to allocate and access funds without penalties. This product optimizes financial planning by catering to both long-term retirement goals and short-term career breaks, ensuring liquidity and growth simultaneously.

Freedom Years Fund

The Freedom Years Fund prioritizes retirement savings to ensure long-term financial security and sustained income during post-career life, contrasting with a sabbatical fund designed for short-term breaks and personal growth through temporary work hiatuses. Allocating resources to the Freedom Years Fund optimizes compounding interest benefits and maximizes retirement capital accumulation for a more stable and fulfilling retirement experience.

Breakwealth Strategy

Retirement savings prioritize long-term financial security through consistent investments and compound growth, while sabbatical funds require short-term liquidity to support extended breaks from work without income. Breakwealth Strategy balances these goals by allocating resources to both, ensuring stable retirement funds alongside flexible sabbatical financing for career rejuvenation.

Pre-retirement Rest Fund

A pre-retirement rest fund prioritizes short-term wellness by allocating savings specifically for sabbaticals, ensuring mental and physical rejuvenation before full retirement. Balancing retirement savings with a dedicated sabbatical fund enhances long-term financial security while promoting a sustainable work-life balance in the years leading up to retirement.

Retirement Savings vs Sabbatical Fund for goal. Infographic

moneydiff.com

moneydiff.com