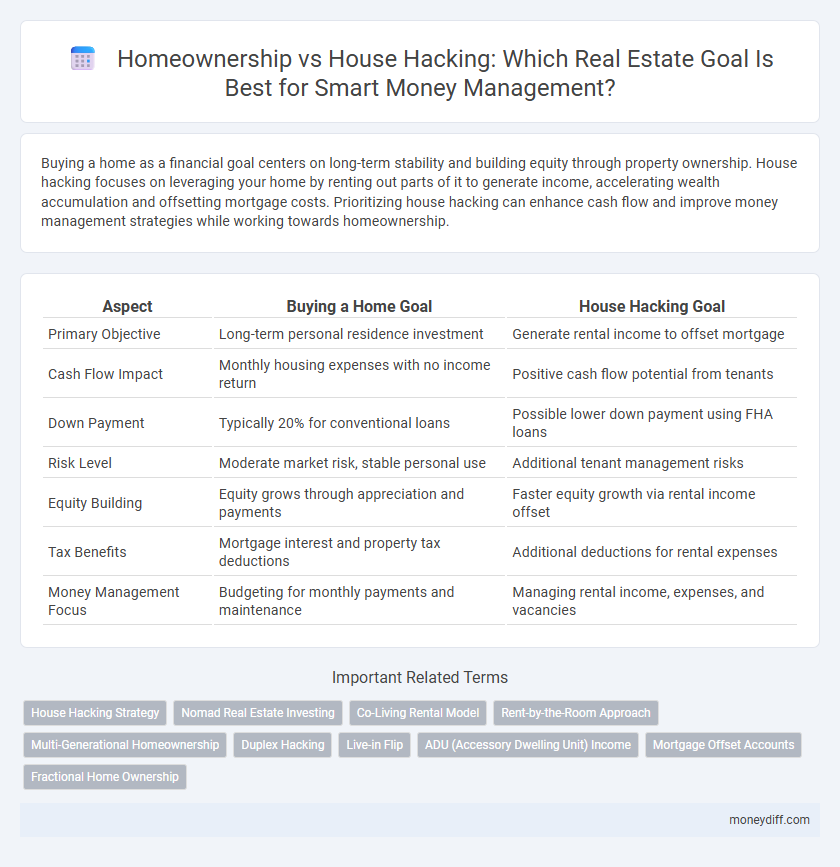

Buying a home as a financial goal centers on long-term stability and building equity through property ownership. House hacking focuses on leveraging your home by renting out parts of it to generate income, accelerating wealth accumulation and offsetting mortgage costs. Prioritizing house hacking can enhance cash flow and improve money management strategies while working towards homeownership.

Table of Comparison

| Aspect | Buying a Home Goal | House Hacking Goal |

|---|---|---|

| Primary Objective | Long-term personal residence investment | Generate rental income to offset mortgage |

| Cash Flow Impact | Monthly housing expenses with no income return | Positive cash flow potential from tenants |

| Down Payment | Typically 20% for conventional loans | Possible lower down payment using FHA loans |

| Risk Level | Moderate market risk, stable personal use | Additional tenant management risks |

| Equity Building | Equity grows through appreciation and payments | Faster equity growth via rental income offset |

| Tax Benefits | Mortgage interest and property tax deductions | Additional deductions for rental expenses |

| Money Management Focus | Budgeting for monthly payments and maintenance | Managing rental income, expenses, and vacancies |

Understanding Buying a Home as a Money Management Goal

Buying a home as a money management goal prioritizes building long-term equity and asset appreciation through mortgage payments and property value growth. This approach requires disciplined budgeting, emphasizing saving for down payments, closing costs, and ongoing maintenance expenses to protect financial stability. Understanding this goal helps individuals align their housing decisions with broader financial objectives, such as wealth accumulation and risk management.

Defining House Hacking for Financial Growth

House hacking involves purchasing a multi-unit property or utilizing extra space in a home to generate rental income, reducing living expenses and accelerating wealth accumulation. This strategy contrasts with a traditional buying a home goal, which primarily focuses on personal residency and property appreciation without immediate financial returns. House hacking serves as a powerful money management tool by combining real estate investment with affordable living, fostering long-term financial growth and stability.

Initial Costs: Buying a Home vs. House Hacking

Initial costs for buying a home typically include a substantial down payment, closing fees, and moving expenses, which can strain personal savings and reduce immediate cash flow. House hacking minimizes upfront costs by allowing occupants to rent out portions of the property, offsetting mortgage payments and reducing financial burden. This strategy enhances money management by leveraging rental income to cover expenses, making housing more affordable while building equity.

Cash Flow Potential: Owner-Occupied vs. Rental Income

Buying a home primarily focuses on owner-occupied living, emphasizing stability and long-term equity rather than immediate cash flow. House hacking leverages rental income from occupants within the property to generate positive cash flow, offsetting mortgage costs and enhancing money management efficiency. Evaluating the cash flow potential highlights the financial advantage of house hacking through consistent rental revenue compared to the limited liquidity benefits of a traditional primary residence.

Risk Assessment in Homeownership and House Hacking

Evaluating risk in homeownership centers on potential market fluctuations, maintenance costs, and long-term investment stability. House hacking mitigates financial risk by generating rental income, which can offset mortgage payments and reduce overall housing expenses. Understanding these dynamics enhances money management strategies by balancing equity growth with cash flow resilience.

Long-Term Wealth Building: Equity vs. Passive Income

Buying a home primarily builds long-term wealth through equity accumulation as mortgage payments increase property ownership value over time. House hacking generates passive income by renting out portions of the property, offsetting living expenses and potentially producing positive cash flow. Balancing equity growth with rental income creates a diversified strategy for sustained financial growth and improved money management.

Tax Implications for Homeowners and House Hackers

Homeowners who buy a primary residence can benefit from mortgage interest deductions and property tax deductions, lowering taxable income and increasing overall savings potential. House hackers, by renting out parts of their property, must accurately report rental income but can also deduct expenses related to the rental portion, including maintenance and depreciation, optimizing tax advantages. Understanding these tax implications helps in strategic money management, allowing homeowners and house hackers to maximize deductions while minimizing tax liability.

Lifestyle Impact: Privacy vs. Income Optimization

Buying a home prioritizes lifestyle impact by offering privacy and personal space, which supports long-term stability and comfort. House hacking focuses on income optimization by generating rental income through shared living spaces, enhancing cash flow and reducing mortgage costs. The choice between these goals depends on whether privacy or financial efficiency holds greater value in money management strategies.

Exit Strategies: Selling a Home vs. Leveraging House Hacking Assets

Exit strategies for buying a home typically involve selling the property to realize capital gains and pay off mortgages, providing a lump sum for future investments or expenses. In contrast, house hacking exit strategies focus on leveraging rental income streams by retaining ownership and gradually expanding the portfolio, optimizing long-term cash flow and wealth building. Effective money management requires evaluating these distinct approaches to maximize financial returns and minimize risks.

Choosing the Right Goal: Factors for Smart Money Management

Choosing the right goal between buying a home and house hacking requires evaluating your financial situation, long-term plans, and risk tolerance to optimize returns and manage expenses effectively. Buying a home offers stability and potential equity growth, while house hacking can generate rental income and reduce living costs, accelerating wealth building. Prioritize clear budgeting, market research, and personal financial goals to ensure smart money management aligns with your chosen real estate strategy.

Related Important Terms

House Hacking Strategy

House hacking strategy maximizes money management by generating rental income to offset mortgage costs, quickly building equity and wealth through smart property use. This approach leverages shared living spaces and reduces living expenses, accelerating financial freedom compared to a traditional home buying goal.

Nomad Real Estate Investing

Buying a home as a primary residence focuses on long-term stability and equity accumulation, whereas house hacking leverages rental income from shared living spaces to accelerate wealth building and cash flow. Nomad Real Estate Investing emphasizes house hacking strategies to optimize money management by reducing living expenses and generating passive income in diverse markets.

Co-Living Rental Model

The Co-Living Rental Model supports the House Hacking Goal by enabling individuals to share living spaces with tenants, significantly reducing personal housing expenses and accelerating wealth accumulation through rental income. This approach contrasts with the traditional Buying a Home Goal, which prioritizes sole ownership and long-term property appreciation over immediate cash flow and collaborative money management strategies.

Rent-by-the-Room Approach

The Rent-by-the-Room approach in house hacking maximizes rental income from a single property, effectively accelerating mortgage payoff and increasing cash flow compared to a traditional home buying goal focused solely on personal occupancy. This strategy leverages shared housing dynamics, optimizing money management by turning living expenses into revenue streams while building equity.

Multi-Generational Homeownership

Buying a home as a goal emphasizes long-term financial stability and asset accumulation, while house hacking focuses on generating immediate rental income through multi-generational homeownership to offset mortgage costs. Multi-generational properties enable shared expenses and wealth-building opportunities, enhancing money management efficiency and investment returns.

Duplex Hacking

Buying a home focuses on long-term investment and stability, while duplex hacking leverages renting one unit to offset mortgage costs, enhancing cash flow and accelerating wealth-building. Duplex hacking optimizes money management by turning a primary residence into a passive income source, reducing living expenses and increasing financial flexibility.

Live-in Flip

Buying a home as a primary goal centers on long-term stability and equity building, whereas a house hacking goal emphasizes generating rental income to offset mortgage costs and accelerate wealth creation. Live-in flip strategies combine both by purchasing undervalued properties, improving them while living onsite, and increasing value to maximize financial returns through resale or rental income.

ADU (Accessory Dwelling Unit) Income

Buying a home focuses on long-term equity and stability, while house hacking with an ADU generates immediate rental income to offset mortgage costs, enhancing cash flow and accelerating financial growth. Leveraging ADU income transforms a primary residence into a revenue-producing asset, optimizing money management and wealth-building strategies.

Mortgage Offset Accounts

Mortgage offset accounts optimize interest savings by linking savings directly to the home loan balance, making them essential for both buying a home and house hacking goals; while buying a home prioritizes long-term equity building, house hacking focuses on maximizing rental income and cash flow. Effective money management through offset accounts reduces mortgage interest, accelerates loan repayment, and increases overall financial flexibility regardless of the chosen goal.

Fractional Home Ownership

Fractional home ownership offers a strategic approach to buying a home by dividing costs and responsibilities among multiple owners, enhancing cash flow management compared to traditional house hacking. This model allows for leveraging shared equity and reducing individual financial burdens, aligning with money management goals focused on minimizing risk and maximizing investment potential.

Buying a Home Goal vs House Hacking Goal for money management. Infographic

moneydiff.com

moneydiff.com