A Rainy Day Fund serves as an emergency cash reserve for unexpected expenses like car repairs or medical bills, providing financial security during unforeseen events. An Opportunity Fund, on the other hand, is designed to seize unexpected chances for growth or investment, enabling quick access to money for ventures such as business opportunities or travel deals. Effective money management involves balancing both funds to ensure stability while remaining prepared to capitalize on potential opportunities.

Table of Comparison

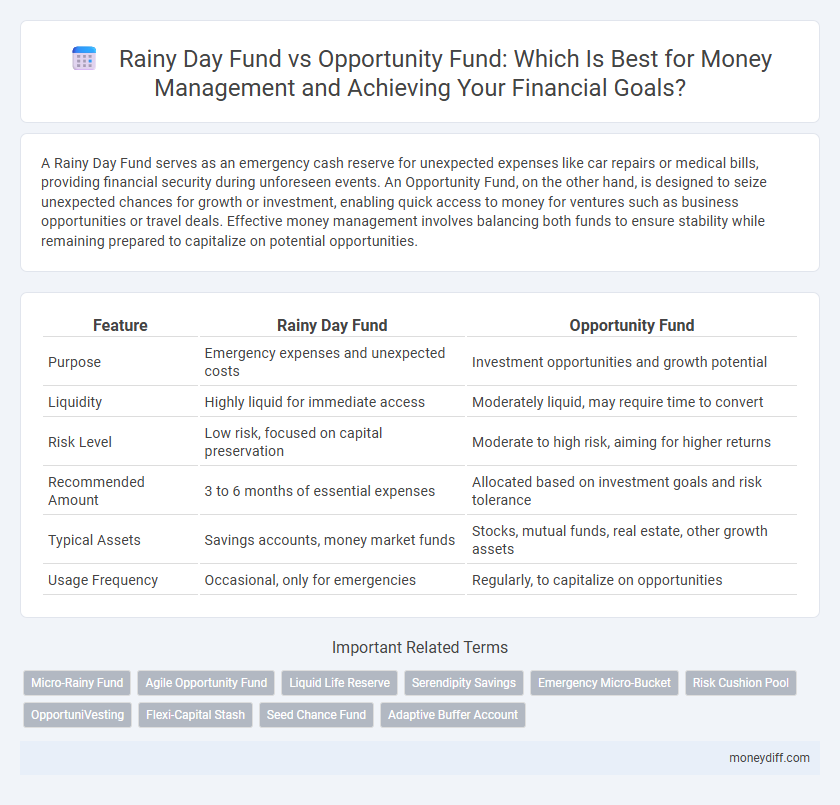

| Feature | Rainy Day Fund | Opportunity Fund |

|---|---|---|

| Purpose | Emergency expenses and unexpected costs | Investment opportunities and growth potential |

| Liquidity | Highly liquid for immediate access | Moderately liquid, may require time to convert |

| Risk Level | Low risk, focused on capital preservation | Moderate to high risk, aiming for higher returns |

| Recommended Amount | 3 to 6 months of essential expenses | Allocated based on investment goals and risk tolerance |

| Typical Assets | Savings accounts, money market funds | Stocks, mutual funds, real estate, other growth assets |

| Usage Frequency | Occasional, only for emergencies | Regularly, to capitalize on opportunities |

Understanding Rainy Day Fund and Opportunity Fund

A Rainy Day Fund specifically safeguards against unexpected expenses like medical emergencies, car repairs, or temporary job loss, emphasizing liquidity and easy access. In contrast, an Opportunity Fund is designed to quickly capitalize on market opportunities or investments, balancing accessibility with potential growth. Both funds serve distinct financial purposes, with the Rainy Day Fund ensuring stability and the Opportunity Fund enhancing financial flexibility for strategic gains.

Key Differences Between Rainy Day Fund and Opportunity Fund

Rainy day funds focus on covering unexpected expenses or financial emergencies, typically maintaining three to six months' worth of living expenses in highly liquid accounts. Opportunity funds are designed for seizing investment or business opportunities, often holding cash reserves that can be deployed quickly for growth or strategic purposes. The primary difference lies in their intent: rainy day funds prioritize safety and accessibility, while opportunity funds emphasize liquidity and readiness to invest.

Why Every Money Management Plan Needs a Rainy Day Fund

A Rainy Day Fund provides essential financial security by covering unexpected expenses such as medical emergencies, car repairs, or sudden job loss, preventing reliance on high-interest debt. In contrast, an Opportunity Fund is designed for proactive investments and growth, emphasizing wealth-building rather than immediate safety. Prioritizing a Rainy Day Fund ensures stability and peace of mind, forming a crucial foundation in every money management plan before allocating resources toward opportunities.

Building Your Opportunity Fund for Financial Growth

Building your Opportunity Fund focuses on allocating money toward investments that yield higher returns compared to a traditional Rainy Day Fund, which is designed for emergencies and short-term needs. Targeting assets such as stocks, bonds, or real estate accelerates financial growth and increases wealth over time. Prioritizing this fund enables strategic risk-taking and maximizes long-term portfolio appreciation beyond basic liquidity reserves.

When to Use a Rainy Day Fund vs Opportunity Fund

A Rainy Day Fund should be used for unexpected expenses such as medical emergencies, urgent home repairs, or sudden job loss, ensuring financial stability during unforeseen circumstances. An Opportunity Fund is reserved for strategic investments or timely chances like starting a new business, purchasing undervalued assets, or investing in personal growth opportunities. Properly distinguishing between these funds helps maintain liquidity while maximizing financial growth potential.

How Much Should You Save in Each Fund?

A Rainy Day Fund typically requires saving three to six months' worth of essential living expenses to cover unexpected emergencies such as medical bills or car repairs. An Opportunity Fund, designed for seizing investment or business opportunities, generally involves setting aside a smaller, more flexible amount, often around 10-20% of overall savings. Balancing these funds ensures financial security while maintaining liquidity for growth opportunities.

Benefits of Separating Rainy Day and Opportunity Funds

Separating Rainy Day and Opportunity Funds enhances financial resilience by ensuring immediate access to emergency cash without compromising investment potential. A Rainy Day Fund provides liquidity for unexpected expenses, while an Opportunity Fund allows for strategic investments or purchases that capitalize on market conditions. This distinction prevents depletion of critical savings and optimizes growth by clearly defining each fund's purpose in money management.

Common Mistakes in Managing Both Funds

Common mistakes in managing Rainy Day Funds include underestimating essential expenses and insufficiently replenishing the fund after use, which can leave individuals vulnerable during emergencies. Opportunity Funds are often mismanaged by misallocating money toward low-yield or high-risk investments, reducing potential growth for strategic opportunities. Failing to maintain clear distinctions between these funds leads to inappropriate withdrawals and hampers effective financial planning for both short-term security and long-term gains.

Strategies to Grow Your Opportunity Fund Safely

Maximize returns in your Opportunity Fund by diversifying investments across low-risk assets such as index funds, bonds, and dividend-paying stocks, balancing growth with safety. Implement a gradual contribution strategy, funneling a fixed percentage of monthly income to leverage compounding while minimizing market volatility impact. Regularly review and adjust your portfolio based on market trends and personal financial goals to protect gains without compromising potential growth.

Balancing Emergency Preparedness and Investing Opportunities

A Rainy Day Fund typically holds three to six months' worth of essential expenses in liquid, low-risk accounts to cover unexpected emergencies, ensuring financial stability without disrupting long-term investments. An Opportunity Fund, in contrast, is a flexible pool of capital reserved for timely investments or business opportunities, enabling quick action without needing to liquidate other assets. Balancing these funds involves maintaining adequate emergency savings to avoid financial strain while allocating surplus resources to growth potential, optimizing both security and investment readiness.

Related Important Terms

Micro-Rainy Fund

A Micro-Rainy Day Fund serves as an immediate cash reserve for small, unexpected expenses, providing quicker access than larger Rainy Day Funds, which are designed for more significant emergencies. Unlike Opportunity Funds, which are geared toward seizing investment or business prospects, Micro-Rainy Funds prioritize liquidity and financial security for everyday unpredictabilities.

Agile Opportunity Fund

The Agile Opportunity Fund focuses on maximizing financial flexibility by rapidly reallocating resources to high-return investments, contrasting with the Rainy Day Fund's emphasis on liquidity for emergencies. Prioritizing adaptive investment strategies, it leverages market opportunities to enhance portfolio growth without compromising essential reserves.

Liquid Life Reserve

A Rainy Day Fund provides immediate access to cash for unexpected expenses, ensuring financial stability during emergencies, while an Opportunity Fund offers liquid resources to capitalize on investments or purchases that can enhance long-term wealth. Maintaining a Liquid Life Reserve balances these funds, guaranteeing both short-term security and readiness for strategic financial opportunities.

Serendipity Savings

Serendipity Savings categorizes funds into a Rainy Day Fund, designated for unexpected emergencies to ensure financial stability, and an Opportunity Fund, which targets strategic investments for potential growth. Efficient money management involves balancing these funds to protect against unforeseen expenses while capitalizing on lucrative opportunities.

Emergency Micro-Bucket

An Emergency Micro-Bucket within a Rainy Day Fund provides quick access to essential cash for unforeseen expenses, ensuring financial stability without tapping into long-term Opportunity Funds meant for growth and investment. Structuring money this way balances immediate liquidity needs against future wealth-building opportunities, optimizing overall money management strategy.

Risk Cushion Pool

A Rainy Day Fund serves as a risk cushion pool by covering unexpected expenses and financial emergencies, ensuring stability without disrupting long-term investments. In contrast, an Opportunity Fund allocates money for strategic investments or timely opportunities, prioritizing growth potential over immediate risk protection.

OpportuniVesting

Opportunity Fund management through OpportuniVesting prioritizes agile investment strategies to capitalize on market fluctuations, contrasting with the conservative, liquidity-focused approach of a Rainy Day Fund. Utilizing OpportuniVesting's platform enables investors to optimize returns by dynamically reallocating assets toward higher-yield opportunities while maintaining sufficient liquidity for unforeseen expenses.

Flexi-Capital Stash

Flexi-Capital Stash offers a flexible way to manage funds by distinguishing between a Rainy Day Fund, designed for emergencies with easy access and high liquidity, and an Opportunity Fund, geared toward strategic investments with moderate liquidity and growth potential. Prioritizing a balanced allocation within Flexi-Capital Stash ensures financial resilience while capitalizing on emerging opportunities.

Seed Chance Fund

A Rainy Day Fund safeguards against unexpected expenses with liquid cash reserves, while an Opportunity Fund, like a Seed Chance Fund, targets strategic investments and growth opportunities by allocating capital for high-return ventures. Prioritizing a Seed Chance Fund within Opportunity Funds enhances financial agility, enabling quick investments in startup projects or emerging markets to maximize long-term wealth creation.

Adaptive Buffer Account

An Adaptive Buffer Account strategically balances the liquidity of a Rainy Day Fund with the growth potential of an Opportunity Fund, allowing seamless allocation of resources depending on immediate needs or investment opportunities. This dynamic approach optimizes financial resilience by reducing the risk of depletion during emergencies while maximizing returns through timely capital deployment.

Rainy Day Fund vs Opportunity Fund for money management. Infographic

moneydiff.com

moneydiff.com