Savings goals focus on accumulating a specific amount of money for short-term needs or planned expenses, providing a clear target to manage funds effectively. Financial independence goals aim for long-term wealth accumulation that supports a lifestyle without relying on active income, emphasizing sustainable income streams and investment growth. Prioritizing savings goals can build the foundation necessary to achieve broader financial independence by cultivating disciplined money management habits.

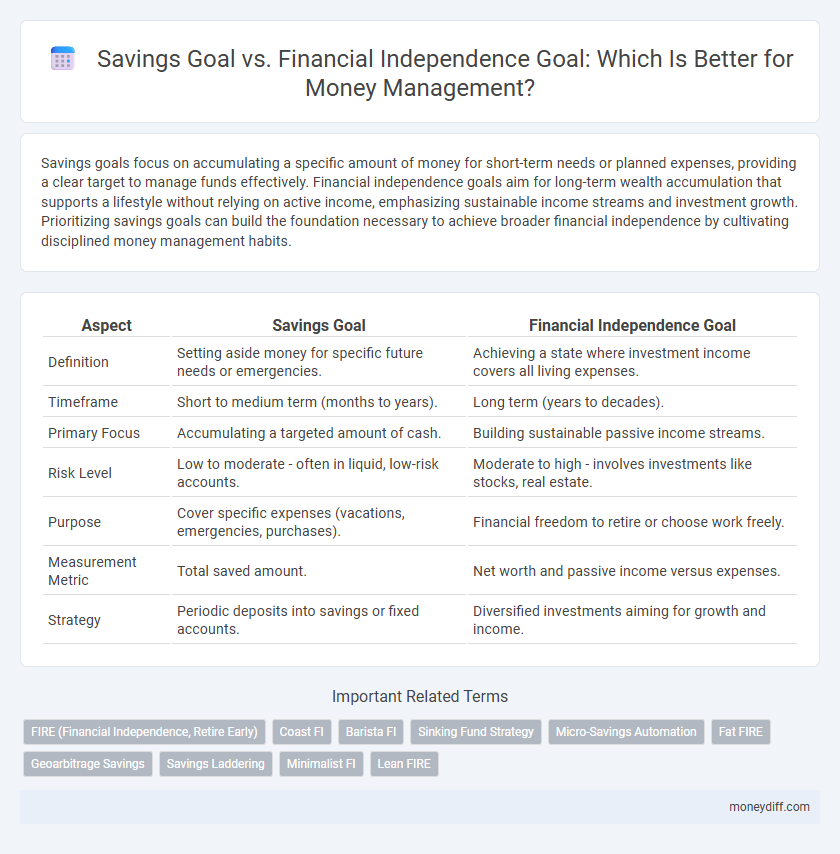

Table of Comparison

| Aspect | Savings Goal | Financial Independence Goal |

|---|---|---|

| Definition | Setting aside money for specific future needs or emergencies. | Achieving a state where investment income covers all living expenses. |

| Timeframe | Short to medium term (months to years). | Long term (years to decades). |

| Primary Focus | Accumulating a targeted amount of cash. | Building sustainable passive income streams. |

| Risk Level | Low to moderate - often in liquid, low-risk accounts. | Moderate to high - involves investments like stocks, real estate. |

| Purpose | Cover specific expenses (vacations, emergencies, purchases). | Financial freedom to retire or choose work freely. |

| Measurement Metric | Total saved amount. | Net worth and passive income versus expenses. |

| Strategy | Periodic deposits into savings or fixed accounts. | Diversified investments aiming for growth and income. |

Understanding Savings Goals in Money Management

Savings goals in money management serve as targeted objectives for accumulating a specific amount of funds within a designated time frame, providing structure and discipline in budgeting and expenditure. Unlike financial independence goals, which aim for a state where investment income covers living expenses indefinitely, savings goals focus on shorter-term achievements such as emergency funds, vacations, or large purchases. Clear savings goals enhance financial clarity, promote consistent saving habits, and reduce the risk of impulsive spending by aligning daily financial decisions with measurable outcomes.

Defining Financial Independence Goals

Financial independence goals prioritize creating passive income streams and accumulating assets that cover living expenses indefinitely, contrasting with savings goals focused on short-term funds accumulation for specific purchases or emergencies. Defining financial independence involves calculating the "number," typically 25 to 30 times annual expenses, guiding investment strategies toward sustainable wealth growth. Emphasizing withdrawal rates, risk tolerance, and long-term asset allocation ensures that the financial independence goal supports lifelong financial freedom and stability.

Key Differences Between Savings and Financial Independence Goals

Savings goals primarily focus on accumulating a specific amount of money for short- to medium-term needs such as emergencies, vacations, or major purchases. Financial independence goals aim at generating sufficient passive income to cover living expenses indefinitely without relying on active employment. The key difference lies in time horizon and purpose: savings goals target finite financial milestones, whereas financial independence seeks long-term wealth sustainability and freedom from paycheck dependency.

Short-Term Benefits of Savings Goals

Savings goals provide immediate financial security by creating an accessible emergency fund, reducing reliance on debt during unexpected expenses. They improve budgeting discipline and enable individuals to accumulate funds for specific short-term purchases, such as vacations or home improvements. These short-term benefits enhance overall financial stability and confidence in money management strategies.

Long-Term Impact of Financial Independence Goals

Financial Independence Goals prioritize building sustainable wealth through diversified investments and passive income streams, resulting in long-term financial security and freedom from reliance on employment income. These goals emphasize consistent saving rates and strategic asset allocation to achieve compounding growth over decades. Savings Goals often target short-to-medium term needs but lack the comprehensive scope to generate lasting economic resilience inherent in Financial Independence planning.

Strategies to Achieve Savings Goals Faster

Targeting specific savings goals requires disciplined budgeting and automated transfers to dedicated accounts, ensuring steady progress without temptation to overspend. Prioritizing high-interest savings vehicles and cutting discretionary expenses accelerates asset accumulation, optimizing returns and time efficiency. Regularly reviewing and adjusting goals based on income changes or unexpected expenses maintains motivation and aligns efforts toward financial milestones.

Building Toward Financial Independence: Essential Steps

Setting a savings goal emphasizes accumulating a specific amount within a set timeframe, while a financial independence goal focuses on generating sufficient passive income to cover living expenses indefinitely. Building toward financial independence requires disciplined budgeting, consistent investment in diversified assets, and strategic debt management to grow net worth. Prioritizing compound interest and reducing liabilities accelerates progress from short-term savings targets to long-term wealth sustainability.

Common Pitfalls in Setting Money Management Goals

Common pitfalls in setting savings goals include underestimating expenses and setting unrealistic timelines, which can lead to frustration and derail progress. Financial independence goals often suffer from vague definitions and lack of measurable benchmarks, causing inconsistent saving and investment habits. Clear, specific, and achievable targets are essential for effective money management and sustained financial growth.

Tracking Progress: Savings vs Financial Independence

Tracking progress in a savings goal involves regularly monitoring account balances and monthly contributions to measure short-term financial achievements. In contrast, financial independence requires tracking net worth growth, passive income streams, and withdrawal rates to ensure sustainable long-term wealth. Utilizing tools like budgeting apps and net worth calculators enhances accuracy in measuring progress for both goals.

Choosing the Right Goal for Your Financial Situation

Savings goals focus on accumulating specific amounts for short-term needs, such as emergencies or purchases, while financial independence goals aim for long-term wealth to cover living expenses without employment. Choosing the right goal depends on factors like income stability, lifestyle, and risk tolerance, ensuring your money management strategy aligns with your financial priorities. Tailoring goals to your current situation enhances focus and increases the likelihood of achieving financial security.

Related Important Terms

FIRE (Financial Independence, Retire Early)

Savings goals prioritize accumulating a specific amount for short-term needs, whereas Financial Independence goals within the FIRE movement emphasize building sufficient passive income streams to cover living expenses indefinitely. Achieving FIRE requires strategic investment and disciplined expense management to ensure long-term financial freedom and early retirement.

Coast FI

Savings goals focus on accumulating a specific amount of money for short-term needs, while Financial Independence (FI) goals aim to generate enough passive income to cover living expenses indefinitely. Coast FI represents a strategy where one saves aggressively early on to allow investments to grow over time without additional contributions, achieving financial freedom by relying on compounding growth alone.

Barista FI

A Savings Goal focuses on accumulating a specific amount for short-term needs or emergencies, while a Financial Independence Goal, exemplified by Barista FI, aims to generate enough passive income to cover basic expenses, allowing partial retirement with reduced reliance on traditional employment. Barista FI combines part-time work benefits with investment income, providing financial flexibility and a smoother transition towards full financial independence.

Sinking Fund Strategy

A savings goal typically targets short-term expenses through disciplined contributions into a sinking fund, ensuring funds are available without disrupting regular cash flow. Financial independence goals prioritize long-term wealth accumulation and passive income streams, often relying on investment growth rather than solely on sinking fund strategies.

Micro-Savings Automation

Micro-savings automation accelerates progress toward both Savings Goals and Financial Independence Goals by systematically channeling small, frequent deposits into separate accounts tailored for short-term needs or long-term wealth building. Leveraging technology-driven micro-investments enhances disciplined money management, reduces impulse spending, and fosters cumulative growth critical for achieving financial independence.

Fat FIRE

Savings goals emphasize accumulating a specific amount for short-term needs, while a Financial Independence Goal targets long-term wealth to cover living expenses without work, with Fat FIRE demanding a higher savings rate to support a luxurious lifestyle. Fat FIRE requires aggressive investment strategies and consistent high savings to achieve financial independence with enhanced spending power and comfort.

Geoarbitrage Savings

Geoarbitrage savings enable faster accumulation by leveraging lower living costs abroad, accelerating progress toward both short-term savings goals and long-term financial independence. Prioritizing geoarbitrage strategies maximizes disposable income, creating a robust foundation for sustainable wealth building and earlier retirement.

Savings Laddering

Savings laddering enhances money management by structuring short-term savings goals to build financial discipline, gradually increasing target amounts and timeframes. This method supports achieving a Financial Independence Goal by creating a scalable, organized pathway from immediate savings objectives to long-term wealth accumulation.

Minimalist FI

A Savings Goal targets accumulating a specific amount for short-term needs or purchases, whereas a Financial Independence Goal aims for sustainable, long-term wealth that covers living expenses indefinitely through investments and passive income. Minimalist Financial Independence emphasizes reducing expenses and simplifying lifestyle to accelerate reaching FI with lower capital requirements.

Lean FIRE

Savings Goals focus on accumulating a specific amount of money for short-term needs or planned expenses, while Financial Independence Goals, especially Lean FIRE (Financial Independence, Retire Early), prioritize building a minimalist yet sustainable passive income stream that covers essential living costs indefinitely. Lean FIRE emphasizes frugality and efficient money management to achieve early retirement with reduced financial resources compared to traditional FIRE benchmarks.

Savings Goal vs Financial Independence Goal for money management. Infographic

moneydiff.com

moneydiff.com