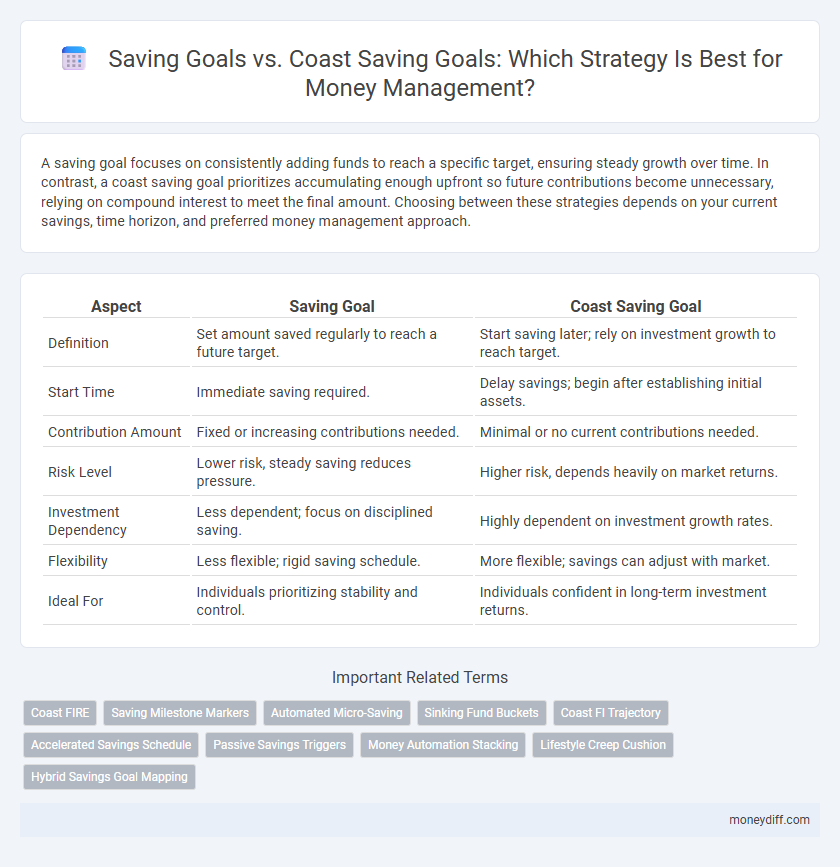

A saving goal focuses on consistently adding funds to reach a specific target, ensuring steady growth over time. In contrast, a coast saving goal prioritizes accumulating enough upfront so future contributions become unnecessary, relying on compound interest to meet the final amount. Choosing between these strategies depends on your current savings, time horizon, and preferred money management approach.

Table of Comparison

| Aspect | Saving Goal | Coast Saving Goal |

|---|---|---|

| Definition | Set amount saved regularly to reach a future target. | Start saving later; rely on investment growth to reach target. |

| Start Time | Immediate saving required. | Delay savings; begin after establishing initial assets. |

| Contribution Amount | Fixed or increasing contributions needed. | Minimal or no current contributions needed. |

| Risk Level | Lower risk, steady saving reduces pressure. | Higher risk, depends heavily on market returns. |

| Investment Dependency | Less dependent; focus on disciplined saving. | Highly dependent on investment growth rates. |

| Flexibility | Less flexible; rigid saving schedule. | More flexible; savings can adjust with market. |

| Ideal For | Individuals prioritizing stability and control. | Individuals confident in long-term investment returns. |

Understanding Traditional Saving Goals

Traditional saving goals prioritize accumulating a specific amount over time to fund future expenses, emphasizing disciplined deposits and steady growth. Unlike Coast saving goals, which focus on early investment to cover future needs without additional contributions, traditional goals require continuous saving efforts. This method helps build a clear financial target and encourages consistent money management habits.

What Are Coast Saving Goals?

Coast saving goals allow individuals to stop contributing new funds once their existing investments have grown enough to reach a future target by retirement or another financial milestone. This strategy focuses on building a nest egg early, then letting compound interest work over time without needing additional deposits. Compared to traditional saving goals, coast saving goals emphasize long-term growth and reduce the pressure of continuous contributions.

Key Differences: Saving Goal vs Coast Saving Goal

Saving goals require consistent contributions to build a fund for a specific purpose, emphasizing active money management and regular deposits. Coast saving goals, by contrast, rely on early, larger contributions that grow over time through compound interest, allowing minimal or no additional deposits later. The key difference lies in the approach: saving goals demand ongoing effort, whereas coast goals focus on front-loading savings to let time and interest complete the process.

Benefits of Setting a Saving Goal

Setting a saving goal improves financial discipline by providing clear targets for budgeting and expenditure control, enhancing the likelihood of achieving long-term wealth. A saving goal, whether traditional or coast saving, promotes consistent contributions that build financial security and reduce reliance on debt. Clear objectives foster motivation and enable individuals to track progress, increasing the efficiency of money management strategies.

Advantages of Coast Saving Goals for Financial Independence

Coast saving goals require reaching a financial milestone early, allowing investments to grow passively until retirement without additional contributions, which reduces ongoing saving pressure. This strategy leverages compound interest effectively, providing greater flexibility and less stress compared to traditional saving goals. By focusing on achieving the coast goal, individuals gain financial independence sooner, enabling them to allocate funds toward other life priorities or investments.

Calculating Your Saving Goal: Steps and Examples

Calculating your saving goal involves identifying a target amount based on future expenses or financial milestones, such as buying a home or building an emergency fund. A traditional saving goal focuses on accumulating the full amount within a specific timeframe, while a coast saving goal calculates the initial lump sum needed today to grow steadily to the target without further contributions. For example, if your goal is $50,000 in 10 years, a saving goal requires monthly deposits, whereas a coast saving goal determines the present value of that $50,000 discounted by expected investment returns, outlining how much to save upfront.

How to Determine Your Coast Saving Number

Determine your Coast Saving Number by calculating the amount you need to have saved today so that, with compound interest, it grows to your desired retirement goal without additional contributions. Use a reliable retirement calculator or formula incorporating your target retirement age, expected rate of return, and inflation adjustments to find this figure. This approach allows you to set a clear savings threshold, helping you manage your money effectively by understanding when your investments can coast to your goal.

Which is Right for You: Saving Goal or Coast Saving Goal?

Choosing between a saving goal and a coast saving goal depends on your financial timeline and risk tolerance. A saving goal targets accumulating a specific amount by a deadline, ideal for short-term objectives like a down payment or vacation. In contrast, a coast saving goal focuses on investing early to allow compounding growth, enabling you to save less over time while still reaching retirement or long-term milestones.

Common Mistakes in Pursuing Saving and Coast Saving Goals

Many individuals confuse saving goals with coast saving goals, leading to inefficient financial planning and underestimating required monthly contributions. Common mistakes include failing to account for inflation in coast saving goals and neglecting to adjust saving goals based on changing income or expenses. Overlooking the distinction between the two strategies often results in delayed retirement or unmet financial targets.

Actionable Tips for Achieving Your Money Management Goal

Set specific milestones for both saving goals and coast saving goals to track progress clearly and maintain motivation. Automate contributions to your saving accounts to ensure consistency and reduce the temptation to spend. Regularly review your budget to identify unnecessary expenses and reallocate those funds toward your targeted savings.

Related Important Terms

Coast FIRE

The Coast FIRE strategy emphasizes reaching a savings milestone early enough so your investments grow passively to fund retirement without additional contributions, contrasting with traditional saving goals that require continuous monthly deposits. This approach optimizes financial independence by minimizing ongoing savings stress and leveraging compound interest to cover future expenses.

Saving Milestone Markers

Saving goal strategies differ by focusing on either reaching a fixed target amount or maintaining current savings levels while relying on investment growth, with milestone markers such as $10,000 or six months' living expenses serving as crucial progress checkpoints. Tracking these milestones helps optimize financial planning by signaling when adjustments to contributions or spending are necessary to stay aligned with long-term wealth accumulation objectives.

Automated Micro-Saving

Automated micro-saving strategies enhance both saving goals and coast saving goals by enabling consistent, small transfers that build wealth with minimal effort. This method leverages technology to optimize cash flow, ensuring users steadily progress towards financial targets without requiring large, upfront deposits.

Sinking Fund Buckets

Sinking fund buckets allow for precise allocation between saving goals and coast saving goals, ensuring targeted funds for future expenses without relying on high returns or urgent withdrawals. By segmenting money into dedicated buckets, individuals can manage their finances efficiently, balancing immediate savings with the consistent growth of coast goals.

Coast FI Trajectory

Coast FI trajectory focuses on building sufficient retirement savings early, allowing investments to grow passively over time without additional contributions, contrasting with traditional saving goals that require consistent deposits. This approach leverages compound interest to reduce financial stress by achieving financial independence sooner through disciplined early investing rather than ongoing savings efforts.

Accelerated Savings Schedule

An accelerated savings schedule in a traditional saving goal focuses on systematically increasing contributions to reach a specific target faster, optimizing cash flow and maximizing interest accumulation. In contrast, a coast saving goal requires a one-time lump sum or minimal ongoing contributions later, leveraging compound interest to grow the existing savings without additional deposits.

Passive Savings Triggers

Passive savings triggers enable automatic contributions toward both Saving goals and Coast saving goals, minimizing effort while maximizing long-term wealth accumulation. Setting up automated transfers or employer contributions leverages compound growth for Saving goals, whereas Coast saving goals rely on early, sufficient deposits allowing funds to grow passively without further input.

Money Automation Stacking

Money automation stacking enhances the effectiveness of a saving goal by systematically directing funds toward specific targets, ensuring consistent accumulation. In contrast, a coast saving goal leverages early savings and investment growth to reduce ongoing contributions, allowing automation to prioritize other financial objectives.

Lifestyle Creep Cushion

A saving goal directly targets accumulating specific funds for future expenses, while a coast saving goal focuses on having enough saved early on to let investments grow without additional contributions. Incorporating a Lifestyle Creep Cushion within either goal helps prevent unchecked spending increases by maintaining a buffer that supports financial stability despite rising lifestyle costs.

Hybrid Savings Goal Mapping

Hybrid Savings Goal Mapping integrates traditional Saving Goals, which target accumulating a specific amount, with Coast Savings Goals that emphasize early savings to let compound interest grow funds independently over time. This approach optimizes money management by balancing immediate savings discipline with long-term growth strategies, enhancing financial flexibility and goal attainment.

Saving goal vs Coast saving goal for money management. Infographic

moneydiff.com

moneydiff.com