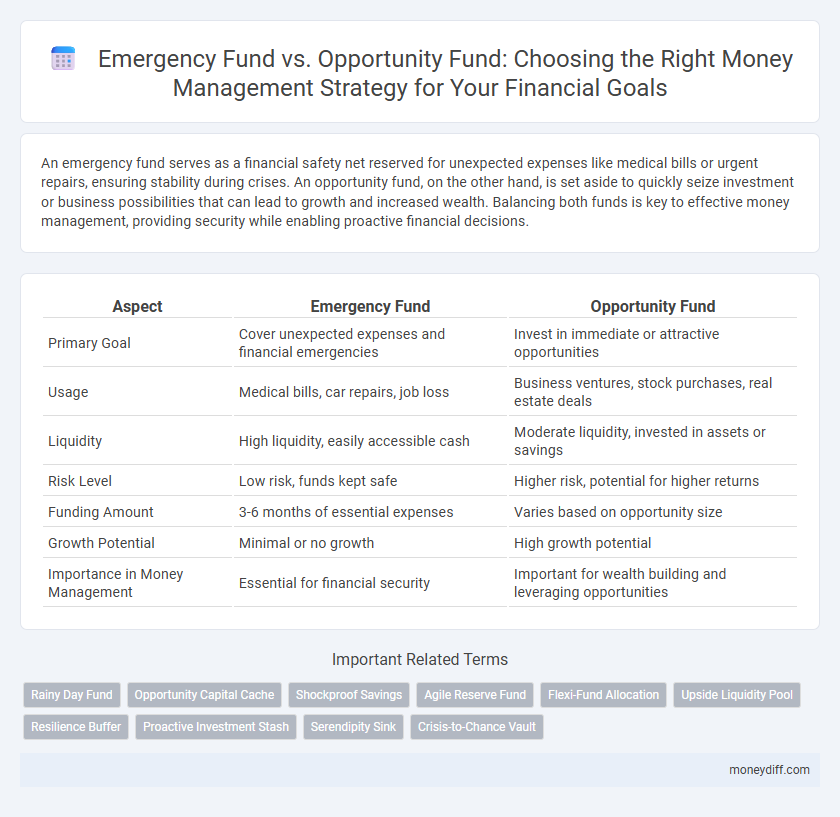

An emergency fund serves as a financial safety net reserved for unexpected expenses like medical bills or urgent repairs, ensuring stability during crises. An opportunity fund, on the other hand, is set aside to quickly seize investment or business possibilities that can lead to growth and increased wealth. Balancing both funds is key to effective money management, providing security while enabling proactive financial decisions.

Table of Comparison

| Aspect | Emergency Fund | Opportunity Fund |

|---|---|---|

| Primary Goal | Cover unexpected expenses and financial emergencies | Invest in immediate or attractive opportunities |

| Usage | Medical bills, car repairs, job loss | Business ventures, stock purchases, real estate deals |

| Liquidity | High liquidity, easily accessible cash | Moderate liquidity, invested in assets or savings |

| Risk Level | Low risk, funds kept safe | Higher risk, potential for higher returns |

| Funding Amount | 3-6 months of essential expenses | Varies based on opportunity size |

| Growth Potential | Minimal or no growth | High growth potential |

| Importance in Money Management | Essential for financial security | Important for wealth building and leveraging opportunities |

Defining Emergency Fund and Opportunity Fund

An emergency fund is a reserved amount of money specifically set aside to cover unexpected expenses such as medical emergencies, car repairs, or job loss, ensuring financial stability during crises. An opportunity fund, on the other hand, is money saved with the intention of quickly capitalizing on unforeseen investment opportunities, business ventures, or advantageous purchases. Proper money management involves clearly defining and maintaining both funds to balance financial security and growth potential.

Key Differences Between Emergency and Opportunity Funds

Emergency funds provide financial security by covering unexpected expenses like medical bills or car repairs, typically held in highly liquid accounts for immediate access. Opportunity funds are reserved for investing in potential growth opportunities, such as business ventures or education, balancing risk with growth potential through moderately liquid assets. The key difference lies in purpose and accessibility: emergency funds prioritize preservation and quick availability, while opportunity funds aim for strategic financial gains with some liquidity trade-offs.

Why You Need an Emergency Fund First

An emergency fund is essential for financial stability, covering unexpected expenses like medical bills, car repairs, or job loss without incurring debt. Unlike an opportunity fund, which is intended for investments or spontaneous purchases, an emergency fund prioritizes security and liquidity in crises. Establishing this fund first ensures a financial safety net that prevents disruption to long-term financial goals.

Building the Ideal Emergency Fund

Building the ideal emergency fund requires saving three to six months' worth of essential living expenses, ensuring financial stability during unexpected events like job loss or medical emergencies. An emergency fund should be easily accessible, typically held in a high-yield savings account to balance liquidity and growth potential. Distinguishing it from an opportunity fund, which is used for potential investments or purchases, keeps funds reserved solely for urgent, unplanned needs.

Unlocking the Power of an Opportunity Fund

An opportunity fund unlocks the potential to seize high-return investments or unexpected financial ventures that arise, providing flexibility beyond the safety net of an emergency fund. Unlike an emergency fund designed strictly for unforeseen expenses, an opportunity fund strategically allocates capital to maximize wealth growth through timely investments. Prioritizing the creation of an opportunity fund enhances financial agility and positions individuals to capitalize on market opportunities without compromising their financial security.

Risk Management: Emergency vs Opportunity Funds

Emergency funds prioritize financial security by covering unexpected expenses such as medical emergencies, job loss, or urgent home repairs, minimizing the risk of debt accumulation. Opportunity funds, conversely, are allocated for strategic investments or timely opportunities, accepting higher risk for potential financial growth. Balancing both funds ensures robust risk management by safeguarding against crises while enabling wealth-building opportunities.

How to Allocate Money Between Both Funds

Allocate money between emergency and opportunity funds based on immediate financial stability and potential growth opportunities, prioritizing emergency funds with three to six months of living expenses for unforeseen events. Direct surplus income towards an opportunity fund to capitalize on investments or business ventures, adjusting contributions as financial conditions and risk tolerance change. Regularly review and rebalance allocations to maintain a balance that supports both safety and wealth building goals.

Strategies for Growing Your Opportunity Fund

Maximize your opportunity fund growth by allocating a portion of your monthly income to high-yield savings accounts or low-risk investment vehicles like index funds and ETFs. Regularly review and adjust contributions based on market conditions and personal financial goals to capitalize on emerging opportunities. Diversification and disciplined reinvestment strategies help accelerate returns while maintaining liquidity for timely investments.

Common Mistakes in Managing These Funds

Confusing an emergency fund with an opportunity fund often leads to misallocation of critical resources, jeopardizing financial security during unforeseen events. Many individuals mistakenly use their emergency savings for investment opportunities, reducing their safety net and increasing vulnerability to financial crises. Properly distinguishing and managing these funds is essential to maintain liquidity for emergencies while capitalizing on potential growth opportunities.

Integrating Both Funds Into Your Financial Plan

Integrating an emergency fund and an opportunity fund into your financial plan balances risk management and growth potential, ensuring liquidity for unforeseen expenses while positioning you to capitalize on market opportunities. Allocate 3-6 months of essential expenses to the emergency fund for financial security, and designate a separate amount based on your investment goals and market conditions to the opportunity fund. Regularly reviewing and adjusting these funds helps maintain optimal readiness and flexibility in your overall money management strategy.

Related Important Terms

Rainy Day Fund

A Rainy Day Fund, a crucial component of emergency funds, provides immediate financial security for unexpected expenses like medical bills or urgent home repairs, ensuring stability without incurring debt. Unlike opportunity funds, which target investments or potential ventures, Rainy Day Funds prioritize liquidity and accessibility to cover unforeseen financial shocks.

Opportunity Capital Cache

Opportunity Capital Cache serves as a strategic financial reserve enabling investors to quickly capitalize on high-return opportunities, unlike traditional emergency funds designed solely for unexpected expenses. Prioritizing an Opportunity Capital Cache enhances portfolio growth potential by ensuring liquidity is available to seize market dips, property deals, or startup investments.

Shockproof Savings

Emergency funds provide a critical safety net for unexpected expenses such as medical emergencies or job loss, ensuring financial stability during crises. Opportunity funds enable quick investment in potential high-return ventures, balancing risk by reserving money separate from essential shockproof savings.

Agile Reserve Fund

An Agile Reserve Fund balances the stability of an Emergency Fund with the flexibility of an Opportunity Fund by providing quick access to cash for unforeseen expenses and strategic investments that can enhance long-term financial growth. This hybrid approach optimizes liquidity management, ensuring funds are allocated efficiently to cover urgent needs while capitalizing on emerging opportunities.

Flexi-Fund Allocation

Emergency funds ensure liquidity for unforeseen expenses, typically covering 3-6 months of essential living costs, while opportunity funds allow flexible investment in unexpected financial prospects. Prioritizing a balanced Flexi-Fund Allocation enhances financial resilience by combining safety with growth potential.

Upside Liquidity Pool

An Upside Liquidity Pool balances the stability of an emergency fund with the growth potential of an opportunity fund, providing accessible cash for unexpected expenses while enabling quick investment in high-return opportunities. This strategic blend ensures liquidity to cover urgent needs without sacrificing the ability to capitalize on market gains.

Resilience Buffer

An emergency fund serves as a resilience buffer by providing immediate access to cash for unexpected expenses such as medical emergencies or job loss, ensuring financial stability during crises. An opportunity fund, while important for seizing investments or ventures, lacks the immediacy and security of a dedicated emergency reserve designed specifically for risk mitigation.

Proactive Investment Stash

Building a proactive investment stash through an emergency fund ensures financial security during unforeseen events, while an opportunity fund allocates liquid assets for seizing market or life opportunities without disrupting long-term investments. Balancing both funds maximizes financial flexibility and growth potential by separating risk management from strategic investment readiness.

Serendipity Sink

Emergency funds provide a financial safety net for unexpected expenses, while opportunity funds enable quick access to capital for unexpected ventures or investments. Serendipity Sink represents the risk of missed opportunities when money is locked exclusively in emergency funds without consideration for potential gains from opportunistic spending.

Crisis-to-Chance Vault

The Crisis-to-Chance Vault balances an emergency fund's liquidity with an opportunity fund's growth potential by allocating resources specifically for unforeseen crises while preserving capital for seizing investment opportunities. This strategic money management approach ensures financial stability during downturns and readiness to capitalize on market volatility.

Emergency fund vs Opportunity fund for money management. Infographic

moneydiff.com

moneydiff.com