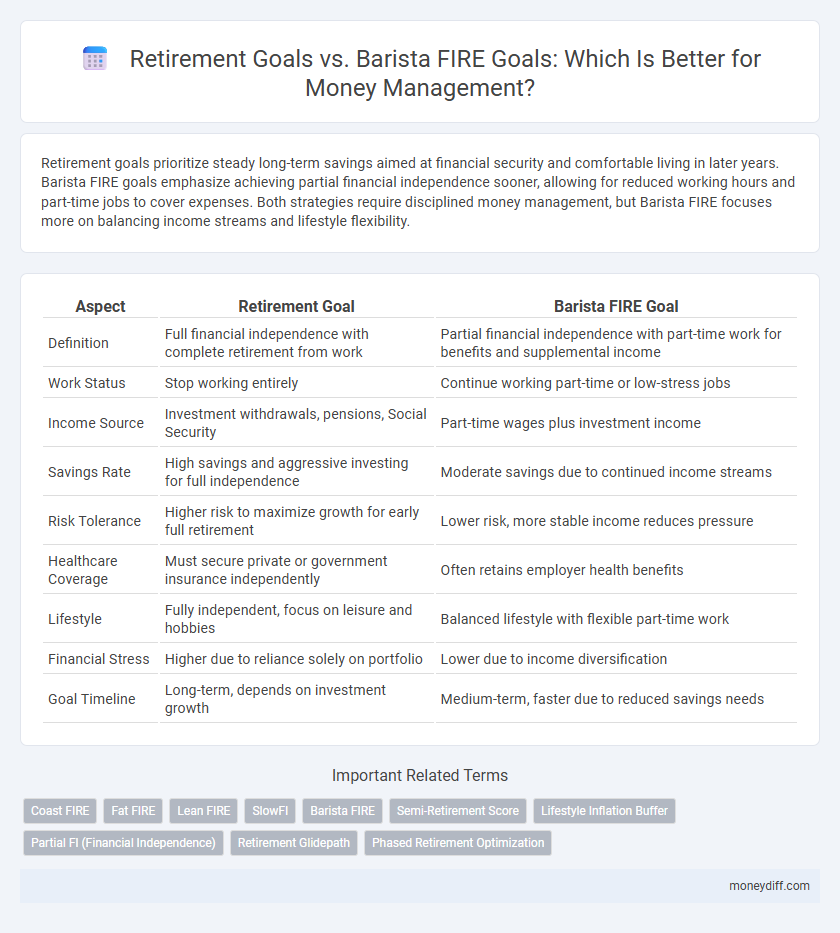

Retirement goals prioritize steady long-term savings aimed at financial security and comfortable living in later years. Barista FIRE goals emphasize achieving partial financial independence sooner, allowing for reduced working hours and part-time jobs to cover expenses. Both strategies require disciplined money management, but Barista FIRE focuses more on balancing income streams and lifestyle flexibility.

Table of Comparison

| Aspect | Retirement Goal | Barista FIRE Goal |

|---|---|---|

| Definition | Full financial independence with complete retirement from work | Partial financial independence with part-time work for benefits and supplemental income |

| Work Status | Stop working entirely | Continue working part-time or low-stress jobs |

| Income Source | Investment withdrawals, pensions, Social Security | Part-time wages plus investment income |

| Savings Rate | High savings and aggressive investing for full independence | Moderate savings due to continued income streams |

| Risk Tolerance | Higher risk to maximize growth for early full retirement | Lower risk, more stable income reduces pressure |

| Healthcare Coverage | Must secure private or government insurance independently | Often retains employer health benefits |

| Lifestyle | Fully independent, focus on leisure and hobbies | Balanced lifestyle with flexible part-time work |

| Financial Stress | Higher due to reliance solely on portfolio | Lower due to income diversification |

| Goal Timeline | Long-term, depends on investment growth | Medium-term, faster due to reduced savings needs |

Understanding Retirement Goals in Money Management

Retirement goals in money management prioritize long-term financial security through consistent savings, investment growth, and risk mitigation strategies to ensure sufficient income post-retirement. Barista FIRE goals emphasize achieving partial financial independence by accumulating enough assets to cover basic expenses while maintaining part-time work, balancing freedom with continued income sources. Understanding these distinctions helps tailor money management approaches to align with individual lifestyle preferences and financial priorities.

What is Barista FIRE? A New Approach to Retirement

Barista FIRE is a money management strategy that blends traditional retirement goals with continued part-time work, allowing individuals to retire early from full-time positions while maintaining financial stability through lower-stress jobs such as barista roles. This approach reduces the required savings threshold compared to conventional retirement by generating supplemental income that covers essential expenses, thereby decreasing reliance on retirement funds. Barista FIRE offers a flexible, sustainable lifestyle by balancing financial independence with ongoing earnings, making early retirement more attainable and less financially risky.

Key Differences: Traditional Retirement vs. Barista FIRE Goals

Traditional retirement goals emphasize accumulating sufficient savings to stop working entirely, typically by age 65, focusing on long-term wealth preservation and predictable income streams like pensions and Social Security. Barista FIRE goals prioritize achieving partial financial independence earlier, allowing for reduced work hours or part-time employment to cover essential expenses while maintaining a more flexible lifestyle and avoiding full retirement. Key differences include the level of required savings, timing of financial independence, and the role of continued income through part-time jobs or side hustles in Barista FIRE strategies.

Income Planning: Full Retirement vs. Supplemental Earnings

Full retirement income planning emphasizes securing a reliable and sustainable income stream through savings, investments, and social security benefits to fully replace pre-retirement earnings. The Barista FIRE goal focuses on achieving partial financial independence by combining modest investment income with supplemental earnings from part-time or flexible jobs, reducing the total amount needed to retire. This strategy balances lower income targets with continued work, optimizing tax efficiency and social security claiming strategies for financial stability.

Expense Forecasting: Living Needs for Each Goal

Retirement goals require detailed expense forecasting to ensure consistent income replacement for long-term living needs, accounting for inflation, healthcare, and lifestyle changes. Barista FIRE goals focus on a reduced expense forecast by combining part-time work with lower living costs, emphasizing flexible budgeting and manageable spending. Understanding precise living needs for each goal enables optimized saving strategies and sustainable financial planning.

Investment Strategies for Retirement and Barista FIRE

Retirement investment strategies focus on maximizing long-term growth through diversified portfolios of stocks, bonds, and index funds, aiming for financial independence by traditional retirement age. Barista FIRE combines part-time work with strategic investments, balancing moderate risk assets like dividend-paying stocks and bond ladders to generate supplemental income while maintaining lower withdrawal rates. Both approaches prioritize tax-advantaged accounts like 401(k)s and IRAs but differ in portfolio allocation and withdrawal flexibility to meet distinct cash flow needs.

Timeline and Milestones: Reaching Retirement vs. Barista FIRE

The Retirement goal typically spans several decades, emphasizing steady accumulation of wealth through traditional savings and investments to achieve full financial independence by a target age. In contrast, the Barista FIRE goal aims for an accelerated timeline, often within 10 to 15 years, combining partial financial independence with part-time work to cover living expenses while minimizing reliance on investment withdrawals. Key milestones for Retirement include maxing out retirement accounts and reaching a safe withdrawal rate, whereas Barista FIRE focuses on building a sustainable income stream and reducing expenses to bridge the gap between passive income and lifestyle costs.

Risk Tolerance in Retirement and Barista FIRE Planning

Retirement goal planning requires a higher risk tolerance due to the need for sustainable income over decades without employment, emphasizing diversified investments and conservative withdrawal strategies. Barista FIRE planning involves moderate risk tolerance as it combines partial income from part-time work with investment returns, allowing for a more flexible approach to market fluctuations. Aligning risk tolerance with the chosen goal impacts asset allocation, withdrawal rates, and long-term financial stability.

Lifestyle Considerations for Both Retirement Paths

Retirement goals emphasize long-term financial security and maintaining a comfortable lifestyle without work-related income, often requiring substantial savings and investment growth. Barista FIRE goals prioritize a balance between financial independence and continued part-time work, enabling a flexible lifestyle with lower savings requirements but steady supplemental income. Lifestyle considerations for both paths include desired work engagement, risk tolerance, healthcare planning, and personal fulfillment preferences.

Choosing the Right Goal: Factors to Help Decide

Choosing between a traditional retirement goal and a Barista FIRE goal depends on factors such as desired lifestyle, savings rate, and risk tolerance. Traditional retirement aims for full financial independence with a larger nest egg, while Barista FIRE combines part-time work with reduced expenses for earlier financial freedom. Assessing income stability, healthcare needs, and personal fulfillment helps determine the optimal money management strategy tailored to long-term financial security.

Related Important Terms

Coast FIRE

Coast FIRE focuses on saving aggressively early, allowing investments to grow over time without additional contributions, contrasting with traditional Retirement goals that require continuous saving until retirement age. Barista FIRE combines partial early retirement with part-time work for income and benefits, offering more flexibility than the pure Coast FIRE strategy which relies on reaching a financial baseline before stopping contributions.

Fat FIRE

Fat FIRE represents an aggressive retirement goal targeting a high net worth and luxurious lifestyle, requiring substantial savings and investment growth compared to the modest income-focused Barista FIRE goal. Prioritizing Fat FIRE involves maximizing cash flow, optimizing tax-efficient investment vehicles, and maintaining disciplined financial planning to achieve financial independence with elevated spending capacity.

Lean FIRE

A Retirement goal centers on accumulating a substantial nest egg to sustain traditional post-career living standards, while Lean FIRE emphasizes minimalistic spending and early financial independence with a lower savings target. Barista FIRE blends part-time work with Lean FIRE principles, allowing for reduced expenses and steady income, optimizing money management for flexible retirement planning.

SlowFI

SlowFI emphasizes steady, intentional saving and spending habits that prioritize long-term financial security over rapid wealth accumulation, aligning more closely with traditional retirement goals. Barista FIRE focuses on achieving partial financial independence quickly through side income and lean living, allowing for reduced work hours but not complete retirement, blending financial freedom with continued income generation.

Barista FIRE

Barista FIRE prioritizes achieving partial financial independence through a sustainable part-time job, enabling individuals to balance work and leisure while maintaining manageable expenses. This approach contrasts traditional retirement goals by emphasizing ongoing income streams and flexibility rather than complete withdrawal from the workforce.

Semi-Retirement Score

The Semi-Retirement Score evaluates financial readiness by comparing savings and passive income against living expenses for both traditional retirement and Barista FIRE goals. This metric helps individuals balance work flexibility with financial independence, quantifying how close they are to sustaining a desired lifestyle without full retirement income.

Lifestyle Inflation Buffer

Retirement goals typically prioritize long-term wealth accumulation and a sustainable withdrawal rate, whereas Barista FIRE focuses on maintaining a modest lifestyle with part-time income supplemented by investments, emphasizing a Lifestyle Inflation Buffer to prevent excess spending as income grows. Properly managing this buffer helps avoid lifestyle creep, ensuring financial independence without compromising everyday quality of life.

Partial FI (Financial Independence)

Partial Financial Independence (FI), often called Barista FIRE, allows individuals to achieve a sustainable income through part-time work while managing expenses to meet retirement goals earlier than traditional plans. Balancing retirement savings with partial FI strategies enables better cash flow control and reduces reliance on full-time employment, optimizing long-term financial security.

Retirement Glidepath

Retirement goals emphasize a carefully structured glidepath that gradually shifts asset allocation from growth to preservation to optimize long-term financial security. In contrast, the Barista FIRE goal prioritizes flexible income streams from part-time work while maintaining a less aggressive glidepath, balancing risk with ongoing cash flow needs.

Phased Retirement Optimization

Phased Retirement Optimization balances the Retirement goal's long-term wealth accumulation with the Barista FIRE goal's strategy of part-time work and reduced expenses to extend financial independence. Integrating sustainable withdrawal rates and income diversification enhances money management efficiency during this transition.

Retirement goal vs Barista FIRE goal for money management. Infographic

moneydiff.com

moneydiff.com