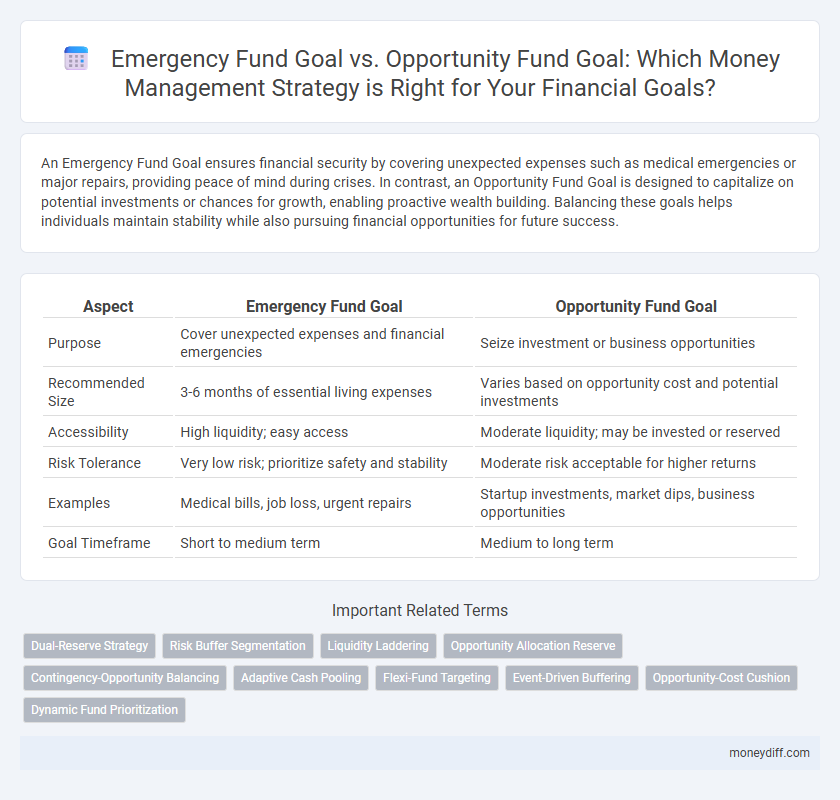

An Emergency Fund Goal ensures financial security by covering unexpected expenses such as medical emergencies or major repairs, providing peace of mind during crises. In contrast, an Opportunity Fund Goal is designed to capitalize on potential investments or chances for growth, enabling proactive wealth building. Balancing these goals helps individuals maintain stability while also pursuing financial opportunities for future success.

Table of Comparison

| Aspect | Emergency Fund Goal | Opportunity Fund Goal |

|---|---|---|

| Purpose | Cover unexpected expenses and financial emergencies | Seize investment or business opportunities |

| Recommended Size | 3-6 months of essential living expenses | Varies based on opportunity cost and potential investments |

| Accessibility | High liquidity; easy access | Moderate liquidity; may be invested or reserved |

| Risk Tolerance | Very low risk; prioritize safety and stability | Moderate risk acceptable for higher returns |

| Examples | Medical bills, job loss, urgent repairs | Startup investments, market dips, business opportunities |

| Goal Timeframe | Short to medium term | Medium to long term |

Understanding Emergency Fund vs Opportunity Fund

Emergency Fund goals prioritize financial security by setting aside three to six months' worth of essential expenses to cover unexpected events such as job loss or medical emergencies. Opportunity Fund goals focus on liquidity for strategic investments or spontaneous opportunities, emphasizing accessible cash beyond the emergency reserves. Distinguishing between these funds enhances money management by balancing risk mitigation with growth potential.

Defining Emergency Fund: Purpose and Scope

An emergency fund is designed to cover unexpected expenses such as medical bills, car repairs, or sudden job loss, providing financial security during crises. Its purpose is to ensure liquidity and prevent reliance on high-interest debt or loans. Typically, the recommended scope of an emergency fund ranges from three to six months' worth of essential living expenses.

Opportunity Fund Explained: Investing in Potential

An Opportunity Fund is a strategic financial goal designed to allocate money specifically for seizing high-potential investments or business ventures, distinct from an Emergency Fund that covers unforeseen expenses. This fund enables individuals to capitalize on growth opportunities quickly, such as stock market dips or startup investments, enhancing overall wealth accumulation. Prioritizing an Opportunity Fund alongside basic savings supports proactive money management and maximizes long-term financial gains.

Key Differences Between Emergency and Opportunity Funds

Emergency funds prioritize financial security by covering unexpected expenses like medical bills or car repairs, typically holding three to six months' worth of living expenses in liquid, easily accessible accounts. Opportunity funds focus on capturing prospective gains, such as investments or business ventures, often involving higher risk and less liquidity to maximize potential returns. The key difference lies in their purpose: emergency funds safeguard against financial crises, while opportunity funds aim to capitalize on growth opportunities.

Financial Planning: When to Prioritize Each Fund

An emergency fund goal should be prioritized during financial planning to cover unexpected expenses such as medical emergencies, job loss, or urgent home repairs, typically recommending three to six months of living expenses. An opportunity fund goal is focused on seizing potential investments or business opportunities and is more flexible, often requiring a smaller amount that can be deployed quickly without destabilizing financial security. Prioritizing the emergency fund first ensures a stable financial foundation before allocating money toward the opportunity fund, which supports growth and wealth-building endeavors.

Setting Realistic Goals for Emergency vs Opportunity Funds

Setting realistic goals for emergency funds involves calculating three to six months' worth of essential living expenses, ensuring financial security during unexpected events such as job loss or medical emergencies. Opportunity fund goals should target a flexible amount that allows quick access to invest in timely ventures or capitalize on market opportunities without jeopardizing emergency savings. Balancing both fund goals requires prioritizing liquidity and accessibility to maintain financial stability while enabling growth through strategic investments.

Calculating How Much to Save for Each Fund

Calculating how much to save for an emergency fund involves setting aside three to six months' worth of essential living expenses, including rent, utilities, groceries, and insurance premiums, to cover unexpected financial crises. Opportunity funds typically require a smaller, flexible savings target based on potential investment or business opportunities, often ranging from 10% to 20% of discretionary income. Balancing both funds ensures financial stability while allowing for growth and seizing advantageous opportunities without jeopardizing basic security.

Risk Management: Protection vs Growth

An Emergency Fund Goal prioritizes risk management by ensuring readily accessible cash to cover unexpected expenses, safeguarding financial stability and preventing high-interest debt accumulation. In contrast, an Opportunity Fund Goal focuses on growth by allocating money for potential investments or ventures, accepting moderate risk to capitalize on market opportunities. Balancing these goals is essential for a comprehensive money management strategy that protects against financial shocks while enabling wealth accumulation.

Integrating Both Funds into Your Overall Money Strategy

Integrating both an emergency fund and an opportunity fund into your money management strategy ensures balanced financial security and growth potential. An emergency fund typically covers 3-6 months of essential expenses to protect against unforeseen events, while an opportunity fund allows quick access to capital for investments or business ventures. Maintaining distinct but coordinated savings for these goals optimizes liquidity and readiness, supporting both risk mitigation and wealth building.

Common Mistakes to Avoid with Emergency and Opportunity Funds

A common mistake in managing emergency and opportunity funds is mixing the two, which jeopardizes financial stability and limits growth potential. Emergency funds should strictly cover 3-6 months of essential expenses, easily accessible but not for spontaneous investments. Opportunity funds require a separate allocation, targeting liquid assets for timely investments without depleting reserved emergency cash.

Related Important Terms

Dual-Reserve Strategy

The Dual-Reserve Strategy involves maintaining both an Emergency Fund Goal, focused on covering unexpected expenses like medical bills or job loss, and an Opportunity Fund Goal, designed to capitalize on time-sensitive investments or business opportunities. By allocating resources to these distinct financial reserves, individuals enhance liquidity and flexibility, ensuring preparedness for crises while maximizing potential wealth growth.

Risk Buffer Segmentation

Emergency Fund Goals provide a critical risk buffer by covering 3 to 6 months of essential expenses, ensuring financial stability during unexpected crises such as job loss or medical emergencies. Opportunity Fund Goals, segmented separately, allocate flexible capital for high-reward investments or spontaneous opportunities without compromising the emergency reserve's safety net.

Liquidity Laddering

Emergency Fund Goal ensures immediate access to liquid cash covering 3-6 months of essential expenses, while Opportunity Fund Goal targets easily accessible capital for strategic investments or unexpected opportunities beyond basic emergencies. Liquidity laddering optimizes fund allocation by staggering asset maturities, balancing quick availability with potential higher returns for both emergency and opportunity reserves.

Opportunity Allocation Reserve

Opportunity Allocation Reserve prioritizes flexible capital set aside to capitalize on unexpected investment or business opportunities, contrasting with the Emergency Fund Goal which focuses on financial security for unforeseen expenses. Establishing a dedicated Opportunity Fund enhances wealth-building potential by enabling timely responses to market conditions and lucrative offers.

Contingency-Opportunity Balancing

Emergency Fund Goal secures 3-6 months of essential expenses to cover unexpected financial shocks, while Opportunity Fund Goal targets capital allocation for timely investments or business prospects. Balancing contingency reserves with opportunity capital ensures liquidity for crises without sacrificing growth potential in money management strategies.

Adaptive Cash Pooling

Emergency fund goals prioritize liquidity and immediate access to cover unforeseen expenses, ensuring financial stability during crises, while opportunity fund goals focus on strategically pooling cash to capitalize on investment or business opportunities, maximizing returns through adaptive cash pooling techniques. Adaptive cash pooling efficiently allocates resources between emergency and opportunity funds, optimizing cash flow management and enhancing both security and growth potential within personal or corporate financial strategies.

Flexi-Fund Targeting

Emergency Fund Goal prioritizes liquidity and security by setting aside three to six months' worth of essential expenses to cover unforeseen financial crises, ensuring immediate access to cash without penalties. Opportunity Fund Goal focuses on flexible capital allocation to seize market opportunities or investments, balancing risk tolerance with growth potential through a dynamic, adjustable Flexi-Fund targeting strategy.

Event-Driven Buffering

Emergency Fund Goals provide a financial safety net designed to cover unexpected expenses such as medical emergencies or job loss, ensuring liquidity and stability during crisis events. Opportunity Fund Goals focus on allocating resources to seize time-sensitive financial opportunities like investments or business ventures, enabling flexibility and growth through strategic event-driven buffering.

Opportunity-Cost Cushion

An Opportunity Fund Goal prioritizes liquidity to capitalize on high-return investments, serving as a financial cushion against opportunity costs that arise when funds are tied up in low-yield emergency reserves. Allocating capital to an Opportunity Fund enhances wealth-building potential by balancing risk with timely access to money, unlike traditional Emergency Fund Goals that focus solely on immediate safety.

Dynamic Fund Prioritization

Dynamic fund prioritization balances Emergency Fund and Opportunity Fund goals by allocating resources based on immediate financial risks and potential investment returns. This strategy optimizes liquidity to cover unexpected expenses while seizing time-sensitive opportunities, enhancing overall financial resilience and growth potential.

Emergency Fund Goal vs Opportunity Fund Goal for money management. Infographic

moneydiff.com

moneydiff.com