Choosing a debt-free goal emphasizes eliminating all debt completely for long-term financial freedom, while the debt snowballing goal targets smaller debts first to build momentum and motivation. Prioritizing snowball payments can improve money management by creating quick wins that encourage consistent repayment habits. Both strategies enhance financial control but differ in psychological impact and repayment sequencing.

Table of Comparison

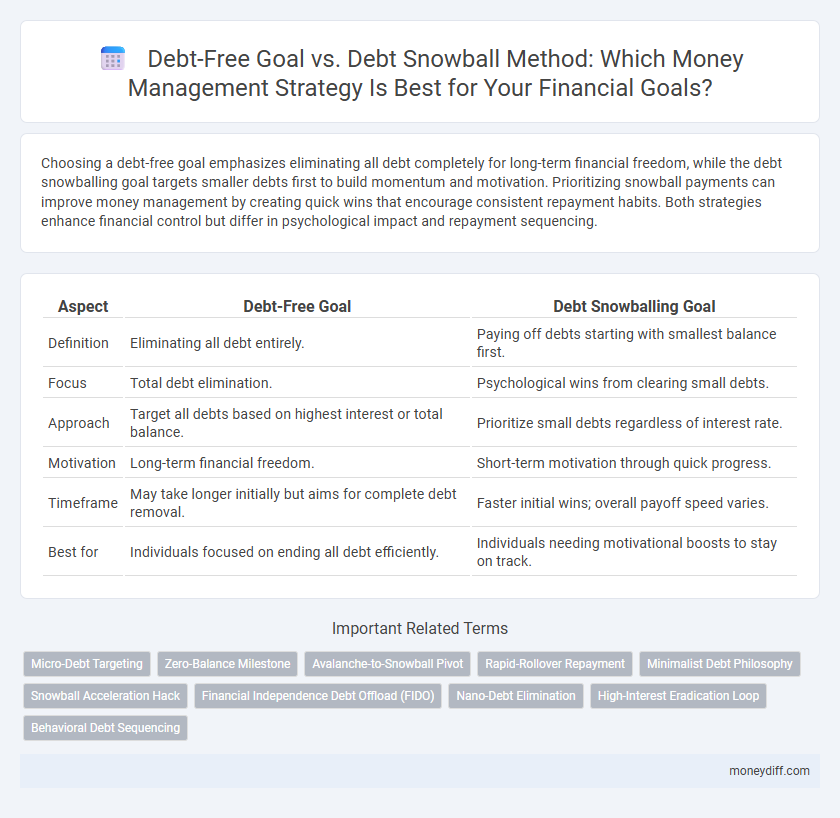

| Aspect | Debt-Free Goal | Debt Snowballing Goal |

|---|---|---|

| Definition | Eliminating all debt entirely. | Paying off debts starting with smallest balance first. |

| Focus | Total debt elimination. | Psychological wins from clearing small debts. |

| Approach | Target all debts based on highest interest or total balance. | Prioritize small debts regardless of interest rate. |

| Motivation | Long-term financial freedom. | Short-term motivation through quick progress. |

| Timeframe | May take longer initially but aims for complete debt removal. | Faster initial wins; overall payoff speed varies. |

| Best for | Individuals focused on ending all debt efficiently. | Individuals needing motivational boosts to stay on track. |

Understanding Debt-Free Goals in Money Management

Understanding debt-free goals in money management involves prioritizing the complete elimination of all outstanding debts to achieve financial freedom and reduce interest payments. This approach emphasizes a holistic view of personal finance by targeting overall debt eradication rather than incremental progress, which can create a stronger psychological commitment to financial discipline. Effective planning incorporates detailed budgeting, consistent savings, and strategic debt repayments to ensure sustainable wealth accumulation and long-term stability.

What Is the Debt Snowball Method?

The debt snowball method is a debt reduction strategy that prioritizes paying off the smallest debts first while making minimum payments on larger debts. This approach builds motivation through quick wins, accelerating momentum toward becoming debt-free. By systematically eliminating smaller balances, individuals can gain financial control and stay committed to long-term money management goals.

Key Differences: Debt-Free Goal vs Debt Snowballing

The debt-free goal focuses on eliminating all outstanding debt to achieve complete financial freedom, emphasizing long-term stability and reduced interest payments. In contrast, debt snowballing targets paying off debts starting from the smallest balance first, boosting motivation through quick wins and momentum. The key difference lies in strategy: debt-free aims for total elimination, while snowballing prioritizes psychological motivation and structured repayment order.

Pros and Cons of Setting a Debt-Free Goal

Setting a debt-free goal promotes financial freedom and reduces long-term interest expenses, enhancing overall money management discipline. However, aggressively pursuing debt elimination may limit liquidity and emergency fund availability, potentially increasing financial stress. Compared to debt snowballing, which prioritizes smaller debts for psychological wins, a strict debt-free focus can be less motivating but results in quicker full debt removal.

Pros and Cons of the Debt Snowball Approach

The debt snowball approach prioritizes paying off the smallest debts first, creating a series of quick wins that boost motivation and encourage continued progress. This method may not minimize interest payments as efficiently as other strategies like the debt avalanche, potentially resulting in higher overall costs. However, its psychological benefits can improve adherence to the debt repayment plan, making it a practical choice for individuals struggling with motivation.

Psychological Benefits: Debt-Free vs Snowballing

Achieving a debt-free goal provides significant psychological relief by eliminating financial stress and fostering a sense of accomplishment and security. In contrast, the debt snowball method builds motivation through incremental wins, enhancing self-discipline and confidence with each paid-off account. Both strategies improve mental well-being, but the debt-free goal offers a profound and lasting impact by removing the burden of debt entirely.

Financial Impact: Debt-Free Goal vs Debt Snowballing

Choosing a debt-free goal emphasizes eliminating all debt to improve overall financial health and increase net worth, offering long-term stability and reduced interest payments. The debt snowballing method prioritizes paying off smaller debts first, which boosts motivation and creates momentum but may result in higher interest costs over time. Understanding the financial impact helps tailor money management strategies that balance psychological benefits with cost efficiency.

Steps to Achieving a Debt-Free Lifestyle

Prioritizing a debt-free goal involves creating a detailed budget and consistently allocating extra funds toward the highest-interest debts to minimize overall interest payments. The debt snowballing goal emphasizes paying off smaller balances first to build momentum and motivation, accelerating progress through psychological rewards. Combining both strategies enhances financial discipline, steadily reducing liabilities while reinforcing positive spending habits crucial for long-term money management success.

Integrating Debt Snowballing into Your Money Management Plan

Integrating debt snowballing into your money management plan accelerates debt repayment by focusing on paying off smaller debts first, creating momentum and motivation. This method enhances financial discipline by providing quick wins, which can help maintain motivation and reduce overall debt faster than tackling all debts simultaneously. Prioritizing debt snowballing within your budget allows for systematic progress toward a debt-free goal, ensuring controlled spending and improved credit health over time.

Choosing the Right Strategy: Which Debt Goal Fits Your Financial Journey?

Selecting the ideal debt management strategy depends on personal financial behavior and psychological motivation. The debt snowball method targets smaller debts first, building momentum and boosting confidence through quick wins, while the debt-free goal emphasizes eliminating all debt systematically, focusing on overall financial freedom. Evaluating your spending habits, emotional triggers, and long-term objectives ensures the chosen approach aligns with your unique financial journey for sustainable success.

Related Important Terms

Micro-Debt Targeting

Micro-debt targeting accelerates financial freedom by prioritizing small, manageable debts that build momentum and reduce overall interest costs faster than traditional debt snowballing methods. This focused strategy enables individuals to systematically eliminate micro-debts, fostering consistent wins that enhance motivation and sustain long-term money management goals.

Zero-Balance Milestone

Reaching the zero-balance milestone in debt management signifies paying off all outstanding debts, providing financial freedom and improved credit health. While the debt snowballing goal accelerates motivation by targeting smallest debts first, achieving a debt-free goal ensures complete elimination of liabilities, optimizing overall financial stability.

Avalanche-to-Snowball Pivot

Shifting from the avalanche method, which targets debts with the highest interest rates first, to the snowball method prioritizes paying off smaller debts to build momentum and motivation. This pivot leverages psychological boosts from early wins, increasing commitment to long-term debt freedom despite potentially higher overall interest costs.

Rapid-Rollover Repayment

Rapid-Rollover Repayment accelerates debt elimination by aggressively targeting the smallest balances first, maximizing psychological momentum and freeing up funds faster than traditional debt snowball methods. Prioritizing high-impact repayments on lower debts creates a cascade effect, enabling quicker financial freedom and improved money management efficiency.

Minimalist Debt Philosophy

The minimalist debt philosophy prioritizes eliminating debt quickly by targeting the smallest balances first through debt snowballing, enhancing motivation with measurable wins. This strategy contrasts with the debt-free goal's broader focus on total elimination, emphasizing simplicity and emotional relief over aggressive payoff timelines.

Snowball Acceleration Hack

Debt snowballing accelerates debt payoff by systematically targeting smaller balances first, creating psychological momentum and freeing funds quicker for larger debts. This snowball acceleration hack optimizes cash flow and motivation, contrasting with the slower, less engaging lump-sum debt-free goal approach.

Financial Independence Debt Offload (FIDO)

Debt-free goals emphasize eliminating all debt to achieve complete financial independence and long-term wealth building, while debt snowballing focuses on paying off smaller debts first to build momentum and motivation, aligning closely with the Financial Independence Debt Offload (FIDO) strategy which combines psychological reinforcement with efficient debt reduction. FIDO integrates structured debt snowball methods to expedite financial freedom, prioritizing psychological wins to sustain momentum and optimize money management outcomes.

Nano-Debt Elimination

Nano-Debt Elimination targets removing small, often overlooked debts first to quickly boost financial momentum, contrasting with Debt Snowballing which prioritizes debts by size to build psychological wins. This strategy accelerates progress toward a debt-free goal by minimizing interest accumulation and freeing up cash flow faster.

High-Interest Eradication Loop

Focusing on the High-Interest Eradication Loop accelerates debt-free goals by prioritizing high-interest debts first, reducing overall interest payments and freeing up cash flow faster than the debt snowballing method, which targets the smallest balances regardless of interest rate. This strategic approach maximizes financial efficiency and minimizes total repayment time, aligning with optimized money management practices.

Behavioral Debt Sequencing

Behavioral debt sequencing emphasizes prioritizing smaller debt payments to build momentum and motivation, aligning with the debt snowballing goal, which leverages psychological wins to sustain financial discipline. The debt-free goal targets full elimination of liabilities regardless of size, focusing more on total balance reduction than emotional reinforcement in money management.

Debt-free goal vs Debt snowballing goal for money management. Infographic

moneydiff.com

moneydiff.com