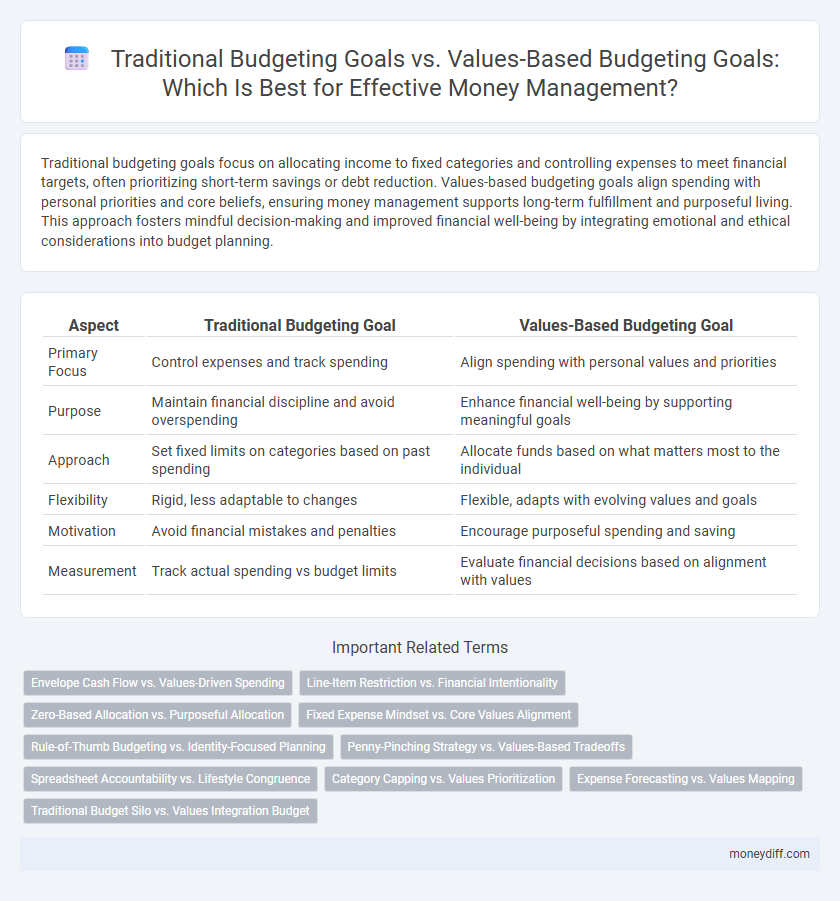

Traditional budgeting goals focus on allocating income to fixed categories and controlling expenses to meet financial targets, often prioritizing short-term savings or debt reduction. Values-based budgeting goals align spending with personal priorities and core beliefs, ensuring money management supports long-term fulfillment and purposeful living. This approach fosters mindful decision-making and improved financial well-being by integrating emotional and ethical considerations into budget planning.

Table of Comparison

| Aspect | Traditional Budgeting Goal | Values-Based Budgeting Goal |

|---|---|---|

| Primary Focus | Control expenses and track spending | Align spending with personal values and priorities |

| Purpose | Maintain financial discipline and avoid overspending | Enhance financial well-being by supporting meaningful goals |

| Approach | Set fixed limits on categories based on past spending | Allocate funds based on what matters most to the individual |

| Flexibility | Rigid, less adaptable to changes | Flexible, adapts with evolving values and goals |

| Motivation | Avoid financial mistakes and penalties | Encourage purposeful spending and saving |

| Measurement | Track actual spending vs budget limits | Evaluate financial decisions based on alignment with values |

Understanding Traditional Budgeting Goals

Traditional budgeting goals focus on setting fixed spending limits based on past income and expenses to control financial resources and avoid overspending. This method prioritizes maintaining balance by allocating funds to predefined categories, emphasizing discipline and predictability. The key objective is to ensure all expenses are planned and accounted for, reducing the risk of debt and fostering savings through strict adherence to the budget plan.

Defining Values-Based Budgeting Goals

Values-based budgeting goals prioritize aligning spending with core personal or organizational values, ensuring every expense supports long-term priorities and meaningful outcomes. Unlike traditional budgeting, which primarily focuses on balancing income and expenses, this approach emphasizes intentional financial decisions that reflect deeply held beliefs and desired life experiences. By defining clear values-based budgeting goals, individuals and organizations create a purposeful framework that drives financial discipline and holistic well-being.

Key Differences Between Traditional and Values-Based Budgeting

Traditional budgeting goals emphasize strict expense control and adherence to fixed spending limits, often leading to rigid financial plans prioritizing short-term savings. Values-based budgeting goals focus on aligning spending with personal priorities and long-term aspirations, fostering financial decisions that reflect core beliefs and enhance life satisfaction. Key differences include flexibility in resource allocation, the integration of emotional and ethical considerations, and the promotion of purposeful spending beyond merely balancing income and expenses.

Benefits of Traditional Budgeting Goals

Traditional budgeting goals provide clear financial boundaries, promoting disciplined spending and effective expense tracking. They enable individuals and organizations to allocate resources efficiently, ensuring essential costs are prioritized and reducing the risk of overspending. This structured approach supports steady savings growth and enhances overall financial stability.

Advantages of Values-Based Budgeting Goals

Values-based budgeting goals enhance financial management by aligning spending with personal priorities, fostering intentional and meaningful use of money. This approach improves motivation and discipline by emphasizing what truly matters rather than arbitrary limits. Greater clarity and satisfaction in budgeting decisions result from connecting financial plans to core values and long-term aspirations.

Challenges in Traditional Budgeting Approaches

Traditional budgeting goals often revolve around strict financial limits and cost control, which can lead to inflexibility and lack of alignment with personal values. This approach typically struggles to adapt to unexpected expenses and changing priorities, causing frustration and inefficiency. In contrast, values-based budgeting emphasizes aligning spending with core values, promoting financial decisions that foster satisfaction and long-term fulfillment despite potential market uncertainties.

How Values-Based Budgeting Aligns with Personal Priorities

Values-based budgeting aligns with personal priorities by directly linking spending decisions to individual core beliefs and long-term aspirations, fostering intentional financial habits. Unlike traditional budgeting focused solely on limiting expenses and categorizing costs, this approach enhances motivation by prioritizing expenditures that resonate with one's values. The integration of personal values into budgeting leads to greater financial satisfaction and improved goal fulfillment.

Transitioning from Traditional to Values-Based Budgeting

Transitioning from traditional budgeting goals, which focus primarily on expense control and financial targets, to values-based budgeting goals emphasizes aligning spending with personal or organizational core values and long-term aspirations. Values-based budgeting prioritizes meaningful investments and resource allocation that support ethical priorities, sustainability, and overall well-being rather than just numerical limits. This shift fosters intentional financial decisions that enhance life satisfaction and purpose-driven outcomes beyond basic cost management.

Measuring Success: Traditional vs Values-Based Goals

Traditional budgeting goals focus on strict financial targets such as expense reduction and profit maximization, emphasizing quantitative success metrics like budget variance and cost control. Values-based budgeting goals prioritize alignment with personal or organizational values, measuring success by how well spending reflects priorities such as sustainability, well-being, and long-term impact. Comparing these, traditional goals quantify financial outcomes, whereas values-based goals integrate qualitative measures that assess meaningful engagement with core principles.

Choosing the Right Budgeting Approach for Your Financial Journey

Traditional budgeting goals emphasize strict expense tracking and fixed spending limits to maintain financial discipline, often prioritizing immediate savings and debt reduction. Values-based budgeting goals focus on aligning spending with personal priorities and long-term aspirations, enhancing motivation and financial satisfaction. Choosing the right budgeting approach depends on individual financial objectives, lifestyle, and the desire for flexibility versus control in money management.

Related Important Terms

Envelope Cash Flow vs. Values-Driven Spending

Traditional budgeting goals emphasize strict envelope cash flow management to control expenses within predefined categories, ensuring financial discipline and avoiding overspending. Values-based budgeting goals prioritize aligning money management with personal values, promoting intentional spending that supports meaningful life priorities rather than merely tracking cash flow constraints.

Line-Item Restriction vs. Financial Intentionality

Traditional budgeting emphasizes strict line-item restrictions to control expenditures, prioritizing categorical spending limits without flexibility. Values-based budgeting prioritizes financial intentionality by aligning expenditures with personal or organizational values, enabling adaptive allocation and purposeful financial decision-making.

Zero-Based Allocation vs. Purposeful Allocation

Traditional budgeting goals emphasize zero-based allocation, where every dollar is assigned a specific task to balance expenditures, often leading to rigid financial planning. Values-based budgeting goals prioritize purposeful allocation by aligning spending with personal or organizational values, fostering intentional money management that reflects core priorities and long-term objectives.

Fixed Expense Mindset vs. Core Values Alignment

Traditional budgeting goals prioritize controlling fixed expenses to maintain financial stability, often emphasizing rigid spending limits and cost-cutting measures. Values-based budgeting goals align financial decisions with personal core values, fostering intentional spending that supports long-term fulfillment and meaningful life priorities.

Rule-of-Thumb Budgeting vs. Identity-Focused Planning

Traditional budgeting goals prioritize adherence to fixed percentages and expense categories using rule-of-thumb budgeting, aiming for straightforward allocation of income to savings, essentials, and discretionary spending. Values-based budgeting goals emphasize identity-focused planning, aligning financial decisions with personal values and long-term aspirations to foster meaningful money management and greater financial fulfillment.

Penny-Pinching Strategy vs. Values-Based Tradeoffs

Traditional budgeting goals emphasize strict penny-pinching strategies to minimize expenditures and maximize savings, often leading to rigid financial limits and missed opportunities. Values-based budgeting goals prioritize aligning spending with personal values, enabling intentional tradeoffs that enhance overall well-being and long-term financial fulfillment.

Spreadsheet Accountability vs. Lifestyle Congruence

Traditional budgeting goals emphasize strict spreadsheet accountability to track every expense precisely, ensuring financial targets are met through detailed numerical control. Values-based budgeting goals prioritize lifestyle congruence by aligning spending with personal values and meaningful experiences, fostering financial decisions that support overall well-being and long-term satisfaction.

Category Capping vs. Values Prioritization

Traditional budgeting goals emphasize strict category capping to limit spending within predetermined financial categories, aiming for control and predictability. Values-based budgeting goals prioritize aligning expenditures with personal or organizational core values, ensuring money management reflects deeper priorities rather than fixed limits.

Expense Forecasting vs. Values Mapping

Traditional budgeting goals emphasize accurate expense forecasting to control spending and ensure financial stability, relying heavily on historical data and fixed categories. Values-based budgeting goals prioritize values mapping to align expenditures with personal priorities, fostering intentional money management and enhancing financial well-being through purpose-driven allocation.

Traditional Budget Silo vs. Values Integration Budget

Traditional budgeting goals often create rigid silos that limit flexibility and fail to align spending with personal values, leading to suboptimal money management and financial dissatisfaction. Values-based budgeting integrates core personal beliefs into financial planning, promoting holistic decision-making that enhances both fiscal responsibility and emotional well-being.

Traditional Budgeting Goal vs Values-Based Budgeting Goal for money management Infographic

moneydiff.com

moneydiff.com