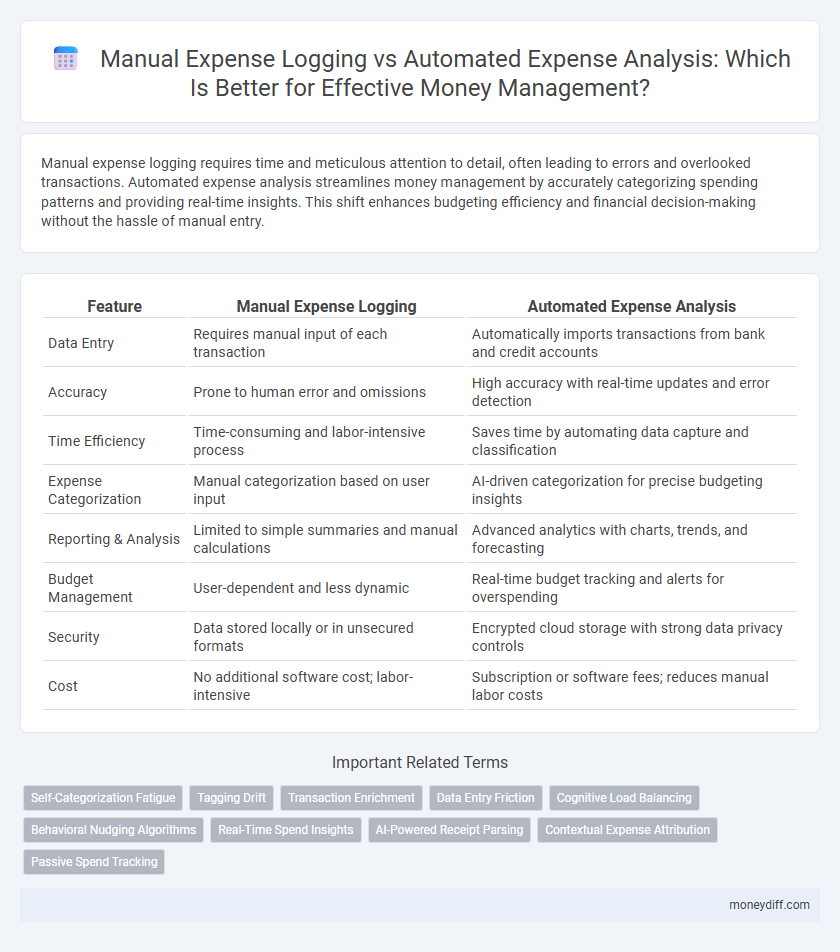

Manual expense logging requires time and meticulous attention to detail, often leading to errors and overlooked transactions. Automated expense analysis streamlines money management by accurately categorizing spending patterns and providing real-time insights. This shift enhances budgeting efficiency and financial decision-making without the hassle of manual entry.

Table of Comparison

| Feature | Manual Expense Logging | Automated Expense Analysis |

|---|---|---|

| Data Entry | Requires manual input of each transaction | Automatically imports transactions from bank and credit accounts |

| Accuracy | Prone to human error and omissions | High accuracy with real-time updates and error detection |

| Time Efficiency | Time-consuming and labor-intensive process | Saves time by automating data capture and classification |

| Expense Categorization | Manual categorization based on user input | AI-driven categorization for precise budgeting insights |

| Reporting & Analysis | Limited to simple summaries and manual calculations | Advanced analytics with charts, trends, and forecasting |

| Budget Management | User-dependent and less dynamic | Real-time budget tracking and alerts for overspending |

| Security | Data stored locally or in unsecured formats | Encrypted cloud storage with strong data privacy controls |

| Cost | No additional software cost; labor-intensive | Subscription or software fees; reduces manual labor costs |

Introduction to Expense Tracking Methods

Manual expense logging involves recording each transaction by hand, allowing for customizable categorization but often resulting in time-consuming and error-prone processes. Automated expense analysis leverages software algorithms to instantly track, categorize, and analyze spending patterns, enhancing accuracy and saving valuable time. Integrating automated tools with personal finance apps offers real-time insights, improving overall money management and budget planning efficiency.

What Is Manual Expense Logging?

Manual expense logging involves individuals recording each expenditure by hand, often using paper logs, spreadsheets, or basic apps. This method requires meticulous input of transaction details such as date, amount, category, and payment method, offering precise control over personal financial records. While time-consuming, manual logging helps users develop a deep understanding of their spending habits but lacks real-time analysis and automation features found in advanced expense management tools.

Understanding Automated Expense Analysis

Automated expense analysis uses intelligent algorithms to categorize and track spending in real time, reducing errors commonly found in manual expense logging. This technology integrates with bank accounts and credit cards, providing instant insights into spending patterns and budget adherence. Enhanced accuracy and efficiency enable better financial decisions and streamlined money management.

Time Commitment: Manual vs Automated Tracking

Manual expense logging demands significant time commitment, requiring individuals to record each transaction manually, often leading to delays and overlooked details. Automated expense analysis leverages software to instantly categorize and track expenses, drastically reducing time spent on data entry and improving accuracy. This efficiency allows for real-time financial insights without the burden of continuous manual input.

Accuracy and Error Rates in Expense Management

Manual expense logging often leads to higher error rates due to human mistakes such as misplaced decimal points or forgotten entries, reducing overall accuracy in financial tracking. Automated expense analysis leverages algorithms and machine learning to categorize transactions precisely and detect inconsistencies, significantly improving data reliability. Businesses utilizing automated systems report up to 80% fewer errors compared to manual methods, enhancing effective money management through accurate expense records.

Customization and Flexibility in Expense Tracking

Manual expense logging allows for high customization and flexibility by enabling users to categorize and annotate expenses according to personal preferences and unique financial goals. Automated expense analysis uses AI-driven algorithms to automatically sort and analyze transactions, offering real-time insights while adapting to spending patterns with minimal user intervention. Combining manual inputs with automated categorization enhances accuracy and personalization in money management strategies.

Data Security: Manual vs Automated Solutions

Manual expense logging reduces exposure to data breaches by keeping sensitive information offline, but it increases the risk of human error and inconsistent record-keeping. Automated expense analysis employs encryption and secure cloud storage protocols, enhancing data protection while enabling real-time monitoring and anomaly detection. Companies prioritizing data security weigh the trade-offs between manual control and automated safeguards to optimize confidentiality and accuracy in money management.

Cost Implications of Manual and Automated Logging

Manual expense logging often incurs higher indirect costs due to time consumption and human errors, resulting in inaccurate financial tracking and potential overspending. Automated expense analysis reduces operational costs by streamlining data entry, enhancing accuracy, and providing real-time spending insights that improve budgeting efficiency. Businesses leveraging automated systems typically experience lower long-term expenses compared to manual methods, maximizing cost-effectiveness in money management.

User Experience: Which Method Suits You?

Manual expense logging offers personalized control and immediate awareness of spending patterns but can be time-consuming and prone to human error. Automated expense analysis leverages artificial intelligence to provide real-time insights, categorizing expenses accurately and reducing manual effort, enhancing efficiency in money management. Selecting the right method depends on user preference for hands-on tracking versus seamless, technology-driven financial oversight.

Choosing the Right Expense Management Approach

Manual expense logging provides detailed control and accuracy by allowing users to input each transaction personally, ensuring precise categorization tailored to individual preferences. Automated expense analysis leverages advanced algorithms and AI to quickly process large volumes of transactions, identifying patterns and offering real-time insights for optimized money management. Selecting the right expense management approach depends on the need for personalized detail versus efficient, data-driven decision-making and scalability.

Related Important Terms

Self-Categorization Fatigue

Manual expense logging often leads to self-categorization fatigue, causing inconsistent data entry and reduced accuracy in personal finance tracking. Automated expense analysis leverages machine learning algorithms to categorize transactions efficiently, minimizing user effort and enhancing the precision of money management insights.

Tagging Drift

Manual expense logging often leads to inconsistent tagging and categorization, causing significant Tagging Drift that undermines accurate financial analysis and budgeting. Automated expense analysis employs machine learning algorithms to maintain consistent tagging, reducing errors and improving the reliability of money management insights.

Transaction Enrichment

Manual expense logging relies heavily on user input, often resulting in incomplete or inconsistent data, while automated expense analysis leverages transaction enrichment techniques to categorize expenses accurately and provide real-time insights. Transaction enrichment enhances money management by attaching metadata such as merchant details, transaction context, and spending patterns, enabling precise budgeting and improved financial decision-making.

Data Entry Friction

Manual expense logging often causes data entry friction due to time-consuming and error-prone processes that hinder accurate money management. Automated expense analysis reduces friction by seamlessly capturing and categorizing transactions, improving financial tracking efficiency and accuracy.

Cognitive Load Balancing

Manual expense logging demands significant cognitive resources as users must accurately record each transaction, increasing mental fatigue and reducing overall financial focus. Automated expense analysis leverages AI algorithms to process and categorize spending patterns effortlessly, effectively balancing cognitive load and enhancing strategic money management.

Behavioral Nudging Algorithms

Behavioral nudging algorithms integrated into automated expense analysis enhance money management by providing real-time, personalized spending insights that encourage smarter financial decisions. This approach significantly reduces the inaccuracies and time-consumption associated with manual expense logging, optimizing budgeting efficiency and promoting consistent saving habits.

Real-Time Spend Insights

Manual expense logging often leads to delayed and inaccurate data entry, limiting timely visibility into spending patterns. Automated expense analysis provides real-time spend insights, enabling immediate tracking, categorization, and smarter budget adjustments for enhanced money management.

AI-Powered Receipt Parsing

AI-powered receipt parsing revolutionizes expense management by automatically extracting key data from receipts, eliminating manual entry errors and saving time. This technology enhances accuracy and offers real-time insights, enabling more efficient budgeting and financial tracking compared to traditional manual expense logging.

Contextual Expense Attribution

Manual expense logging often leads to inconsistent contextual expense attribution due to human error and time constraints, resulting in less accurate money management insights. Automated expense analysis utilizes machine learning algorithms to accurately categorize and attribute expenses based on contextual data, enhancing financial decision-making and budget optimization.

Passive Spend Tracking

Manual expense logging requires individuals to record every transaction, increasing the risk of human error and incomplete data, whereas automated expense analysis utilizes passive spend tracking through AI-driven software that captures and categorizes expenses in real time, enhancing accuracy and providing comprehensive financial insights. Passive spend tracking streamlines money management by eliminating manual input, enabling users to monitor spending patterns effortlessly and optimize budgeting strategies with detailed, up-to-date reports.

Manual expense logging vs Automated expense analysis for money management. Infographic

moneydiff.com

moneydiff.com