Bank statements provide a detailed record of all transactions, offering a straightforward method for expense auditing by listing withdrawals, deposits, and balances. Open Banking insights enhance this process by aggregating real-time financial data from multiple accounts, enabling more comprehensive and accurate expense tracking. Utilizing Open Banking technology allows auditors to quickly identify patterns, discrepancies, and fraud risks that traditional bank statements may overlook.

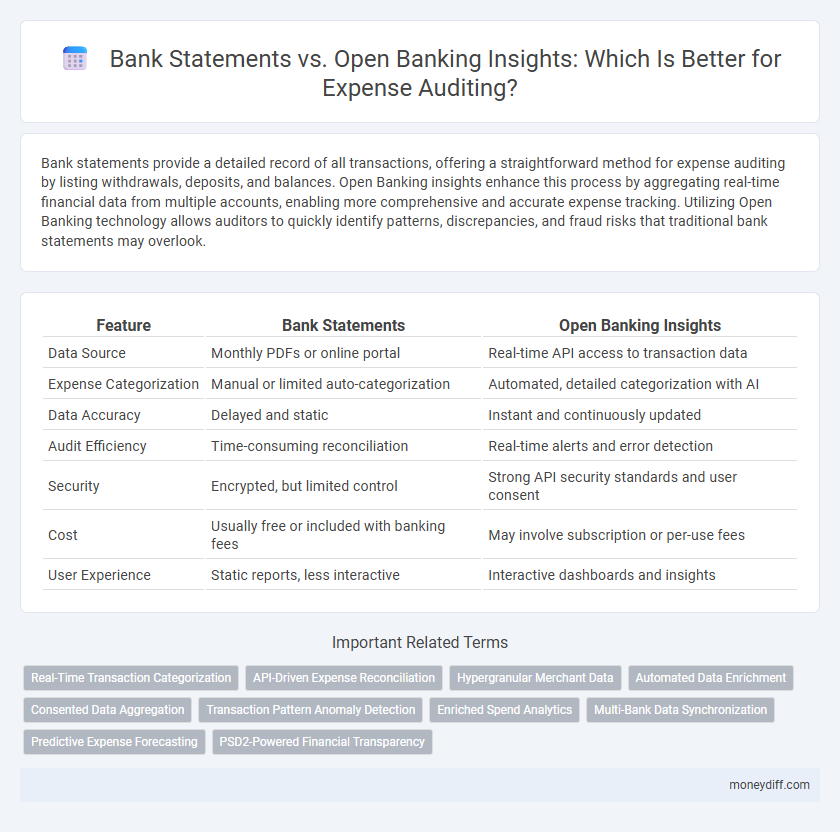

Table of Comparison

| Feature | Bank Statements | Open Banking Insights |

|---|---|---|

| Data Source | Monthly PDFs or online portal | Real-time API access to transaction data |

| Expense Categorization | Manual or limited auto-categorization | Automated, detailed categorization with AI |

| Data Accuracy | Delayed and static | Instant and continuously updated |

| Audit Efficiency | Time-consuming reconciliation | Real-time alerts and error detection |

| Security | Encrypted, but limited control | Strong API security standards and user consent |

| Cost | Usually free or included with banking fees | May involve subscription or per-use fees |

| User Experience | Static reports, less interactive | Interactive dashboards and insights |

Understanding Bank Statements in Expense Auditing

Bank statements provide a detailed record of all transactions within a specified period, making them essential for verifying expenses and detecting discrepancies during audits. They offer standardized formats that auditors can easily analyze to track spending patterns, reconcile accounts, and ensure compliance with financial policies. Accurate interpretation of bank statements enhances transparency and supports effective expense management by validating the authenticity of reported transactions.

What Are Open Banking Insights?

Open Banking Insights utilize aggregated financial data from multiple bank accounts to provide a comprehensive view of expenses, enabling more accurate and real-time auditing compared to traditional bank statements. Unlike static bank statements that show only transactional history, Open Banking Insights analyze spending patterns, categorizing expenses automatically for better financial control. This advanced approach helps businesses and individuals identify irregularities and optimize cash flow management efficiently.

Key Differences Between Bank Statements and Open Banking Data

Bank statements provide static, historical records of transactions issued periodically by financial institutions, whereas Open Banking insights offer real-time, granular transaction data through APIs enabling dynamic expense auditing. Bank statements typically include summarized information with limited categorization, while Open Banking data allows automated categorization and richer contextual analysis for enhanced expense management. The integration of Open Banking insights facilitates faster fraud detection and deeper spending pattern analysis, contrasting with the more delayed and manual review processes associated with traditional bank statements.

Accuracy and Timeliness: Which Source Wins?

Bank statements provide accurate, verifiable records of all transactions but often suffer from delays due to monthly reporting cycles. Open Banking insights offer real-time access to financial data, enabling timely expense auditing with enhanced accuracy through direct integration with multiple accounts. For precise and prompt expense analysis, Open Banking insights generally outperform traditional bank statements.

Enhancing Expense Audits with Open Banking Technology

Open Banking technology revolutionizes expense audits by providing real-time access to detailed transaction data beyond the static information found in traditional bank statements. This enhanced visibility enables auditors to identify discrepancies and categorize expenses with greater accuracy and efficiency. Leveraging Open Banking insights reduces manual reconciliation efforts and improves compliance monitoring across financial activities.

Data Granularity: Bank Statements vs Open Banking

Bank statements provide a summary of financial transactions, often lacking detailed categorization and real-time updates needed for thorough expense auditing. Open Banking delivers granular transaction-level data with enriched metadata, enabling precise categorization and faster identification of spending patterns. This enhanced data granularity in Open Banking significantly improves accuracy and efficiency in expense auditing processes compared to traditional bank statements.

Security and Privacy Considerations

Bank statements provide a traditional, encrypted record of financial transactions directly from the bank, ensuring high security and minimal data exposure. Open Banking Insights use APIs to aggregate and analyze user financial data in real-time, requiring strict adherence to regulatory standards like PSD2 and GDPR to protect privacy. Advanced encryption and user consent mechanisms are critical in both methods to mitigate risks of data breaches and unauthorized access during expense auditing.

Streamlining Reconciliation with Open Banking Insights

Open Banking Insights significantly streamline expense auditing by providing real-time access to categorized transaction data directly from financial institutions, reducing the manual effort of cross-referencing bank statements. This technology enhances accuracy in reconciling expenses by automatically highlighting discrepancies and enabling faster verification processes. Leveraging Open Banking Insights minimizes errors, accelerates audit cycles, and improves overall financial transparency for businesses.

Challenges in Traditional Bank Statement Auditing

Traditional bank statement auditing faces challenges such as lack of real-time data access, limited transaction categorization, and manual reconciliation errors, which hinder accurate expense tracking. Bank statements provide static, retrospective information, making it difficult to detect spending anomalies or fraudulent transactions promptly. Open Banking Insights offer enhanced visibility with automated categorization and continuous data access, addressing limitations inherent in conventional statement reviews.

Choosing the Right Approach for Effective Expense Management

Bank statements provide detailed historical transaction data essential for traditional expense auditing, offering accuracy and regulatory compliance. Open Banking Insights leverage real-time financial data aggregation, enabling proactive expense tracking, trend analysis, and improved cash flow management. Selecting the right approach depends on your organization's need for either comprehensive audit trails or dynamic expense monitoring to optimize financial oversight.

Related Important Terms

Real-Time Transaction Categorization

Bank statements provide historical expense data but lack real-time transaction categorization, limiting timely auditing insights. Open Banking Insights enable immediate categorization of expenses, enhancing accuracy and efficiency in expense monitoring and fraud detection.

API-Driven Expense Reconciliation

API-driven expense reconciliation leverages open banking insights to provide real-time, detailed transaction data beyond traditional bank statements, enabling more accurate and efficient expense auditing. This approach enhances visibility into spending patterns and detects anomalies faster by integrating dynamic financial feeds directly into auditing systems.

Hypergranular Merchant Data

Bank statements provide basic transaction details, while Open Banking insights deliver hypergranular merchant data including itemized purchases and spending patterns, enhancing accuracy in expense auditing. Leveraging Open Banking enables detailed analysis of expenditures, reducing errors and improving financial transparency for businesses.

Automated Data Enrichment

Automated data enrichment in expense auditing enhances traditional bank statements by integrating Open Banking insights, allowing for real-time transaction categorization, merchant identification, and anomaly detection. This fusion increases accuracy, reduces manual reconciliation efforts, and accelerates financial compliance processes.

Consented Data Aggregation

Consented data aggregation in open banking insights enables real-time, detailed expense auditing by securely combining transaction data from multiple financial accounts, surpassing the static and often delayed information found in traditional bank statements. This granular, unified view allows for more accurate expense tracking and fraud detection while maintaining user privacy through explicit consent.

Transaction Pattern Anomaly Detection

Bank statements provide a static record of transactions, but Open Banking insights leverage real-time data analysis and machine learning algorithms to detect transaction pattern anomalies more effectively. Enhanced anomaly detection helps identify unusual spending behaviors and potential fraud quicker, improving expense auditing accuracy and financial oversight.

Enriched Spend Analytics

Bank statements provide basic transaction records, while Open Banking Insights deliver enriched spend analytics by categorizing expenses, detecting spending patterns, and offering real-time financial behavior insights. Enriched spend analytics enhances expense auditing accuracy and efficiency through detailed data segmentation and predictive analysis.

Multi-Bank Data Synchronization

Bank statements provide static snapshots of transactions from individual accounts, while Open Banking Insights enable real-time, multi-bank data synchronization for comprehensive expense auditing. This integration enhances accuracy by aggregating data across various financial institutions, facilitating faster anomaly detection and streamlined reconciliation.

Predictive Expense Forecasting

Bank statements provide historical transaction data crucial for accurate expense auditing, while open banking insights enhance predictive expense forecasting by leveraging real-time financial data and machine learning algorithms. Integrating open banking insights with traditional bank statements enables businesses to anticipate future expenses more effectively, improving cash flow management and budget planning.

PSD2-Powered Financial Transparency

Bank statements provide a historical record of transactions, while PSD2-powered open banking insights offer real-time, categorized expense data that enhances accuracy and transparency in expense auditing. Open banking enables seamless access to granular financial information, facilitating more efficient compliance and fraud detection compared to traditional bank statements.

Bank Statements vs Open Banking Insights for expense auditing Infographic

moneydiff.com

moneydiff.com