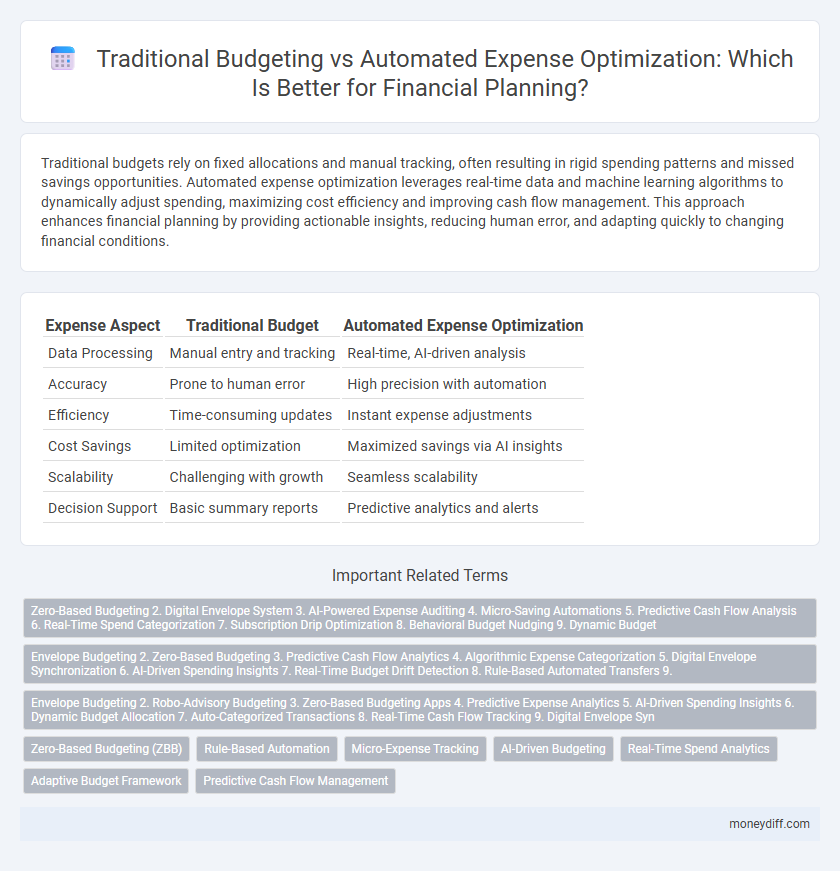

Traditional budgets rely on fixed allocations and manual tracking, often resulting in rigid spending patterns and missed savings opportunities. Automated expense optimization leverages real-time data and machine learning algorithms to dynamically adjust spending, maximizing cost efficiency and improving cash flow management. This approach enhances financial planning by providing actionable insights, reducing human error, and adapting quickly to changing financial conditions.

Table of Comparison

| Expense Aspect | Traditional Budget | Automated Expense Optimization |

|---|---|---|

| Data Processing | Manual entry and tracking | Real-time, AI-driven analysis |

| Accuracy | Prone to human error | High precision with automation |

| Efficiency | Time-consuming updates | Instant expense adjustments |

| Cost Savings | Limited optimization | Maximized savings via AI insights |

| Scalability | Challenging with growth | Seamless scalability |

| Decision Support | Basic summary reports | Predictive analytics and alerts |

Defining Traditional Budgeting Methods

Traditional budgeting methods rely on manual data entry, historical expense tracking, and fixed allocation of funds across categories, often leading to time-consuming adjustments and limited flexibility. These approaches typically use spreadsheets or ledger books, which increase the risk of human error and delay in detecting overspending. Manual forecasts based on past spending patterns struggle to adapt to real-time financial changes, reducing overall efficiency in expense management.

Understanding Automated Expense Optimization

Automated expense optimization leverages advanced algorithms and real-time data analytics to identify spending inefficiencies and recommend cost-saving measures, surpassing the static nature of traditional budget methods. This technology integrates seamlessly with financial planning tools, enabling continuous monitoring and adaptive adjustments to expenses based on dynamic financial goals. By utilizing machine learning, automated systems provide more accurate forecasts and personalized expense management, improving overall financial health and decision-making.

Key Differences Between Traditional and Automated Approaches

Traditional budgets rely on static spending limits and manual tracking, often leading to rigid financial plans and delayed adjustments. Automated expense optimization uses real-time data analysis and AI-driven insights to dynamically adjust spending patterns, enhancing accuracy and responsiveness. This shift from fixed allocations to adaptive financial management enables more efficient cash flow control and improved cost savings.

Benefits of Manual Budgeting Techniques

Manual budgeting techniques offer precise control over individual expenses, enabling tailored adjustments that align closely with personal financial goals. Tracking expenses manually encourages greater financial awareness and discipline, helping to identify unnecessary spending patterns. This approach provides flexibility to adapt quickly without relying on automated systems or software limitations.

Advantages of Automated Expense Tools

Automated expense optimization tools enhance financial planning by providing real-time expense tracking and data analysis, reducing human error compared to traditional budget methods. These tools offer dynamic budget adjustments based on actual spending patterns, increasing accuracy and efficiency in managing cash flow. Integration with multiple financial accounts allows seamless categorization and optimization of expenses, leading to better cost control and improved savings.

Common Challenges in Traditional Budgeting

Traditional budgeting often struggles with inaccurate forecasting and time-consuming manual data entry, leading to frequent overspending or underspending. Fixed budget categories lack flexibility to adapt to fluctuating expenses, causing misallocation of funds. These common challenges hinder effective financial planning and limit the ability to optimize expenses efficiently.

How Automation Streamlines Financial Planning

Automation streamlines financial planning by accurately tracking expenses in real time and categorizing them with minimal manual input, reducing errors and saving time. Traditional budgets rely on periodic updates and estimates, leading to delayed insights and less adaptive financial decisions. Automated expense optimization integrates predictive analytics, enabling dynamic budget adjustments that improve cash flow management and financial forecasting.

Costs and Accessibility of Each Method

Traditional budgets often involve manual tracking and spreadsheets, resulting in higher labor costs and time consumption, with limited accessibility due to reliance on specific software or expertise. Automated expense optimization leverages AI-driven tools that reduce operational costs by streamlining data processing and providing real-time insights accessible across devices and platforms. This technology enhances scalability and user accessibility while minimizing human error, making it a cost-effective solution for dynamic financial planning.

Security and Data Privacy Considerations

Traditional budget methods often rely on manual data entry and spreadsheet management, increasing the risk of human error and unauthorized access to sensitive financial information. Automated expense optimization leverages encrypted cloud-based platforms with robust authentication protocols, significantly enhancing security and safeguarding data privacy throughout the financial planning process. Implementing advanced cybersecurity measures such as multi-factor authentication and real-time monitoring ensures compliance with data protection regulations like GDPR and CCPA, reducing vulnerabilities associated with expense management systems.

Choosing the Right Expense Management Strategy

Traditional budgets rely on fixed allocations and manual tracking, often leading to inaccuracies and delayed insights in financial planning. Automated expense optimization integrates real-time data analysis and AI-driven forecasting, enabling dynamic adjustments that improve cost control and resource allocation. Selecting the right expense management strategy depends on organizational size, complexity, and the need for agility in responding to financial fluctuations.

Related Important Terms

Zero-Based Budgeting 2. Digital Envelope System 3. AI-Powered Expense Auditing 4. Micro-Saving Automations 5. Predictive Cash Flow Analysis 6. Real-Time Spend Categorization 7. Subscription Drip Optimization 8. Behavioral Budget Nudging 9. Dynamic Budget

Zero-Based Budgeting eliminates waste by allocating every dollar to specific expenses, while Digital Envelope Systems visually segment funds to enhance spending discipline. AI-Powered Expense Auditing identifies inefficiencies in real-time, complemented by Micro-Saving Automations that incrementally boost savings; Predictive Cash Flow Analysis and Real-Time Spend Categorization provide proactive financial insights, whereas Subscription Drip Optimization and Behavioral Budget Nudging fine-tune spending habits within a Dynamic Budget framework.

Envelope Budgeting 2. Zero-Based Budgeting 3. Predictive Cash Flow Analytics 4. Algorithmic Expense Categorization 5. Digital Envelope Synchronization 6. AI-Driven Spending Insights 7. Real-Time Budget Drift Detection 8. Rule-Based Automated Transfers 9.

Envelope Budgeting allocates funds into predefined spending categories, while Zero-Based Budgeting requires each expense to be justified against income, enhancing financial discipline. Predictive Cash Flow Analytics and Algorithmic Expense Categorization enable precise forecasting and automatic classification of expenditures, supported by Digital Envelope Synchronization for seamless fund management across accounts. AI-Driven Spending Insights provide personalized recommendations, complemented by Real-Time Budget Drift Detection and Rule-Based Automated Transfers to maintain budget adherence and optimize cash flow efficiency.

Envelope Budgeting 2. Robo-Advisory Budgeting 3. Zero-Based Budgeting Apps 4. Predictive Expense Analytics 5. AI-Driven Spending Insights 6. Dynamic Budget Allocation 7. Auto-Categorized Transactions 8. Real-Time Cash Flow Tracking 9. Digital Envelope Syn

Envelope Budgeting 2 divides funds into virtual categories ensuring disciplined spending, while Robo-Advisory Budgeting automates financial planning using AI algorithms for personalized expense management. Zero-Based Budgeting Apps require every dollar to be allocated, combined with Predictive Expense Analytics and AI-Driven Spending Insights to forecast expenses and optimize spending patterns dynamically. Dynamic Budget Allocation adjusts budgets in real-time based on spending behavior, supported by Auto-Categorized Transactions for seamless tracking and Real-Time Cash Flow Tracking to monitor liquidity instantly. Digital Envelope Sync integrates physical and digital budgeting methods, enhancing transparency and control in traditional and automated expense strategies.

Zero-Based Budgeting (ZBB)

Traditional budget methods often rely on historical data, which can perpetuate inefficiencies, whereas automated expense optimization leverages real-time analytics and machine learning to implement Zero-Based Budgeting (ZBB), ensuring every dollar is justified from zero each cycle. By integrating ZBB through automation, organizations achieve more precise financial planning, reducing waste and enhancing cost control compared to conventional incremental budgeting approaches.

Rule-Based Automation

Rule-based automation in automated expense optimization leverages predefined algorithms to systematically enforce spending limits and categorize expenses, enhancing accuracy and compliance in financial planning. Traditional budgets rely on static allocations that lack real-time adjustments, whereas rule-based systems dynamically adapt to changing financial conditions and optimize resource allocation.

Micro-Expense Tracking

Traditional budget methods rely on manual entry and static categories, leading to less accurate micro-expense tracking that often misses small but frequent costs. Automated expense optimization leverages real-time data analysis and AI to identify and adjust micro-expenses instantly, enhancing financial planning precision and cost-saving opportunities.

AI-Driven Budgeting

AI-driven budgeting leverages machine learning algorithms to analyze spending patterns, enabling precise expense forecasting and real-time adjustments that enhance financial planning accuracy. Automated expense optimization reduces manual errors and identifies cost-saving opportunities, outperforming traditional budget methods reliant on static data and periodic reviews.

Real-Time Spend Analytics

Traditional budgets rely on static allocations that often miss dynamic spending patterns, whereas automated expense optimization leverages real-time spend analytics to provide continuous visibility into financial outflows. This enables precise adjustments based on live data, improving accuracy in forecasting and maximizing cost efficiency across departments.

Adaptive Budget Framework

Adaptive budget frameworks integrate real-time data analytics and machine learning to continuously refine expense forecasts, enhancing financial planning accuracy compared to static traditional budgets. Automated expense optimization reduces manual interventions, enabling dynamic allocation of resources that align with changing business conditions and improve cost efficiency.

Predictive Cash Flow Management

Traditional budgets rely on historical data and static allocations, often leading to inefficiencies in managing unexpected expenses and cash flow fluctuations. Automated expense optimization leverages predictive cash flow management using real-time analytics and machine learning algorithms to forecast inflows and outflows, enabling proactive financial planning and improved liquidity management.

Traditional Budget vs Automated Expense Optimization for financial planning. Infographic

moneydiff.com

moneydiff.com