Analyzing monthly expenses reveals a steady financial outflow, while subscription creep causes hidden incremental costs that often go unnoticed. Regularly reviewing subscription services helps identify unnecessary charges contributing to budget overflows. Controlling subscription creep is essential for accurate monthly expense management and optimizing overall financial health.

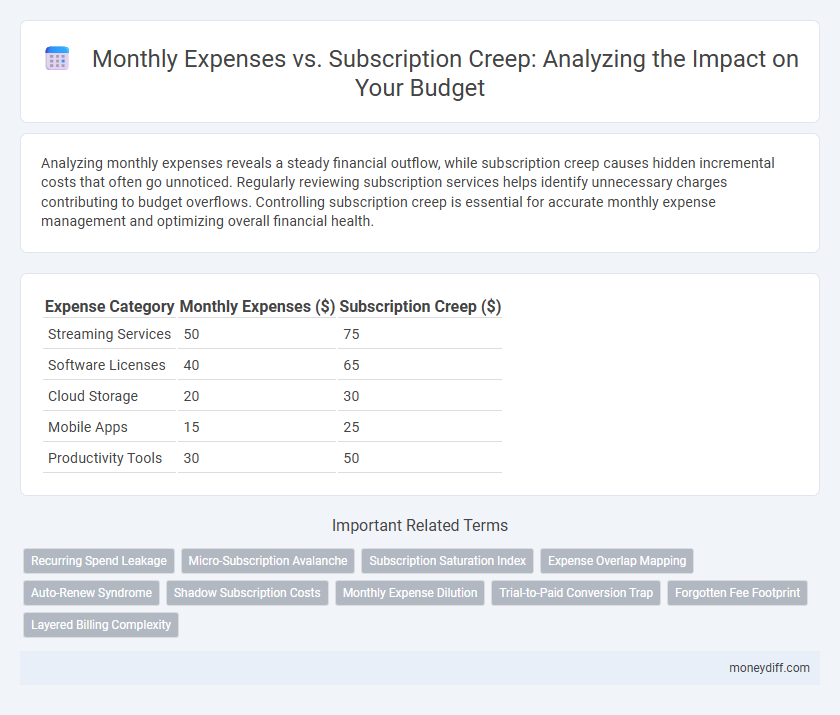

Table of Comparison

| Expense Category | Monthly Expenses ($) | Subscription Creep ($) |

|---|---|---|

| Streaming Services | 50 | 75 |

| Software Licenses | 40 | 65 |

| Cloud Storage | 20 | 30 |

| Mobile Apps | 15 | 25 |

| Productivity Tools | 30 | 50 |

Understanding Monthly Expenses: The Basics

Monthly expenses include fixed costs such as rent, utilities, and insurance, alongside variable spending like groceries and transportation. Subscription creep occurs when multiple recurring service subscriptions accumulate unnoticed, inflating overall monthly costs. Tracking and categorizing each expense accurately is essential for managing budgets and preventing subscription creep from eroding financial health.

What is Subscription Creep?

Subscription creep refers to the gradual increase in monthly expenses caused by accumulating multiple recurring service fees, often unnoticed by individuals. This phenomenon results in higher overall spending as numerous small subscriptions, such as streaming services, software licenses, or memberships, add up over time. Monitoring and analyzing subscription creep is essential to control monthly expenses and avoid financial strain.

Identifying Recurring Monthly Costs

Identifying recurring monthly costs is essential for accurate expense analysis and controlling subscription creep, which often leads to unnoticed financial drain. Detailed tracking of all subscription services, including streaming platforms, software licenses, and membership fees, reveals patterns in recurring payments that contribute to monthly expenses. Evaluating these costs helps individuals and businesses optimize budgets by eliminating redundant or underutilized subscriptions, ensuring a clearer understanding of true monthly expenditure.

Comparing Fixed vs. Variable Expenses

Fixed expenses, such as rent and insurance premiums, remain constant each month, providing predictable financial outflows. Variable expenses, including utilities and entertainment subscriptions, fluctuate and contribute significantly to subscription creep, where small, recurring charges accumulate unnoticed. Analyzing the balance between these expense types helps identify opportunities to curb unnecessary spending and improve overall budget management.

The Hidden Impact of Subscriptions on Budgets

Monthly expenses often appear controlled until subscription creep silently inflates costs, with recurring charges accumulating unnoticed across platforms. This hidden impact can erode budgets, leading to overspending due to overlapping or rarely used services. Tracking and analyzing subscription data against overall monthly expenditures reveals significant opportunities for budget optimization and expense reduction.

Analyzing Spending Patterns: Monthly Bills vs. Subscriptions

Analyzing spending patterns reveals that monthly expenses often remain fixed, while subscription creep gradually increases total outflows through multiple small, recurring charges. Detailed tracking of subscriptions uncovers hidden costs that traditional bill monitoring may overlook, significantly impacting overall financial health. Identifying and consolidating redundant services can effectively control budget leaks caused by unchecked subscription growth.

Psychological Traps of Subscription Services

Subscription creep often leads to unnoticed monthly expense inflation, as recurring charges accumulate silently in personal budgets. Psychological traps such as the sunk cost fallacy and the scarcity principle exploit consumer behavior, encouraging continued spending beyond actual needs. Analyzing these patterns reveals how subscription services subtly erode financial discipline, necessitating deliberate expense tracking to counteract cognitive biases.

Strategies to Manage Monthly and Subscription Expenses

Effective strategies to manage monthly expenses and subscription creep include conducting regular audits of all active subscriptions and categorizing them by necessity and frequency of use. Implementing budgeting tools that track recurring charges helps identify redundant or unused services, allowing for timely cancellations and cost optimization. Negotiating subscription plans or consolidating services under bundled offers can further reduce overall monthly expenses.

Tools for Tracking and Auditing Expenses

Effective tools for tracking and auditing expenses, such as budgeting apps and expense management software, enable detailed monitoring of monthly expenses and identification of subscription creep. Features like automated transaction categorization, real-time alerts, and subscription tracking dashboards provide insights into recurring charges and potential cost overruns. Utilizing these tools facilitates accurate expense analysis, helps avoid unnecessary subscriptions, and optimizes overall financial management.

Reducing Financial Drain: Cancel or Consolidate?

Monthly expenses often escalate unnoticed due to subscription creep, where multiple small fees accumulate into a significant financial drain. Analyzing recurring payments and consolidating overlapping services can streamline costs and improve budget control. Proactively canceling unused or redundant subscriptions reduces unnecessary expenditures and enhances overall financial health.

Related Important Terms

Recurring Spend Leakage

Monthly expenses often conceal subscription creep, where unnoticed recurring charges accumulate over time, leading to significant recurring spend leakage. Analyzing detailed transaction records and categorizing recurring payments is essential to identify and eliminate these hidden costs, improving financial efficiency.

Micro-Subscription Avalanche

Micro-subscription avalanche significantly inflates monthly expenses as numerous small subscriptions accumulate unnoticed, creating a substantial financial burden over time. Tracking and analyzing these micro-subscriptions reveals hidden costs that traditional budgeting methods often overlook, emphasizing the need for detailed expense management.

Subscription Saturation Index

Analyzing monthly expenses reveals a growing Subscription Saturation Index, indicating how subscription creep drives unnecessary financial drain by accumulating overlapping services. Tracking this index helps identify redundant subscriptions, optimize budget allocation, and prevent overspending in recurring costs.

Expense Overlap Mapping

Expense Overlap Mapping reveals critical patterns in monthly expenses and subscription creep by identifying redundant or overlapping subscriptions that inflate spending without delivering proportional value. Pinpointing these overlaps streamlines budgeting efforts, enabling more efficient allocation of resources and reducing unnecessary financial leakage.

Auto-Renew Syndrome

Monthly expenses often balloon unexpectedly due to subscription creep, a phenomenon where myriad auto-renewing services accumulate unnoticed, leading to significant financial drain. Analyzing spending patterns reveals that auto-renew syndrome causes recurring charges to multiply, necessitating vigilant monitoring of subscriptions to curb unnecessary outflows.

Shadow Subscription Costs

Shadow subscription costs hidden within monthly expenses often lead to unnoticed budget increases, significantly impacting financial planning accuracy. Identifying and managing these covert recurring charges is essential to prevent subscription creep from eroding overall savings.

Monthly Expense Dilution

Monthly expense dilution occurs when numerous small subscriptions accumulate, subtly increasing total costs without immediate notice. Analyzing monthly expenses against subscription creep helps identify hidden financial drains, enabling better budget optimization and cost control.

Trial-to-Paid Conversion Trap

Monthly expenses often escalate unexpectedly due to subscription creep, as trial-to-paid conversion traps lead users to commit to multiple recurring payments without full awareness. Monitoring trial periods and implementing strict subscription reviews can mitigate hidden cost accumulation and improve budget control.

Forgotten Fee Footprint

Monthly expenses often mask the true cost of subscription creep, where forgotten fees silently accumulate and inflate overall spending. Analyzing the Forgotten Fee Footprint reveals hidden recurring charges that can significantly impact budget accuracy and financial planning.

Layered Billing Complexity

Analyzing monthly expenses reveals that subscription creep significantly amplifies layered billing complexity, causing hidden charges and overlapping fees that complicate budget management. Detailed tracking of each subscription's billing cycles and cumulative impact exposes inefficiencies and potential savings opportunities within recurring expenses.

Monthly expenses vs Subscription creep for analysis. Infographic

moneydiff.com

moneydiff.com