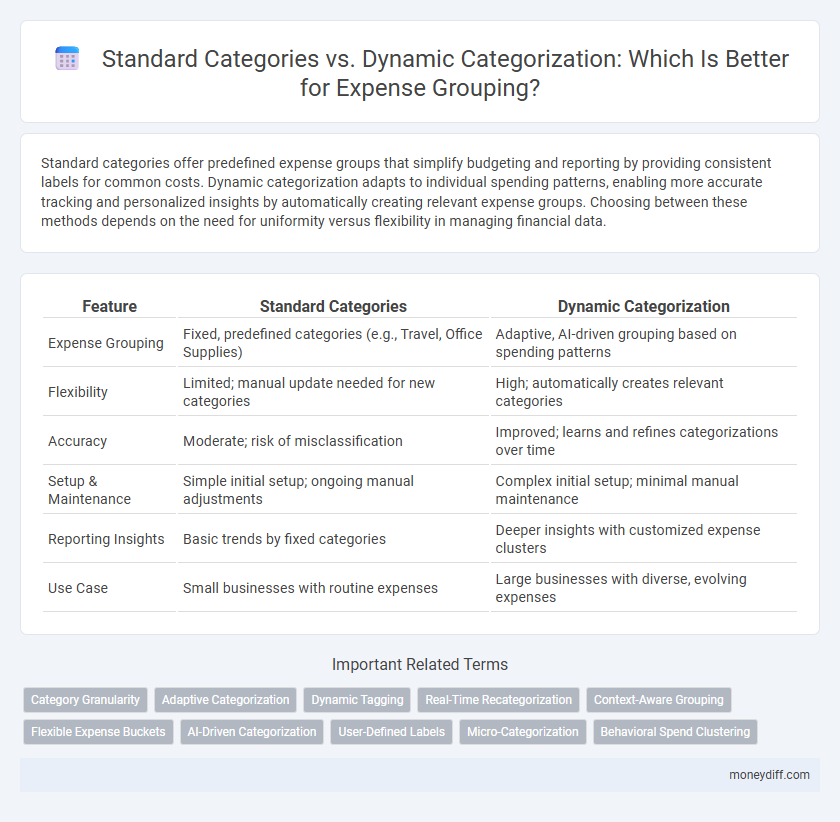

Standard categories offer predefined expense groups that simplify budgeting and reporting by providing consistent labels for common costs. Dynamic categorization adapts to individual spending patterns, enabling more accurate tracking and personalized insights by automatically creating relevant expense groups. Choosing between these methods depends on the need for uniformity versus flexibility in managing financial data.

Table of Comparison

| Feature | Standard Categories | Dynamic Categorization |

|---|---|---|

| Expense Grouping | Fixed, predefined categories (e.g., Travel, Office Supplies) | Adaptive, AI-driven grouping based on spending patterns |

| Flexibility | Limited; manual update needed for new categories | High; automatically creates relevant categories |

| Accuracy | Moderate; risk of misclassification | Improved; learns and refines categorizations over time |

| Setup & Maintenance | Simple initial setup; ongoing manual adjustments | Complex initial setup; minimal manual maintenance |

| Reporting Insights | Basic trends by fixed categories | Deeper insights with customized expense clusters |

| Use Case | Small businesses with routine expenses | Large businesses with diverse, evolving expenses |

Introduction to Expense Grouping Methods

Standard categories for expense grouping utilize predefined, fixed labels such as travel, office supplies, and utilities to streamline budgeting and reporting. Dynamic categorization employs AI-driven algorithms to automatically sort expenses based on transaction details, enabling more flexible and context-sensitive grouping. This approach enhances accuracy and adaptability in financial analysis by capturing evolving spending patterns beyond rigid category boundaries.

Defining Standard Expense Categories

Standard expense categories provide a consistent framework for organizing costs, enabling streamlined financial reporting and easier budget tracking. Common categories include travel, office supplies, utilities, and payroll, each designed to encompass related transactions for accurate analysis. Defining these categories clearly helps maintain uniformity across departments and time periods, improving expense management and decision-making.

Understanding Dynamic Categorization

Dynamic categorization leverages machine learning algorithms to automatically group expenses based on patterns, merchant data, and user behavior, offering more personalized and accurate expense tracking than static standard categories. This approach adapts in real-time to new spending trends and unique transaction attributes, enhancing budget insights and financial management. Businesses benefit from reduced manual entry and increased granularity, leading to optimized reporting and smarter expense controls.

Key Differences Between Standard and Dynamic Methods

Standard categories for expense grouping rely on predefined, fixed labels that facilitate consistent reporting and compliance tracking, while dynamic categorization employs machine learning algorithms to adaptively classify expenses based on evolving data patterns and contextual information. Key differences include flexibility, with dynamic methods offering real-time adjustment to new expense types, contrasted with the rigidity of standard categories that may require manual updates. Dynamic categorization enhances accuracy and reduces manual intervention by leveraging natural language processing and anomaly detection to automatically allocate expenses to the most relevant categories.

Advantages of Using Standard Categories

Standard categories streamline expense tracking by providing consistent, predefined groups that simplify reporting and analysis across diverse datasets. They enhance accuracy in budgeting by reducing classification errors and enabling clear comparisons over time. Implementing standard categories also supports automation in financial software, accelerating data processing and improving overall efficiency.

Benefits of Dynamic Categorization

Dynamic categorization enhances expense management by automatically adapting to new and complex transaction types, ensuring accurate and granular expense grouping without manual intervention. This approach improves financial reporting accuracy and provides real-time insights into spending patterns across various categories. Businesses benefit from increased efficiency and reduced errors compared to rigid standard categories that often fail to capture evolving expense trends.

Challenges of Fixed Expense Groupings

Fixed expense groupings often struggle to accommodate the complexity and variability of modern spending, leading to misclassification and reduced accuracy in financial analysis. Standard categories lack flexibility, causing difficulties in capturing unique or evolving expense types that dynamic categorization systems handle more effectively. This rigidity limits detailed insights and can hinder adaptive budgeting and expense forecasting.

When to Choose Dynamic Expense Categorization

Dynamic expense categorization is ideal for businesses facing rapidly changing expense patterns or industries with diverse and unpredictable spending. It enables real-time analysis by automatically adapting categories based on transaction data, improving accuracy and relevancy compared to static standard categories. Organizations experiencing frequent operational changes or those aiming to leverage machine learning for predictive insights benefit most from dynamic categorization.

Impact on Financial Tracking and Reporting

Standard categories provide consistent and easily comparable expense grouping, enhancing the accuracy and clarity of financial reporting. Dynamic categorization adapts to evolving business needs, allowing more granular and relevant tracking but may introduce complexity in maintaining uniform financial records. Effective financial tracking often requires balancing the stability of standard categories with the flexibility of dynamic categorization to optimize reporting precision and decision-making.

Choosing the Right Categorization Approach for You

Standard categories provide predefined expense groups that simplify budgeting and reporting with consistent labels, making them ideal for organizations seeking uniformity and ease of use. Dynamic categorization leverages AI and machine learning to adapt and create personalized expense groups based on evolving spending patterns, offering flexibility and detailed insights for nuanced financial analysis. Selecting the right approach depends on your business needs for consistency versus customization, data complexity, and the level of automation desired in expense management.

Related Important Terms

Category Granularity

Standard categories for expense grouping provide fixed, broad classifications like Travel, Meals, and Office Supplies, ensuring consistency but limiting detail. Dynamic categorization enhances category granularity by adapting to specific transaction attributes, enabling more precise, context-driven expense tracking and better financial analysis.

Adaptive Categorization

Adaptive Categorization leverages machine learning algorithms to analyze transaction patterns and automatically update expense categories, offering superior flexibility over static Standard Categories. This dynamic approach enhances accuracy in expense grouping by continuously learning from new data and accommodating evolving spending behaviors.

Dynamic Tagging

Dynamic tagging for expense grouping enables real-time, flexible categorization using AI-driven algorithms that adapt to unique spending patterns and business needs, enhancing accuracy beyond fixed standard categories. This method improves financial analysis and reporting by capturing nuanced transaction details, facilitating more granular insights and automated expense management.

Real-Time Recategorization

Standard categories provide fixed labels for expense grouping, simplifying reporting but often failing to capture changing spending patterns. Dynamic categorization enables real-time recategorization of expenses based on evolving data, improving accuracy and adaptability in financial analysis.

Context-Aware Grouping

Standard categories provide fixed, predefined expense groups that simplify reporting but may overlook nuanced spending patterns, while dynamic categorization utilizes machine learning models to create context-aware groupings tailored to transactional metadata, enhancing accuracy and personalization in expense management. Context-aware grouping adapts to individual user behavior and business context, enabling more relevant and actionable insights compared to static classification.

Flexible Expense Buckets

Flexible expense buckets enhance dynamic categorization by allowing organizations to adapt classifications based on evolving spending patterns and business needs, offering greater precision than fixed standard categories. This approach enables more granular tracking and analysis of expenses, improving budget management and financial forecasting accuracy.

AI-Driven Categorization

AI-driven categorization leverages machine learning algorithms to dynamically group expenses based on patterns and context, offering greater accuracy and adaptability compared to standard categories that rely on preset, static labels. This dynamic approach enhances financial management by automatically classifying diverse expenses, reducing manual entry errors, and providing real-time insights tailored to evolving spending behaviors.

User-Defined Labels

User-defined labels in expense grouping offer dynamic categorization by allowing personalized tags that adapt to individual spending patterns, enhancing accuracy beyond standard categories. This flexibility empowers users to customize labels such as "business meals" or "project supplies," improving expense tracking and reporting precision.

Micro-Categorization

Standard categories provide a fixed framework for expense grouping, limiting granularity and adaptability in tracking financial data. Micro-categorization enhances dynamic categorization by enabling precise, context-specific expense grouping that improves data accuracy and actionable insights.

Behavioral Spend Clustering

Behavioral spend clustering enhances expense grouping by analyzing transaction patterns to create dynamic, personalized categories that adapt to individual spending behaviors rather than relying on rigid standard categories. This approach improves accuracy in expense tracking and budgeting by reflecting real-time financial habits and contextual nuances in spending data.

Standard Categories vs Dynamic Categorization for expense grouping. Infographic

moneydiff.com

moneydiff.com