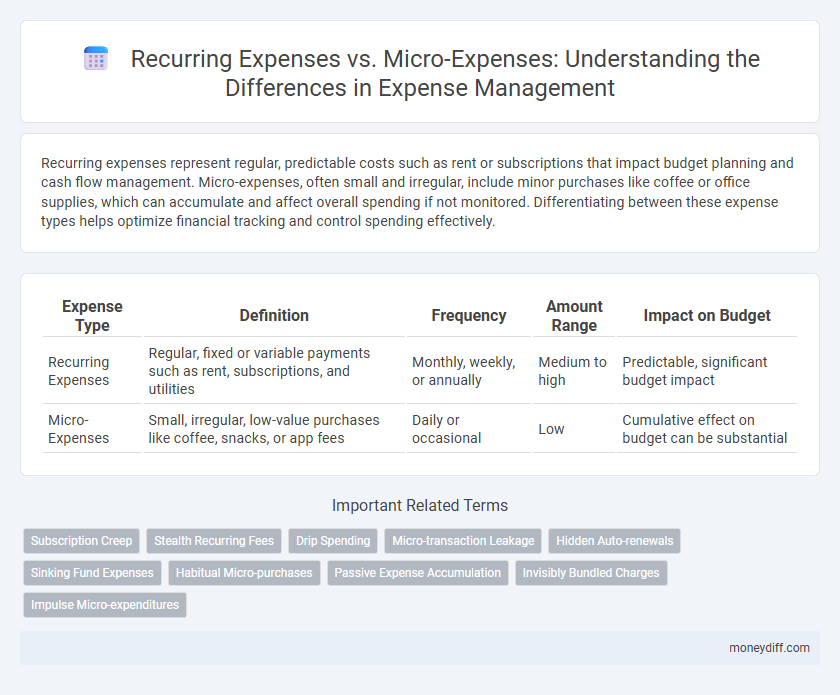

Recurring expenses represent regular, predictable costs such as rent or subscriptions that impact budget planning and cash flow management. Micro-expenses, often small and irregular, include minor purchases like coffee or office supplies, which can accumulate and affect overall spending if not monitored. Differentiating between these expense types helps optimize financial tracking and control spending effectively.

Table of Comparison

| Expense Type | Definition | Frequency | Amount Range | Impact on Budget |

|---|---|---|---|---|

| Recurring Expenses | Regular, fixed or variable payments such as rent, subscriptions, and utilities | Monthly, weekly, or annually | Medium to high | Predictable, significant budget impact |

| Micro-Expenses | Small, irregular, low-value purchases like coffee, snacks, or app fees | Daily or occasional | Low | Cumulative effect on budget can be substantial |

Understanding Recurring Expenses and Micro-Expenses in Personal Finance

Recurring expenses, such as rent, utilities, and subscription services, represent predictable and consistent outflows crucial for budgeting accuracy in personal finance management. Micro-expenses, including small daily purchases like coffee or snacks, often seem insignificant individually but cumulatively can impact savings goals and overall financial health. Distinguishing between these expense types enables more effective tracking, control, and allocation of funds, optimizing both short-term liquidity and long-term financial planning.

Key Differences Between Recurring Expenses and Micro-Expenses

Recurring expenses involve regular, predictable payments such as rent, subscriptions, and utility bills that occur on a consistent schedule, often monthly. Micro-expenses are small, infrequent purchases like coffee, snacks, or minor office supplies that may seem insignificant individually but accumulate over time. The key difference lies in their frequency and impact on budgeting: recurring expenses require planned allocation, while micro-expenses demand ongoing tracking to prevent budget overruns.

Why Recurring Expenses Matter in Budgeting

Recurring expenses provide a predictable framework for budgeting by establishing consistent, scheduled costs such as rent, utilities, and subscriptions. These expenses significantly impact cash flow management, enabling accurate forecasting and financial planning over time. Unlike micro-expenses, which are small and sporadic, recurring expenses form the foundation of budget stability and long-term financial health.

The Hidden Impact of Micro-Expenses on Your Finances

Micro-expenses, often overlooked daily costs under $5, can cumulatively surpass major recurring expenses, weakening your overall financial health significantly. Tracking these small transactions reveals patterns of unnecessary spending that drain savings and hinder budgeting efforts. Ignoring micro-expenses leads to underestimated spending habits, obscuring the true state of your financial picture.

How to Track Recurring Expenses Effectively

Tracking recurring expenses effectively requires automating payment schedules through budgeting apps that categorize transactions and send timely alerts. Regularly reviewing bank statements and using expense management software helps identify patterns and prevent overlooked subscriptions. Accurate record-keeping combined with consolidation of recurring charges streamlines cash flow analysis and financial forecasting.

Strategies to Minimize Micro-Expenses

Minimizing micro-expenses involves rigorous tracking and categorizing of small, frequent payments that often go unnoticed yet accumulate significantly over time. Utilizing budgeting apps equipped with expense alerts helps identify patterns and implement targeted spending limits on recurring micro-purchases such as subscriptions, coffee, or dining out. Consolidating vendors and negotiating service contracts can further streamline these minor outflows, maximizing overall expense efficiency.

Evaluating the Long-Term Effects of Recurring Expenses

Recurring expenses, such as subscriptions, rent, and utilities, significantly impact long-term financial health due to their consistent and predictable outflow, often accumulating to a substantial annual cost. Evaluating these expenses requires analyzing their necessity and potential for reduction to improve cash flow management and investment capacity. In contrast, micro-expenses, though frequent, usually have minimal individual effect but can collectively erode savings if not monitored effectively.

Tools and Apps for Managing Every Type of Expense

Tools and apps designed for managing recurring expenses often feature automated payment tracking, subscription management, and forecasting capabilities, ensuring consistent monitoring of regular financial outflows. In contrast, micro-expense management apps specialize in real-time tracking, categorization, and analysis of small, everyday purchases to prevent budget leaks. Integrating both types of tools enables comprehensive expense oversight, combining long-term financial planning with detailed daily spending control.

Balancing Recurring and Micro-Expenses for Financial Health

Balancing recurring expenses, such as rent and subscriptions, with micro-expenses like daily coffee or snacks is crucial for maintaining financial health. Tracking both categories allows for better budgeting by identifying patterns that can be optimized or reduced. Efficient management of recurring and micro-expenses supports sustained savings and prevents overspending.

Actionable Tips for Controlling All Your Expenses

Track both recurring expenses, such as subscriptions and utility bills, and micro-expenses like daily coffee or small online purchases to get a comprehensive view of your spending. Set limits for recurring payments and use budgeting apps to categorize and monitor micro-expenses, ensuring no small costs slip through unnoticed. Regularly review statements to identify trends and adjust spending habits, helping maintain financial control and reduce unnecessary outflows.

Related Important Terms

Subscription Creep

Subscription creep significantly increases recurring expenses by accumulating multiple small, often unnoticed monthly charges that collectively burden budgets. Tracking micro-expenses is essential to identify and manage these incremental subscriptions, preventing financial leakage over time.

Stealth Recurring Fees

Stealth recurring fees often hide within recurring expenses, leading to unnoticed ongoing charges that accumulate significantly over time. Micro-expenses, while small individually, can collectively mask these stealth fees, making thorough expense tracking essential for accurate budget management.

Drip Spending

Recurring expenses involve regular, fixed payments such as subscriptions or utility bills, offering predictable costs that simplify budgeting. Micro-expenses, often referred to as drip spending, consist of small, frequent purchases like daily coffee or app upgrades that accumulate over time, potentially impacting overall financial health if not monitored closely.

Micro-transaction Leakage

Micro-expenses often lead to significant micro-transaction leakage, silently eroding budgets through numerous small, untracked costs compared to predictable recurring expenses. Organizations must implement detailed expense tracking systems to identify and control these incremental outflows, optimizing overall financial efficiency.

Hidden Auto-renewals

Recurring expenses often include hidden auto-renewals that silently drain budgets through subscriptions or services forgotten by users. Micro-expenses, although small individually, accumulate significantly over time due to unnoticed automatic charges embedded in these auto-renewals.

Sinking Fund Expenses

Sinking fund expenses, categorized as recurring expenses, involve systematic savings over time to cover future large costs, contrasting with micro-expenses which are small, irregular, and typically operational in nature. Managing sinking fund expenses ensures financial readiness for significant purchases or liabilities, while micro-expenses require vigilant tracking to prevent budget leaks and maintain cash flow control.

Habitual Micro-purchases

Habitual micro-purchases, often overlooked in expense tracking, accumulate significantly and can surpass recurring expenses over time due to their frequent, small-scale nature. Analyzing these micro-expenses alongside monthly subscriptions and bills reveals hidden spending patterns essential for accurate budgeting and financial optimization.

Passive Expense Accumulation

Recurring expenses generate predictable, consistent financial outflows that can lead to passive expense accumulation if not actively monitored, whereas micro-expenses--small, frequent purchases--often accumulate unnoticed, significantly impacting overall spending over time. Effective expense management requires tracking both categories to prevent gradual budget erosion and maintain financial stability.

Invisibly Bundled Charges

Recurring expenses often include invisibly bundled charges that accumulate unnoticed over time, significantly impacting monthly budgets without clear itemization. Micro-expenses, while individually minor, can also conceal small recurring fees, making it essential to monitor transaction details and subscription services to identify hidden cost patterns.

Impulse Micro-expenditures

Impulse micro-expenditures are small, unplanned purchases that rapidly accumulate and can significantly impact monthly budgets despite their low individual costs. Unlike recurring expenses, which are predictable and scheduled, these impulsive micro-expenses often go unnoticed, leading to reduced financial control and unexpected budget constraints.

Recurring Expenses vs Micro-Expenses for Expense Infographic

moneydiff.com

moneydiff.com