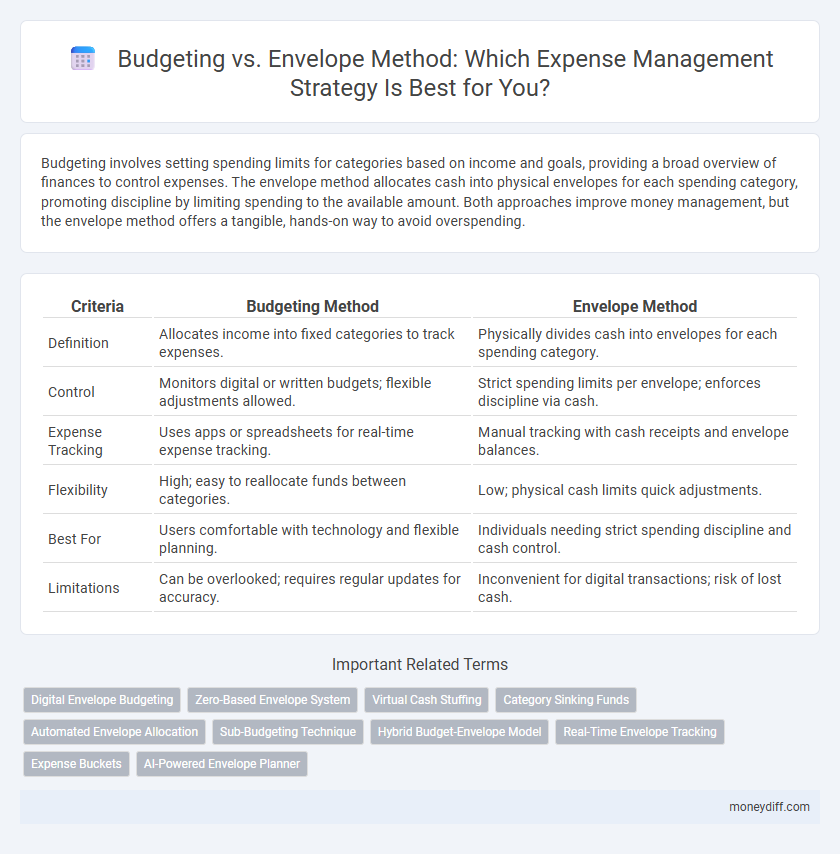

Budgeting involves setting spending limits for categories based on income and goals, providing a broad overview of finances to control expenses. The envelope method allocates cash into physical envelopes for each spending category, promoting discipline by limiting spending to the available amount. Both approaches improve money management, but the envelope method offers a tangible, hands-on way to avoid overspending.

Table of Comparison

| Criteria | Budgeting Method | Envelope Method |

|---|---|---|

| Definition | Allocates income into fixed categories to track expenses. | Physically divides cash into envelopes for each spending category. |

| Control | Monitors digital or written budgets; flexible adjustments allowed. | Strict spending limits per envelope; enforces discipline via cash. |

| Expense Tracking | Uses apps or spreadsheets for real-time expense tracking. | Manual tracking with cash receipts and envelope balances. |

| Flexibility | High; easy to reallocate funds between categories. | Low; physical cash limits quick adjustments. |

| Best For | Users comfortable with technology and flexible planning. | Individuals needing strict spending discipline and cash control. |

| Limitations | Can be overlooked; requires regular updates for accuracy. | Inconvenient for digital transactions; risk of lost cash. |

Understanding Budgeting: Definition and Key Principles

Budgeting is a financial planning method that allocates income to different expense categories to control spending and achieve saving goals. Key principles of budgeting include tracking income, setting spending limits, and regularly reviewing financial progress to ensure funds align with priorities. Unlike the envelope method, budgeting focuses on a comprehensive plan rather than physically dividing cash into spending categories.

What Is the Envelope Method?

The Envelope Method is a money management technique where cash is allocated into separate envelopes designated for specific spending categories, helping to control expenses and prevent overspending. By physically limiting spending to the money in each envelope, it encourages disciplined budgeting and mindful financial decisions. This method contrasts with traditional budgeting by emphasizing tangible cash flow management rather than abstract financial tracking.

Budgeting vs Envelope Method: Core Differences

Budgeting involves creating a comprehensive financial plan that allocates income across various categories for a specified period, promoting overall expense control and long-term savings goals. The Envelope Method physically separates cash into labeled envelopes representing different spending categories, enforcing strict limits and preventing overspending by using only the cash available in each envelope. While budgeting provides a flexible overview of income and expenses, the Envelope Method offers tangible spending boundaries, making it easier to manage daily cash flow and avoid debt.

Benefits of Traditional Budgeting Techniques

Traditional budgeting techniques provide a clear framework for tracking income and expenses, promoting disciplined spending habits. These methods enable precise allocation of funds to various categories, improving financial control and reducing the risk of overspending. Consistent use of a traditional budget supports long-term financial goals by offering measurable progress and fostering accountability.

Advantages of the Envelope Method for Expense Control

The Envelope Method enhances expense control by physically dividing cash into labeled envelopes for each spending category, preventing overspending. This tactile approach promotes conscious spending habits and increases awareness of budget limits. The method also offers flexibility, allowing adjustments to envelopes based on real-time financial needs, which strengthens overall money management discipline.

Challenges of Budgeting and How to Overcome Them

Budgeting challenges often include difficulty tracking expenses, unrealistic spending limits, and lack of flexibility, which can lead to frustration and failure to save. The envelope method overcomes these obstacles by physically dividing cash into categories, enhancing tangible control and discipline over spending. Combining digital budgeting tools with the envelope system creates a hybrid strategy that improves accountability and adapts to fluctuating financial needs.

Common Pitfalls of the Envelope Method

The envelope method often leads to overspending due to the physical limitation of cash in envelopes, making it difficult to track digital or unexpected expenses. Users may struggle with inflexibility when rigidly dividing funds, causing frustration during irregular income periods or fluctuating bills. Lack of integration with modern financial tools can hinder comprehensive budgeting and detailed expense analysis.

When to Use Budgeting or Envelope Method

Budgeting is effective for individuals seeking a comprehensive overview of their finances, allowing for flexible spending within set categories and long-term financial goal planning. The envelope method is ideal for those who struggle with overspending and prefer a tangible way to control daily expenses by physically separating cash into labeled envelopes. Choosing between these methods depends on personal discipline levels and whether detailed tracking or strict spending limits best support your financial habits.

Choosing the Right Money Management Method for You

Choosing the right money management method depends on your spending habits and financial goals, with budgeting offering a flexible framework to allocate funds across different categories based on monthly income and expenses. The envelope method emphasizes physical or digital envelopes to limit spending by dividing cash into discrete portions for essential categories such as groceries, rent, and entertainment, promoting disciplined money allocation. Evaluating personal discipline and the complexity of expenses helps determine whether the structured budgeting or tactile envelope approach aligns best with individual financial management needs.

Tips for Successful Expense Tracking with Both Methods

Effective expense tracking with budgeting requires setting clear spending limits aligned with monthly income and regularly reviewing financial statements to adjust allocations. The Envelope method demands physically dividing cash into labeled envelopes for each expense category, reinforcing discipline and preventing overspending. Combining digital apps for budgeting and tangible cash management in envelopes enhances visibility and control over daily expenditures.

Related Important Terms

Digital Envelope Budgeting

Digital envelope budgeting leverages technology to allocate funds into virtual envelopes, enhancing spending discipline and real-time tracking compared to traditional budgeting methods. This approach integrates with banking apps and financial software, allowing users to automate allocations, reduce overspending, and increase savings efficiency.

Zero-Based Envelope System

The Zero-Based Envelope System allocates every dollar of income to specific spending categories, ensuring no money is left unassigned and promoting disciplined spending habits. Unlike traditional budgeting, this method physically separates funds into envelopes, enhancing accountability and preventing overspending by limiting purchases to allocated amounts.

Virtual Cash Stuffing

Virtual cash stuffing enhances money management by digitally allocating funds into budgeting envelopes, promoting disciplined spending without the need for physical cash. This method combines the structure of the envelope system with the convenience of virtual tracking, improving expense control and financial awareness.

Category Sinking Funds

Budgeting allocates a fixed amount to each spending category, while the Envelope Method physically separates cash into labeled envelopes for expenses, enhancing discipline for Category Sinking Funds by preventing overspending and ensuring funds are reserved for future specific expenses. Category Sinking Funds under the Envelope Method allow targeted savings for irregular or large upcoming costs, improving financial preparedness and reducing reliance on credit.

Automated Envelope Allocation

Automated Envelope Allocation streamlines money management by digitally assigning funds to specific spending categories, enhancing the traditional Envelope method's hands-on approach. This system integrates with budgeting tools to provide real-time tracking, ensuring disciplined spending and improved financial control.

Sub-Budgeting Technique

The Sub-Budgeting Technique within budgeting divides expenses into specific categories, allowing precise allocation of funds for each area, enhancing control over spending. Unlike the Envelope method which uses physical or digital envelopes for cash allocation, Sub-Budgeting emphasizes detailed categorization and tracking to optimize financial planning and reduce overspending.

Hybrid Budget-Envelope Model

The Hybrid Budget-Envelope Model combines the strategic planning of budgeting with the disciplined spending limits of the envelope method, allowing for flexible allocation of funds while maintaining control over expenses. This approach enhances cash flow management by integrating categorized digital envelopes with adaptable budget categories, optimizing both savings goals and day-to-day spending.

Real-Time Envelope Tracking

Real-time envelope tracking enhances the traditional budgeting method by allocating funds into distinct categories and monitoring expenses instantly, preventing overspending in any envelope. This dynamic approach improves financial discipline and adaptability compared to static monthly budgets, offering precise control over spending patterns.

Expense Buckets

The Budgeting method allocates fixed amounts to broad expense categories for overall financial control, while the Envelope method uses physical or digital containers to separate money into specific expense buckets, ensuring disciplined spending within each category. Expense buckets in the Envelope method promote clarity and accountability by restricting funds to designated uses, reducing overspending and enhancing cash flow management.

AI-Powered Envelope Planner

AI-powered envelope planners enhance traditional budgeting by automating expense categorization and real-time allocation of funds into virtual envelopes, increasing spending accuracy and financial discipline. These tools leverage machine learning algorithms to predict upcoming expenses, optimize fund distribution, and provide personalized insights, outperforming manual budgeting methods in efficiency and adaptability.

Budgeting vs Envelope method for money management. Infographic

moneydiff.com

moneydiff.com