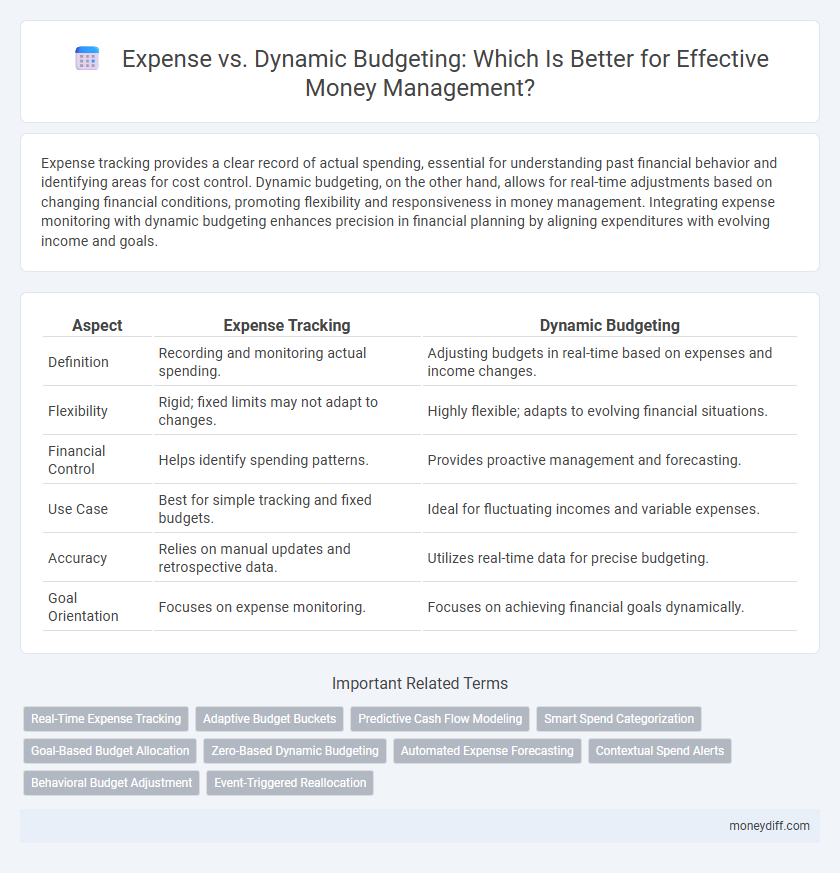

Expense tracking provides a clear record of actual spending, essential for understanding past financial behavior and identifying areas for cost control. Dynamic budgeting, on the other hand, allows for real-time adjustments based on changing financial conditions, promoting flexibility and responsiveness in money management. Integrating expense monitoring with dynamic budgeting enhances precision in financial planning by aligning expenditures with evolving income and goals.

Table of Comparison

| Aspect | Expense Tracking | Dynamic Budgeting |

|---|---|---|

| Definition | Recording and monitoring actual spending. | Adjusting budgets in real-time based on expenses and income changes. |

| Flexibility | Rigid; fixed limits may not adapt to changes. | Highly flexible; adapts to evolving financial situations. |

| Financial Control | Helps identify spending patterns. | Provides proactive management and forecasting. |

| Use Case | Best for simple tracking and fixed budgets. | Ideal for fluctuating incomes and variable expenses. |

| Accuracy | Relies on manual updates and retrospective data. | Utilizes real-time data for precise budgeting. |

| Goal Orientation | Focuses on expense monitoring. | Focuses on achieving financial goals dynamically. |

Understanding Expenses: The Foundation of Money Management

Understanding expenses is crucial for effective money management, as it provides a clear picture of where money is spent and helps identify areas for optimization. Unlike dynamic budgeting, which adjusts allocations based on changing financial circumstances, managing expenses focuses on tracking fixed and variable costs to maintain financial discipline. Accurate expense monitoring lays the foundation for informed decision-making and improved cash flow control.

What Is Dynamic Budgeting? A Modern Approach

Dynamic budgeting is an adaptive financial management method that adjusts expenses in real-time based on actual income and changing business conditions. Unlike traditional static expense budgets, dynamic budgeting uses continuous data analysis to allocate resources more efficiently and respond swiftly to market fluctuations. This modern approach enhances cash flow control and improves financial decision-making by prioritizing flexibility over fixed spending plans.

Expense Tracking Methods: Traditional vs. Dynamic Budgeting

Traditional expense tracking relies on fixed categories and periodic reviews, offering clear but static insights into spending patterns. Dynamic budgeting adapts in real-time using predictive analytics and AI, allowing for flexible adjustments based on current financial behavior. Incorporating dynamic budgeting methods significantly enhances accuracy in money management by continuously aligning expenses with evolving income and goals.

Advantages of Monitoring Expenses in Real-Time

Monitoring expenses in real-time enhances financial accuracy by providing immediate visibility into spending patterns, allowing for swift adjustments that prevent budget overruns. This approach supports dynamic budgeting by facilitating continuous updates to financial plans based on actual expenditures, improving overall money management. Real-time expense tracking also aids in identifying unnecessary costs quickly, leading to better control over cash flow and more informed financial decision-making.

Flexibility and Adaptability: The Edge of Dynamic Budgeting

Dynamic budgeting offers superior flexibility and adaptability compared to traditional expense tracking by allowing real-time adjustments based on changing financial circumstances. This approach enables more responsive allocation of funds, preventing overspending and optimizing cash flow management. Enhanced adaptability in dynamic budgeting supports better financial decision-making through continuous monitoring and timely revisions.

Identifying and Categorizing Expenses for Better Control

Identifying and categorizing expenses within dynamic budgeting enhances money management by providing real-time visibility into spending patterns and financial priorities. This approach allows for the allocation of funds to variable and fixed costs with precision, enabling adjustments based on actual financial performance. Effective expense categorization supports informed decision-making, minimizes overspending, and aligns budget forecasts with current financial circumstances.

Dynamic Budgeting Tools and Apps for Effective Money Management

Dynamic budgeting tools and apps offer real-time tracking and adaptive financial planning, enabling users to manage expenses more efficiently than static budgeting methods. Features such as automated expense categorization, customizable alerts, and integration with financial accounts provide comprehensive visibility and control over spending patterns. These dynamic solutions enhance money management by offering flexible adjustments based on income fluctuations, helping individuals maintain financial discipline and achieve savings goals.

Challenges of Fixed Budgets vs. Dynamic Adjustments

Fixed budgets often fail to accommodate unexpected expenses or fluctuating income, leading to overspending or underspending issues. Dynamic budgeting allows real-time adjustments based on actual cash flow, providing greater flexibility and accuracy in money management. Challenges with fixed budgets include rigidity and a lack of responsiveness, which can hinder effective financial planning.

How Dynamic Budgeting Prevents Overspending

Dynamic budgeting adapts spending limits based on real-time income and expense tracking, providing a proactive approach to money management that prevents overspending. By continuously adjusting budget categories according to actual financial behavior, dynamic budgeting reduces the risk of depleting funds prematurely. This method ensures more accurate allocation, helping users maintain control over their expenses and avoid unexpected debt.

Choosing the Right Approach: Expense Tracking or Dynamic Budgeting?

Choosing the right approach between expense tracking and dynamic budgeting depends on individual financial goals and flexibility requirements. Expense tracking offers precise monitoring of spending patterns, allowing for better control over daily outflows, while dynamic budgeting adapts to changing income or expenses, providing a responsive framework for managing money. Evaluating factors such as financial stability, spending habits, and need for adaptability helps determine the most effective method for optimizing personal money management.

Related Important Terms

Real-Time Expense Tracking

Real-time expense tracking enhances dynamic budgeting by providing instant data on spending patterns, enabling immediate budget adjustments and more accurate financial control. This approach reduces the risk of overspending and improves cash flow management compared to traditional static budgeting methods.

Adaptive Budget Buckets

Adaptive Budget Buckets enable dynamic allocation of funds by grouping expenses into flexible categories that adjust based on real-time spending patterns, enhancing precision in money management over static expense tracking. This approach optimizes cash flow control and financial planning by continuously calibrating budgets to actual expenditures and financial goals.

Predictive Cash Flow Modeling

Expense tracking provides historical data, but dynamic budgeting leverages predictive cash flow modeling to forecast future financial positions accurately. This approach enables proactive adjustments based on anticipated income and expenses, optimizing money management efficiency.

Smart Spend Categorization

Smart spend categorization enhances expense tracking by automatically classifying transactions into precise categories, enabling more dynamic budgeting adjustments based on real-time financial behavior. This approach facilitates improved money management by continuously aligning budget allocations with actual spending patterns, reducing overspending and optimizing resource distribution.

Goal-Based Budget Allocation

Goal-based budget allocation in expense management prioritizes specific financial objectives, enabling more precise tracking and adjustment of funds compared to dynamic budgeting's flexible, real-time approach. By aligning expenditures with predefined goals, this method enhances financial discipline and ensures resources are optimally utilized to achieve targeted outcomes.

Zero-Based Dynamic Budgeting

Zero-Based Dynamic Budgeting allocates every dollar of income to specific expenses, eliminating waste by requiring justification for all expenditures from scratch each period. Unlike traditional expense tracking, this approach enhances money management by continuously adjusting budgets based on real-time financial goals and cash flow changes.

Automated Expense Forecasting

Automated expense forecasting leverages dynamic budgeting to predict future costs more accurately by analyzing real-time transaction data and spending patterns, unlike static expense tracking that relies on fixed budgets. This approach enables proactive financial adjustments, optimizing cash flow management and reducing the risk of budget overruns.

Contextual Spend Alerts

Contextual spend alerts enhance expense tracking by providing real-time notifications based on dynamic budgeting parameters, allowing for adaptive money management that aligns with fluctuating financial goals. This approach reduces overspending risks by analyzing spending patterns and adjusting alerts to reflect current budget constraints and priorities.

Behavioral Budget Adjustment

Behavioral budget adjustment refines expense tracking by aligning spending habits with dynamic budgeting, allowing real-time allocation shifts based on actual financial behavior and priorities. This approach enhances money management by promoting flexible expense control that adapts to fluctuating income and unforeseen costs.

Event-Triggered Reallocation

Expense management benefits from dynamic budgeting through event-triggered reallocation, allowing real-time adjustments based on unforeseen costs or income changes. This approach enhances financial flexibility by reallocating funds promptly, minimizing budget overruns and optimizing cash flow efficiency.

Expense vs Dynamic Budgeting for money management. Infographic

moneydiff.com

moneydiff.com