Conventional family budgeting often relies on strict tracking and limitations, which can feel restrictive and reduce motivation over time. Expense gamification introduces interactive elements such as rewards, challenges, and progress tracking, making financial management more engaging and motivating for all family members. This approach transforms budgeting into a collaborative and enjoyable activity, encouraging consistent participation and better spending habits.

Table of Comparison

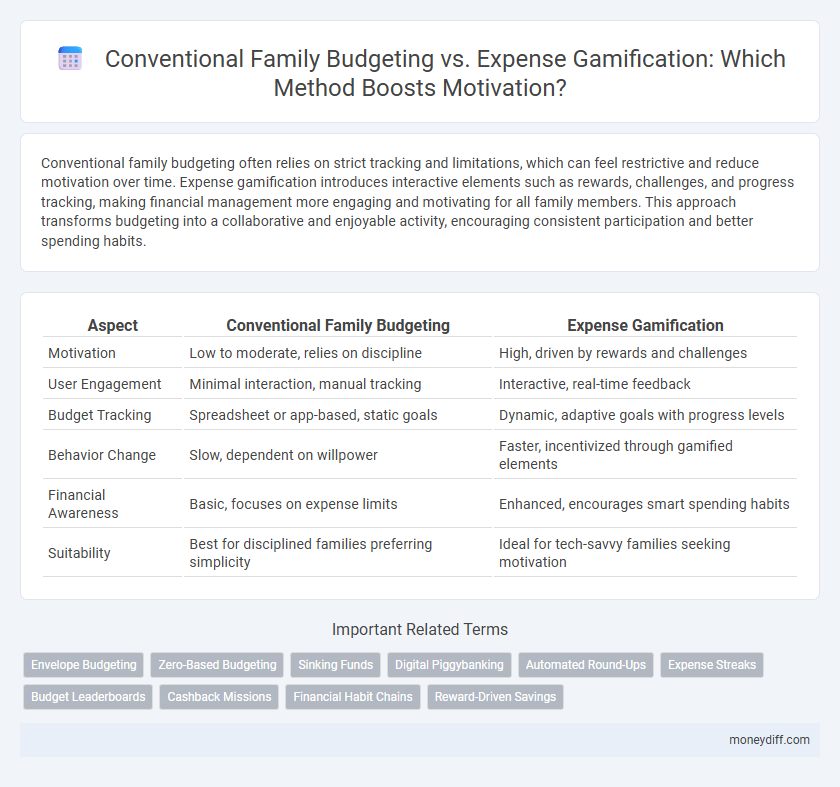

| Aspect | Conventional Family Budgeting | Expense Gamification |

|---|---|---|

| Motivation | Low to moderate, relies on discipline | High, driven by rewards and challenges |

| User Engagement | Minimal interaction, manual tracking | Interactive, real-time feedback |

| Budget Tracking | Spreadsheet or app-based, static goals | Dynamic, adaptive goals with progress levels |

| Behavior Change | Slow, dependent on willpower | Faster, incentivized through gamified elements |

| Financial Awareness | Basic, focuses on expense limits | Enhanced, encourages smart spending habits |

| Suitability | Best for disciplined families preferring simplicity | Ideal for tech-savvy families seeking motivation |

Introduction to Family Budgeting Methods

Conventional family budgeting involves setting fixed categories for expenses and monitoring spending through detailed tracking to maintain financial control. Expense gamification introduces interactive elements such as rewards, challenges, and progress tracking to enhance motivation and engagement in managing household finances. These contrasting approaches impact how families approach saving, spending, and achieving financial goals.

What is Conventional Family Budgeting?

Conventional family budgeting involves creating a detailed financial plan that tracks income, expenses, and savings to ensure effective money management and financial goals achievement. This method typically uses spreadsheets or budgeting apps to allocate funds for necessities, discretionary spending, and emergency funds, emphasizing discipline and regular monitoring. By maintaining structured oversight, families can avoid overspending and increase savings stability.

The Challenges of Traditional Budget Planning

Traditional family budgeting often faces challenges such as lack of engagement, difficulty tracking expenses consistently, and limited motivation to stick to financial goals. Conventional methods rely heavily on manual entry and rigid categories, which can lead to frustration and decreased adherence over time. Expense gamification introduces interactive elements and rewards to boost accountability and make financial management more appealing and sustainable.

Understanding Expense Gamification

Expense gamification transforms traditional family budgeting by integrating game-like elements such as rewards, challenges, and progress tracking to boost motivation and engagement in managing finances. This innovative approach encourages consistent expense tracking and goal achievement by making budget management interactive and entertaining, fostering better financial habits. Consequently, families experience improved discipline and satisfaction compared to the routine, often tedious nature of conventional budgeting methods.

Key Differences: Conventional Budgeting vs Gamified Expenses

Conventional family budgeting relies on rigid categories and strict spending limits to control expenses, often leading to frustration and low motivation. Expense gamification introduces interactive elements such as rewards, progress tracking, and challenges, which enhance motivation by transforming budgeting into an engaging and dynamic activity. Key differences include the psychological impact, with gamified expenses fostering positive reinforcement and conventional budgeting emphasizing discipline and restraint.

Psychological Impact of Gamification on Spending Habits

Expense gamification leverages psychological triggers such as reward systems and progress tracking to reshape spending habits, promoting mindful financial decisions and reducing impulsive expenses. Unlike conventional family budgeting, which often relies on rigid tracking and restriction, gamification introduces positive reinforcement that increases engagement and motivation to adhere to spending limits. Studies show that gamified budgeting tools can significantly improve long-term financial discipline by making expense management more interactive and enjoyable.

Enhancing Family Engagement Through Expense Gamification

Expense gamification transforms conventional family budgeting by introducing interactive elements like point scoring, challenges, and rewards to increase motivation and participation. This approach leverages behavioral economics principles to foster consistent saving habits and transparent spending discussions among family members. Enhanced engagement through gamified budgeting tools leads to improved financial literacy and collaborative goal-setting within households.

Measuring Motivation: Which Method Works Better?

Measuring motivation in expense management reveals that conventional family budgeting relies on strict tracking and goal-setting, often leading to compliance but limited sustained engagement. Expense gamification introduces rewards, challenges, and interactive elements that enhance motivation by making financial tasks more enjoyable and reinforcing positive behaviors. Studies indicate gamified approaches improve long-term adherence and proactive saving habits compared to traditional budgeting methods.

Potential Drawbacks and Risks of Each Approach

Conventional family budgeting often faces challenges such as rigid tracking, leading to frustration and reduced motivation over time due to perceived restrictions. Expense gamification, while increasing engagement and motivation through rewards and competition, risks promoting impulsive spending and undermining financial discipline if game mechanics overshadow practical budgeting goals. Both approaches may struggle with sustainability, where conventional methods can feel monotonous and gamification might encourage short-term behaviors instead of long-term financial health.

Choosing the Right Expense Management Strategy for Your Family

Conventional family budgeting relies on strict categories and limits to control spending, providing clear financial structure but often lacking engagement. Expense gamification introduces interactive challenges, rewards, and progress tracking, boosting motivation and encouraging consistent saving habits. Selecting the right expense management strategy depends on your family's financial goals, behavioral preferences, and long-term commitment to fostering positive money habits.

Related Important Terms

Envelope Budgeting

Envelope budgeting segments expenses into designated cash categories to enhance spending control and reduce overspending risks. Expense gamification transforms budgeting into an engaging challenge by rewarding goal achievement and promoting consistent financial discipline, boosting motivation beyond traditional methods.

Zero-Based Budgeting

Zero-Based Budgeting increases financial discipline by allocating every dollar a specific purpose, eliminating unnecessary expenses and increasing accountability in conventional family budgeting. Expense gamification enhances motivation by turning budgeting into an interactive experience, using rewards and challenges to encourage consistent adherence to saving and spending goals.

Sinking Funds

Conventional family budgeting relies on fixed allocations for sinking funds to manage future expenses, creating predictable financial discipline. Expense gamification enhances motivation by turning sinking fund contributions into engaging challenges or rewards, promoting consistent savings through behavioral incentives.

Digital Piggybanking

Conventional family budgeting often relies on static spreadsheets and manual tracking, leading to reduced engagement and difficulty maintaining motivation over time. Digital piggybanking gamifies expense management by integrating interactive goals, rewards, and real-time progress tracking, enhancing motivation and fostering consistent saving habits within family finance management.

Automated Round-Ups

Automated round-ups in expense management transform conventional family budgeting by rounding up purchases to the nearest dollar and allocating the difference to savings or goals, enhancing motivation through instant, effortless contributions. This gamified approach increases engagement by turning routine financial tasks into rewarding experiences, promoting consistent saving habits without manual tracking.

Expense Streaks

Expense streaks leverage gamification to transform conventional family budgeting into an engaging motivational tool by rewarding consecutive days of tracked spending, increasing financial discipline and awareness. This method enhances commitment to budget goals through real-time progress visualization and positive reinforcement, outperforming traditional static budgeting techniques.

Budget Leaderboards

Budget leaderboards in expense gamification transform conventional family budgeting by introducing competitive elements that boost motivation and accountability; families can track spending habits in real time and compare their progress to others. This dynamic approach enhances financial discipline, making budgeting more engaging and effective than traditional static methods.

Cashback Missions

Conventional family budgeting often struggles with engagement, while expense gamification, particularly through Cashback Missions, incentivizes saving by awarding cashback rewards for meeting spending goals. This approach leverages behavioral economics to boost motivation and improve financial discipline by turning routine expenses into interactive challenges.

Financial Habit Chains

Conventional family budgeting often relies on rigid spreadsheets and fixed expense categories, which can lead to disengagement and inconsistent financial habits. Expense gamification introduces reward-based challenges and progress tracking, effectively reinforcing financial habit chains through motivation and positive behavioral triggers.

Reward-Driven Savings

Conventional family budgeting often relies on strict allocation of funds to categories, which can lead to low engagement and motivation. Expense gamification introduces reward-driven savings by turning financial goals into interactive challenges, increasing motivation through tracking progress and earning incentives.

Conventional family budgeting vs Expense gamification for motivation. Infographic

moneydiff.com

moneydiff.com