Effective money management requires distinguishing between actual expenses and ghost expenses, which are hidden or forgotten costs that silently erode your budget. Tracking all expenditures, including small or irregular ghost expenses, ensures accurate financial planning and prevents unexpected shortfalls. Identifying and minimizing ghost expenses enhances overall financial control and maximizes savings potential.

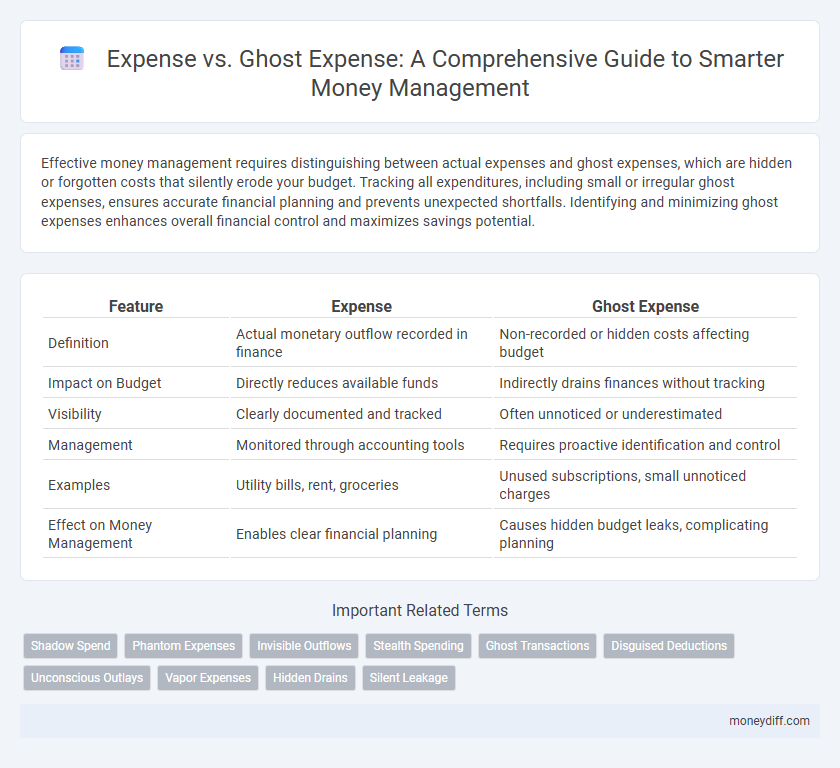

Table of Comparison

| Feature | Expense | Ghost Expense |

|---|---|---|

| Definition | Actual monetary outflow recorded in finance | Non-recorded or hidden costs affecting budget |

| Impact on Budget | Directly reduces available funds | Indirectly drains finances without tracking |

| Visibility | Clearly documented and tracked | Often unnoticed or underestimated |

| Management | Monitored through accounting tools | Requires proactive identification and control |

| Examples | Utility bills, rent, groceries | Unused subscriptions, small unnoticed charges |

| Effect on Money Management | Enables clear financial planning | Causes hidden budget leaks, complicating planning |

Understanding Expense vs Ghost Expense in Money Management

Expense refers to actual cash outflows or financial transactions recorded in budgets and accounting books, directly impacting cash flow and financial statements. Ghost Expense, however, represents unrecorded or overlooked costs such as forgotten subscriptions or hidden fees that silently drain resources without clear tracking. Recognizing and differentiating these expenses enhances accurate budgeting, financial forecasting, and effective money management strategies.

Defining Ghost Expenses: Hidden Costs Draining Your Finances

Ghost expenses represent hidden or overlooked costs that silently drain your finances, such as automatic subscriptions, forgotten memberships, and small recurring fees. Unlike regular expenses that are tracked and budgeted for, ghost expenses often go unnoticed, leading to unexpected budget shortfalls and financial stress. Identifying and eliminating these covert charges is essential for accurate money management and achieving financial stability.

How to Identify Your Regular and Ghost Expenses

Regular expenses are recurring and well-documented payments such as rent, utilities, and subscriptions, clearly impacting your monthly budget. Ghost expenses, often unnoticed charges like small automatic renewals or forgotten memberships, can stealthily drain your funds if not regularly reviewed. Tracking bank statements and categorizing transactions monthly helps identify both regular and ghost expenses, enabling better control over your financial health.

The Psychological Impact of Ghost Expenses

Ghost expenses, which are small, often overlooked purchases, significantly undermine budgeting efforts by creating a false sense of financial security. These minor, untracked costs accumulate unnoticed, leading to increased stress and anxiety due to unexpected shortages in available funds. Recognizing and managing ghost expenses can improve psychological well-being by fostering greater control and transparency in personal money management.

Common Types of Ghost Expenses in Daily Life

Common types of ghost expenses in daily life include subscription services that are rarely used, unnoticed automatic renewals, and small, frequent charges such as app purchases or convenience fees that accumulate over time. These hidden costs can significantly impact monthly budgets and distort financial planning by creating the illusion of lower spending. Identifying and tracking these ghost expenses is essential for effective money management and maximizing savings.

Why Tracking Both Expense Types Matters for Budgeting

Tracking both actual expenses and ghost expenses is crucial for accurate budgeting because ghost expenses, such as subscription fees or recurring charges that often go unnoticed, can silently deplete funds. Recognizing these hidden costs alongside regular expenditures provides a comprehensive view of cash flow, preventing budget shortfalls. Effective money management hinges on identifying and accounting for every outflow to maintain financial control and optimize savings.

Strategies to Eliminate Ghost Expenses from Your Finances

Identifying ghost expenses, such as unnoticed subscriptions and recurring fees, is crucial for effective money management. Utilizing budgeting tools and regularly reviewing bank statements helps uncover and eliminate these hidden costs. Implementing automated alerts for unusual transactions further strengthens control over ghost expenses and improves overall financial health.

Practical Tools for Managing Expenses and Ghost Expenses

Practical tools for managing expenses and ghost expenses include budgeting apps with real-time tracking features that distinguish between actual transactions and recurring phantom charges. Automated expense categorization and alert systems help identify ghost expenses by analyzing spending patterns and highlighting discrepancies or duplicate payments. Utilizing expense reconciliation software streamlines monitoring and controls, ensuring greater accuracy in financial management and preventing unnoticed financial leaks.

The Long-Term Effects of Ignoring Ghost Expenses

Ignoring ghost expenses--small, recurring charges like unused subscriptions or overlooked fees--can silently erode financial stability over time, leading to significant budget deficits and reduced savings. These hidden costs often go unnoticed, resulting in cumulative losses that undermine long-term wealth accumulation and financial goals. Proactive identification and elimination of ghost expenses enhance money management by preserving cash flow and enabling more accurate expense tracking.

Building a Financial Plan that Addresses Both Expense Types

A comprehensive financial plan must account for both visible expenses and ghost expenses, which are hidden or overlooked costs that erode savings over time. Identifying ghost expenses like subscription fees, impulse purchases, or small but frequent charges allows for more accurate budgeting and improved cash flow management. Incorporating strategies to monitor and reduce these hidden costs enhances overall financial discipline and long-term wealth accumulation.

Related Important Terms

Shadow Spend

Shadow spend, often referred to as ghost expense, represents untracked or unauthorized expenditures outside formal budgeting processes, posing significant risks to accurate financial management. Identifying and controlling shadow spend enables organizations to enhance transparency, reduce unexpected costs, and improve overall expense tracking accuracy.

Phantom Expenses

Phantom expenses refer to unrecognized or hidden costs that do not appear in regular transactions but significantly impact money management by eroding budgets unnoticed. Identifying and accounting for phantom expenses is crucial for accurate financial planning and preventing unexpected shortfalls.

Invisible Outflows

Invisible outflows, often categorized as ghost expenses, subtly drain your finances without immediate notice or documentation, undermining accurate money management and budgeting efforts. Tracking these hidden costs is essential to gain a comprehensive understanding of total expenses and to optimize financial planning.

Stealth Spending

Stealth spending refers to hidden or untracked expenses that quietly erode your budget, contrasting with regular expenses which are clearly recorded and monitored. Understanding and identifying ghost expenses, such as automatic subscriptions or small impulse purchases, is crucial for effective money management and maintaining financial control.

Ghost Transactions

Ghost expenses, also known as ghost transactions, are unauthorized or hidden charges that do not correspond to actual purchases, often causing discrepancies in money management and budgeting. Identifying and monitoring ghost transactions is crucial for maintaining financial accuracy, preventing fraud, and ensuring that expense reports reflect genuine outflows.

Disguised Deductions

Disguised deductions, often classified as ghost expenses, can significantly distort financial reporting by masking the true cost of operations and misleading budgeting efforts. Differentiating between legitimate expenses and ghost expenses is crucial for accurate money management and enhancing transparency in financial statements.

Unconscious Outlays

Unconscious outlays, often categorized as ghost expenses, silently erode budgets by representing untracked or overlooked spending, unlike traditional expenses which are consciously recorded and managed. Identifying and minimizing ghost expenses is essential for accurate money management and improved financial control.

Vapor Expenses

Vapor expenses refer to small, often forgotten transactions that accumulate unnoticed, undermining effective money management by creating hidden budget leaks. Unlike ghost expenses, which are unauthorized or unknown charges, vapor expenses are legitimate but lack clear tracking, requiring meticulous monitoring to improve financial control.

Hidden Drains

Hidden drains in money management often stem from ghost expenses, which are recurring costs like subscriptions or fees that go unnoticed and untracked, leading to significant financial leakage. Identifying and eliminating these ghost expenses improves budget accuracy and enhances overall expense control.

Silent Leakage

Silent leakage from ghost expenses often undermines accurate money management by causing unnoticed cash outflows that do not reflect in regular expense reports. Identifying and eliminating these ghost expenses is crucial for maintaining precise financial control and improving budget accuracy.

Expense vs Ghost Expense for money management. Infographic

moneydiff.com

moneydiff.com