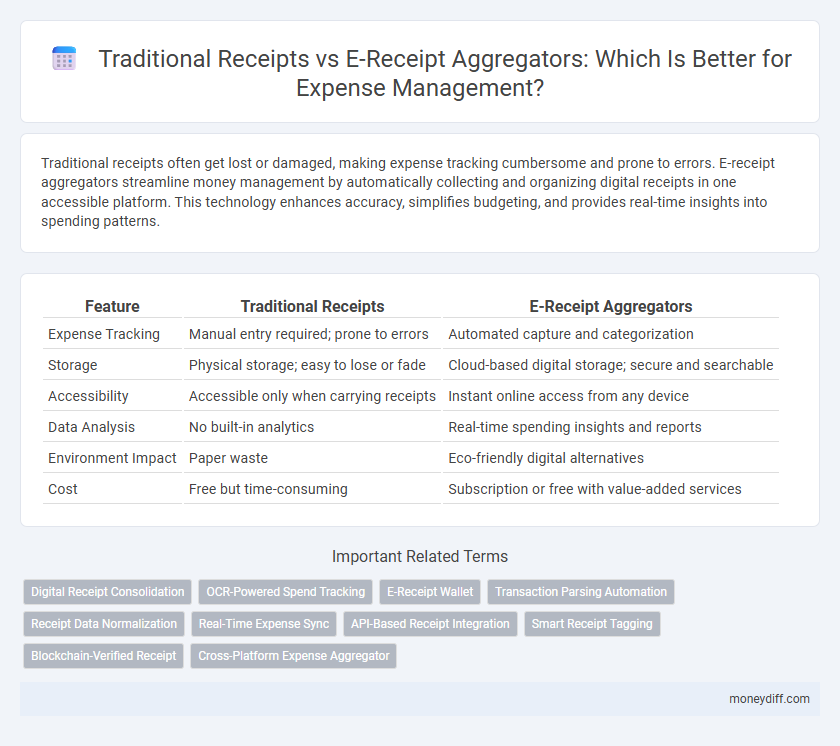

Traditional receipts often get lost or damaged, making expense tracking cumbersome and prone to errors. E-receipt aggregators streamline money management by automatically collecting and organizing digital receipts in one accessible platform. This technology enhances accuracy, simplifies budgeting, and provides real-time insights into spending patterns.

Table of Comparison

| Feature | Traditional Receipts | E-Receipt Aggregators |

|---|---|---|

| Expense Tracking | Manual entry required; prone to errors | Automated capture and categorization |

| Storage | Physical storage; easy to lose or fade | Cloud-based digital storage; secure and searchable |

| Accessibility | Accessible only when carrying receipts | Instant online access from any device |

| Data Analysis | No built-in analytics | Real-time spending insights and reports |

| Environment Impact | Paper waste | Eco-friendly digital alternatives |

| Cost | Free but time-consuming | Subscription or free with value-added services |

Understanding Traditional Receipts in Money Management

Traditional receipts serve as tangible proof of purchases, essential for accurate expense tracking and budget management. They provide detailed transaction information, including date, amount, and vendor, which supports financial record-keeping and reimbursement processes. However, physical receipts are prone to loss and damage, making them less reliable for long-term money management compared to digital alternatives.

What Are E-Receipt Aggregators?

E-receipt aggregators are digital platforms that collect and organize electronic receipts from multiple vendors into a single interface, streamlining expense tracking and management. These systems leverage cloud technology to provide real-time access to transaction records, reducing the risk of lost or damaged receipts common with traditional paper receipts. By integrating with banking and payment apps, e-receipt aggregators offer enhanced visibility and accuracy in personal and business financial management.

Key Differences: Paper Receipts vs. Digital Receipts

Traditional paper receipts require physical storage and are prone to fading or loss, making expense tracking cumbersome and error-prone. E-receipt aggregators digitize and organize receipts automatically, offering real-time access, searchability, and integration with budgeting apps for enhanced financial management. This digital transformation streamlines expense tracking, reduces clutter, and improves accuracy in personal and business money management.

Expense Tracking Efficiency: Manual vs. Automated Solutions

Traditional receipts require manual entry, increasing the risk of errors and time consumption during expense tracking. E-receipt aggregators automate data collection by electronically capturing and categorizing purchases, significantly enhancing accuracy and saving time. Automated solutions integrate seamlessly with budgeting software, providing real-time expense insights and streamlining financial management.

Data Security: Paper Storage vs. Digital Protection

Traditional receipts require physical storage that risks damage, loss, or unauthorized access, compromising financial record security. E-receipt aggregators utilize encrypted cloud storage and multi-factor authentication, significantly enhancing data protection and reducing the risk of fraud. Digital solutions also enable automated backups and secure remote access, ensuring expense records remain intact and confidential at all times.

Environmental Impact: Sustainability of Receipts

Traditional receipts contribute significantly to paper waste and chemical pollution due to thermal paper coatings containing BPA and BPS, which pose environmental and health risks. E-receipt aggregators reduce carbon footprints by eliminating physical paper usage and enabling centralized digital storage, enhancing long-term sustainability in expense tracking. Transitioning to e-receipts supports greener financial practices by minimizing resource consumption and lowering waste production associated with conventional receipt management.

Accessibility and Organization of Financial Records

Traditional receipts often get lost or damaged, making accurate expense tracking difficult and limiting accessibility. E-receipt aggregators store digital copies in centralized platforms, enhancing organization and enabling quick retrieval of financial records. These systems provide improved visibility into spending habits and streamline budget management through searchable, categorized data.

Integration with Budgeting Tools and Apps

Traditional receipts often require manual entry to track expenses, increasing the risk of errors and time consumption in money management. E-receipt aggregators automatically capture and categorize digital receipts, providing seamless integration with popular budgeting tools and apps like Mint, YNAB, and PocketGuard. This automation enhances real-time expense tracking and improves accuracy in financial planning and budget adherence.

Reducing Errors in Personal Expense Reporting

Traditional receipts often lead to errors in personal expense reporting due to illegible handwriting, loss, and manual data entry mistakes. E-receipt aggregators automatically capture and categorize expenses, minimizing human errors and improving accuracy in financial tracking. This automation streamlines reconciliation processes and enhances overall financial management efficiency.

Choosing the Best Receipt Solution for Your Financial Goals

Traditional receipts often get lost or damaged, making it difficult to track expenses accurately, whereas e-receipt aggregators consolidate digital receipts automatically for seamless financial management. E-receipt platforms provide real-time expense categorization and analytics, enhancing budgeting and tax preparation efficiency. Selecting the best receipt solution depends on your preference for convenience, accuracy, and integration with personal finance tools to support your financial goals effectively.

Related Important Terms

Digital Receipt Consolidation

Digital receipt consolidation through e-receipt aggregators streamlines expense tracking by automatically organizing purchase data from multiple vendors into a centralized platform. This method reduces paper clutter and enhances financial accuracy, unlike traditional receipts that require manual entry and risk being lost or damaged.

OCR-Powered Spend Tracking

Traditional receipts often get lost or damaged, making expense tracking tedious and error-prone, whereas e-receipt aggregators use OCR-powered spend tracking to automatically capture and categorize purchases, enhancing accuracy and efficiency in money management. By converting receipt data into searchable digital records, OCR technology streamlines budget monitoring and financial reporting for individuals and businesses alike.

E-Receipt Wallet

E-Receipt Wallet centralizes all traditional and digital receipts in one secure, searchable platform, simplifying expense tracking and reducing paper clutter. Integrating with bank accounts and credit cards, it automates expense categorization, enhancing budgeting accuracy and saving valuable time for users.

Transaction Parsing Automation

E-receipt aggregators enhance money management by automating transaction parsing, enabling faster categorization and analysis of expenses compared to traditional receipts that require manual entry. Automated extraction of transaction details from digital receipts reduces errors and improves accuracy in budgeting and financial tracking.

Receipt Data Normalization

Traditional receipts often contain inconsistent formats and unstructured data, complicating expense tracking and analysis, whereas e-receipt aggregators leverage automated receipt data normalization to standardize information such as vendor name, date, and amount, enabling precise categorization and seamless integration with budgeting software. This normalization process reduces manual entry errors, streamlines financial reporting, and enhances real-time visibility into spending patterns across multiple vendors and platforms.

Real-Time Expense Sync

E-receipt aggregators enable real-time expense sync by automatically capturing and categorizing purchases, eliminating manual entry errors common with traditional receipts. This instant data integration improves cash flow visibility and streamlines budget tracking for more effective money management.

API-Based Receipt Integration

API-based receipt integration enables seamless aggregation of traditional paper receipts into digital platforms, enhancing accuracy and real-time visibility in money management. E-receipt aggregators streamline expense tracking by automatically capturing purchase data, reducing manual entry errors and improving financial analytics.

Smart Receipt Tagging

Smart receipt tagging in e-receipt aggregators automatically categorizes expenses with high accuracy using OCR and AI technologies, enhancing expense tracking and budgeting efficiency compared to manual sorting of traditional receipts. This technology enables real-time data extraction and seamless integration with financial management apps, reducing errors and saving time for users.

Blockchain-Verified Receipt

Blockchain-verified receipts offer unmatched security and transparency compared to traditional paper receipts, enabling accurate and tamper-proof expense tracking. E-receipt aggregators leveraging blockchain technology streamline money management by automatically organizing and verifying transactions, reducing errors and fraud risks.

Cross-Platform Expense Aggregator

Cross-platform expense aggregators streamline money management by consolidating traditional receipts and e-receipts from various sources into a single, organized digital platform, enhancing accuracy and real-time tracking. These tools reduce manual entry errors and provide comprehensive spending insights across devices, optimizing financial oversight and budgeting efficiency.

Traditional receipts vs E-receipt aggregators for money management. Infographic

moneydiff.com

moneydiff.com