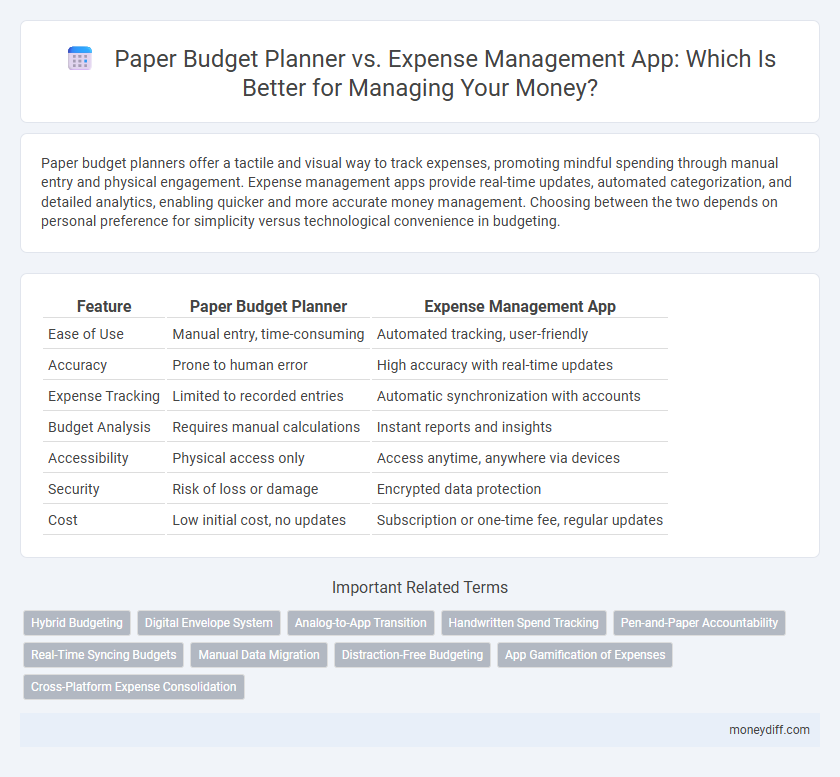

Paper budget planners offer a tactile and visual way to track expenses, promoting mindful spending through manual entry and physical engagement. Expense management apps provide real-time updates, automated categorization, and detailed analytics, enabling quicker and more accurate money management. Choosing between the two depends on personal preference for simplicity versus technological convenience in budgeting.

Table of Comparison

| Feature | Paper Budget Planner | Expense Management App |

|---|---|---|

| Ease of Use | Manual entry, time-consuming | Automated tracking, user-friendly |

| Accuracy | Prone to human error | High accuracy with real-time updates |

| Expense Tracking | Limited to recorded entries | Automatic synchronization with accounts |

| Budget Analysis | Requires manual calculations | Instant reports and insights |

| Accessibility | Physical access only | Access anytime, anywhere via devices |

| Security | Risk of loss or damage | Encrypted data protection |

| Cost | Low initial cost, no updates | Subscription or one-time fee, regular updates |

Introduction to Paper Budget Planners and Expense Management Apps

Paper budget planners offer a tactile, analog approach to tracking income and expenses, often featuring customizable templates that help users visually organize monthly budgets and savings goals. Expense management apps leverage digital technology to automate transaction tracking, provide real-time spending insights, and sync across multiple devices for enhanced accessibility. Both tools serve distinct needs in personal finance management, with paper planners favoring manual input and reflection, while apps emphasize efficiency and detailed analytics.

Key Features of Paper Budget Planners

Paper budget planners offer tangible tracking of expenses, allowing users to physically write down income and expenditures for clear visibility. Key features include monthly budgeting templates, categorized expense sections, and space for financial goal setting, which enhance manual tracking and personalization. These planners promote mindful spending habits by encouraging daily entries and immediate reflection on financial decisions.

Key Features of Expense Management Apps

Expense management apps offer real-time transaction tracking, automated expense categorization, and integrated budgeting tools that enhance financial control compared to traditional paper budget planners. Features such as receipt scanning, bill reminders, and multi-account synchronization provide seamless management of personal finances on mobile devices. Advanced analytics and customizable reports enable users to identify spending patterns and optimize savings strategies effectively.

Comparing Usability: Paper vs. Digital Tools

Paper budget planners offer tactile engagement and simplicity, making expense tracking straightforward for users who prefer physical records and minimal distractions. Expense management apps provide automated features, real-time updates, and integration with bank accounts, enhancing efficiency for users seeking detailed analysis and mobile access. Usability comparison highlights that paper planners excel in intuitive, offline use, while digital tools deliver scalability and advanced financial insights.

Accuracy and Error Reduction in Tracking Expenses

Expense management apps significantly enhance accuracy and reduce errors in tracking expenses by automatically categorizing transactions and providing real-time updates. Paper budget planners rely on manual entry, which increases the risk of miscalculations and overlooked expenses, leading to inaccuracies. Digital tools use algorithms to detect anomalies and duplicate entries, ensuring more precise financial records and effective money management.

Accessibility and Convenience: On-the-Go Budgeting

Expense management apps offer superior accessibility and convenience for on-the-go budgeting compared to paper budget planners. Mobile apps provide real-time transaction tracking, instant budget updates, and cloud synchronization, enabling users to manage finances anytime and anywhere. In contrast, paper planners require manual entry and physical presence, limiting flexibility and timely financial adjustments.

Customization and Personalization Options

Paper budget planners offer limited customization, mostly relying on manual entries and fixed categories, which can restrict personalized financial tracking. Expense management apps provide advanced personalization options, including customizable budget categories, real-time spending alerts, and tailored financial insights based on user behavior. These apps leverage data analytics to adapt to individual spending patterns, enhancing precision in money management.

Security and Privacy Concerns

Expense management apps offer advanced encryption protocols and biometric authentication to enhance security, minimizing the risk of unauthorized access compared to paper budget planners. Paper planners, while offline and immune to digital hacking, are vulnerable to physical theft, loss, or damage, posing significant privacy concerns. Users prioritizing data confidentiality should evaluate app providers' privacy policies and compliance with regulations like GDPR to ensure robust protection of their financial information.

Cost Considerations: Free vs. Paid Solutions

Paper budget planners offer a low-cost, often one-time purchase option with no ongoing fees, making them attractive for users seeking a simple budgeting tool without subscription costs. Expense management apps may require monthly or annual fees but provide advanced features such as real-time tracking, automated expense categorization, and financial insights that justify the higher price for frequent users. Evaluating total cost of ownership, including hidden fees and feature value, is crucial when choosing between free or paid money management solutions.

Which Money Management Tool Suits Your Lifestyle?

Paper budget planners offer tactile control and simplicity, ideal for those who prefer handwritten tracking and offline accessibility, enhancing focus through manual entry. Expense management apps provide real-time synchronization, automated categorization, and customizable alerts, perfect for tech-savvy users seeking convenience and data-driven insights. Choosing between these tools depends on your preference for physical interaction versus digital efficiency and the level of automation that fits your daily money management routine.

Related Important Terms

Hybrid Budgeting

Hybrid budgeting combines the tactile control of a paper budget planner with the real-time tracking and analytics of an expense management app, offering a comprehensive approach to money management. This method leverages manual entry for intentional spending decisions while utilizing digital tools for automated expense categorization and financial insights, enhancing accuracy and budgeting efficiency.

Digital Envelope System

The Digital Envelope System in expense management apps offers real-time tracking and automatic categorization of spending, enhancing budget accuracy and control beyond traditional paper budget planners. These apps provide seamless syncing with bank accounts and customizable alerts, making money management more efficient and accessible.

Analog-to-App Transition

Transitioning from paper budget planners to expense management apps enhances real-time tracking and categorization of finances, leveraging digital tools like AI-driven insights and automatic bank synchronization. This shift streamlines budget monitoring, reduces manual errors, and provides interactive dashboards for comprehensive money management.

Handwritten Spend Tracking

Handwritten spend tracking in a paper budget planner provides tactile engagement and personalization, enhancing memory retention and awareness of expenses. Expense management apps leverage automated categorization and real-time updates, offering greater accuracy and convenience but may lack the intuitive insight gained through manual entry.

Pen-and-Paper Accountability

A paper budget planner offers tangible pen-and-paper accountability, allowing users to physically write down and review expenses, which can enhance mindfulness and commitment to financial goals. In contrast, expense management apps automate tracking but may reduce the personal connection and focus that manual entry fosters in managing money effectively.

Real-Time Syncing Budgets

Paper budget planners lack real-time syncing, causing delays in updating expenses and income, which can lead to inaccurate budget tracking. Expense management apps offer instant synchronization across devices, providing up-to-date financial data and enabling more precise and timely money management decisions.

Manual Data Migration

Manual data migration from a paper budget planner to an expense management app often involves time-consuming entry errors and difficulty in tracking historical spending accurately. Expense management apps streamline this process by automatically categorizing transactions and syncing data in real-time, reducing human error and improving financial oversight.

Distraction-Free Budgeting

Paper budget planners offer distraction-free budgeting by eliminating digital notifications and app distractions, allowing users to focus solely on their financial goals. Expense management apps provide real-time tracking and automation but may introduce interruptions from alerts, potentially affecting concentration during money management.

App Gamification of Expenses

Expense management apps use gamification techniques such as rewards, challenges, and progress tracking to motivate users and improve financial habits, making money management more engaging than traditional paper budget planners. These apps leverage real-time data and interactive features to provide personalized insights and instant feedback, driving better budgeting discipline and expense control.

Cross-Platform Expense Consolidation

Expense management apps provide seamless cross-platform expense consolidation by automatically syncing transactions across devices and accounts, offering real-time updates and detailed analytics. In contrast, paper budget planners require manual entry and lack integration capabilities, making it challenging to maintain consistent and comprehensive financial records across multiple platforms.

Paper budget planner vs Expense management app for money management. Infographic

moneydiff.com

moneydiff.com