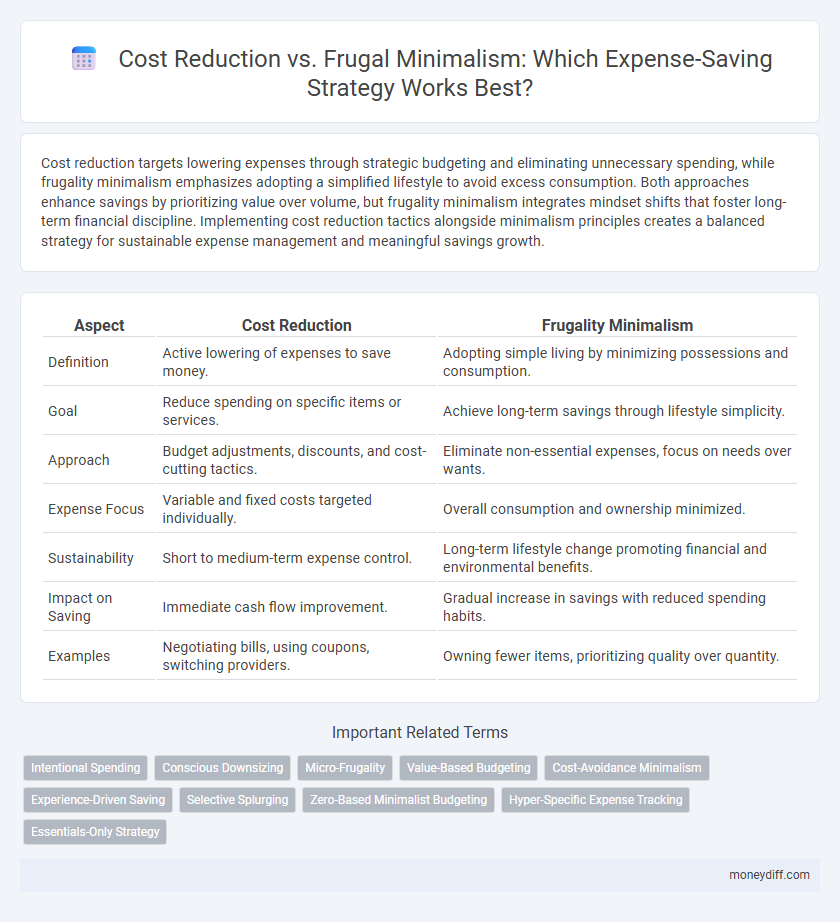

Cost reduction targets lowering expenses through strategic budgeting and eliminating unnecessary spending, while frugality minimalism emphasizes adopting a simplified lifestyle to avoid excess consumption. Both approaches enhance savings by prioritizing value over volume, but frugality minimalism integrates mindset shifts that foster long-term financial discipline. Implementing cost reduction tactics alongside minimalism principles creates a balanced strategy for sustainable expense management and meaningful savings growth.

Table of Comparison

| Aspect | Cost Reduction | Frugality Minimalism |

|---|---|---|

| Definition | Active lowering of expenses to save money. | Adopting simple living by minimizing possessions and consumption. |

| Goal | Reduce spending on specific items or services. | Achieve long-term savings through lifestyle simplicity. |

| Approach | Budget adjustments, discounts, and cost-cutting tactics. | Eliminate non-essential expenses, focus on needs over wants. |

| Expense Focus | Variable and fixed costs targeted individually. | Overall consumption and ownership minimized. |

| Sustainability | Short to medium-term expense control. | Long-term lifestyle change promoting financial and environmental benefits. |

| Impact on Saving | Immediate cash flow improvement. | Gradual increase in savings with reduced spending habits. |

| Examples | Negotiating bills, using coupons, switching providers. | Owning fewer items, prioritizing quality over quantity. |

Understanding Cost Reduction and Frugality Minimalism

Cost reduction emphasizes systematic analysis and elimination of unnecessary expenses to improve profitability, while frugality minimalism centers on adopting a lifestyle that limits spending to essential needs, fostering sustainable saving habits. Cost reduction strategies often involve strategic purchasing, process optimization, and negotiation to decrease operational costs. Frugality minimalism promotes mindful consumption and intentional simplicity, reducing financial stress and encouraging long-term financial health.

Key Differences Between Cost Reduction and Frugality

Cost reduction focuses on systematically lowering expenses through strategic budgeting, supplier negotiations, and process efficiencies, targeting specific areas to improve overall financial performance. Frugality minimalism emphasizes intentional lifestyle choices that reduce consumption and prioritize essential needs, fostering sustainable saving habits through simplicity. Key differences lie in cost reduction's tactical approach to cutting costs versus frugality's mindset-driven emphasis on minimizing excess and valuing simplicity.

The Psychological Impact of Spending Less

Cost reduction strategies focus on cutting expenses efficiently without sacrificing quality, whereas frugality and minimalism emphasize conscious spending aligned with personal values. The psychological impact of spending less includes increased financial control, reduced stress, and enhanced satisfaction from mindful consumption. Adopting minimalism fosters a mindset shift that prioritizes long-term well-being over immediate gratification.

Core Principles of Frugality Minimalism

Frugality minimalism centers on intentional living by prioritizing essential expenditures and eliminating non-essential spending to achieve long-term financial sustainability. Core principles include mindful consumption, valuing quality over quantity, and fostering contentment with fewer possessions, which reduces wasteful expenses and promotes efficient resource allocation. This approach contrasts with cost reduction, which often targets immediate savings through cutting expenses without addressing the underlying habits influencing spending behavior.

Effective Cost Reduction Techniques for Everyday Expenses

Effective cost reduction techniques for everyday expenses include budgeting with detailed tracking of variable and fixed costs to identify savings opportunities. Utilizing bulk purchasing, comparison shopping, and leveraging discounts or coupons can significantly decrease grocery and household costs. Adopting energy-efficient practices and minimizing unnecessary subscriptions further enhance financial savings without compromising lifestyle quality.

How Minimalism Encourages Mindful Spending

Minimalism promotes mindful spending by encouraging individuals to prioritize essential purchases and avoid impulsive buying, leading to intentional allocation of financial resources. Unlike cost reduction strategies that focus on cutting expenses, minimalism fosters a lifestyle centered on value and purpose, thereby reducing unnecessary consumption. This approach not only helps in saving money but also cultivates long-term financial well-being through conscious decision-making.

Pros and Cons: Cost Reduction vs. Frugality Minimalism

Cost reduction focuses on lowering expenses by eliminating unnecessary costs without significantly altering lifestyle, offering measurable financial savings but sometimes leading to diminished comfort or convenience. Frugality minimalism emphasizes intentional living with fewer possessions and mindful consumption, promoting long-term sustainability and mental clarity though it may require a substantial mindset shift and initial adjustment period. Both strategies enhance savings but differ in approach: cost reduction targets immediate financial impact while frugality minimalism fosters ongoing value alignment and reduced financial dependency.

Choosing the Right Saving Strategy for Your Lifestyle

Cost reduction focuses on systematically lowering expenses without sacrificing quality, making it ideal for those with fixed incomes or essential spending needs. Frugality minimalism emphasizes intentional living by eliminating non-essential purchases, appealing to individuals seeking simplicity and long-term sustainability. Selecting the right saving strategy depends on personal financial goals, lifestyle preferences, and the balance between necessity and discretionary spending.

Real-Life Examples of Cost Reduction and Minimalism

Cost reduction strategies often involve analyzing expenses to identify unnecessary spending, such as companies optimizing supply chains to lower production costs by 15%, while frugality minimalism centers on lifestyle changes like adopting capsule wardrobes or decluttering homes to save monthly budgets significantly. Real-life examples include households reducing utility bills by switching to energy-efficient appliances, showcasing cost reduction, whereas minimalist advocates save money by limiting purchases to essential items only, reducing consumption by up to 40%. Both approaches contribute to financial health, but cost reduction emphasizes systematic spending cuts, and frugality minimalism promotes sustainable, mindful consumption habits.

Actionable Steps to Implement Your Chosen Saving Strategy

Evaluate monthly expenses to identify non-essential costs, then prioritize cutting or eliminating these items for effective cost reduction. Implement frugality by adopting minimalism principles such as decluttering possessions, reducing utility usage, and choosing multipurpose products. Track progress through budgeting apps and adjust spending habits regularly to sustain long-term savings goals.

Related Important Terms

Intentional Spending

Cost reduction targets specific expenses to maximize savings without compromising quality, while frugality minimalism emphasizes intentional spending by prioritizing essential needs to avoid unnecessary purchases. Adopting intentional spending habits enhances financial discipline, promoting long-term sustainability and mindful resource allocation.

Conscious Downsizing

Conscious downsizing as a saving strategy prioritizes intentional reduction of expenses by evaluating actual needs rather than mere cost cutting or frugality minimalism. This method emphasizes sustainable financial habits through mindful spending choices that align with long-term goals, resulting in effective and enduring expense management.

Micro-Frugality

Micro-frugality emphasizes small, consistent savings in daily expenses to complement broader cost reduction strategies, enhancing overall financial efficiency. This approach targets habitual spending patterns, enabling individuals to achieve sustainable budget improvements without sacrificing essential needs.

Value-Based Budgeting

Cost reduction targets lowering expenses by cutting unnecessary costs without compromising quality, while frugality minimalism emphasizes intentional spending aligned with core values and long-term satisfaction. Value-based budgeting integrates both approaches by prioritizing expenditures that deliver maximum personal or organizational value, ensuring effective savings through mindful allocation rather than mere cost-cutting.

Cost-Avoidance Minimalism

Cost-avoidance minimalism emphasizes proactive elimination of unnecessary expenses by critically assessing value before purchase, leading to sustainable long-term savings beyond simple cost reduction. This strategy prioritizes mindful consumption and strategic spending habits, effectively minimizing financial waste while fostering intentional resource allocation.

Experience-Driven Saving

Experience-driven saving prioritizes meaningful activities and quality moments over sacrificing essentials, aligning with frugality minimalism's focus on intentional spending rather than arbitrary cost reduction. This strategy enhances well-being by reallocating expenses towards valuable experiences, fostering long-term satisfaction without compromising financial goals.

Selective Splurging

Selective splurging balances cost reduction and frugality minimalism by strategically allocating funds to high-value experiences or items that enhance quality of life without undermining overall savings goals. This approach optimizes expense management by prioritizing meaningful expenditures while maintaining disciplined budget control.

Zero-Based Minimalist Budgeting

Zero-Based Minimalist Budgeting emphasizes allocating every dollar with intentionality, eliminating unnecessary expenses by scrutinizing each cost from a zero base rather than relying on past budgets, fostering precise cost reduction without sacrificing essential needs. This approach merges cost reduction with frugality minimalism by prioritizing essential spending and avoiding excess, resulting in optimal savings and financial efficiency.

Hyper-Specific Expense Tracking

Hyper-specific expense tracking enables precise identification of unnecessary costs, facilitating targeted cost reduction strategies that go beyond the broad approach of frugality minimalism. By analyzing detailed spending data, organizations can implement efficient budget optimizations without sacrificing essential value or quality.

Essentials-Only Strategy

The Essentials-Only Strategy prioritizes spending strictly on necessities, enhancing cost reduction by eliminating unnecessary expenses without sacrificing quality of life. This approach contrasts with frugality minimalism, which often involves broader lifestyle changes, by focusing sharply on optimizing essential costs to achieve maximum savings efficiency.

Cost Reduction vs Frugality Minimalism for saving strategy. Infographic

moneydiff.com

moneydiff.com