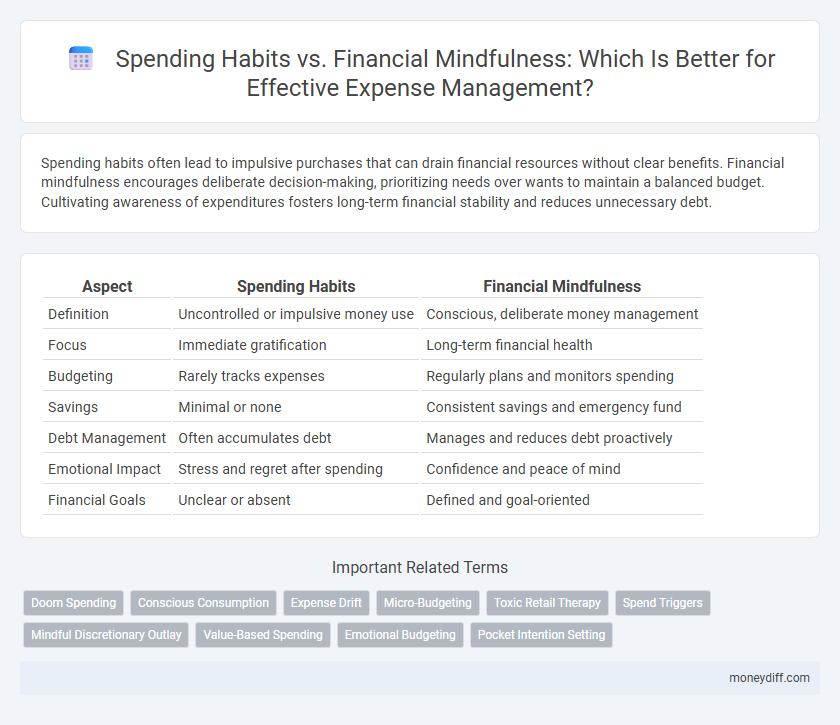

Spending habits often lead to impulsive purchases that can drain financial resources without clear benefits. Financial mindfulness encourages deliberate decision-making, prioritizing needs over wants to maintain a balanced budget. Cultivating awareness of expenditures fosters long-term financial stability and reduces unnecessary debt.

Table of Comparison

| Aspect | Spending Habits | Financial Mindfulness |

|---|---|---|

| Definition | Uncontrolled or impulsive money use | Conscious, deliberate money management |

| Focus | Immediate gratification | Long-term financial health |

| Budgeting | Rarely tracks expenses | Regularly plans and monitors spending |

| Savings | Minimal or none | Consistent savings and emergency fund |

| Debt Management | Often accumulates debt | Manages and reduces debt proactively |

| Emotional Impact | Stress and regret after spending | Confidence and peace of mind |

| Financial Goals | Unclear or absent | Defined and goal-oriented |

Understanding Spending Habits: The Foundation of Money Management

Understanding spending habits is essential for effective money management, as it reveals patterns that influence financial stability and goals achievement. Analyzing expenses like discretionary spending, impulse purchases, and recurring bills helps identify areas for adjustment and improved budgeting. Developing financial mindfulness encourages deliberate decisions, reducing overspending and promoting savings growth.

What Is Financial Mindfulness?

Financial mindfulness involves a conscious awareness of spending habits and intentional control over financial decisions to align with long-term goals. Unlike impulsive spending, it emphasizes deliberate budgeting, tracking expenses, and reflecting on the emotional triggers behind purchases. Integrating financial mindfulness leads to improved money management, reduced unnecessary expenses, and greater financial stability.

The Psychological Triggers Behind Spending

Impulsive spending often stems from psychological triggers such as emotional stress, social influence, and the dopamine release associated with purchasing, which can undermine financial mindfulness. Understanding these cognitive biases is crucial for cultivating mindful money management practices that prioritize long-term financial goals over immediate gratification. Developing awareness of spending triggers enables individuals to implement strategies like budgeting and delayed gratification to improve overall monetary control.

Comparing Impulsive Spending and Mindful Spending

Impulsive spending often leads to unplanned purchases that disrupt budgeting and increase financial stress, while mindful spending encourages deliberate decisions aligned with long-term financial goals. Individuals practicing financial mindfulness assess needs versus wants, prioritize essential expenses, and track their cash flow to avoid debt accumulation. Studies reveal that mindful spending habits improve savings rates and promote financial stability compared to impulsive buying behaviors.

Building Awareness: Track Every Expense

Building awareness through tracking every expense enhances financial mindfulness by revealing true spending habits and identifying unnecessary costs. Detailed expense records empower better budgeting decisions and promote intentional money management. This practice fosters greater control over finances and helps prevent impulsive purchases that undermine savings goals.

Emotional Spending vs Rational Decision-Making

Emotional spending often leads to impulsive purchases driven by feelings rather than needs, negatively impacting long-term financial stability. Rational decision-making in money management prioritizes intentional budgeting and prioritizing expenses based on goals and necessities. Developing financial mindfulness helps individuals recognize emotional triggers, enabling more controlled and strategic spending habits that support wealth building.

How Financial Mindfulness Reduces Unnecessary Expenses

Financial mindfulness promotes intentional spending by encouraging individuals to evaluate the necessity and value of each purchase, effectively reducing impulsive and unnecessary expenses. Tracking expenses and setting clear financial goals enhances awareness of spending patterns, allowing for better budget adherence and resource allocation. This disciplined approach minimizes wasteful consumption, leading to improved savings and overall financial health.

Practical Strategies to Shift from Habits to Mindfulness

Tracking daily expenses and setting intentional spending goals help break automatic spending habits and foster financial mindfulness. Utilizing budgeting apps that send real-time alerts encourages conscious decision-making and reduces impulsive purchases. Practicing delayed gratification through waiting periods before major purchases strengthens awareness of true needs versus habitual wants.

Long-Term Benefits of Mindful Money Management

Mindful money management fosters long-term financial stability by encouraging intentional spending habits that prioritize savings and essential expenses over impulsive purchases. This disciplined approach reduces debt accumulation and builds wealth through consistent budgeting and investment planning. Over time, financial mindfulness enhances economic resilience, enabling individuals to achieve goals like retirement security and emergency fund readiness.

Creating a Personal Action Plan: Bridging Habits and Mindfulness

Developing a personal action plan bridges spending habits and financial mindfulness by identifying patterns and setting clear budgeting goals to control expenses. Prioritizing mindful decision-making during purchases helps reduce impulsive spending and increases awareness of long-term financial impacts. Tracking expenses regularly and adjusting strategies accordingly ensures continuous alignment with financial objectives and sustainable money management.

Related Important Terms

Doom Spending

Doom spending, a pattern where individuals compulsively spend to cope with negative emotions, disrupts financial mindfulness and undermines effective money management. Cultivating awareness of emotional triggers and adopting intentional spending habits enhances control over finances and reduces impulsive, detrimental expenses.

Conscious Consumption

Conscious consumption prioritizes intentional spending habits over impulsive purchases, helping individuals align expenses with financial goals and values. This approach enhances money management by promoting awareness of expenditures, reducing unnecessary costs, and fostering sustainable financial well-being.

Expense Drift

Expense drift occurs when small, unplanned spending increases steadily over time, undermining financial mindfulness and leading to budget overruns. Monitoring spending habits closely helps identify and control expense drift, ensuring more disciplined money management and long-term financial stability.

Micro-Budgeting

Micro-budgeting enhances financial mindfulness by tracking every small expense, enabling more intentional spending habits and preventing impulsive purchases. This precise approach to budget management promotes awareness of spending patterns, fostering long-term financial stability and better control over discretionary expenses.

Toxic Retail Therapy

Toxic retail therapy, characterized by impulsive spending to cope with negative emotions, undermines financial mindfulness and long-term money management goals. Developing conscious spending habits involves recognizing emotional triggers and prioritizing purposeful purchases to enhance financial stability and reduce debt.

Spend Triggers

Spending habits often stem from emotional spend triggers like stress, boredom, or social pressure, leading to impulsive purchases that undermine financial goals. Cultivating financial mindfulness involves recognizing these triggers, enabling deliberate spending decisions that promote long-term money management and budget adherence.

Mindful Discretionary Outlay

Mindful discretionary outlay emphasizes intentional spending by distinguishing essential expenses from impulsive purchases, promoting financial stability and long-term goal achievement. Adopting this approach reduces unnecessary costs and enhances budgeting accuracy, fostering greater control over personal finances.

Value-Based Spending

Value-based spending prioritizes aligning expenses with personal values and long-term financial goals, promoting mindful decision-making over impulsive purchases. This approach fosters financial mindfulness by encouraging deliberate allocation of funds toward meaningful experiences and essential needs, improving overall money management.

Emotional Budgeting

Emotional budgeting integrates spending habits with financial mindfulness by recognizing and managing the emotional triggers that influence purchases, leading to more intentional money management. Tracking emotional responses during spending helps reduce impulsive expenses and strengthens long-term financial goals.

Pocket Intention Setting

Setting pocket intentions enhances financial mindfulness by aligning daily spending habits with clear monetary goals, reducing impulsive purchases and promoting budget adherence. Prioritizing intentional expenditures supports effective money management, leading to improved savings and controlled discretionary spending.

Spending habits vs Financial mindfulness for money management. Infographic

moneydiff.com

moneydiff.com