Spending categories group similar expenses based on purpose, such as groceries, utilities, and entertainment, enabling detailed tracking and budget planning. Expense buckets, on the other hand, are broader groupings that consolidate multiple spending categories to simplify overall financial management and highlight major areas of expenditure. Using both methods enhances clarity in expense organization, supporting effective budgeting and financial analysis.

Table of Comparison

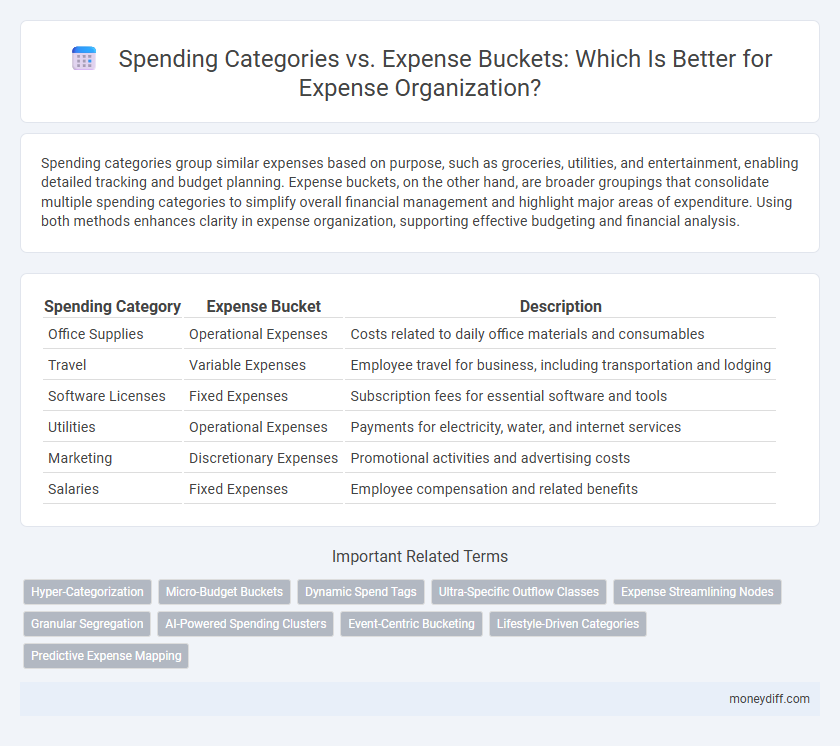

| Spending Category | Expense Bucket | Description |

|---|---|---|

| Office Supplies | Operational Expenses | Costs related to daily office materials and consumables |

| Travel | Variable Expenses | Employee travel for business, including transportation and lodging |

| Software Licenses | Fixed Expenses | Subscription fees for essential software and tools |

| Utilities | Operational Expenses | Payments for electricity, water, and internet services |

| Marketing | Discretionary Expenses | Promotional activities and advertising costs |

| Salaries | Fixed Expenses | Employee compensation and related benefits |

Understanding Spending Categories and Expense Buckets

Spending categories classify expenses based on types such as utilities, payroll, or marketing to provide a high-level overview of where money is allocated. Expense buckets, on the other hand, offer a more granular segmentation within these categories, enabling detailed tracking and analysis of individual cost components. Understanding the distinction between spending categories and expense buckets helps organizations optimize budgeting, improve financial reporting accuracy, and identify cost-saving opportunities.

Core Differences Between Spending Categories and Expense Buckets

Spending categories are broad classifications used to organize expenses by type, such as travel, office supplies, or marketing, providing a high-level overview of where money is allocated. Expense buckets are more granular groupings within these categories, designed to track specific costs with greater detail and accuracy, facilitating precise budget management and reporting. The core difference lies in the level of detail: spending categories group expenses broadly for strategic analysis, while expense buckets break down costs for operational control and tracking.

Importance of Expense Structure in Organizations

Effective expense structure in organizations hinges on clearly defined spending categories and expense buckets, which streamline budget allocation and financial analysis. Spending categories group similar expenses for strategic oversight, while expense buckets enable detailed tracking and control of costs, enhancing transparency and accountability. This structured approach facilitates accurate forecasting, regulatory compliance, and informed decision-making critical for organizational financial health.

Advantages of Using Spending Categories

Spending categories provide a structured framework for organizing expenses, enabling precise tracking and analysis of financial outflows within an organization. They enhance budgeting accuracy by grouping related costs, which facilitates easier identification of cost-saving opportunities and more informed decision-making. Leveraging spending categories also improves reporting clarity, allowing stakeholders to quickly assess financial performance and allocate resources efficiently.

Benefits of Implementing Expense Buckets

Implementing expense buckets enables organizations to categorize spending with greater precision and consistency compared to traditional spending categories, improving budget tracking and financial analysis. Expense buckets facilitate streamlined reporting by grouping similar expenses, enhancing visibility into cost drivers and enabling more effective cost control measures. This structured approach supports better resource allocation and strategic decision-making, ultimately boosting operational efficiency and financial accountability.

Examples of Common Organizational Expense Buckets

Organizational expense buckets typically include categories such as payroll, office supplies, marketing, travel, and utilities, which help track and allocate expenditures efficiently. Spending categories often align with these buckets but focus more specifically on subcategories like employee salaries, printer ink, online advertising, airfare, and electricity bills. Clear differentiation between these expense buckets and detailed spending categories ensures precise budgeting and financial analysis within companies.

How to Align Spending Categories with Business Goals

Align spending categories with business goals by categorizing expenses based on strategic priorities such as marketing, operations, and product development. Utilize expense buckets that reflect key performance indicators to track budget allocation and optimize resource distribution effectively. Regularly analyze spending data within these buckets to ensure alignment with organizational objectives and improve financial decision-making.

Streamlining Financial Reporting with Expense Buckets

Expense buckets enable organizations to streamline financial reporting by consolidating spending categories into broader, manageable groups that enhance clarity and accuracy. Utilizing expense buckets reduces complexity, improves budget tracking, and facilitates more effective analysis of cost patterns across departments. Implementing well-defined expense buckets supports strategic decision-making by providing a clear overview of organizational expenditures.

Challenges in Managing Spending Categories and Buckets

Managing spending categories and expense buckets presents challenges such as overlapping classifications that complicate accurate tracking and reporting. Inconsistent definitions across departments lead to misallocation of funds and hinder budget adherence. Organizations often struggle with integrating diverse financial systems, causing delayed reconciliation and reduced visibility into spending patterns.

Best Practices for Optimizing Organizational Expense Management

Defining clear spending categories aligned with specific expense buckets enables organizations to track and analyze financial data more effectively, improving budget accuracy and resource allocation. Implementing granular expense buckets, such as travel, supplies, and utilities, supports detailed reporting and helps identify cost-saving opportunities. Consistent categorization combined with regular review fosters transparency, accountability, and streamlined expense management across departments.

Related Important Terms

Hyper-Categorization

Spending categories define broad groups such as travel, office supplies, or software subscriptions, while expense buckets involve more granular segmentation within these categories to enhance financial tracking and reporting. Hyper-categorization enables organizations to precisely allocate costs, optimize budget controls, and identify spending patterns by breaking down expenses into highly specific subcategories.

Micro-Budget Buckets

Spending categories classify expenses by broad types such as travel, utilities, and office supplies, while expense buckets break down these categories into micro-budget buckets for precise tracking and control. Implementing micro-budget buckets enables organizations to allocate funds granularly, monitor small-scale expenditures, and optimize cash flow management effectively.

Dynamic Spend Tags

Dynamic Spend Tags enhance organizational expense management by providing flexible, real-time categorization that goes beyond traditional Spending categories and Expense buckets. These tags enable granular tracking and analysis, allowing companies to adapt quickly to changing financial patterns and optimize budget allocations effectively.

Ultra-Specific Outflow Classes

Spending categories and expense buckets represent ultra-specific outflow classes that help organizations precisely classify financial transactions for better budgeting and reporting accuracy. Utilizing granular expense buckets enables detailed tracking and analysis of costs within broader spending categories, enhancing financial control and strategic decision-making.

Expense Streamlining Nodes

Spending categories organize expenses by type, such as marketing or utilities, while expense buckets group costs based on purpose or project alignment, enhancing budget tracking accuracy. Expense streamlining nodes integrate these classifications to optimize financial workflows, reduce redundancies, and improve reporting precision for organizational efficiency.

Granular Segregation

Spending categories enable organizations to classify expenses by broad functions such as marketing, operations, or payroll, while expense buckets provide granular segregation by breaking down these categories into specific subgroups like digital ads, office supplies, or employee bonuses. This detailed segmentation enhances financial analysis, budgeting accuracy, and expense tracking, leading to more precise cost control and strategic decision-making.

AI-Powered Spending Clusters

AI-powered spending clusters enhance organizational budgeting by automatically categorizing transactions into dynamic spending categories that reflect real-time financial behavior, unlike static expense buckets. This advanced segmentation enables precise tracking, predictive analytics, and optimized resource allocation, driving smarter financial decisions.

Event-Centric Bucketing

Event-centric bucketing prioritizes grouping expenses by specific events or projects, enabling organizations to track spending categories like travel, catering, and marketing more precisely within each event. This approach enhances financial visibility and control by aligning expense buckets directly with event-driven budgets and outcomes.

Lifestyle-Driven Categories

Lifestyle-driven spending categories such as dining, travel, and entertainment provide a granular view of personal habits, whereas expense buckets organize these costs into broader groups like essentials, discretionary, and savings. Prioritizing lifestyle categories helps organizations tailor financial strategies and optimize budget allocation based on consumer behavior and spending patterns.

Predictive Expense Mapping

Spending categories classify expenses by general types such as travel, utilities, and office supplies, while expense buckets group transactions into predefined organizational units to streamline budgeting and reporting. Predictive Expense Mapping leverages machine learning algorithms to analyze historical spending patterns and automatically allocate new expenses to the correct buckets, improving accuracy and efficiency in financial forecasting.

Spending categories vs Expense buckets for organization. Infographic

moneydiff.com

moneydiff.com