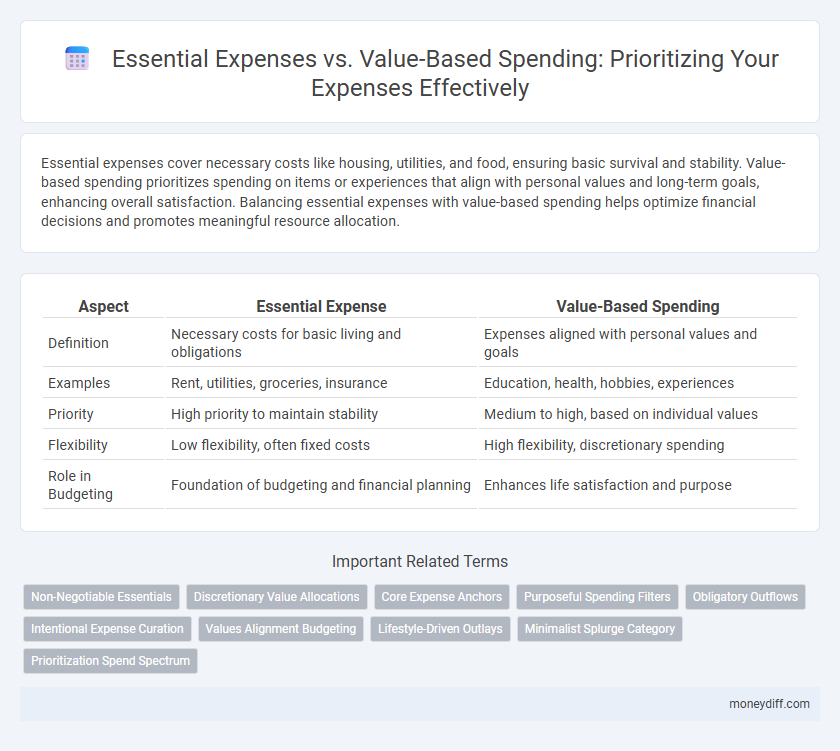

Essential expenses cover necessary costs like housing, utilities, and food, ensuring basic survival and stability. Value-based spending prioritizes spending on items or experiences that align with personal values and long-term goals, enhancing overall satisfaction. Balancing essential expenses with value-based spending helps optimize financial decisions and promotes meaningful resource allocation.

Table of Comparison

| Aspect | Essential Expense | Value-Based Spending |

|---|---|---|

| Definition | Necessary costs for basic living and obligations | Expenses aligned with personal values and goals |

| Examples | Rent, utilities, groceries, insurance | Education, health, hobbies, experiences |

| Priority | High priority to maintain stability | Medium to high, based on individual values |

| Flexibility | Low flexibility, often fixed costs | High flexibility, discretionary spending |

| Role in Budgeting | Foundation of budgeting and financial planning | Enhances life satisfaction and purpose |

Understanding Essential Expenses: The Non-Negotiables

Essential expenses are the foundational non-negotiables in any budget, covering costs like housing, utilities, groceries, and healthcare that must be paid to maintain basic living standards. Prioritizing these unavoidable expenses ensures financial stability before allocating funds toward discretionary or value-based spending categories such as entertainment or personal growth. Clear differentiation between essential costs and flexible spending helps in effective financial planning and avoids debt accumulation by securing critical needs first.

What Is Value-Based Spending?

Value-based spending prioritizes expenses that directly contribute to personal goals and long-term satisfaction rather than merely covering essential, necessary costs. Unlike essential expenses, which include fixed bills like rent and utilities, value-based spending focuses on discretionary purchases that enhance quality of life and align with individual values. This method encourages mindful budgeting by evaluating whether each expense delivers meaningful benefits, improving overall financial well-being and prioritization.

Comparing Essential vs. Value-Based Expenses

Essential expenses encompass necessities such as housing, utilities, and groceries that secure basic living standards, whereas value-based spending targets discretionary costs aligned with personal values and long-term goals like education or experiences. Prioritizing essential expenses ensures financial stability and meets immediate needs, while value-based spending fosters purposeful allocation of surplus funds to enhance life satisfaction. Comparing these categories helps individuals balance fundamental obligations with meaningful investments, optimizing both security and fulfillment in budget management.

Why Prioritization Matters in Money Management

Prioritization in money management ensures essential expenses such as housing, utilities, and food are covered before discretionary spending, preventing financial instability. Value-based spending aligns purchases with personal values and long-term goals, enhancing satisfaction and reducing impulsive buys. This balance promotes overall financial well-being by focusing resources on true necessities and meaningful expenditures.

Identifying Your Personal Values in Spending

Identifying your personal values in spending is crucial for effective prioritization between essential expenses and value-based spending. Essential expenses cover necessities like housing, utilities, and food, while value-based spending aligns with your priorities such as hobbies, education, or health. Understanding which expenses reflect your core values helps allocate your budget more meaningfully, reducing unnecessary costs and enhancing financial satisfaction.

Strategies for Balancing Needs and Values

Essential expenses cover fundamental needs like housing, utilities, and groceries, ensuring financial stability and security. Value-based spending aligns purchases with personal priorities and long-term goals, enhancing satisfaction and purposeful use of funds. Balancing these strategies involves allocating a budget that meets indispensable costs while selectively investing in areas that reflect core values, promoting both practicality and intentional living.

Common Essential Expenses to Always Prioritize

Common essential expenses to always prioritize include housing, utilities, groceries, transportation, and healthcare, as these directly impact daily living and well-being. Value-based spending emphasizes allocating funds toward these necessities before discretionary purchases to ensure financial stability and reduce stress. Prioritizing essential expenses in budgeting helps maintain a secure foundation, allowing for better management of value-based choices and long-term financial goals.

How to Transition from Impulse Buys to Value-Driven Choices

Shifting from impulse buys to value-based spending involves identifying essential expenses that align with long-term financial goals and personal priorities. Prioritize purchases that offer lasting benefits, such as quality investments in health, education, and home essentials, rather than transient gratification. Employ budgeting tools and mindful evaluation techniques to differentiate needs from wants, fostering sustainable financial habits and maximizing overall value.

Tools and Frameworks for Expense Prioritization

Expense prioritization relies on tools and frameworks that distinguish essential expenses from value-based spending to optimize financial allocation. Frameworks like the Eisenhower Matrix and zero-based budgeting facilitate categorizing expenses by necessity and impact, ensuring essential costs are covered before discretionary spending. Digital tools such as budgeting apps and expense trackers integrate these frameworks, offering real-time insights for more strategic financial decision-making.

Building a Sustainable Budget: Integrating Essentials and Values

Essential expenses such as housing, utilities, and groceries form the foundation of a sustainable budget by covering basic needs and ensuring financial stability. Value-based spending prioritizes expenditures that align with personal goals and long-term well-being, like education, health, and experiences that enhance quality of life. Integrating essential expenses with value-driven choices creates a balanced budget that supports both immediate necessities and meaningful growth, fostering financial resilience and purposeful living.

Related Important Terms

Non-Negotiable Essentials

Non-negotiable essentials such as housing, utilities, and basic food are critical expenses that form the foundation of any budget, ensuring financial stability before allocating funds to value-based spending like discretionary purchases or entertainment. Prioritizing these essential expenses minimizes financial risk and supports long-term well-being by covering fundamental needs first.

Discretionary Value Allocations

Discretionary value allocations prioritize spending on non-essential expenses that enhance quality of life, emphasizing purchases aligned with personal values and long-term satisfaction rather than immediate necessity. This approach contrasts essential expenses by allocating resources strategically towards experiences or items that yield meaningful benefits, optimizing financial well-being through intentional value-based spending.

Core Expense Anchors

Core Expense Anchors focus on essential expenses such as housing, utilities, and food, ensuring financial stability before allocating funds to discretionary categories. Value-based spending prioritizes expenditures aligned with personal values and long-term goals, optimizing budgets by balancing necessity and meaningful investments.

Purposeful Spending Filters

Essential expenses cover fundamental needs like housing, utilities, and groceries, ensuring financial stability and security. Value-based spending prioritizes expenditures aligned with personal goals and values, promoting purposeful spending filters that optimize resource allocation for long-term satisfaction.

Obligatory Outflows

Obligatory outflows refer to essential expenses that must be prioritized to maintain financial stability, including rent, utilities, and loan payments. Value-based spending, on the other hand, allocates funds to expenditures aligned with personal values, enhancing quality of life beyond mandatory financial commitments.

Intentional Expense Curation

Essential expenses cover critical needs such as housing, utilities, and food, forming the foundation of intentional expense curation by ensuring financial stability. Value-based spending prioritizes purchases aligned with personal values and goals, enhancing overall satisfaction and promoting mindful financial decision-making.

Values Alignment Budgeting

Essential expenses cover vital needs like housing, food, and healthcare, ensuring financial stability, while value-based spending prioritizes purchases aligned with personal values and long-term goals to enhance life satisfaction. Values alignment budgeting integrates both approaches by allocating funds first to essential costs and then directing discretionary income toward meaningful experiences and investments that reflect individual priorities.

Lifestyle-Driven Outlays

Lifestyle-driven outlays often blur the line between essential expenses and value-based spending, making it crucial to evaluate expenditures based on their long-term benefits and personal satisfaction rather than immediate necessity. Prioritizing value-based spending encourages mindful allocation toward experiences and items that enhance well-being and align with individual values, unlike essential expenses which primarily cover basic needs and obligations.

Minimalist Splurge Category

Minimalist splurge category prioritizes value-based spending by allocating funds to essential experiences or items that enhance well-being without excess, ensuring expenses align with personal values rather than mere necessity. This approach optimizes budget allocation by distinguishing essential expenses from discretionary splurges that provide meaningful satisfaction and long-term happiness.

Prioritization Spend Spectrum

Essential expenses cover basic needs like housing, utilities, and food, forming the lower end of the prioritization spend spectrum with fixed, unavoidable costs. Value-based spending occupies the higher end, focusing on discretionary purchases that align with personal values and long-term goals, optimizing financial well-being and satisfaction.

Essential Expense vs Value-Based Spending for prioritization. Infographic

moneydiff.com

moneydiff.com