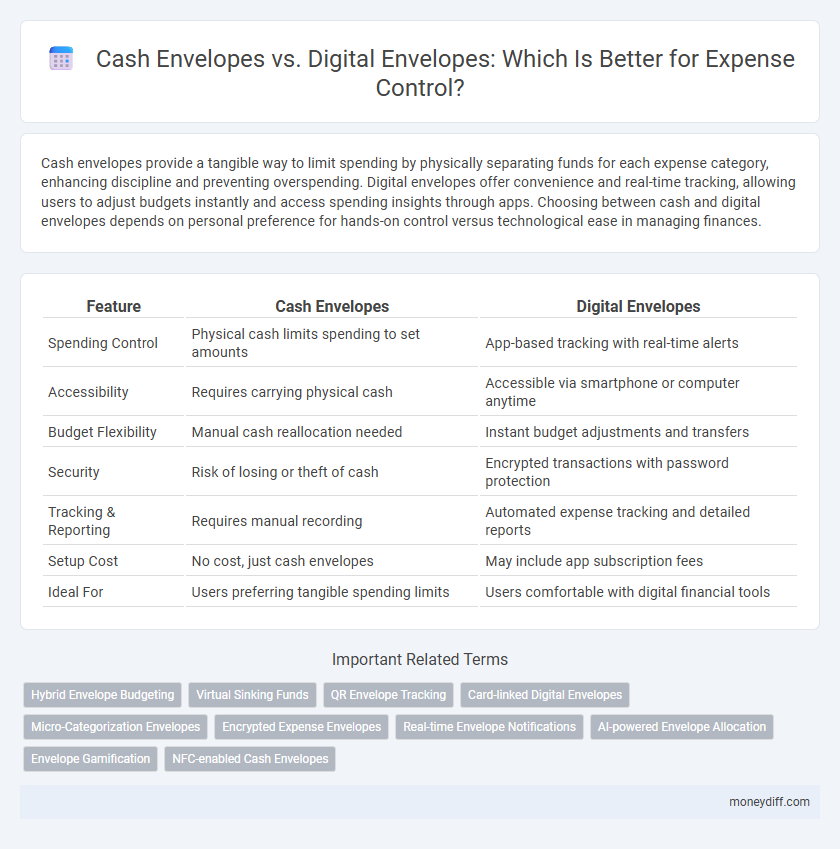

Cash envelopes provide a tangible way to limit spending by physically separating funds for each expense category, enhancing discipline and preventing overspending. Digital envelopes offer convenience and real-time tracking, allowing users to adjust budgets instantly and access spending insights through apps. Choosing between cash and digital envelopes depends on personal preference for hands-on control versus technological ease in managing finances.

Table of Comparison

| Feature | Cash Envelopes | Digital Envelopes |

|---|---|---|

| Spending Control | Physical cash limits spending to set amounts | App-based tracking with real-time alerts |

| Accessibility | Requires carrying physical cash | Accessible via smartphone or computer anytime |

| Budget Flexibility | Manual cash reallocation needed | Instant budget adjustments and transfers |

| Security | Risk of losing or theft of cash | Encrypted transactions with password protection |

| Tracking & Reporting | Requires manual recording | Automated expense tracking and detailed reports |

| Setup Cost | No cost, just cash envelopes | May include app subscription fees |

| Ideal For | Users preferring tangible spending limits | Users comfortable with digital financial tools |

Understanding Cash Envelopes for Money Management

Cash envelopes are a tangible budgeting system where physical cash is allocated to designated envelopes based on spending categories, enhancing awareness and discipline in money management. This method limits overspending by providing a clear visual cue of available funds, improving control over discretionary expenses. Compared to digital envelopes, cash envelopes instill a stronger psychological connection to spending, encouraging mindful financial decision-making through direct interaction with money.

How Digital Envelopes Work for Expense Tracking

Digital envelopes for expense tracking utilize virtual categories to allocate funds within budgeting apps, allowing real-time monitoring of spending across different areas. Each envelope represents a specific budget limit, and transactions are automatically deducted as expenses are recorded, providing instant feedback on remaining balances. Integration with bank accounts and mobile notifications ensures users maintain control and avoid overspending through timely alerts and data synchronization.

Pros and Cons of Cash Envelope Systems

Cash envelope systems provide tangible budgeting by allocating physical cash to specific spending categories, which helps limit overspending and promotes disciplined financial habits. However, their drawbacks include inconvenience in carrying cash, risk of loss or theft, and lack of integration with digital payment methods. Despite these cons, cash envelopes remain effective for individuals seeking strict spending control without relying on technology.

Benefits and Drawbacks of Digital Envelope Tools

Digital envelope tools offer precise budget tracking through real-time notifications and automated expense categorization, enhancing spending control efficiency. However, reliance on technology may expose users to data security risks and depend on consistent internet access. These tools provide convenient accessibility across devices but lack the tangible enforcement that physical cash envelopes impose, potentially reducing spending discipline.

Security and Risk Factors: Cash vs. Digital Envelopes

Cash envelopes offer enhanced physical control and reduce exposure to digital theft, yet face risks of loss, theft, or damage without recovery mechanisms. Digital envelopes provide encryption, fraud detection, and transaction tracking, significantly mitigating unauthorized access but depend on cybersecurity and data privacy measures. Balancing both methods involves assessing the risk tolerance for physical theft against vulnerabilities within online platforms and digital wallets.

Budget Flexibility: Paper Envelopes vs. Mobile Apps

Cash envelopes offer tangible budget flexibility by limiting spending to physical cash allocated for each category, preventing overspending through strict visual and physical cues. Digital envelopes via mobile apps provide real-time tracking, instant budget adjustments, and automated alerts, enhancing flexibility but sometimes risking overspending due to the ease of digital transactions. Choosing between paper and digital methods depends on individual preference for disciplined physical control versus dynamic, data-driven budget management.

Ease of Use: Physical Cash vs. Digital Spending Controls

Cash envelopes offer a tactile way to manage budgets, making spending limits visually and physically clear, which helps reduce overspending through direct cash handling. Digital envelopes utilize apps that track expenses in real-time, providing instant updates and notifications for budget adherence, enhancing convenience and data accuracy. Comparing ease of use, physical cash envelopes rely on manual tracking and discipline, while digital envelopes streamline monitoring through automation and accessibility on multiple devices.

Accountability and Spending Awareness in Both Methods

Cash envelopes enhance spending accountability by providing a tactile limitation on expenses, making it easier to track and control cash flow physically. Digital envelopes offer real-time notifications and detailed transaction histories, increasing spending awareness through immediate feedback and data analytics. Both methods promote financial discipline but differ in how they drive accountability and awareness through tangible versus digital interactions.

Integrating Envelopes with Other Financial Strategies

Integrating cash envelopes with budgeting software and expense tracking apps enhances real-time monitoring and categorization of spending, promoting disciplined financial habits. Digital envelopes offer seamless synchronization with bank accounts and credit cards, enabling automatic fund allocation and reducing overspending risks. Combining envelope methods with goal-setting and alert systems creates a comprehensive approach to personal finance management and expense control.

Choosing the Best Envelope System for Your Lifestyle

Cash envelopes provide tangible control by limiting spending to physical cash and preventing overspending through a fixed budget, making them ideal for individuals who prefer hands-on money management. Digital envelopes offer convenience and real-time tracking with apps that categorize expenses, suited for tech-savvy users who want seamless integration with bank accounts. Choosing the best envelope system depends on personal habits, lifestyle, and comfort with technology, balancing accessibility with budgeting discipline.

Related Important Terms

Hybrid Envelope Budgeting

Hybrid envelope budgeting combines the tactile control of cash envelopes with the convenience of digital envelopes, allowing users to allocate physical cash alongside app-based tracking for categories like groceries and entertainment. This dual system maximizes spending discipline by providing real-time alerts through digital tools while maintaining the psychological benefit of handling tangible money.

Virtual Sinking Funds

Virtual sinking funds in digital envelopes offer enhanced flexibility and real-time tracking compared to traditional cash envelopes, allowing users to allocate funds for specific expenses without carrying physical cash. This method improves spending control by providing instant updates and reducing the risk of overspending through automated budget adjustments.

QR Envelope Tracking

Cash envelopes provide tactile budget control through physical allocation of funds, while digital envelopes enhance spending oversight with real-time tracking and transaction alerts; QR envelope tracking integrates these benefits by enabling quick access to envelope details via scanned codes, improving accuracy and convenience in budget management.

Card-linked Digital Envelopes

Card-linked digital envelopes provide seamless spending control by automatically categorizing transactions and restricting card use based on preset budgets, enhancing real-time expense tracking and reducing overspending risks compared to traditional cash envelopes. Integration with mobile apps and financial institutions enables dynamic adjustments and detailed analytics, offering greater convenience and accuracy in personal finance management.

Micro-Categorization Envelopes

Micro-categorization envelopes in expense management enhance spending control by allocating specific amounts to narrowly defined cash or digital categories, improving budget accuracy and preventing overspending. Digital envelopes offer real-time tracking and automated alerts, while cash envelopes provide tangible spending limits and promote mindful financial habits.

Encrypted Expense Envelopes

Encrypted expense envelopes offer heightened security for both cash and digital spending methods, ensuring transaction privacy and preventing unauthorized access. Implementing encrypted digital envelopes enhances real-time tracking and categorization of expenses, improving budget adherence and financial transparency.

Real-time Envelope Notifications

Cash envelopes provide tangible spending limits but lack real-time notifications, making immediate budget adjustments challenging. Digital envelopes offer instant alerts for transactions, enhancing real-time spending control and improving overall financial discipline.

AI-powered Envelope Allocation

AI-powered envelope allocation enhances spending control by automatically categorizing expenses into cash or digital envelopes based on real-time spending patterns and budget limits. This method optimizes financial discipline by providing precise allocation, reducing overspending risks, and enabling dynamic adjustments aligned with user behavior.

Envelope Gamification

Cash envelopes provide a tactile, visual method of managing budgets that enhances spending awareness through physical limitation, while digital envelopes leverage app-based gamification features such as points, rewards, and progress tracking to motivate disciplined financial behavior. Gamification in digital envelopes increases user engagement and accountability by turning budgeting into an interactive experience with real-time feedback and personalized challenges.

NFC-enabled Cash Envelopes

NFC-enabled cash envelopes combine the tactile budgeting method with digital tracking, allowing users to manage spending through physical cash while syncing transactions to mobile apps in real time. This hybrid approach enhances expense control by providing instant data analytics, reducing overspending risks compared to traditional digital envelopes that rely solely on virtual funds.

Cash envelopes vs Digital envelopes for spending control. Infographic

moneydiff.com

moneydiff.com