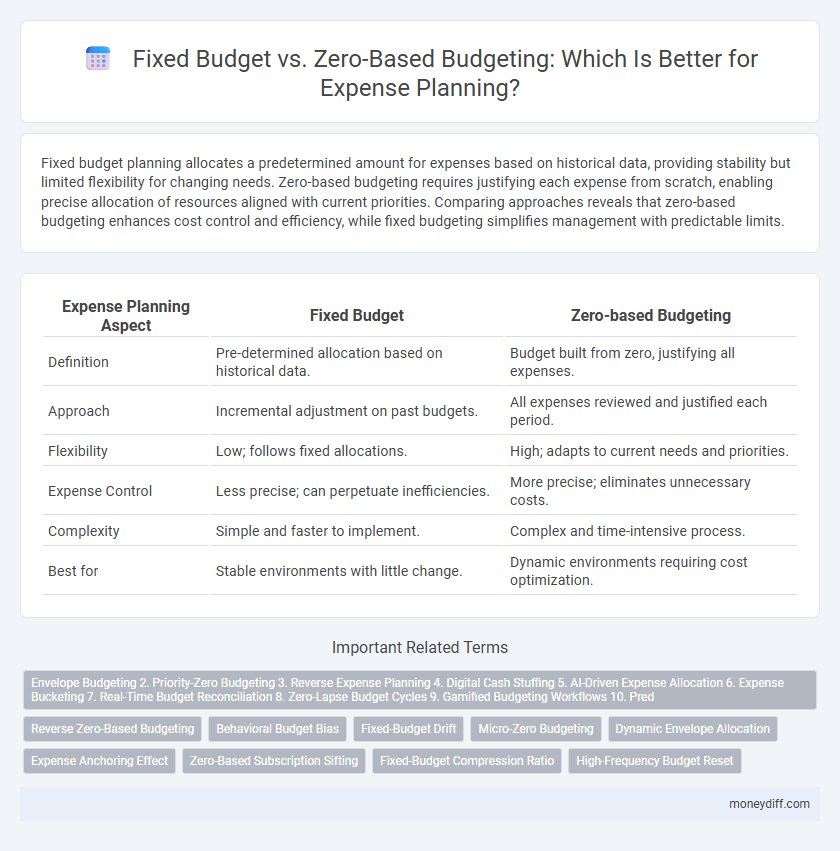

Fixed budget planning allocates a predetermined amount for expenses based on historical data, providing stability but limited flexibility for changing needs. Zero-based budgeting requires justifying each expense from scratch, enabling precise allocation of resources aligned with current priorities. Comparing approaches reveals that zero-based budgeting enhances cost control and efficiency, while fixed budgeting simplifies management with predictable limits.

Table of Comparison

| Expense Planning Aspect | Fixed Budget | Zero-based Budgeting |

|---|---|---|

| Definition | Pre-determined allocation based on historical data. | Budget built from zero, justifying all expenses. |

| Approach | Incremental adjustment on past budgets. | All expenses reviewed and justified each period. |

| Flexibility | Low; follows fixed allocations. | High; adapts to current needs and priorities. |

| Expense Control | Less precise; can perpetuate inefficiencies. | More precise; eliminates unnecessary costs. |

| Complexity | Simple and faster to implement. | Complex and time-intensive process. |

| Best for | Stable environments with little change. | Dynamic environments requiring cost optimization. |

Understanding Fixed Budgeting

Fixed budgeting allocates a predetermined amount of funds to each expense category based on the previous period's expenditures, providing predictable financial limits and simplifying expense tracking. This approach helps organizations maintain control over spending by setting consistent budgets that do not fluctuate with activity levels or changing needs. Fixed budgets are particularly effective for departments with stable costs, ensuring disciplined financial planning and minimizing the risk of overspending.

What is Zero-Based Budgeting?

Zero-based budgeting (ZBB) is a method where every expense must be justified from scratch for each new budgeting period, starting from a "zero base." Unlike fixed budgeting, which allocates funds based on previous budgets, ZBB requires detailed examination and approval of all expenses, ensuring that resources are allocated efficiently and aligned with current organizational priorities. This approach helps eliminate unnecessary costs and promotes cost-effective resource management by focusing on actual needs rather than historical spending.

Key Differences Between Fixed and Zero-Based Budgeting

Fixed budgeting allocates a predetermined amount for expenses based on historical data, maintaining consistent financial limits regardless of actual needs. Zero-based budgeting requires each expense to be justified from scratch, promoting detailed cost analysis and more precise resource allocation. Key differences include the level of flexibility, with zero-based budgeting encouraging cost efficiency and fixed budgeting offering simplicity and stability.

Advantages of Fixed Budgeting for Expense Planning

Fixed budgeting for expense planning offers predictability by allocating a consistent amount to expenses, which simplifies financial management and ensures spending stays within set limits. This method facilitates easier tracking and control of costs over a specific period, reducing the risk of overspending. Organizations benefit from streamlined budgeting processes and improved stability in cash flow forecasting through fixed budgeting.

Benefits of Zero-Based Budgeting for Managing Expenses

Zero-based budgeting enhances expense management by requiring every expense to be justified from scratch, promoting cost efficiency and eliminating unnecessary expenditures. This method improves resource allocation accuracy and adapts swiftly to changing business priorities, unlike fixed budgets which often perpetuate past spending patterns. Companies adopting zero-based budgeting report better financial discipline, increased transparency, and more strategic control over operational costs.

Challenges of Fixed vs Zero-Based Budgeting

Fixed budgets often face challenges such as inflexibility in adapting to changing business needs and the risk of perpetuating inefficiencies by allocating funds based on historical spending rather than current priorities. Zero-based budgeting requires intensive time and resource investment due to the need for thorough justification of every expense, making it difficult to implement regularly. Both methods present challenges in balancing accuracy and adaptability for effective expense planning.

Choosing the Right Budgeting Method for Your Finances

Fixed budget allocates a predetermined amount for expenses, ensuring predictable spending but often lacking flexibility for unforeseen costs. Zero-based budgeting requires justifying every expense from scratch each period, promoting cost-efficiency and detailed financial control. Selecting the right budgeting method depends on your financial goals, cash flow variability, and the need for adaptability in managing expenses.

Implementation Steps for Fixed and Zero-Based Budgeting

Fixed budgeting implementation involves analyzing historical expenses, setting a predetermined budget limit, and consistently monitoring actual costs against the fixed allocation. Zero-based budgeting requires identifying all expense categories from scratch, justifying each expenditure with detailed cost-benefit analysis, and allocating funds based on current organizational priorities rather than past spending. Both methods demand rigorous tracking, but zero-based budgeting emphasizes thorough justification and resource optimization in every budgeting cycle.

Real-Life Examples: Fixed vs Zero-Based Budgeting

Fixed budgeting allocates predetermined amounts to expense categories based on historical data, ideal for companies with stable costs like manufacturing firms maintaining consistent material expenses. Zero-based budgeting requires justifying every expense from scratch, benefiting dynamic businesses such as SaaS startups that prioritize agile allocation by evaluating each function's current value. Real-life implementation shows companies like Unilever using fixed budgets for predictable operations, while Amazon adopts zero-based budgeting to optimize rapidly changing technology and marketing expenditures.

Which Budgeting Approach Improves Expense Control?

Zero-based budgeting improves expense control by requiring all expenses to be justified for each new period, eliminating automatic baseline increases and encouraging more detailed scrutiny of costs. Fixed budgeting sets predetermined expense limits which can lead to rigid spending patterns and overlook changing financial priorities. Companies aiming for precise expense management often prefer zero-based budgeting due to its emphasis on aligning resources directly with current business needs.

Related Important Terms

Envelope Budgeting 2. Priority-Zero Budgeting 3. Reverse Expense Planning 4. Digital Cash Stuffing 5. AI-Driven Expense Allocation 6. Expense Bucketing 7. Real-Time Budget Reconciliation 8. Zero-Lapse Budget Cycles 9. Gamified Budgeting Workflows 10. Pred

Envelope Budgeting divides expenses into predefined categories with set limits, ensuring disciplined spending and preventing overspending, while Priority-Zero Budgeting allocates funds by ranking expenses in order of importance, eliminating non-essential costs for strict financial control. Reverse Expense Planning starts with savings goals and works backward to determine allowable expenses, complemented by Digital Cash Stuffing which tracks spending through digital envelopes for real-time monitoring, enabling precise AI-Driven Expense Allocation that uses machine learning to optimize budget distribution across multiple Expense Bucketing categories. Real-Time Budget Reconciliation automates expense tracking to maintain accuracy and supports Zero-Lapse Budget Cycles that ensure continuous, gap-free budgeting periods, all enhanced by Gamified Budgeting Workflows which increase user engagement and adherence through interactive goal-setting and rewards.

Reverse Zero-Based Budgeting

Reverse Zero-Based Budgeting reconstructs expenses by starting from a fixed budget ceiling and then prioritizing essential costs, enhancing cost control compared to traditional Zero-Based Budgeting which builds budgets from zero. This method enables organizations to maintain strict financial limits while systematically evaluating and justifying each expense within predefined budget constraints.

Behavioral Budget Bias

Fixed budget planning often suffers from behavioral budget bias, leading departments to spend allocated funds regardless of necessity to avoid future budget cuts. Zero-based budgeting reduces this bias by requiring justification for all expenses, promoting more deliberate and efficient resource allocation.

Fixed-Budget Drift

Fixed-budget drift occurs when expenses gradually exceed the predefined limits in a fixed budget, undermining financial control and reducing the accuracy of expense forecasting. Zero-based budgeting eliminates this drift by requiring every expense to be justified from scratch each period, ensuring tighter expense planning and alignment with actual financial goals.

Micro-Zero Budgeting

Fixed budget allocates a predetermined amount for expenses regardless of actual needs, while zero-based budgeting requires justifying every expense from zero each period, promoting more accurate cost management. Micro-zero budgeting further refines this approach by scrutinizing small expense categories individually, enabling precise control and enhanced allocation efficiency in expense planning.

Dynamic Envelope Allocation

Fixed budget strategies allocate expenses based on historical data with predefined limits, often leading to static spending patterns, while zero-based budgeting requires justifying every expense from scratch, enabling more flexible, dynamic envelope allocation tailored to current financial priorities. Dynamic envelope allocation in zero-based budgeting enhances resource optimization by continuously adjusting fund distribution according to evolving business goals and expense needs.

Expense Anchoring Effect

Fixed budgets often reinforce the Expense Anchoring Effect by basing future allocations on previous spending levels, which can perpetuate inefficiencies and limit cost control. Zero-based budgeting counters this by requiring all expenses to be justified from scratch each period, minimizing anchoring bias and promoting more accurate, needs-based expense planning.

Zero-Based Subscription Sifting

Zero-based subscription sifting enhances expense planning by scrutinizing each subscription from the ground up, ensuring all subscriptions justify their cost without relying on previous budget baselines. This method contrasts with fixed budgets by eliminating unnecessary recurring expenses and promoting dynamic allocation aligned with current business priorities.

Fixed-Budget Compression Ratio

The Fixed-Budget Compression Ratio measures the extent to which fixed budgets are reduced to align with cost-saving goals, providing a quantitative metric for evaluating efficiency in traditional expense planning. This ratio helps organizations identify how much expenses must be compressed without compromising operational effectiveness, making it a crucial factor when comparing fixed budgets to Zero-based Budgeting, which builds budgets from the ground up based on actual needs.

High-Frequency Budget Reset

High-frequency budget resets in zero-based budgeting enable precise expense planning by requiring justification for every expense cycle, unlike fixed budgets which allocate static funds regardless of fluctuating needs. This method enhances cost control and responsiveness, optimizing resource allocation based on current operational priorities.

Fixed Budget vs Zero-based Budgeting for expense planning Infographic

moneydiff.com

moneydiff.com