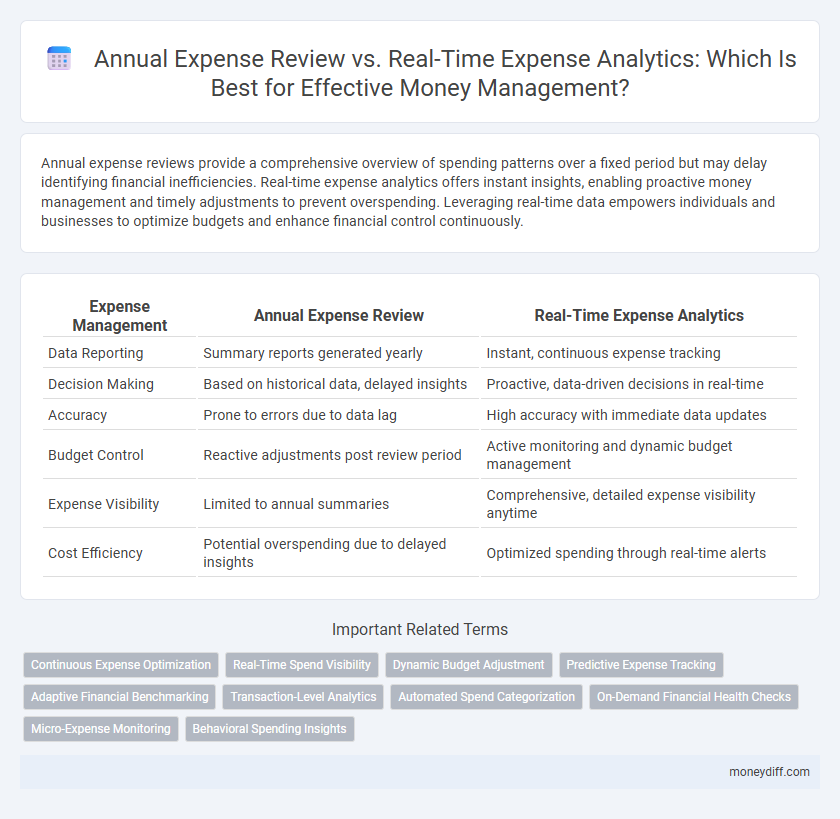

Annual expense reviews provide a comprehensive overview of spending patterns over a fixed period but may delay identifying financial inefficiencies. Real-time expense analytics offers instant insights, enabling proactive money management and timely adjustments to prevent overspending. Leveraging real-time data empowers individuals and businesses to optimize budgets and enhance financial control continuously.

Table of Comparison

| Expense Management | Annual Expense Review | Real-Time Expense Analytics |

|---|---|---|

| Data Reporting | Summary reports generated yearly | Instant, continuous expense tracking |

| Decision Making | Based on historical data, delayed insights | Proactive, data-driven decisions in real-time |

| Accuracy | Prone to errors due to data lag | High accuracy with immediate data updates |

| Budget Control | Reactive adjustments post review period | Active monitoring and dynamic budget management |

| Expense Visibility | Limited to annual summaries | Comprehensive, detailed expense visibility anytime |

| Cost Efficiency | Potential overspending due to delayed insights | Optimized spending through real-time alerts |

Annual Expense Review: Traditional Approach to Money Management

Annual expense review relies on historical financial data, analyzing past spending patterns once a year to identify budgeting trends and cost-saving opportunities. This traditional method often delays actionable insights, limiting timely adjustments that can optimize cash flow and reduce unnecessary expenditures. Compared to real-time expense analytics, annual reviews provide a retrospective snapshot rather than continuous monitoring, potentially missing immediate financial risks or savings.

Real-Time Expense Analytics: Modern Solutions for Financial Control

Real-time expense analytics leverages advanced data processing and AI algorithms to provide instant visibility into spending patterns, enabling proactive money management and timely financial decisions. This modern solution surpasses traditional annual expense reviews by offering up-to-the-minute insights that help identify unusual transactions, optimize budgets, and enhance cash flow control. Businesses and individuals gain increased financial agility through platforms integrating real-time dashboards, predictive analytics, and automated alerts.

Benefits of Reviewing Expenses Annually

Reviewing expenses annually provides a comprehensive overview of spending patterns, enabling more accurate budgeting and long-term financial planning. It helps identify significant cost-saving opportunities by highlighting trends and irregularities over the entire year. Annual reviews also support informed decision-making for tax deductions and investment strategies by consolidating all financial data into a holistic report.

Advantages of Real-Time Expense Tracking

Real-time expense tracking enables instant visibility into spending patterns, allowing for immediate adjustments and more precise budget control. This continuous monitoring reduces the risk of overspending and identifies unusual transactions quickly, enhancing financial security. Compared to annual expense reviews, real-time analytics provide actionable insights that support proactive money management and smarter financial decisions.

Drawbacks of Annual Expense Review

Annual expense reviews often lead to delayed identification of overspending or budget discrepancies, causing inefficient cash flow management. These reviews rely on outdated data, limiting the ability to make proactive financial decisions and adapt to sudden changes in expenses. Real-time expense analytics provide continuous monitoring, reducing the risk of financial surprises and improving overall money management accuracy.

Challenges of Implementing Real-Time Expense Analytics

Implementing real-time expense analytics faces challenges such as the need for advanced data integration across multiple financial platforms, ensuring data accuracy amid constant transaction updates, and managing the high costs of deploying sophisticated analytics infrastructure. Organizations must also address privacy concerns and comply with regulatory requirements while maintaining system security in real-time environments. The complexity of interpreting continuous data streams for actionable insights further complicates the adoption compared to traditional annual expense reviews.

Comparing Accuracy: Annual Review vs Real-Time Analytics

Real-time expense analytics provides significantly higher accuracy by continuously tracking and categorizing transactions, reducing errors and omissions common in annual expense reviews. Annual expense reviews rely on retrospective data, which can lead to outdated insights and missed anomalies, impacting budget adjustments and financial forecasting. Advanced analytics powered by AI and machine learning enhance the precision of real-time monitoring, enabling proactive money management and more reliable expense control.

Impact on Budgeting: Year-End vs Ongoing Expense Monitoring

Annual expense reviews provide a comprehensive overview of spending patterns, enabling strategic budget adjustments based on historical data. In contrast, real-time expense analytics offer continuous monitoring and immediate insights, allowing for proactive budget management and quick correction of overspending. Integrating ongoing expense tracking enhances financial agility by maintaining budget discipline throughout the year rather than relying solely on year-end evaluations.

Choosing the Right Expense Management Strategy

Annual expense review offers a comprehensive overview of spending patterns and budget adherence, enabling strategic adjustments for future financial planning. Real-time expense analytics provide immediate insights into transactions, allowing for proactive money management and quick detection of anomalies. Selecting the right expense management strategy depends on balancing long-term financial goals with the need for timely, detailed expenditure monitoring.

Integrating Annual Reviews with Real-Time Analytics for Optimal Money Management

Integrating annual expense reviews with real-time expense analytics enhances money management by combining comprehensive historical insights with up-to-the-minute financial data, enabling more accurate budgeting and forecasting. Real-time analytics offer continuous monitoring of spending patterns, while annual reviews provide strategic evaluation and goal alignment. This synergy supports proactive decision-making, reduces financial risks, and optimizes resource allocation for improved fiscal health.

Related Important Terms

Continuous Expense Optimization

Real-time expense analytics enable continuous expense optimization by providing up-to-the-minute insights into spending patterns, allowing for immediate adjustments and improved budget control. Annual expense reviews lack this immediacy, often resulting in delayed responses to financial inefficiencies and missed opportunities for ongoing cost reduction.

Real-Time Spend Visibility

Real-time spend visibility provides instant insights into financial transactions, enabling proactive budget adjustments and improved cash flow management. Unlike annual expense reviews, this dynamic approach enhances decision-making by delivering up-to-date data on expenditures and identifying spending patterns as they occur.

Dynamic Budget Adjustment

Real-time expense analytics enable dynamic budget adjustment by providing up-to-the-minute insights into spending patterns, allowing individuals and businesses to immediately modify their financial plans. Annual expense reviews lack this flexibility, often resulting in outdated budgets that fail to respond to sudden changes in cash flow or unexpected expenses.

Predictive Expense Tracking

Predictive expense tracking utilizes real-time expense analytics to forecast future spending patterns, enabling proactive money management and reducing the reliance on traditional annual expense reviews. By continuously analyzing transaction data and behavioral trends, it provides dynamic budgeting insights and minimizes financial surprises.

Adaptive Financial Benchmarking

Annual expense review provides a static overview of spending patterns, often missing dynamic shifts and real-time financial behaviors. Real-time expense analytics enable adaptive financial benchmarking by continuously comparing current expenditures against personalized benchmarks, enhancing proactive money management and responsiveness to market changes.

Transaction-Level Analytics

Transaction-level analytics provide granular insights into spending patterns, enabling real-time expense tracking and proactive budget adjustments. Unlike annual expense reviews that rely on aggregated data, real-time analytics facilitate immediate identification of anomalies and optimize cash flow management.

Automated Spend Categorization

Automated spend categorization enhances real-time expense analytics by instantly classifying transactions into predefined categories, enabling dynamic money management and immediate budget adjustments. In contrast, annual expense reviews rely on retrospective data analysis, which may delay recognition of spending patterns and reduce the effectiveness of financial decision-making.

On-Demand Financial Health Checks

Real-time expense analytics empower on-demand financial health checks by providing instantaneous insights into spending patterns, enabling proactive adjustments for optimized money management. Annual expense reviews, while useful for long-term assessments, lack the immediacy and precision needed to respond to dynamic financial situations effectively.

Micro-Expense Monitoring

Micro-expense monitoring leverages real-time expense analytics to provide immediate insights into spending patterns, enabling more precise money management compared to annual expense reviews that offer only retrospective summaries. Real-time data processing and categorization empower users to quickly identify and adjust micro-level expenditures, reducing financial leakage and improving budget adherence.

Behavioral Spending Insights

Annual expense reviews provide retrospective data that helps identify broad spending patterns, while real-time expense analytics deliver immediate behavioral spending insights, enabling proactive money management and timely adjustments to reduce unnecessary costs. Integrating real-time analytics with behavioral data enhances financial decision-making by revealing spending triggers and habits as they occur, fostering more disciplined and strategic expense control.

Annual expense review vs Real-time expense analytics for money management. Infographic

moneydiff.com

moneydiff.com