Monthly review of expenses provides a comprehensive overview of spending patterns, allowing for trend identification and budget adjustments over time. Real-time analytics enables immediate detection of anomalies and faster decision-making by offering up-to-date expense data. Combining both approaches enhances financial control by balancing detailed periodic insights with agile, on-the-spot monitoring.

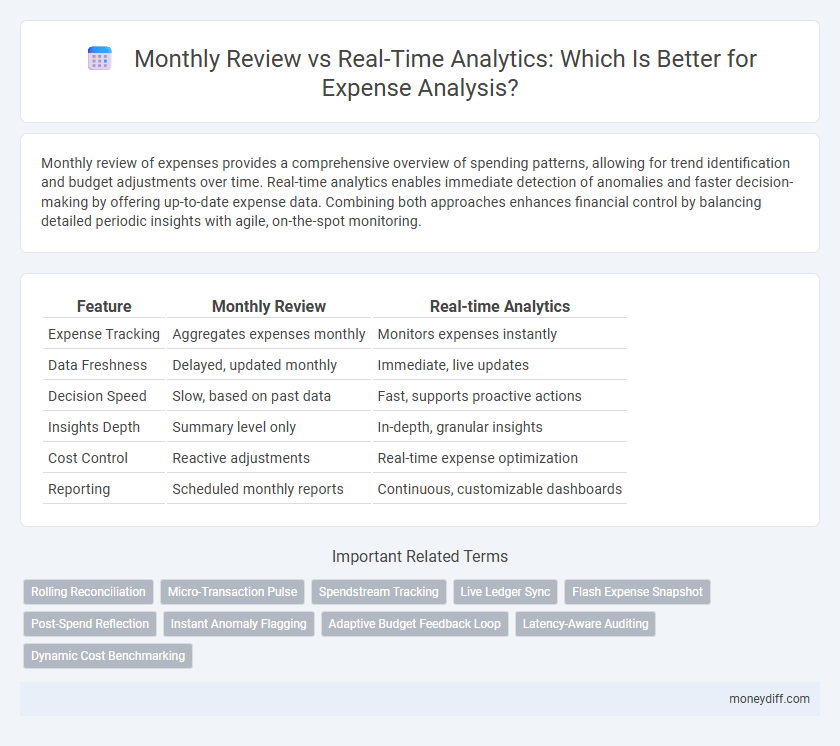

Table of Comparison

| Feature | Monthly Review | Real-time Analytics |

|---|---|---|

| Expense Tracking | Aggregates expenses monthly | Monitors expenses instantly |

| Data Freshness | Delayed, updated monthly | Immediate, live updates |

| Decision Speed | Slow, based on past data | Fast, supports proactive actions |

| Insights Depth | Summary level only | In-depth, granular insights |

| Cost Control | Reactive adjustments | Real-time expense optimization |

| Reporting | Scheduled monthly reports | Continuous, customizable dashboards |

Understanding Monthly Review in Expense Management

Monthly Review in expense management offers a comprehensive summary of spending patterns by aggregating data over a fixed period, enabling strategic budget adjustments and identifying recurring cost trends. This method supports detailed reconciliation and compliance verification, ensuring accuracy in financial reporting. Organizations relying on Monthly Reviews benefit from a structured, time-based analysis that enhances long-term fiscal planning and expense control.

Exploring Real-time Analytics for Expense Tracking

Real-time analytics for expense tracking enables immediate identification of spending patterns and anomalies, improving budget adherence and fraud detection. Unlike monthly reviews, which provide retrospective insights, real-time data integration from multiple financial sources allows dynamic expense management and quicker decision-making. Leveraging machine learning algorithms in real-time systems enhances predictive accuracy and optimizes cash flow monitoring for businesses.

Key Differences Between Monthly Reviews and Real-time Analytics

Monthly reviews aggregate expense data at the end of each month, providing comprehensive insights into spending patterns but lacking immediate responsiveness. Real-time analytics continuously track expenses, enabling instant detection of anomalies and timely decision-making to control budget overruns. The key difference lies in latency and granularity, where monthly reviews offer depth over time, while real-time analytics prioritize speed and proactive expense management.

Advantages of Monthly Expense Reviews

Monthly expense reviews provide a comprehensive overview of spending patterns, enabling businesses to identify trends and make informed budget adjustments. This retrospective analysis supports strategic financial planning and helps detect irregularities or anomalies that may be overlooked in real-time monitoring. By consolidating data over a longer period, monthly reviews enhance accuracy and facilitate better forecasting for future expenses.

Benefits of Real-time Expense Analytics

Real-time expense analytics enables instant tracking and categorization of expenditures, allowing businesses to identify spending patterns and anomalies immediately. This timely insight supports more accurate budget adjustments and prevents overspending before it escalates. Enhanced data accuracy and faster decision-making significantly improve overall financial management compared to monthly reviews.

Challenges of Monthly Review Systems

Monthly review systems for expense analysis often face challenges such as delayed detection of overspending, limited agility in responding to budget deviations, and the inability to capture real-time fluctuations in expenses. These systems rely on aggregated historical data, which can result in outdated insights and slow decision-making processes. Consequently, organizations may miss opportunities for timely cost control and proactive financial management.

Limitations of Real-time Analytics in Expense Management

Real-time analytics in expense management often struggles with data accuracy due to transaction delays and system synchronization issues, leading to potential discrepancies in reports. These tools may generate overwhelming data volumes, making it difficult for finance teams to identify actionable insights quickly. Furthermore, real-time systems can incur higher implementation and maintenance costs compared to monthly reviews, impacting overall budget efficiency.

Impact on Financial Decision-Making

Monthly reviews offer a comprehensive overview of expense patterns, enabling strategic budget adjustments based on consolidated data, while real-time analytics provide immediate visibility into spending fluctuations, allowing for swift corrective actions. Real-time analytics enhance financial decision-making by identifying anomalies and trends as they occur, reducing the risk of overspending and improving cash flow management. Integrating both approaches maximizes accuracy in forecasting and supports proactive, data-driven expense management strategies.

Choosing the Right Method for Your Expense Analysis

Monthly review of expenses provides a comprehensive overview of spending patterns and identifies trends over time, making it ideal for strategic budgeting and long-term financial planning. Real-time analytics enables immediate tracking and detection of transaction anomalies, offering dynamic control for organizations needing prompt decision-making and fraud prevention. Selecting the right method depends on business priorities, balancing the need for detailed historical insights with the demand for instantaneous financial data visibility.

Integrating Monthly Reviews and Real-time Analytics for Optimal Results

Integrating monthly reviews with real-time analytics enhances expense analysis by combining comprehensive historical data with immediate financial insights, enabling more accurate budgeting and fraud detection. Real-time analytics offer up-to-the-minute tracking of expenditures, while monthly reviews provide contextual evaluation of spending patterns and variance analysis. This hybrid approach optimizes financial decision-making, ensuring both strategic oversight and operational agility in expense management.

Related Important Terms

Rolling Reconciliation

Rolling reconciliation enhances expense analysis by integrating real-time analytics to continuously compare and validate transactions against monthly reviews. This approach enables dynamic identification of discrepancies, improves cash flow accuracy, and accelerates financial reporting cycles.

Micro-Transaction Pulse

Monthly review provides a comprehensive summary of expense patterns, while real-time analytics offers immediate insights into micro-transactions through the Micro-Transaction Pulse feature, enabling businesses to detect anomalies and optimize spending instantly. Leveraging real-time data enhances decision-making accuracy and financial agility compared to traditional monthly expense analyses.

Spendstream Tracking

Monthly review offers comprehensive spendstream tracking by consolidating expense data over time, identifying long-term patterns and budget variances. Real-time analytics enhances this process by providing immediate visibility into transactions, enabling quicker identification of overspending and prompt corrective actions.

Live Ledger Sync

Real-time analytics with Live Ledger Sync offers continuous expense tracking and immediate data updates, enabling timely financial decisions and quicker anomaly detection. Monthly reviews provide comprehensive summaries but lack the instant accuracy and responsiveness of live syncing, which reduces reconciliation errors and enhances budget management efficiency.

Flash Expense Snapshot

Flash Expense Snapshot offers immediate insights into spending patterns, enabling businesses to detect anomalies and adjust budgets in real-time. Monthly reviews provide comprehensive trend analysis but lack the agility and immediacy to respond quickly to unexpected expense fluctuations.

Post-Spend Reflection

Monthly review enables comprehensive post-spend reflection by aggregating expense data to identify trends and anomalies over time, supporting strategic budget adjustments. Real-time analytics provides immediate insights into spending patterns, allowing quicker detection of overspending but may lack the depth and context achieved through periodic analysis.

Instant Anomaly Flagging

Real-time analytics enables instant anomaly flagging in expense analysis by continuously monitoring transactions and triggering alerts the moment irregularities occur. Monthly reviews often delay detection, increasing the risk of prolonged financial discrepancies and reduced responsiveness.

Adaptive Budget Feedback Loop

Monthly reviews provide a comprehensive overview of expenses, enabling identification of trends and anomalies for informed budget adjustments, while real-time analytics offer immediate visibility into spending patterns, facilitating adaptive budget feedback loops that optimize financial control and responsiveness. Integrating real-time data with monthly reviews enhances accuracy in expense forecasting and supports proactive decision-making to maintain budget adherence.

Latency-Aware Auditing

Monthly review processes often delay the identification of irregular expenses, reducing the effectiveness of financial controls. Real-time analytics enable latency-aware auditing by continuously monitoring transactions, allowing immediate detection and correction of anomalies to enhance expense accuracy and compliance.

Dynamic Cost Benchmarking

Monthly reviews provide structured expense analysis but often lack the agility needed for dynamic cost benchmarking, whereas real-time analytics enable continuous monitoring and immediate adjustment of spending patterns, optimizing budget alignment and identifying cost-saving opportunities more effectively. Integrating real-time data feeds with historical benchmarks enhances decision-making accuracy in expense management through dynamic comparison of actual versus projected costs.

Monthly Review vs Real-time Analytics for expense analysis Infographic

moneydiff.com

moneydiff.com