Manual expense logs often lead to inaccuracies and consume significant time during expense analysis, limiting real-time insights and efficiency. Artificial intelligence-driven expense categorization automates data entry, improves accuracy by recognizing patterns and anomalies, and accelerates financial reporting processes. This advanced technology enables businesses to optimize budget tracking, reduce human error, and enhance decision-making through precise and timely expense analysis.

Table of Comparison

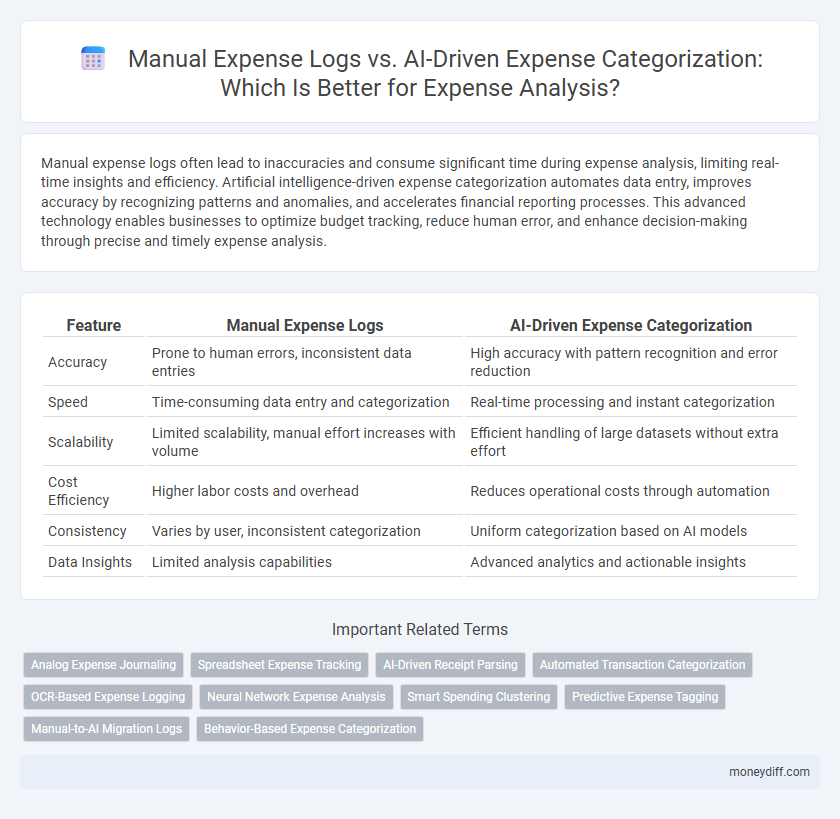

| Feature | Manual Expense Logs | AI-Driven Expense Categorization |

|---|---|---|

| Accuracy | Prone to human errors, inconsistent data entries | High accuracy with pattern recognition and error reduction |

| Speed | Time-consuming data entry and categorization | Real-time processing and instant categorization |

| Scalability | Limited scalability, manual effort increases with volume | Efficient handling of large datasets without extra effort |

| Cost Efficiency | Higher labor costs and overhead | Reduces operational costs through automation |

| Consistency | Varies by user, inconsistent categorization | Uniform categorization based on AI models |

| Data Insights | Limited analysis capabilities | Advanced analytics and actionable insights |

Understanding Manual Expense Logs

Manual expense logs require employees to record expenditures by hand, often leading to inconsistencies and human errors that affect data accuracy. These logs lack real-time updates and require significant time for data entry and reconciliation, delaying expense analysis. Manual methods also struggle to identify spending patterns or anomalies, limiting the depth of financial insights compared to AI-driven categorization systems.

Introduction to AI-Driven Expense Categorization

AI-driven expense categorization leverages machine learning algorithms to automatically classify and organize expense data with high accuracy, reducing the need for time-consuming manual entry. This technology enables real-time analysis of spending patterns by detecting anomalies and categorizing transactions based on company-specific rules and historical data. Integration of AI in expense management enhances efficiency, minimizes human errors, and provides actionable insights for better financial decision-making.

Accuracy and Reliability: Manual Logs vs AI Solutions

Manual expense logs often suffer from human errors and inconsistencies, leading to lower accuracy and reliability in expense analysis. AI-driven expense categorization leverages machine learning algorithms to automatically classify expenses with higher precision and consistency. This technological approach reduces errors, enhances data integrity, and provides more reliable insights for financial decision-making.

Time Efficiency in Expense Tracking

Manual expense logs require significant time investment for data entry and classification, often leading to delays in expense tracking and reporting. Artificial intelligence-driven expense categorization accelerates the process by automatically identifying and organizing expenses with high accuracy. This efficiency enables real-time financial insights and reduces administrative workload, optimizing overall expense management.

Data Security and Privacy Considerations

Manual expense logs increase the risk of human error and data breaches due to inconsistent handling and storage of sensitive financial information. Artificial intelligence-driven expense categorization employs encryption, secure cloud storage, and anonymization techniques to safeguard data privacy and ensure compliance with regulations such as GDPR and CCPA. Implementing AI solutions enables continuous monitoring, reducing the potential for unauthorized access and enhancing overall data security in expense analysis.

Error Reduction: Human vs Machine

Manual expense logs often suffer from human errors such as misclassification and data entry mistakes, leading to inaccuracies in expense analysis. Artificial intelligence-driven expense categorization leverages machine learning algorithms to automatically identify and categorize expenses with high precision, significantly reducing error rates. This AI-powered approach enhances data accuracy, enabling more reliable financial insights and streamlined expense management.

Customization and Flexibility in Expense Analysis

Manual expense logs allow for high customization and flexibility, enabling users to categorize expenses based on unique business rules and specific needs. Artificial intelligence-driven expense categorization enhances scalability by automatically adapting to evolving spending patterns, but may require fine-tuning to achieve the same level of tailored analysis. Combining AI-driven automation with manual overrides provides an optimal balance between efficiency and personalized expense tracking.

Cost Implications: Traditional vs AI-Based Methods

Manual expense logs require significant time and labor, leading to higher operational costs and increased risk of human error. AI-driven expense categorization automates data entry and analysis, reducing overhead expenses by streamlining workflows and improving accuracy. Implementing AI solutions offers a scalable approach that minimizes cost per transaction compared to traditional methods.

User Experience and Learning Curve

Manual expense logs often result in slower data entry and higher error rates due to the repetitive nature and lack of automation, leading to a steeper learning curve for users unfamiliar with detailed categorization rules. Artificial intelligence-driven expense categorization simplifies the user experience by automatically classifying expenses with high accuracy, reducing manual input and cognitive load. This technology accelerates adoption by providing intuitive interfaces and real-time analytics, allowing users to focus on decision-making rather than data management.

Future Trends in Expense Management Technologies

Artificial intelligence-driven expense categorization leverages machine learning algorithms to automatically classify expenses with high accuracy, drastically reducing manual entry errors and saving valuable time. Future trends in expense management technologies highlight increased integration of AI with real-time data analytics and blockchain for enhanced transparency, fraud detection, and compliance. Companies adopting these advanced AI systems can expect improved financial forecasting and smarter expense analysis, driving more strategic business decisions.

Related Important Terms

Analog Expense Journaling

Analog expense journaling relies on manual expense logs that require significant time and effort for accurate entry, often leading to errors and inconsistencies in financial records. In contrast, artificial intelligence-driven expense categorization automates data extraction and classification, improving accuracy, efficiency, and enabling deeper insights during expense analysis.

Spreadsheet Expense Tracking

Manual expense logs in spreadsheet expense tracking often result in time-consuming data entry and higher risks of human error, limiting accurate expense analysis. Artificial intelligence-driven expense categorization automates data sorting and classification, enhancing precision and efficiency while enabling real-time insights and streamlined financial reporting.

AI-Driven Receipt Parsing

AI-driven receipt parsing significantly enhances expense analysis by automatically extracting key data points such as vendor names, dates, and amounts from receipts, reducing human errors associated with manual expense logs. This technology accelerates expense categorization, improves accuracy, and enables real-time insights into spending patterns, optimizing financial management processes.

Automated Transaction Categorization

Manual expense logs often lead to inconsistent data entry and increased errors, while artificial intelligence-driven expense categorization utilizes machine learning algorithms to automatically classify transactions with high accuracy, significantly enhancing expense analysis efficiency. Automated transaction categorization enables real-time processing, reduces manual labor, and improves data accuracy by identifying patterns and anomalies in spending behavior.

OCR-Based Expense Logging

OCR-based expense logging automates data extraction from receipts, significantly reducing errors and processing time compared to manual expense logs. AI-driven expense categorization leverages optical character recognition to accurately classify transactions, enhancing accuracy and efficiency in expense analysis.

Neural Network Expense Analysis

Neural network expense analysis leverages deep learning models to automatically categorize and analyze expenses with high accuracy, reducing human error inherent in manual expense logs. This AI-driven approach enhances real-time expense tracking, uncovers hidden spending patterns, and optimizes financial decision-making efficiency.

Smart Spending Clustering

Manual expense logs often lead to inconsistent data entry and time-consuming reconciliation, hindering accurate expense analysis. Artificial intelligence-driven expense categorization enhances Smart Spending Clustering by automatically grouping expenditures based on patterns, enabling precise budget optimization and real-time financial insights.

Predictive Expense Tagging

Manual expense logs often lead to inconsistent categorization and increased processing time, whereas artificial intelligence-driven expense categorization enhances accuracy by utilizing predictive expense tagging algorithms to automatically classify expenses based on patterns and contextual data. Predictive expense tagging significantly improves the efficiency of expense analysis, reduces human error, and enables real-time financial insights for better budgeting and forecasting.

Manual-to-AI Migration Logs

Migrating from manual expense logs to AI-driven categorization enhances accuracy by reducing human errors and accelerates data processing through automated recognition of spending patterns. This transition supports real-time expense analysis, improves compliance with company policies, and streamlines auditing by leveraging machine learning algorithms to classify transactions efficiently.

Behavior-Based Expense Categorization

Manual expense logs often suffer from human error and inconsistent categorization, hindering accurate behavior-based expense analysis. Artificial intelligence-driven expense categorization leverages machine learning algorithms to automatically classify expenditures based on user behavior patterns, enhancing precision and enabling real-time insights.

Manual expense logs vs Artificial intelligence-driven expense categorization for expense analysis. Infographic

moneydiff.com

moneydiff.com