Traditional categorization of expenses relies on preset rules and manual input, which can lead to errors and inefficiencies in sorting and reporting. AI-based categorization leverages machine learning algorithms to automatically classify expenses with higher accuracy and adapt to new spending patterns over time. This approach reduces administrative overhead and provides real-time insights, enabling more effective budget management and financial analysis.

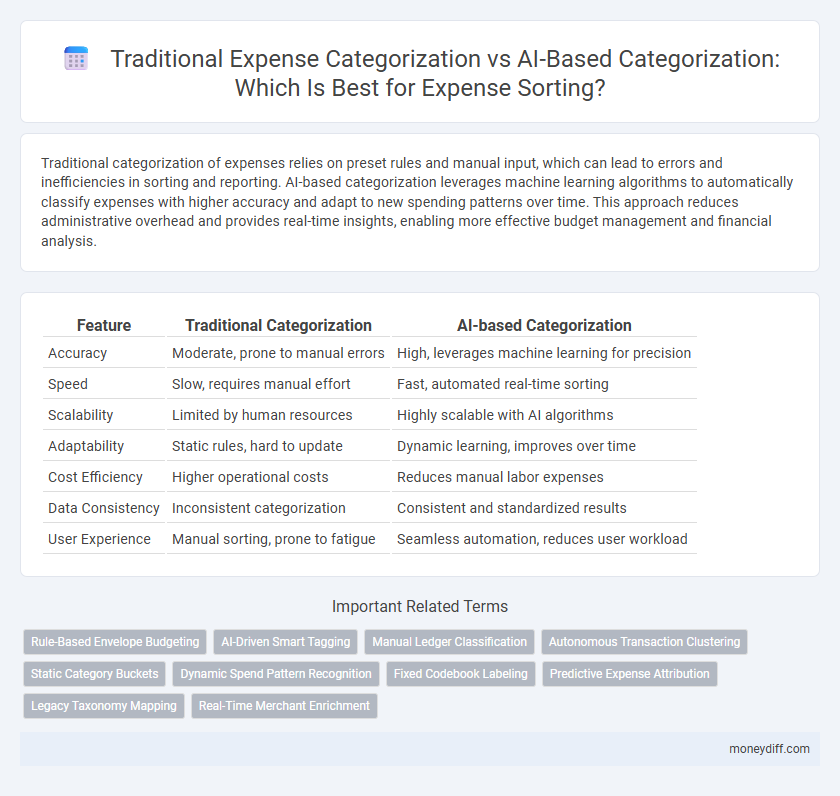

Table of Comparison

| Feature | Traditional Categorization | AI-based Categorization |

|---|---|---|

| Accuracy | Moderate, prone to manual errors | High, leverages machine learning for precision |

| Speed | Slow, requires manual effort | Fast, automated real-time sorting |

| Scalability | Limited by human resources | Highly scalable with AI algorithms |

| Adaptability | Static rules, hard to update | Dynamic learning, improves over time |

| Cost Efficiency | Higher operational costs | Reduces manual labor expenses |

| Data Consistency | Inconsistent categorization | Consistent and standardized results |

| User Experience | Manual sorting, prone to fatigue | Seamless automation, reduces user workload |

Overview of Expense Categorization Methods

Traditional expense categorization relies on predefined categories and manual data entry, often resulting in errors and time-consuming processes. AI-based categorization utilizes machine learning algorithms to automatically classify expenses with higher accuracy by analyzing patterns in transaction data. This approach improves efficiency, reduces human error, and enables dynamic adaptation to new spending behaviors.

Defining Traditional Expense Categorization

Traditional expense categorization relies on manual entry and static rule-based systems, where expenses are sorted into predefined categories such as travel, office supplies, and utilities. This method depends heavily on human accuracy and consistency, often leading to errors and time-consuming reconciliation processes. Limited scalability and inflexible classification frameworks pose challenges for businesses with complex or evolving expense patterns.

Understanding AI-Based Expense Categorization

AI-based expense categorization leverages machine learning algorithms to analyze transaction data with higher accuracy and efficiency than traditional rule-based methods. This technology identifies patterns, vendor information, and contextual details to dynamically sort expenses into relevant categories, reducing manual errors and saving time. Enhanced by continuous learning, AI systems adapt to evolving expense behaviors and company-specific policies, offering scalable and precise financial management solutions.

Accuracy Comparison: Traditional vs AI Approaches

Traditional expense categorization relies on predefined rules and manual input, often leading to inaccuracies and misclassifications due to human error and rigid criteria. AI-based categorization employs machine learning algorithms that analyze patterns and context, resulting in significantly higher accuracy and faster processing times. Studies show AI models can achieve categorization accuracy rates exceeding 90%, compared to 70-80% for traditional methods.

Manual Effort in Traditional Categorization

Manual effort in traditional expense categorization involves significant time consumption and repetitive data entry, often resulting in human errors and inconsistencies. Employees must meticulously review each transaction, assign categories based on predefined rules, and verify accuracy without automated assistance. This labor-intensive process limits scalability and delays real-time financial analysis essential for efficient expense management.

Automation and Efficiency with AI Categorization

AI-based categorization revolutionizes expense sorting by automating data entry, reducing human error, and accelerating processing time compared to traditional categorization. Machine learning algorithms analyze transaction patterns and context, enabling dynamic and highly accurate categorization without manual intervention. This automation enhances operational efficiency, decreases administrative costs, and provides real-time insights for improved financial management.

Adaptability to Changing Expense Types

Traditional categorization relies on static rules and predefined categories, limiting its adaptability to emerging or evolving expense types. AI-based categorization leverages machine learning algorithms that continuously learn from new data, enabling dynamic adjustment to changing expense patterns. This adaptability ensures more accurate and real-time expense sorting, reducing manual reclassification efforts.

Error Reduction and Consistency in AI Sorting

Traditional categorization methods for expense sorting often suffer from human errors and inconsistent classification due to subjective judgment and manual data entry. AI-based categorization leverages machine learning algorithms to analyze patterns and automatically classify expenses with higher accuracy, significantly reducing error rates. This consistency in AI sorting ensures reliable financial reporting and facilitates more efficient expense management.

User Experience in Both Categorization Methods

Traditional expense categorization relies on manual sorting, which often leads to errors and increased time spent by users managing their budgets. AI-based categorization enhances user experience by automatically classifying expenses with higher accuracy and learning individual spending patterns for personalized insights. This automation reduces effort, providing users with quicker, more reliable expense tracking and improved financial decision-making.

Future Trends in Expense Categorization Technology

AI-based categorization leverages machine learning algorithms to analyze vast datasets, improving accuracy and efficiency in expense sorting compared to traditional rule-based methods. Future trends include real-time transaction analysis, adaptive learning from user behavior, and integration with blockchain for enhanced transparency and fraud detection. These advancements drive smarter financial management and streamlined expense reporting in increasingly complex business environments.

Related Important Terms

Rule-Based Envelope Budgeting

Rule-based envelope budgeting relies on predefined categories and strict spending limits, providing clear structure but often lacking flexibility and adaptability to dynamic expense patterns. AI-based categorization enhances accuracy by analyzing transaction data with machine learning algorithms, enabling personalized budget adjustments and real-time expense tracking beyond the constraints of traditional rule-based methods.

AI-Driven Smart Tagging

AI-driven smart tagging revolutionizes expense sorting by automatically analyzing transaction data with natural language processing and machine learning algorithms, resulting in highly accurate and dynamic expense categorization. Unlike traditional categorization methods reliant on static rules and manual input, AI-based systems continuously learn from user behavior and contextual patterns to optimize expense management and reduce errors.

Manual Ledger Classification

Manual ledger classification in traditional expense categorization relies heavily on human input, often leading to inconsistencies and time-consuming errors. AI-based categorization automates this process by using machine learning algorithms to accurately sort expenses, improving efficiency and reducing manual workload.

Autonomous Transaction Clustering

Traditional categorization of expenses relies on predefined rules and manual classification, often leading to inaccuracies and inefficiencies in sorting large volumes of transaction data. AI-based categorization employs Autonomous Transaction Clustering to automatically group similar expenses by analyzing patterns and contextual information, enhancing accuracy and reducing the need for human intervention.

Static Category Buckets

Traditional expense categorization relies on static category buckets that often lack flexibility and fail to adapt to evolving spending patterns, resulting in inaccurate or incomplete sorting of transactions. AI-based categorization improves accuracy by dynamically learning from transaction data and user behavior, enabling more precise and personalized expense grouping beyond rigid predefined categories.

Dynamic Spend Pattern Recognition

AI-based categorization leverages dynamic spend pattern recognition to automatically adapt to evolving expense behaviors, improving accuracy over traditional static categorization methods. This approach enables real-time identification of expense categories by analyzing transaction contexts and user habits, reducing manual adjustments and errors.

Fixed Codebook Labeling

Traditional categorization relies on fixed codebook labeling, assigning expenses to predetermined categories that are often rigid and unable to adapt to evolving spending patterns. AI-based categorization leverages machine learning algorithms to dynamically analyze transaction data, improving accuracy and enabling personalized, context-aware expense sorting beyond static codebook constraints.

Predictive Expense Attribution

Traditional categorization of expenses relies on static rules and manual input, often leading to inaccuracies and time-consuming processes. AI-based categorization uses predictive expense attribution, leveraging machine learning algorithms to analyze patterns and automatically classify transactions with higher precision and efficiency.

Legacy Taxonomy Mapping

Traditional categorization relies on legacy taxonomy mapping which often results in rigid, manual classification of expenses prone to human error and limited scalability. AI-based categorization leverages machine learning algorithms to dynamically interpret and sort expenses, enhancing accuracy and adaptability beyond static legacy taxonomies.

Real-Time Merchant Enrichment

Traditional expense categorization relies on static rules and manual input, often leading to delayed and inaccurate sorting, while AI-based categorization leverages real-time merchant enrichment to automatically identify transaction details and context for precise and dynamic expense allocation. Real-time merchant data integration enhances accuracy, reduces human error, and enables instant categorization updates aligned with changing business needs.

Traditional Categorization vs AI-based Categorization for expense sorting Infographic

moneydiff.com

moneydiff.com