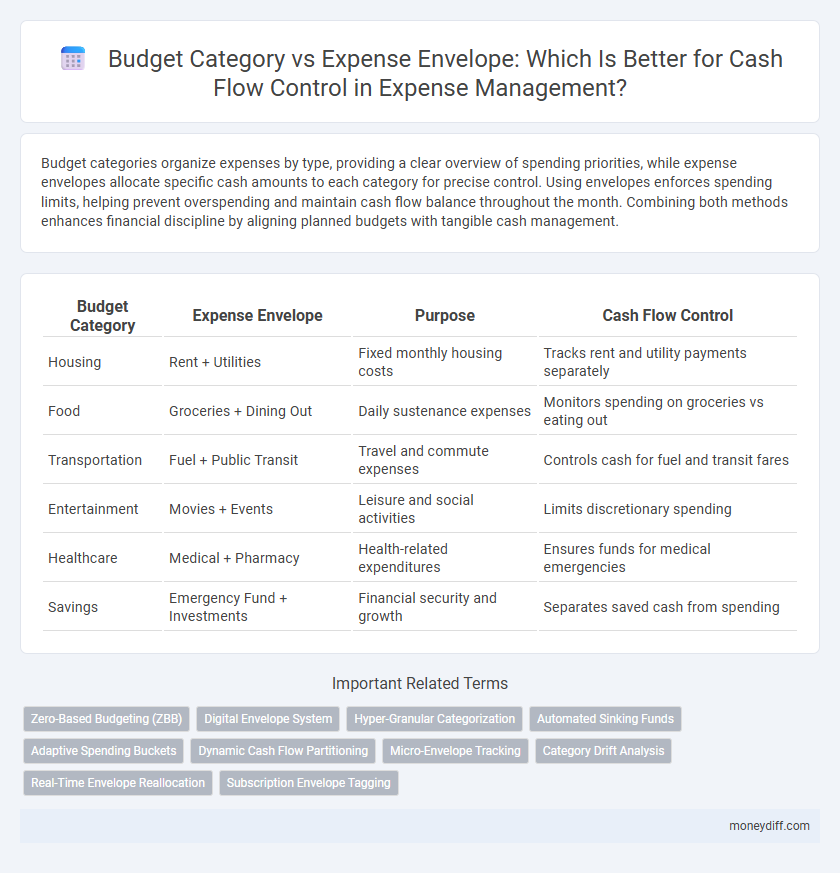

Budget categories organize expenses by type, providing a clear overview of spending priorities, while expense envelopes allocate specific cash amounts to each category for precise control. Using envelopes enforces spending limits, helping prevent overspending and maintain cash flow balance throughout the month. Combining both methods enhances financial discipline by aligning planned budgets with tangible cash management.

Table of Comparison

| Budget Category | Expense Envelope | Purpose | Cash Flow Control |

|---|---|---|---|

| Housing | Rent + Utilities | Fixed monthly housing costs | Tracks rent and utility payments separately |

| Food | Groceries + Dining Out | Daily sustenance expenses | Monitors spending on groceries vs eating out |

| Transportation | Fuel + Public Transit | Travel and commute expenses | Controls cash for fuel and transit fares |

| Entertainment | Movies + Events | Leisure and social activities | Limits discretionary spending |

| Healthcare | Medical + Pharmacy | Health-related expenditures | Ensures funds for medical emergencies |

| Savings | Emergency Fund + Investments | Financial security and growth | Separates saved cash from spending |

Understanding Budget Categories and Expense Envelopes

Budget categories represent broad spending groups such as groceries, utilities, and entertainment, used to allocate funds within a budget framework. Expense envelopes are physical or digital containers that hold specific cash amounts assigned to these categories, enabling precise cash flow control and preventing overspending. Combining budget categories with expense envelopes creates a structured system that enhances financial discipline by visually tracking and limiting expenditures.

Key Differences Between Budget Categories and Expense Envelopes

Budget categories organize expenses by type, such as groceries or utilities, providing a broad framework for financial planning. Expense envelopes allocate specific cash amounts to each category, ensuring strict spending limits and enhancing cash flow management. This method enforces discipline by physically separating funds, while budget categories offer a more flexible, overview-based approach.

How Budget Categories Streamline Money Management

Budget categories streamline money management by organizing expenses into defined groups, allowing for clearer tracking and allocation of funds. This structured approach improves forecasting accuracy and highlights spending patterns, making it easier to adjust financial goals and avoid overspending. Compared to expense envelopes, budget categories provide a digital framework for holistic cash flow control and efficient resource distribution.

Expense Envelopes: A Hands-on Approach to Spending

Expense envelopes provide a practical, hands-on method for managing cash flow by allocating specific amounts of cash to designated categories, ensuring disciplined spending. Unlike broad budget categories that track expenses retrospectively, expense envelopes emphasize proactive control and visibility of available funds. This tangible approach reduces overspending and enhances financial accountability by physically separating money for each spending purpose.

Pros and Cons: Budget Category vs Expense Envelope

Budget categories provide a broad overview of spending by grouping expenses into fixed allocations, which simplifies financial planning but may lack real-time flexibility. Expense envelopes allocate cash to specific purposes, enhancing control over daily spending and preventing overspending, yet they require consistent tracking and can be time-consuming. Budget categories suit long-term financial strategies, while expense envelopes excel in managing immediate cash flow and promoting discipline.

Which Method Improves Cash Flow Control?

Budget categories provide a high-level overview of planned spending across various financial areas, making it easier to allocate funds strategically. Expense envelopes offer a more granular, physical method by dividing cash into specific pockets for each type of expense, limiting overspending within each category. Employing expense envelopes typically improves cash flow control more effectively by enforcing strict spending limits and enhancing real-time visibility of available funds.

Integrating Budget Categories with Envelope Systems

Integrating budget categories with expense envelopes enhances cash flow control by assigning specific spending limits to each envelope based on predefined financial goals. This method ensures precise tracking of expenditures within distinct categories, promoting disciplined spending and preventing overspending. The combined approach leverages budget categories for strategic planning and envelopes for tactical execution, optimizing overall budget adherence.

Choosing the Right System for Personal Finances

Budget categories organize expenses by purpose, providing a broad overview of spending patterns, while expense envelopes allocate specific amounts of cash for each category to enforce strict cash flow control. Selecting the right system depends on your financial goals: budget categories suit digital tracking and flexibility, whereas envelopes promote disciplined cash usage and prevent overspending. An optimal personal finance strategy may combine both methods to balance detailed budgeting with hands-on cash management.

Common Mistakes in Budgeting and Envelope Use

Confusing budget categories with expense envelopes often leads to misallocated funds and poor cash flow control, as categories track spending goals while envelopes manage actual cash distribution. A common mistake is using envelopes without clear budget categories, which results in overspending or unused cash, undermining financial discipline. Effective cash flow control requires aligning precise budget categories with designated envelopes to ensure funds are available for intended expenses and prevent budget leaks.

Tips for Effective Cash Flow Control Using Both Methods

Using both budget categories and expense envelopes enhances cash flow control by clearly defining spending limits across different areas while physically or digitally allocating funds for discretionary expenses. Regularly track expenses by comparing actual spending within each budget category and envelope to identify overspending early and adjust accordingly. Implementing detailed classifications and consistent monitoring ensures improved financial discipline and prevents cash shortages.

Related Important Terms

Zero-Based Budgeting (ZBB)

Budget categories allocate funds broadly for specific spending areas, while expense envelopes assign precise cash limits to control discretionary spending in real time; Zero-Based Budgeting (ZBB) enhances cash flow control by requiring every expense envelope to be justified from zero each period, ensuring more accurate and disciplined financial management. This method prevents overspending by enforcing strict adherence to the cash limits of each expense envelope, promoting optimized budget allocation aligned with current financial priorities.

Digital Envelope System

The Digital Envelope System enhances cash flow control by allocating funds into specific Expense Envelopes tied directly to Budget Categories, ensuring precise spending limits and real-time tracking. This method minimizes overspending by enforcing pre-set budgets within each envelope, optimizing financial discipline and liquidity management.

Hyper-Granular Categorization

Budget categories provide broad financial classifications for overall spending analysis, while expense envelopes enable hyper-granular categorization by allocating specific cash amounts for precise cash flow control. This granular approach enhances tracking, limits overspending, and improves financial discipline by assigning exact funds to detailed spending areas.

Automated Sinking Funds

Automated sinking funds use expense envelopes to allocate cash for specific future expenses, ensuring precise cash flow control by setting aside money incrementally within each budget category. This method enhances financial discipline by linking budget categories directly to sinking funds, enabling seamless automation and preventing overspending.

Adaptive Spending Buckets

Budget categories organize expenses into predefined groups for tracking overall cash flow, while expense envelopes allocate specific cash amounts for controlled spending within each category. Adaptive Spending Buckets dynamically adjust envelope limits based on real-time income and spending patterns to optimize cash flow management and prevent overspending.

Dynamic Cash Flow Partitioning

Budget categories allocate funds based on planned spending goals, while expense envelopes enable dynamic cash flow partitioning by physically separating cash for specific expenses, enhancing real-time spending control. This method improves financial discipline and adaptability by limiting expenditures to available envelope funds, preventing overspending and ensuring balanced cash flow management.

Micro-Envelope Tracking

Budget categories organize overall spending into broad groups such as housing, groceries, and entertainment, while expense envelopes enable precise micro-envelope tracking by allocating specific cash amounts for subcategories to control daily cash flow. This granular approach helps monitor and adjust spending in real-time, preventing overspending and improving financial discipline within each budget category.

Category Drift Analysis

Budget categories provide a higher-level classification of expenses, while expense envelopes allocate specific cash amounts for spending, enabling precise control over cash flow. Category Drift Analysis tracks discrepancies between planned budget categories and actual spending within envelopes, identifying misallocations that can disrupt financial discipline.

Real-Time Envelope Reallocation

Budget categories provide a broad classification of expenses, while expense envelopes allocate specific cash amounts to subcategories for precise tracking. Real-time envelope reallocation enables immediate adjustment of funds between envelopes, enhancing cash flow control by preventing overspending and optimizing fund usage dynamically.

Subscription Envelope Tagging

Budget categories organize expenses by type or purpose, while expense envelopes physically allocate cash for specific spending needs, enhancing cash flow control by preventing overspending. Subscription envelope tagging specifically tracks recurring payments, allowing precise monitoring and optimization of subscription expenditures within the cash flow system.

Budget Category vs Expense Envelope for cash flow control. Infographic

moneydiff.com

moneydiff.com