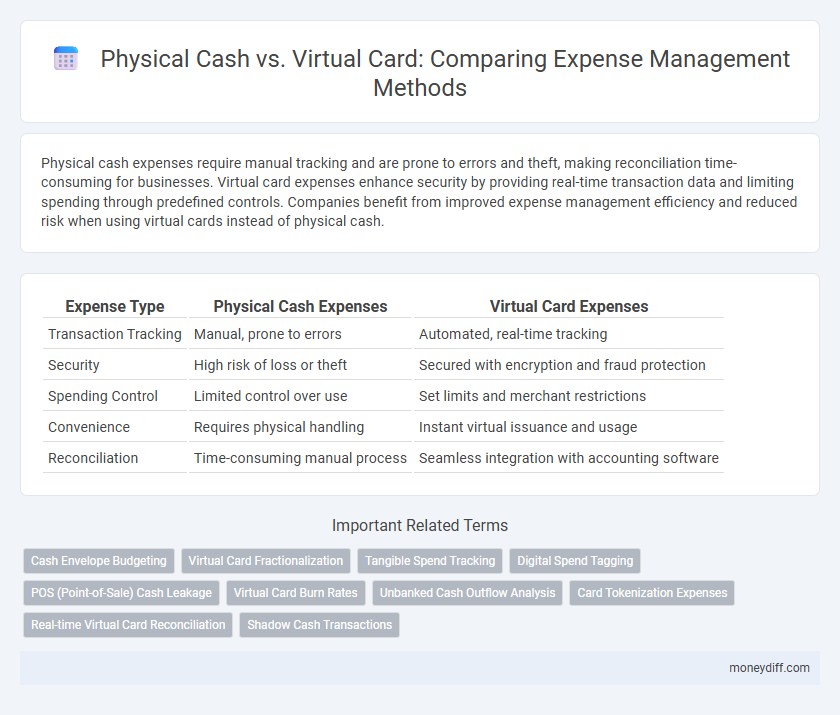

Physical cash expenses require manual tracking and are prone to errors and theft, making reconciliation time-consuming for businesses. Virtual card expenses enhance security by providing real-time transaction data and limiting spending through predefined controls. Companies benefit from improved expense management efficiency and reduced risk when using virtual cards instead of physical cash.

Table of Comparison

| Expense Type | Physical Cash Expenses | Virtual Card Expenses |

|---|---|---|

| Transaction Tracking | Manual, prone to errors | Automated, real-time tracking |

| Security | High risk of loss or theft | Secured with encryption and fraud protection |

| Spending Control | Limited control over use | Set limits and merchant restrictions |

| Convenience | Requires physical handling | Instant virtual issuance and usage |

| Reconciliation | Time-consuming manual process | Seamless integration with accounting software |

Understanding Physical Cash and Virtual Card Expenses

Physical cash expenses involve direct, tangible spending without digital tracking, often leading to challenges in real-time expense monitoring and reconciliation. Virtual card expenses provide enhanced control and security through digital platforms, enabling precise transaction tracking, automated categorization, and easier integration with expense management systems. Understanding the differences between these expense types is crucial for optimizing budget oversight and reducing risk in financial operations.

Key Differences Between Cash and Virtual Card Spending

Physical cash expenses require carrying and handling money, making it harder to track and manage spending accurately compared to virtual card expenses, which offer real-time digital transaction monitoring and automated record-keeping. Virtual cards enhance security by reducing the risk of theft or loss, while cash expenses are vulnerable to misplacement and misuse without easy audit trails. Businesses benefit from virtual card expenses through streamlined approvals and detailed reporting, whereas cash expenses often lack transparency and control.

Security Aspects: Cash vs Virtual Card Transactions

Physical cash expenses pose higher security risks due to the potential for theft, loss, and lack of transaction traceability. Virtual card expenses enhance security by offering encrypted transactions, real-time monitoring, and controlled spending limits, reducing fraud opportunities. Digital authentication and automatic record-keeping in virtual cards provide a more secure and transparent alternative to traditional cash handling.

Tracking and Recording Expenses: Manual vs Digital

Physical cash expenses require manual tracking and recording, often leading to errors and delayed reconciliation. Virtual card expenses enable automated tracking through integrated software, providing real-time expense monitoring and accurate digital records. Digital records from virtual cards streamline auditing and improve overall financial transparency.

Advantages of Using Physical Cash for Expenses

Physical cash expenses offer immediate transaction finality without reliance on digital networks, reducing the risk of technical failures or fraud associated with virtual card processing. Cash provides enhanced control over spending by limiting expenditures to available funds, which aids in better budgeting and prevents overspending. Additionally, physical cash is widely accepted in all types of merchants, including those without digital payment infrastructure, ensuring seamless and universal usability for various expense scenarios.

Benefits of Virtual Card Payments for Expense Management

Virtual card payments streamline expense management by offering enhanced security features such as dynamic CVV codes and spend controls, reducing fraud risk compared to physical cash expenses. They enable real-time transaction tracking and automated expense categorization, improving accuracy and efficiency in financial reporting. Virtual cards eliminate the need for cash handling, minimizing operational costs and simplifying reconciliation processes for businesses.

Challenges with Handling Cash Expenses

Physical cash expenses pose significant challenges due to difficulties in tracking and reconciling transactions accurately, often leading to errors and increased administrative workload. Cash payments lack real-time reporting and integration with digital expense management systems, making it harder to enforce company policies and prevent fraud. In contrast, virtual card expenses offer enhanced transparency, automated tracking, and streamlined reconciliation processes, reducing risks associated with manual cash handling.

Potential Risks of Relying on Virtual Cards

Virtual card expenses pose potential risks including limited acceptance at some vendors and increased vulnerability to cyber fraud due to reliance on digital systems. Physical cash expenses, while harder to trace, reduce electronic fraud risks but present challenges in accountability and record-keeping. Organizations must balance the convenience of virtual cards with their susceptibility to hacking and phishing attacks, which can lead to significant financial losses.

Which Option Is More Cost-Effective?

Physical cash expenses often incur hidden costs such as counting, handling, and security fees, making them less cost-effective compared to virtual card expenses, which offer streamlined transaction tracking and reduced fraud risks. Virtual cards provide precise spending controls and real-time monitoring, minimizing unnecessary expenditures and administrative overhead. Businesses utilizing virtual card expenses typically experience improved cost management and higher efficiency in expense reconciliation.

Choosing the Right Expense Method for Your Business

Physical cash expenses offer immediate liquidity and are ideal for small, on-the-spot purchases, but they lack detailed tracking and security features compared to virtual card expenses. Virtual card expenses enhance control with customizable spending limits, real-time transaction monitoring, and reduced fraud risk, making them suitable for businesses seeking streamlined expense management. Choosing the right expense method depends on your business size, transaction volume, and the need for transparency and audit readiness.

Related Important Terms

Cash Envelope Budgeting

Physical cash expenses offer tangible control and immediate visibility for categories within the cash envelope budgeting system, enhancing spending discipline by limiting funds to predefined envelopes. Virtual card expenses provide digital tracking and security but may lack the tactile enforcement of physical cash, potentially reducing the psychological impact of spending limits inherent in cash envelope budgeting.

Virtual Card Fractionalization

Virtual card fractionalization allows businesses to allocate specific budget portions to individual transactions, enhancing control and reducing overspending compared to physical cash expenses that lack detailed tracking capabilities. This method improves expense management by enabling real-time monitoring, automated reconciliation, and minimizing fraud risk through customizable spending limits on virtual cards.

Tangible Spend Tracking

Physical cash expenses provide direct, tangible receipts and easily traceable transaction records, enhancing accuracy in spend tracking. Virtual card expenses offer digital footprints with real-time monitoring capabilities, streamlining reconciliation and reducing the risk of cash mismanagement.

Digital Spend Tagging

Physical cash expenses lack automated categorization, making digital spend tagging inefficient and prone to errors, whereas virtual card expenses enable precise, real-time digital spend tagging through integrated software solutions, enhancing expense tracking accuracy and reporting. Leveraging virtual cards improves audit trails and reduces reconciliation time by automatically associating transactions with specific budgets, projects, or departments.

POS (Point-of-Sale) Cash Leakage

Physical cash expenses at POS points are prone to significant cash leakage due to untracked withdrawals and manual handling errors, often leading to financial discrepancies. Virtual card expenses offer enhanced tracking and controlled spending limits, reducing the risk of cash leakage and improving expense management accuracy at POS terminals.

Virtual Card Burn Rates

Virtual card expenses demonstrate lower burn rates compared to physical cash due to enhanced tracking, automated controls, and real-time spending limits, reducing unauthorized or excessive expenditures. These digital payment methods streamline expense management, providing detailed transaction data that increases transparency and budget adherence.

Unbanked Cash Outflow Analysis

Physical cash expenses present challenges in unbanked cash outflow analysis due to limited traceability and higher risks of misappropriation compared to virtual card expenses, which offer detailed transaction records and enhanced control. Analyzing unbanked cash outflows requires robust tracking mechanisms to mitigate risks associated with physical cash handling and improve financial transparency.

Card Tokenization Expenses

Card tokenization reduces fraud risks and enhances security in virtual card expenses by substituting sensitive card details with unique tokens during transactions. Physical cash expenses lack this encryption, increasing vulnerability to theft and limiting traceability in corporate spending.

Real-time Virtual Card Reconciliation

Virtual card expenses enable real-time reconciliation by automatically syncing transaction data with expense management systems, eliminating delays and reducing discrepancies common with physical cash expenses. Physical cash expenses lack instant tracking, leading to manual entry errors and slower reimbursement processes.

Shadow Cash Transactions

Physical cash expenses often lead to shadow cash transactions, as untracked withdrawals and informal reimbursements bypass formal accounting systems. Virtual card expenses reduce the risk of shadow cash by providing detailed transaction records and real-time monitoring, enhancing visibility and control over company spending.

Physical Cash Expenses vs Virtual Card Expenses for Expense Infographic

moneydiff.com

moneydiff.com