Organizing receipts through filing ensures physical copies are preserved for audit and tax purposes, offering immediate access without reliance on technology. Receipt scanning apps streamline expense documentation by converting paper receipts into digital format, enabling quick search, categorization, and integration with accounting software. Both methods serve vital roles, with filing providing tangible proof and scanning apps enhancing efficiency and accuracy in expense management.

Table of Comparison

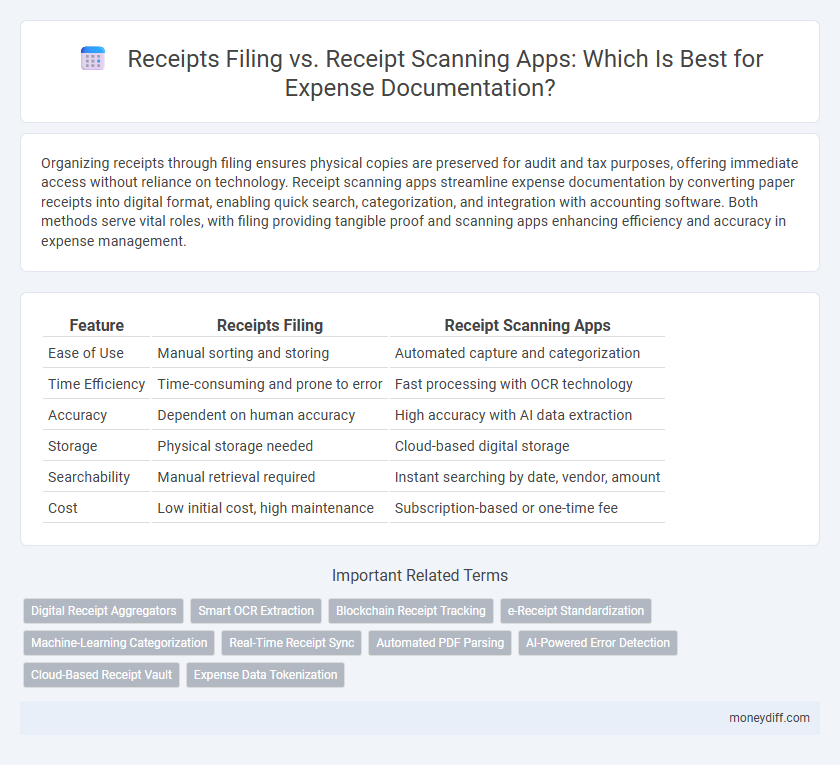

| Feature | Receipts Filing | Receipt Scanning Apps |

|---|---|---|

| Ease of Use | Manual sorting and storing | Automated capture and categorization |

| Time Efficiency | Time-consuming and prone to error | Fast processing with OCR technology |

| Accuracy | Dependent on human accuracy | High accuracy with AI data extraction |

| Storage | Physical storage needed | Cloud-based digital storage |

| Searchability | Manual retrieval required | Instant searching by date, vendor, amount |

| Cost | Low initial cost, high maintenance | Subscription-based or one-time fee |

Introduction: The Importance of Accurate Expense Documentation

Accurate expense documentation is essential for maintaining financial transparency, ensuring tax compliance, and simplifying reimbursement processes. Traditional receipts filing systems involve physical organization, which can be time-consuming and prone to loss or damage. Receipt scanning apps offer digital solutions that automatically capture, categorize, and store expense data, improving efficiency and reducing errors in financial record-keeping.

Traditional Receipts Filing: Overview and Process

Traditional receipts filing involves organizing physical paper receipts into folders or envelopes, sorted by date or expense category to maintain clear records for accounting and tax purposes. This manual process includes clipping receipts, labeling them accurately, and storing them securely to prevent loss or damage. While time-consuming, traditional filing ensures tangible proof of expenses and complies with audit requirements.

Receipt Scanning Apps: How They Work

Receipt scanning apps utilize optical character recognition (OCR) technology to automatically extract key expense data such as vendor names, dates, and amounts from photographed receipts. These apps streamline expense documentation by digitizing and categorizing receipts in real time, reducing manual entry errors and saving time. Integration with accounting software further enhances accuracy and simplifies expense reporting processes.

Comparing Organizational Efficiency: Filing vs. Scanning

Receipt filing requires manual sorting and physical storage, which can lead to time-consuming retrieval and increased risk of misplacement. Receipt scanning apps automate data capture, enabling instant digital organization, searchability, and integration with expense management systems. Scanning technology significantly enhances organizational efficiency by reducing administrative burden and improving accuracy in expense documentation.

Accessibility and Retrieval: Digital vs. Physical Receipts

Digital receipt scanning apps enhance accessibility by allowing instant access to expense documentation from any device with internet connectivity, facilitating quick retrieval through keyword search and categorization features. Physical receipt filing requires manual organization and often leads to misplaced documents, reducing efficiency during expense audits or reimbursements. Digital systems also offer cloud backup, ensuring secure and long-term storage compared to the risk of damage or loss inherent in paper receipts.

Security and Data Protection Considerations

Receipt scanning apps leverage advanced encryption protocols and secure cloud storage to protect sensitive financial data, reducing risks associated with physical receipt loss or damage. Manual receipts filing requires strict organizational controls and physical security measures to prevent unauthorized access, theft, or degradation of costly documents. Both methods demand compliance with data protection regulations such as GDPR and PCI DSS to ensure confidentiality and integrity of expense information.

Cost Implications: Manual Filing vs. Digital Scanning

Manual receipts filing incurs higher labor costs due to time-consuming sorting, organizing, and storage processes, often leading to increased expenses in office supplies and physical storage space. Receipt scanning apps reduce these costs by automating data extraction and categorization, minimizing human error and allowing faster retrieval, thus lowering administrative overhead. Digital scanning also enables real-time expense tracking and integration with accounting software, resulting in improved accuracy and cost efficiency for businesses managing expense documentation.

Suitability for Small Businesses and Individuals

Receipts filing offers a straightforward, low-cost method ideal for small businesses and individuals who handle a limited volume of expenses and prefer physical record-keeping. Receipt scanning apps provide enhanced efficiency through automated data extraction, making them suitable for busy users seeking to streamline expense documentation and reduce manual entry errors. Small businesses benefit from digital organization and faster retrieval, while individuals gain convenience and improved expense tracking.

Integration with Expense Tracking and Accounting Tools

Receipt scanning apps offer seamless integration with popular expense tracking and accounting tools such as QuickBooks, Expensify, and Xero, enabling automatic data synchronization and reducing manual entry errors. Traditional receipts filing lacks real-time connectivity, often requiring manual reconciliation and increasing the risk of lost or misplaced documents. Utilizing receipt scanning apps streamlines expense documentation workflows, enhances accuracy, and improves financial reporting efficiency.

Future Trends: The Evolution of Receipt Management

Receipt scanning apps are transforming expense documentation by automating data extraction and integration with accounting software, enhancing accuracy and efficiency. Future trends point toward AI-powered receipt management systems that can predict expense categorization and provide real-time analytics for better financial decision-making. As digital transformation accelerates, seamless cloud synchronization and blockchain-based receipt verification will become standard features to ensure security and transparency in expense management.

Related Important Terms

Digital Receipt Aggregators

Digital receipt aggregators streamline expense documentation by automatically capturing, categorizing, and storing receipts from various sources, eliminating the need for manual filing. These apps enhance accuracy, reduce administrative workload, and enable real-time expense tracking through secure cloud-based platforms.

Smart OCR Extraction

Smart OCR extraction in receipt scanning apps dramatically improves expense documentation accuracy by automatically capturing and categorizing data such as totals, dates, and vendor information from receipts. Unlike manual filing, these apps accelerate processing time, reduce human errors, and seamlessly integrate with accounting software for efficient expense management.

Blockchain Receipt Tracking

Blockchain receipt tracking enhances expense documentation by providing immutable, timestamped records that improve accuracy and reduce fraud in receipts filing and scanning apps. Integrating blockchain technology with receipt scanning apps ensures secure, transparent expense verification, streamlining audit processes and compliance.

e-Receipt Standardization

Receipt scanning apps enhance expense documentation by automatically extracting data and standardizing e-receipts to ensure consistent formatting and easy integration with accounting systems. Filing physical receipts remains prone to loss or damage, while digital solutions improve accuracy and streamline expense reporting through real-time synchronization and searchable databases.

Machine-Learning Categorization

Receipt scanning apps leverage machine-learning categorization to automatically identify and organize expenses by vendor, date, and category, significantly reducing manual entry errors and improving compliance in expense documentation. In contrast, traditional receipt filing relies on manual sorting and categorization, which is more time-consuming and prone to inaccuracies without the benefit of advanced AI-driven data extraction.

Real-Time Receipt Sync

Receipt scanning apps with real-time receipt sync enable instant capture and automatic uploading of expense data, greatly reducing manual filing errors and improving accuracy. This seamless integration streamlines expense documentation, ensuring that financial records are consistently up-to-date and easily accessible for audits or reporting.

Automated PDF Parsing

Automated PDF parsing in receipt scanning apps significantly enhances expense documentation accuracy by extracting key data such as merchant names, dates, and amounts directly from digital receipts, reducing manual entry errors. Unlike traditional receipts filing, these apps streamline record-keeping processes and enable faster expense reporting through intelligent data capture and integration with accounting software.

AI-Powered Error Detection

AI-powered receipt scanning apps significantly reduce errors in expense documentation by automatically extracting accurate data and flagging inconsistencies that manual receipts filing often overlooks. This technology enhances compliance and accelerates reimbursement processes, making digital scanning solutions superior to traditional paper filing methods.

Cloud-Based Receipt Vault

Cloud-based receipt vaults centralize expense documentation by securely storing digital copies of receipts accessible from any device, enhancing organization and reducing paper clutter. Receipt scanning apps integrate seamlessly with these vaults, automatically extracting and categorizing data to streamline expense tracking and reporting.

Expense Data Tokenization

Receipt scanning apps utilize advanced expense data tokenization techniques to convert physical receipt information into secure, structured digital formats, enhancing accuracy and data privacy. This process streamlines expense documentation by minimizing manual entry errors and facilitating automated expense categorization and reporting.

Receipts Filing vs Receipt Scanning Apps for expense documentation. Infographic

moneydiff.com

moneydiff.com