Spending limits establish fixed caps on expenditures, helping individuals control their outflows by setting clear boundaries. Zero-based budgeting requires every dollar to be assigned a purpose, promoting disciplined allocation of resources based on actual needs rather than past habits. This method fosters careful financial planning by ensuring all expenses are justified, reducing unnecessary spending and enhancing budgetary control.

Table of Comparison

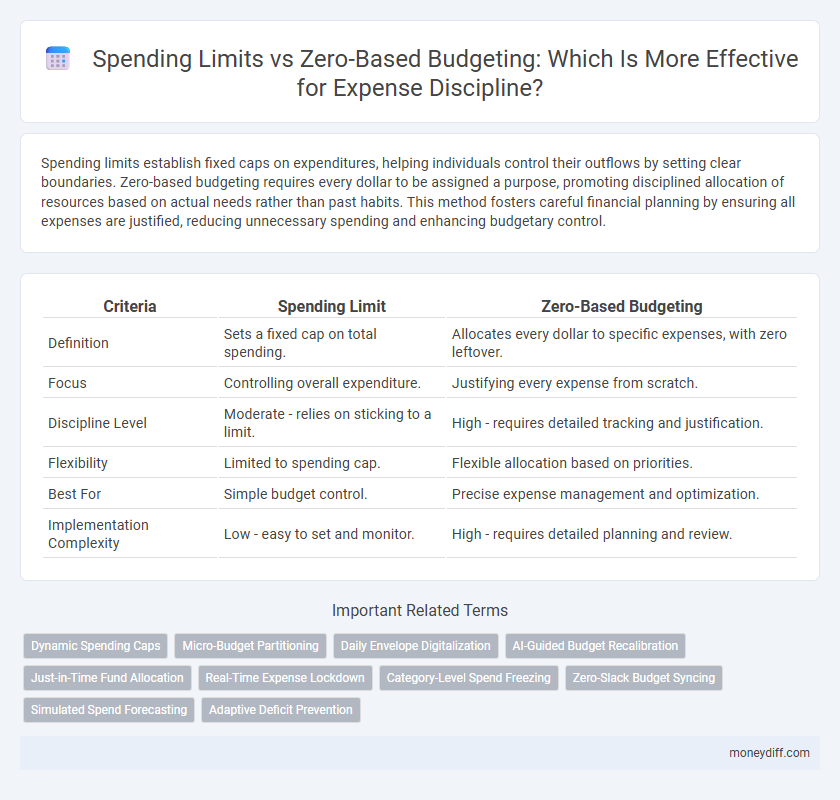

| Criteria | Spending Limit | Zero-Based Budgeting |

|---|---|---|

| Definition | Sets a fixed cap on total spending. | Allocates every dollar to specific expenses, with zero leftover. |

| Focus | Controlling overall expenditure. | Justifying every expense from scratch. |

| Discipline Level | Moderate - relies on sticking to a limit. | High - requires detailed tracking and justification. |

| Flexibility | Limited to spending cap. | Flexible allocation based on priorities. |

| Best For | Simple budget control. | Precise expense management and optimization. |

| Implementation Complexity | Low - easy to set and monitor. | High - requires detailed planning and review. |

Comparing Spending Limits and Zero-Based Budgeting

Spending limits set predefined caps on expenses to control overall budget adherence, providing clear boundaries to prevent overspending. Zero-based budgeting requires justifying every expense from scratch each period, promoting detailed scrutiny and eliminating unnecessary costs. Comparing the two, zero-based budgeting offers greater precision and accountability, while spending limits provide straightforward, easy-to-monitor financial discipline.

Core Principles: Spending Limit Approach

Spending Limit Approach enforces strict caps on expenditures within predefined categories, promoting disciplined financial management by preventing overspending. It emphasizes allocation limits based on income, ensuring expenses do not exceed set thresholds and maintaining budget control. This method contrasts with Zero-Based Budgeting, which requires justification of each expense from zero, focusing instead on maintaining spending boundaries to encourage consistent fiscal responsibility.

How Zero-Based Budgeting Works

Zero-Based Budgeting enforces discipline by requiring every expense to be justified from scratch each budgeting period, ensuring all spending aligns with current priorities. Unlike spending limits that cap expenditures without scrutinizing their necessity, zero-based budgeting evaluates each cost's value, eliminating unnecessary expenses. This method promotes strategic allocation of resources, fostering financial control and minimizing waste.

Benefits of Setting a Spending Limit

Setting a spending limit enforces financial discipline by capping expenditures within a clear, manageable boundary, which helps prevent overspending and promotes savings. Unlike zero-based budgeting that requires detailed allocation of every dollar, spending limits simplify budget management by focusing on overall expenditure control. This approach enhances awareness of spending habits and encourages mindful financial decisions, leading to improved cash flow stability.

Advantages of Zero-Based Budgeting for Discipline

Zero-Based Budgeting enforces discipline by requiring every expense to be justified for each new period, eliminating unnecessary spending often carried over in traditional budgets with preset spending limits. This method promotes meticulous scrutiny of all expenditures, encouraging accountability and financial efficiency. It helps organizations allocate resources based on actual needs rather than relying on historical spending patterns, reducing waste and enhancing cost control.

Common Challenges with Each Method

Spending limits often face challenges like rigid constraints that can lead to unmet needs or unnecessary sacrifices, reducing financial flexibility. Zero-based budgeting demands precise tracking of every expense, which can be time-consuming and overwhelming, causing difficulties in maintaining long-term discipline. Both methods require consistent monitoring and adaptation to avoid overspending or underfunding essential categories.

Choosing the Right Strategy for Your Lifestyle

Spending limits set a fixed cap on expenses, promoting financial discipline by preventing overspending and ensuring consistent savings. Zero-based budgeting allocates every dollar a purpose, enhancing control and flexibility by linking spending directly to income and priorities. Choosing the right strategy depends on your lifestyle's complexity and cash flow variability, with spending limits suiting those seeking simplicity and zero-based budgeting benefitting individuals requiring precise expense management.

Impact on Savings and Financial Goals

Spending limits cap expenses to maintain control, but zero-based budgeting allocates every dollar intentionally, enhancing precision in tracking and optimizing savings. Zero-based budgeting drives disciplined spending by requiring justification for each expense, directly supporting financial goals through meticulous allocation. This method significantly increases the impact on savings by minimizing waste and ensuring alignment with long-term objectives.

Tools and Apps for Effective Implementation

Spending limit tools and apps help enforce discipline by setting predefined caps on expenditure categories, enabling real-time tracking and alert notifications to prevent overspending. Zero-based budgeting applications facilitate precise allocation of every dollar by requiring users to assign expenses to specific categories until the budget reaches zero, promoting accountability and reducing waste. Popular tools like YNAB (You Need A Budget) and Mint integrate both methods to enhance financial control through automated tracking, customized budgeting, and insightful reporting features.

Final Thoughts: Which Budgeting Method Wins?

Spending Limit imposes a fixed cap on expenses, ensuring disciplined control by preventing overspending, while Zero-Based Budgeting demands detailed allocation of every dollar, promoting thorough financial accountability. Both methods enhance budget discipline, but Zero-Based Budgeting offers greater precision and alignment with financial goals by requiring justification for all expenditures. Choosing the ideal approach depends on the organization's size, complexity, and need for granular expense management, with Zero-Based Budgeting favored for strategic financial discipline.

Related Important Terms

Dynamic Spending Caps

Dynamic spending caps adjust monthly based on zero-based budgeting principles, ensuring every dollar is allocated purposefully to maintain strict financial discipline. This approach contrasts with fixed spending limits by providing real-time flexibility that aligns expenditures directly with income and priorities.

Micro-Budget Partitioning

Spending limits set predefined caps on expenses to control overall outflow, while zero-based budgeting requires every expense to be justified from scratch, promoting strict discipline in resource allocation. Micro-budget partitioning enhances this discipline by breaking down the budget into small, detailed segments, ensuring precise monitoring and minimizing unnecessary spending.

Daily Envelope Digitalization

Spending limits set clear boundaries on expenses to prevent overspending, while zero-based budgeting requires allocating every dollar to specific categories, promoting strict financial discipline. The digitalization of daily envelopes enhances this process by automating expense tracking and ensuring adherence to budget constraints in real time.

AI-Guided Budget Recalibration

Spending limits establish fixed caps that control expenses and prevent overspending, while zero-based budgeting requires detailed justification for every dollar allocated, promoting rigorous financial discipline. AI-guided budget recalibration dynamically analyzes spending patterns and adjusts limits in real-time, optimizing resource allocation and enhancing precision in maintaining budget discipline.

Just-in-Time Fund Allocation

Spending limits establish predefined caps to control expenses, while zero-based budgeting requires justifying all costs from scratch, promoting meticulous allocation of funds only when necessary. Just-in-time fund allocation in zero-based budgeting enhances financial discipline by releasing resources precisely when needed, reducing waste and improving cash flow management.

Real-Time Expense Lockdown

Spending Limit enforces a strict cap on expenses within a fixed budget to prevent overspending, while Zero-Based Budgeting requires justifying every expense from scratch for precise financial discipline. Real-Time Expense Lockdown enhances control by immediately halting unauthorized transactions, ensuring adherence to either method for optimized spending discipline.

Category-Level Spend Freezing

Spending limits set predefined caps on expenses within each category to prevent overspending, promoting disciplined financial control. Zero-based budgeting enforces strict category-level spend freezing by requiring justification for every dollar allocated, ensuring precise allocation and eliminating unnecessary expenditures.

Zero-Slack Budget Syncing

Zero-based budgeting enforces strict spending limits by requiring all expenses to be justified for each new period, eliminating any leftover slack in the budget. Zero-slack budget syncing aligns all financial activities precisely with these stringent limits, ensuring maximum discipline and reducing overspending risks.

Simulated Spend Forecasting

Spending limits provide a fixed cap based on historical expenses, enforcing discipline by restricting total outflows, while zero-based budgeting demands justification for every expense from scratch, enhancing precision in simulated spend forecasting. Simulated spend forecasting leverages zero-based budgeting's detailed expense analysis to predict future cash flows with higher accuracy, improving financial control and resource allocation.

Adaptive Deficit Prevention

Spending limit sets a fixed cap on expenses to maintain financial discipline, while zero-based budgeting allocates every dollar purposefully to prevent overspending. Adaptive Deficit Prevention emphasizes dynamic adjustments in spending limits and budgeting allocations based on real-time financial data to enhance control over cash flow and avoid deficits.

Spending Limit vs Zero-Based Budgeting for discipline. Infographic

moneydiff.com

moneydiff.com