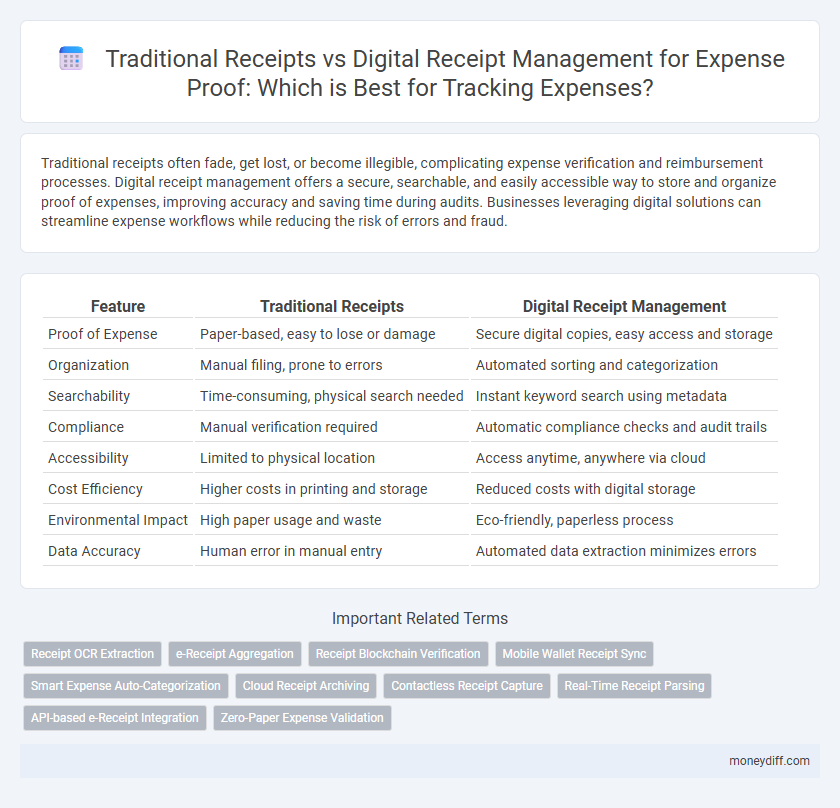

Traditional receipts often fade, get lost, or become illegible, complicating expense verification and reimbursement processes. Digital receipt management offers a secure, searchable, and easily accessible way to store and organize proof of expenses, improving accuracy and saving time during audits. Businesses leveraging digital solutions can streamline expense workflows while reducing the risk of errors and fraud.

Table of Comparison

| Feature | Traditional Receipts | Digital Receipt Management |

|---|---|---|

| Proof of Expense | Paper-based, easy to lose or damage | Secure digital copies, easy access and storage |

| Organization | Manual filing, prone to errors | Automated sorting and categorization |

| Searchability | Time-consuming, physical search needed | Instant keyword search using metadata |

| Compliance | Manual verification required | Automatic compliance checks and audit trails |

| Accessibility | Limited to physical location | Access anytime, anywhere via cloud |

| Cost Efficiency | Higher costs in printing and storage | Reduced costs with digital storage |

| Environmental Impact | High paper usage and waste | Eco-friendly, paperless process |

| Data Accuracy | Human error in manual entry | Automated data extraction minimizes errors |

Introduction to Receipt Management in Expense Tracking

Traditional receipts, often printed on paper, serve as physical proof of expenses but are prone to loss, damage, and disorganization, complicating accurate expense tracking. Digital receipt management utilizes electronic formats to store, categorize, and retrieve receipts efficiently, enhancing accuracy and reducing manual errors. Implementing digital systems enables real-time expense monitoring and seamless integration with accounting software, streamlining overall expense proof management.

Understanding Traditional Receipts: Paper Trails and Processes

Traditional receipts create a tangible paper trail essential for verifying expenses and maintaining financial records. These physical documents require manual organization, filing, and are prone to loss or damage, increasing the risk of errors in expense tracking. Understanding the limitations of traditional paper-based processes highlights the need for more efficient, error-reducing digital receipt management solutions.

Digital Receipts Explained: Features and Functionality

Digital receipts enhance expense management by automatically capturing transaction details, reducing paper clutter and the risk of lost proof. Features include instant email delivery, cloud storage, and integration with accounting software for seamless expense tracking. Advanced functionalities such as keyword search, categorization, and real-time expense reporting improve accuracy and efficiency in financial record-keeping.

Efficiency Comparison: Traditional vs Digital Receipt Handling

Traditional receipt management demands manual sorting, physical storage, and increased risk of loss or damage, significantly slowing down expense reporting processes. Digital receipt handling automates capture, categorization, and storage through cloud-based platforms, enhancing accuracy and reducing processing time by up to 50%. Companies adopting digital solutions experience improved expense tracking efficiency, streamlined audits, and faster reimbursement cycles.

Accuracy and Error Reduction in Receipt Management

Digital receipt management significantly improves accuracy by automating data capture through OCR technology, reducing manual entry errors common with traditional paper receipts. Unlike traditional receipts prone to loss or damage, digital systems provide secure, centralized storage, enhancing proof of expense reliability and audit readiness. Advanced analytics in digital platforms also identify discrepancies early, minimizing costly mistakes in expense reporting and reimbursement processes.

Security and Privacy Concerns for Expense Receipts

Traditional receipts are vulnerable to loss, damage, and unauthorized access, increasing risks to sensitive financial information. Digital receipt management systems employ encryption and secure cloud storage to protect expense data from cyber threats and unauthorized viewing. Enhanced privacy controls in digital solutions ensure that only authorized personnel can access receipt information, reducing the risk of identity theft and fraud.

Storage and Accessibility: Paper vs Digital Formats

Traditional receipts require physical storage space, making organization and retrieval time-consuming and prone to loss or damage. Digital receipt management offers cloud-based storage solutions that ensure secure, centralized access and easy retrieval from any device. The digital format enhances accessibility by enabling quick searches, categorization, and automatic backup, significantly reducing the risk of missing or misplaced expense proof.

Cost Implications: Managing Receipts the Old and New Way

Traditional receipt management incurs higher costs due to physical storage, printing supplies, and time spent on manual organization and retrieval. Digital receipt management reduces expenses by automating data capture, minimizing paper use, and streamlining expense reporting processes. Companies adopting digital solutions report up to 30% savings in processing costs and faster reimbursement cycles, enhancing overall financial efficiency.

Environmental Impact: Paper Receipts vs Digital Alternatives

Traditional paper receipts contribute significantly to deforestation, waste generation, and carbon emissions due to their production, printing, and disposal processes. Digital receipt management drastically reduces environmental impact by minimizing paper usage and cutting down the resources required for storage and physical transportation. Embracing digital alternatives supports sustainability efforts and promotes eco-friendly expense proof methods.

Choosing the Right Receipt Management Solution for Your Needs

Traditional receipts often get lost or damaged, complicating expense tracking and reimbursement processes. Digital receipt management solutions provide secure storage, easy retrieval, and automated organization, enhancing accuracy and efficiency in expense reporting. Selecting the right system depends on factors like business size, integration capabilities, and budget constraints to ensure seamless proof of expenses and compliance.

Related Important Terms

Receipt OCR Extraction

Traditional receipts often suffer from fading ink and physical damage, complicating expense proof and manual data entry. Digital receipt management leverages Receipt OCR extraction technology to automatically capture, verify, and organize expense details, enhancing accuracy and speeding up reimbursement processes.

e-Receipt Aggregation

E-receipt aggregation streamlines expense proof by consolidating digital receipts from multiple sources into a centralized platform, reducing the risk of loss and enhancing record accuracy compared to traditional paper receipts. Digital receipt management offers automated tracking, faster expense reporting, and improved compliance with audit requirements.

Receipt Blockchain Verification

Traditional receipts are prone to loss, fraud, and manual errors, making expense proof verification cumbersome, while digital receipt management leveraging blockchain offers immutable, transparent, and tamper-proof verification, enhancing accuracy and trust in expense reporting. Blockchain-based receipt verification ensures each transaction is securely recorded with timestamps and cryptographic hashes, facilitating seamless audit trails and reducing the risk of fraudulent expense claims.

Mobile Wallet Receipt Sync

Mobile Wallet Receipt Sync enables seamless integration of digital receipts into expense management systems, reducing the risk of lost or damaged paper receipts and enhancing accuracy in expense tracking. This technology automates expense proof collection by syncing purchase data directly from mobile wallets, streamlining reimbursement processes and improving audit compliance.

Smart Expense Auto-Categorization

Traditional receipts often get lost or damaged, complicating expense tracking, whereas digital receipt management leverages smart expense auto-categorization to instantly organize and classify expenses based on vendor, date, and category. This technology enhances accuracy, reduces manual entry errors, and streamlines expense reporting for faster reimbursements.

Cloud Receipt Archiving

Cloud receipt archiving enhances expense proof management by securely storing digital receipts, ensuring easy access, organized data retrieval, and compliance with tax regulations. Traditional receipts risk loss, damage, and manual sorting, whereas cloud solutions automate expense tracking, reduce errors, and support real-time auditing for improved financial reporting.

Contactless Receipt Capture

Contactless receipt capture in digital receipt management significantly reduces errors and saves time compared to traditional paper receipts by automatically scanning and storing expense proofs via mobile devices or email. This method enhances data accuracy, improves expense tracking efficiency, and supports seamless integration with accounting software for audit readiness.

Real-Time Receipt Parsing

Real-time receipt parsing in digital receipt management automates data extraction, ensuring immediate and accurate expense tracking compared to traditional paper receipts that require manual entry and are prone to errors. This technology enhances compliance and streamlines reimbursement processes by converting receipt images into structured data instantly.

API-based e-Receipt Integration

API-based e-Receipt Integration streamlines expense proof by automating the capture, verification, and storage of digital receipts, reducing human error and saving time compared to traditional paper receipts. This technology ensures real-time expense tracking and seamless compatibility with accounting software, enhancing accuracy and compliance in expense management.

Zero-Paper Expense Validation

Traditional receipts often get lost or damaged, complicating expense validation, while digital receipt management enables zero-paper expense proof by securely storing and easily accessing electronic records, enhancing accuracy and streamlining audits. Automated data extraction and cloud-based platforms reduce manual errors and accelerate reimbursement processes, ensuring compliance and transparency in expense reporting.

Traditional receipts vs Digital receipt management for expense proof. Infographic

moneydiff.com

moneydiff.com