Traditional expense categories group spending into broad areas like housing, groceries, and transportation, providing a general overview of cash flow. Hyper-personalized spending categories use advanced data analysis to tailor classifications based on individual habits and preferences, offering deeper insights into specific spending patterns. This approach enhances money management by enabling more accurate budgeting and targeted savings strategies.

Table of Comparison

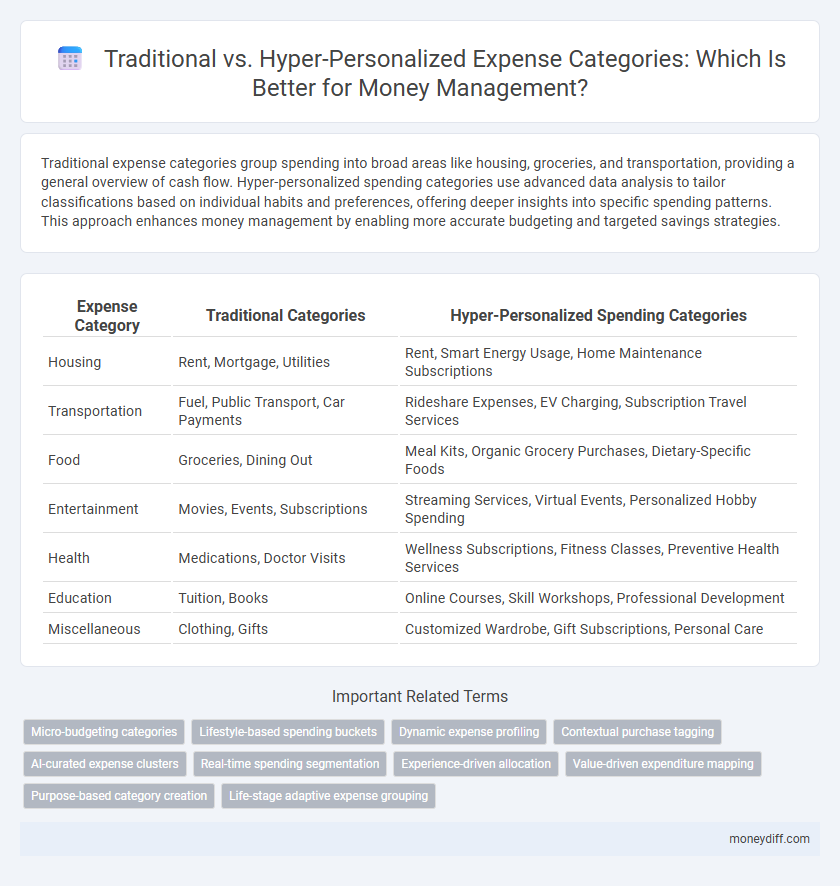

| Expense Category | Traditional Categories | Hyper-Personalized Spending Categories |

|---|---|---|

| Housing | Rent, Mortgage, Utilities | Rent, Smart Energy Usage, Home Maintenance Subscriptions |

| Transportation | Fuel, Public Transport, Car Payments | Rideshare Expenses, EV Charging, Subscription Travel Services |

| Food | Groceries, Dining Out | Meal Kits, Organic Grocery Purchases, Dietary-Specific Foods |

| Entertainment | Movies, Events, Subscriptions | Streaming Services, Virtual Events, Personalized Hobby Spending |

| Health | Medications, Doctor Visits | Wellness Subscriptions, Fitness Classes, Preventive Health Services |

| Education | Tuition, Books | Online Courses, Skill Workshops, Professional Development |

| Miscellaneous | Clothing, Gifts | Customized Wardrobe, Gift Subscriptions, Personal Care |

Understanding Expense Categories: Traditional vs Hyper-personalized

Traditional expense categories group spending into broad segments such as housing, transportation, and groceries, providing a general overview of financial habits. Hyper-personalized spending categories utilize data-driven insights and AI to classify expenses based on individual behavior, lifestyle, and preferences, enabling more precise budget management. This tailored approach enhances money management by offering actionable insights aligned with unique spending patterns.

The Evolution of Money Management Strategies

Traditional expense categories such as housing, utilities, groceries, and transportation have long structured personal budgeting frameworks. Hyper-personalized spending categories leverage AI and data analytics to tailor expense tracking to individual habits, enabling more precise financial insights and optimizing cash flow management. This evolution in money management strategies reflects a shift from broad expense buckets to dynamic, behavior-driven categories that enhance budgeting accuracy and financial decision-making.

Traditional Expense Categories: Pros and Cons

Traditional expense categories like housing, transportation, and food provide a straightforward framework for budgeting that simplifies tracking and financial clarity. However, their broad classifications often overlook individual spending nuances, limiting personalized insights and the ability to address unique financial behaviors. This lack of granularity can result in less effective money management compared to hyper-personalized spending categories.

Hyper-personalized Spending Categories: A Modern Approach

Hyper-personalized spending categories leverage data analytics and AI to tailor expense tracking according to individual behavior and preferences, allowing for more accurate budgeting and financial insights. Unlike traditional categories such as "groceries" or "transportation," hyper-personalized categories dynamically adapt to unique spending patterns, improving money management efficiency. This modern approach enhances financial decision-making by providing granular visibility into niche or evolving expense areas that generic classifications often overlook.

Comparing Flexibility in Expense Tracking

Traditional expense categories provide standardized classifications such as housing, transportation, and groceries, which simplify budgeting but lack adaptability to individual spending habits. Hyper-personalized spending categories leverage real-time data and machine learning to create dynamic, customized labels aligned with unique financial behaviors and goals, enhancing precision in tracking. This flexibility allows for more granular insight into specific purchases and improved decision-making tailored to personal financial patterns.

Impact on Financial Awareness and Control

Traditional expense categories offer a broad overview of spending but often lack the nuance needed for precise financial awareness and control. Hyper-personalized spending categories enable individuals to track expenses with greater specificity, improving budget accuracy and highlighting unique spending patterns. This tailored approach enhances financial decision-making by providing actionable insights that conventional categories may overlook.

Customization: Meeting Individual Financial Goals

Traditional expense categories offer broad classifications like housing, groceries, and transportation, which may not capture nuanced spending habits. Hyper-personalized spending categories utilize data analytics and AI to create tailored segments that align precisely with individual financial goals and lifestyle patterns. This customization enhances budgeting accuracy and empowers better financial decision-making by reflecting unique spending behaviors.

Technology’s Role in Hyper-personalized Money Management

Technology's role in hyper-personalized money management involves leveraging artificial intelligence and machine learning algorithms to analyze individual spending patterns with exceptional precision. This enables dynamic categorization of expenses beyond traditional fixed categories such as groceries or utilities, tailoring insights to personal behaviors and goals. Advanced financial apps integrate real-time data streams to provide customized budgeting advice, predictive cash flow analysis, and personalized alerts, transforming how users control their finances.

Challenges and Pitfalls of Hyper-personalized Categories

Hyper-personalized spending categories often lead to inconsistent classification and confusion due to overly granular or overlapping labels, making it difficult to track overall financial health. This complexity can result in fragmented expense reports that hinder accurate budgeting and forecasting. Traditional expense categories provide a standardized framework that ensures clarity and comparability across reporting periods, avoiding the pitfalls of hyper-customization.

Choosing the Right Expense Categorization for You

Selecting the right expense categorization involves comparing traditional expense categories, such as housing, utilities, and groceries, with hyper-personalized spending categories tailored to individual habits and goals. Hyper-personalized categories leverage data analytics and AI to provide detailed insights into unique spending patterns, enabling more effective budgeting and money management. Users benefit from increased accuracy in tracking expenses, leading to optimized financial decision-making and improved control over personal finances.

Related Important Terms

Micro-budgeting categories

Traditional expense categories group spending into broad segments like housing, transportation, and food, often overlooking individual nuances in spending behavior. Hyper-personalized spending categories enable micro-budgeting by breaking down expenses into highly specific, context-driven segments such as daily coffee purchases, subscription services, or hobby-related costs, allowing precise tracking and optimized financial management.

Lifestyle-based spending buckets

Traditional expense categories group transactions into broad labels like groceries, utilities, and transportation, often overlooking individual lifestyle preferences. Hyper-personalized spending categories tailor expense tracking to unique lifestyle choices such as fitness, travel habits, or dining preferences, enabling more accurate budgeting and money management.

Dynamic expense profiling

Dynamic expense profiling revolutionizes money management by shifting from static traditional expense categories like rent or groceries to hyper-personalized spending categories based on individual habits and lifestyle patterns. This adaptive approach enhances budget accuracy and financial insights by continuously analyzing transaction data to create tailored categories such as "weekend dining" or "health and wellness subscriptions.

Contextual purchase tagging

Traditional expense categories like groceries, utilities, and entertainment offer broad classifications, whereas hyper-personalized spending categories leverage contextual purchase tagging to analyze transaction data with greater specificity such as meal types, frequent brands, or event-related shopping. This advanced tagging enhances money management by providing users with tailored insights and precise budget tracking based on real-time purchase contexts.

AI-curated expense clusters

AI-curated expense clusters enable hyper-personalized spending categories by analyzing transaction patterns and financial behaviors beyond traditional fixed categories like groceries or utilities. This dynamic categorization improves money management accuracy and relevance, allowing users to track nuanced spending habits tailored to their unique financial lifestyle.

Real-time spending segmentation

Real-time spending segmentation enables hyper-personalized categories that adapt instantly to individual habits and lifestyle changes, offering more precise insights than traditional fixed expense categories. This dynamic approach improves budgeting accuracy and financial decision-making by reflecting actual spending patterns as they occur.

Experience-driven allocation

Hyper-personalized spending categories leverage user behavior and preferences to create experience-driven allocation that enhances budget accuracy and financial awareness. Traditional expense categories often overlook individual lifestyle nuances, while hyper-personalized models adapt dynamically to unique spending patterns, optimizing money management.

Value-driven expenditure mapping

Traditional expense categories group spending into fixed segments like housing, food, and transportation, often overlooking individual priorities and nuanced financial behaviors. Hyper-personalized spending categories utilize advanced data analytics and AI to map expenditures according to personal values and lifestyle goals, enabling more precise budgeting and value-driven financial decision-making.

Purpose-based category creation

Purpose-based category creation in hyper-personalized spending systems tailors expense tracking to individual financial goals and habits, enhancing budgeting accuracy and user engagement. Traditional expense categories, often broad and generic, lack this specificity, limiting their effectiveness in guiding personal money management strategies.

Life-stage adaptive expense grouping

Traditional expense categories often group spending by generic labels such as housing, food, and transportation, which may overlook individual financial priorities and life stages. Hyper-personalized spending categories adapt dynamically to life-stage changes like marriage, parenthood, or retirement, enabling more accurate budgeting and targeted money management strategies.

Traditional expense categories vs Hyper-personalized spending categories for money management. Infographic

moneydiff.com

moneydiff.com