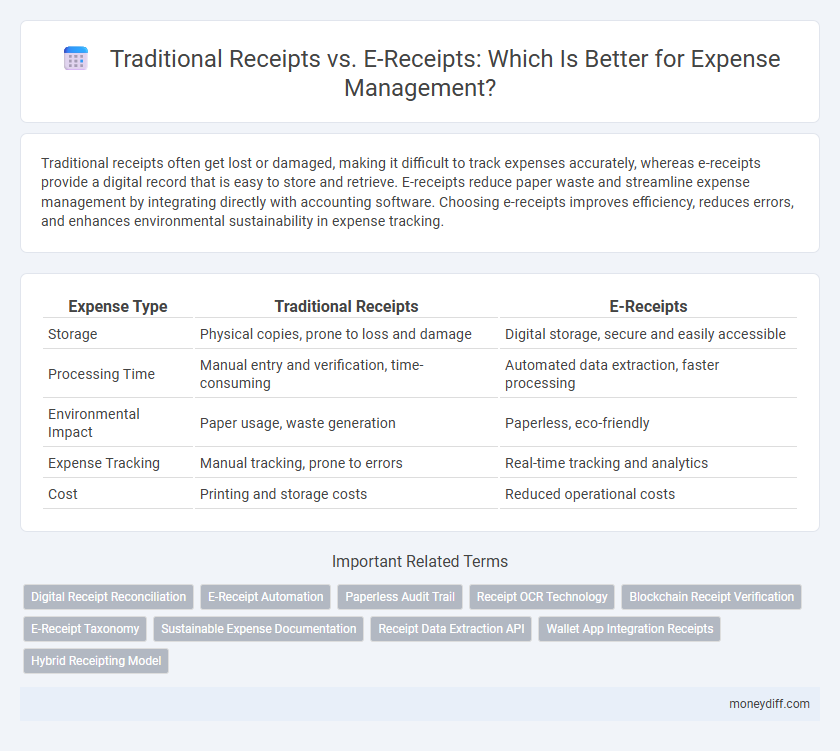

Traditional receipts often get lost or damaged, making it difficult to track expenses accurately, whereas e-receipts provide a digital record that is easy to store and retrieve. E-receipts reduce paper waste and streamline expense management by integrating directly with accounting software. Choosing e-receipts improves efficiency, reduces errors, and enhances environmental sustainability in expense tracking.

Table of Comparison

| Expense Type | Traditional Receipts | E-Receipts |

|---|---|---|

| Storage | Physical copies, prone to loss and damage | Digital storage, secure and easily accessible |

| Processing Time | Manual entry and verification, time-consuming | Automated data extraction, faster processing |

| Environmental Impact | Paper usage, waste generation | Paperless, eco-friendly |

| Expense Tracking | Manual tracking, prone to errors | Real-time tracking and analytics |

| Cost | Printing and storage costs | Reduced operational costs |

Introduction to Receipts in Expense Management

Traditional receipts, often printed on paper, serve as physical proof of transactions, playing a crucial role in expense management by documenting purchases for reimbursement and auditing purposes. E-receipts, digital versions sent via email or apps, enhance efficiency through easy storage, searchability, and integration with expense management software. Both types ensure accurate tracking and validation of expenses, but e-receipts offer scalability and environmental benefits that align with modern financial practices.

Understanding Traditional Paper Receipts

Traditional paper receipts are physical proofs of purchase often printed on thermal or regular paper, essential for documenting business expenses and tax purposes. These receipts can be prone to fading, loss, and damage, making expense tracking and reimbursement processes challenging. Despite these limitations, paper receipts remain a widely accepted method for record-keeping in many industries.

What Are E-Receipts?

E-receipts are digital versions of traditional paper receipts, generated and delivered electronically via email or apps, offering a convenient and eco-friendly way to track expenses. They enable automatic data capture, reducing manual entry errors and streamlining expense reporting for individuals and businesses. Integration with accounting software enhances real-time expense management, improving accuracy and organizational efficiency.

Efficiency: Comparing Receipt Types

E-receipts significantly enhance expense tracking efficiency by enabling instant digital storage and retrieval, reducing time spent on manual entry and organization. Traditional receipts often lead to lost or damaged paper records, resulting in delays during reimbursement and auditing processes. Digital formats support automated expense reporting systems, streamlining approval workflows and improving accuracy in financial management.

Storage and Organization Benefits

Traditional receipts require physical storage, which can lead to clutter and increased risk of loss or damage over time. E-receipts offer streamlined digital organization, enabling easy categorization, quick retrieval, and secure cloud storage that enhances long-term record keeping. Businesses leveraging e-receipts benefit from improved expense tracking accuracy and efficient auditing processes due to centralized data management.

Accuracy and Error Reduction

Traditional receipts often suffer from handwriting errors, fading ink, and physical damage, leading to inaccurate expense records and increased risk of audit discrepancies. E-receipts enhance accuracy by capturing detailed, digital transaction data instantly, enabling automated expense categorization and minimizing human input errors. The integration of e-receipts with expense management software significantly reduces errors and streamlines reconciliation processes, ensuring precise financial reporting.

Environmental Impact: Paper vs. Digital

Traditional receipts generate substantial paper waste, contributing to deforestation and increased landfill volume, with billions of paper receipts discarded annually worldwide. E-receipts minimize environmental impact by reducing paper consumption and associated carbon emissions from production and transportation processes. Digital storage of receipts promotes resource efficiency and supports sustainable business practices by lowering the carbon footprint linked to physical document handling.

Security and Data Privacy Considerations

Traditional receipts pose risks of physical loss or damage, exposing sensitive transaction details to potential misuse. E-receipts enhance security through encryption and secure digital storage, reducing unauthorized access to personal and financial data. Implementing e-receipts supports compliance with data privacy regulations such as GDPR and CCPA, ensuring better protection of consumer information.

Integration with Expense Tracking Tools

Traditional receipts often require manual data entry into expense tracking tools, increasing the risk of errors and time consumption. E-receipts seamlessly integrate with digital expense management systems, enabling automatic data capture and real-time synchronization. This integration streamlines expense reporting and improves accuracy by eliminating paper handling and manual transcription.

Choosing the Right Receipt Method for Your Business

Traditional receipts offer tangible proof of purchase and are widely accepted for tax documentation but can be easily lost or damaged, complicating expense tracking. E-receipts provide digital records that streamline expense management, improve organization, and integrate seamlessly with accounting software, enhancing accuracy and efficiency. Selecting the right receipt method depends on your business's scale, technological capabilities, and preference for accessibility versus physical documentation.

Related Important Terms

Digital Receipt Reconciliation

Digital receipt reconciliation expedites expense management by automating data extraction and minimizing human errors compared to traditional receipts, which require manual entry and physical storage. E-receipts enable real-time validation and seamless integration with accounting software, enhancing accuracy and efficiency in financial reporting.

E-Receipt Automation

E-receipt automation streamlines expense management by instantly capturing, categorizing, and storing digital receipts, reducing manual data entry errors and saving time. Traditional receipts often lead to lost paperwork and delayed reimbursements, whereas e-receipts enhance accuracy, compliance, and real-time expense tracking.

Paperless Audit Trail

E-receipts provide a seamless, paperless audit trail that simplifies expense tracking and reduces the risk of lost or damaged documents compared to traditional paper receipts. Automated digital storage ensures faster retrieval, enhanced accuracy, and improved compliance with financial regulations.

Receipt OCR Technology

Receipt OCR technology enhances the accuracy and efficiency of expense management by digitizing traditional paper receipts into searchable e-receipts, reducing manual data entry errors and processing time. This technology leverages advanced optical character recognition algorithms to extract relevant expense data, streamlining financial reporting and integration with accounting software.

Blockchain Receipt Verification

Blockchain receipt verification enhances the security and authenticity of e-receipts by creating an immutable digital ledger, reducing the risk of fraud associated with traditional paper receipts. This technology enables real-time expense tracking and automated auditing, streamlining expense management and improving compliance accuracy.

E-Receipt Taxonomy

E-Receipt taxonomy categorizes digital invoices into key types such as transactional, promotional, and informational receipts, enabling precise tracking and automated expense management. Unlike traditional receipts, e-receipts leverage standardized data formats like XML and JSON, facilitating seamless integration with accounting software and enhancing accuracy in tax reporting and audit compliance.

Sustainable Expense Documentation

Traditional receipts contribute to environmental waste through paper consumption and chemical inks, making e-receipts a more sustainable choice by reducing physical storage and minimizing carbon footprint. E-receipts enable efficient digital expense documentation, improving accuracy, accessibility, and supporting eco-friendly business practices.

Receipt Data Extraction API

Traditional receipts often present challenges for accurate expense tracking due to their physical format prone to damage and loss, whereas E-Receipts enable seamless digital storage and accessibility. Receipt Data Extraction APIs utilize optical character recognition (OCR) and machine learning algorithms to efficiently extract, categorize, and validate critical expense information such as vendor names, dates, amounts, and taxes from both traditional and electronic receipts, significantly enhancing expense management accuracy and automation.

Wallet App Integration Receipts

Traditional receipts are often lost or damaged, complicating expense tracking, while e-receipts integrated into wallet apps enable automatic expense categorization, real-time tracking, and seamless synchronization with financial management tools. Wallet app integration supports secure storage and easy retrieval of e-receipts, enhancing accuracy and efficiency in personal and business expense reporting.

Hybrid Receipting Model

A Hybrid Receipting Model combines traditional paper receipts and digital e-receipts to streamline expense management, offering flexibility for users who prefer physical records or electronic documentation. This integrated approach enhances accuracy, reduces loss of receipts, and supports seamless expense tracking across diverse spending scenarios.

Traditional Receipts vs E-Receipts for Expense Infographic

moneydiff.com

moneydiff.com