Monthly review of expenses provides a comprehensive overview of spending patterns and budget adherence over a set period, allowing for strategic adjustments and long-term financial planning. Real-time analytics offers immediate visibility into transactions, enabling prompt detection of anomalies and faster decision-making to control costs effectively. Combining both approaches enhances expense management by balancing detailed historical insights with dynamic, up-to-the-minute data analysis.

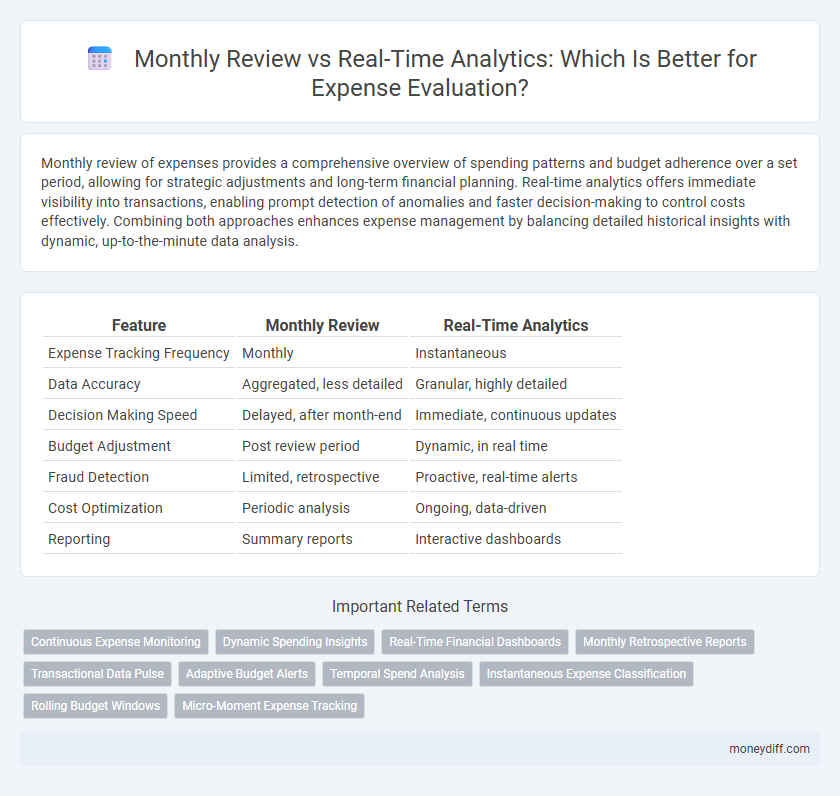

Table of Comparison

| Feature | Monthly Review | Real-Time Analytics |

|---|---|---|

| Expense Tracking Frequency | Monthly | Instantaneous |

| Data Accuracy | Aggregated, less detailed | Granular, highly detailed |

| Decision Making Speed | Delayed, after month-end | Immediate, continuous updates |

| Budget Adjustment | Post review period | Dynamic, in real time |

| Fraud Detection | Limited, retrospective | Proactive, real-time alerts |

| Cost Optimization | Periodic analysis | Ongoing, data-driven |

| Reporting | Summary reports | Interactive dashboards |

Introduction to Expense Evaluation Methods

Expense evaluation methods encompass both monthly review and real-time analytics, each offering distinct advantages for financial management. Monthly reviews provide comprehensive summaries that facilitate strategic budgeting decisions by consolidating expense data over a fixed period. Real-time analytics enable immediate detection of spending patterns and anomalies, enhancing agility in expense control and cash flow optimization.

Understanding Monthly Review in Money Management

Monthly review in money management involves analyzing all expenses accumulated over a 30-day period to identify spending patterns, track budget adherence, and adjust financial goals accordingly. This method provides a comprehensive overview of cash flow and highlights areas where overspending occurs, enabling informed decisions for future budgeting strategies. Unlike real-time analytics, monthly reviews emphasize reflective financial assessment, fostering long-term fiscal discipline and improved expense control.

Exploring Real-Time Analytics for Expense Tracking

Real-time analytics enhances expense evaluation by providing immediate visibility into spending patterns, enabling quicker identification of anomalies and cost-saving opportunities. Unlike monthly reviews, which offer retrospective insights, real-time tracking delivers dynamic data updates that support proactive budget adjustments and improved financial control. Integrating real-time expense analytics tools can significantly optimize cash flow management and reduce the risk of overspending.

Key Differences: Monthly Review vs Real-Time Analytics

Monthly reviews consolidate expense data into comprehensive reports, offering a broad perspective on spending patterns and budget adherence over time. Real-time analytics provide instant visibility into expenses as they occur, enabling quicker decision-making and proactive cost control. The key difference lies in the timing and granularity of data, with monthly reviews favoring retrospective analysis and real-time analytics supporting immediate operational adjustments.

Benefits of Monthly Expense Reviews

Monthly expense reviews provide a structured approach to budgeting by identifying spending patterns and highlighting areas for cost reduction over time. This method enhances financial accountability and supports strategic decision-making by offering a comprehensive overview of expenses at regular intervals. Consistent monthly analysis helps detect recurring issues, enabling organizations to implement sustainable cost-control measures effectively.

Advantages of Real-Time Expense Analytics

Real-time expense analytics enables immediate detection of overspending, allowing businesses to swiftly adjust budgets and prevent cost overruns. Continuous monitoring of transactions provides up-to-date financial insights, enhancing accuracy in forecasting and decision-making. This dynamic approach increases operational efficiency by quickly highlighting anomalies and enabling proactive expense management.

Challenges of Each Approach

Monthly review of expenses often faces challenges such as delayed data insights, which can hinder timely decision-making and risk identification. Real-time analytics demands advanced technology infrastructure and can produce data overload, complicating accurate expense tracking. Both approaches require balancing data accuracy with operational efficiency to effectively control and optimize expenditures.

Impact on Financial Decision-Making

Monthly reviews provide a comprehensive overview of expenses, allowing for strategic adjustments based on historical data trends. Real-time analytics enable immediate detection of anomalies and prompt corrective actions, enhancing agility in financial decision-making. Combining both approaches optimizes budget management by balancing long-term insight with instant expense monitoring.

Choosing the Right Method for Your Financial Goals

Evaluating expenses through monthly reviews provides a comprehensive overview of spending patterns, ideal for long-term budget planning and identifying recurring costs. Real-time analytics offers immediate insights, enabling rapid response to unusual transactions and better cash flow management. Selecting the right method depends on your financial goals: opt for monthly reviews to maintain strategic control or real-time analytics for dynamic expense tracking and proactive decision-making.

Integrating Monthly Reviews with Real-Time Analytics

Integrating monthly reviews with real-time analytics enhances expense evaluation by providing comprehensive insights that combine historical trends with immediate data updates. This integration allows businesses to identify spending anomalies quickly while validating broader budgetary patterns, improving financial accuracy and control. Leveraging dashboards that synchronize real-time expense tracking with monthly summaries optimizes decision-making and resource allocation.

Related Important Terms

Continuous Expense Monitoring

Continuous expense monitoring through real-time analytics enables timely detection of anomalies and swift corrective actions, enhancing financial accuracy beyond traditional monthly reviews. Integrating real-time data streams with predictive algorithms drives proactive expense control and optimized budget management.

Dynamic Spending Insights

Real-time analytics provides dynamic spending insights by continuously monitoring expenses, enabling immediate identification of budget variances and cost-saving opportunities. Monthly reviews, while helpful for historical expenditure evaluation, lack the agility to respond promptly to financial fluctuations and emerging trends.

Real-Time Financial Dashboards

Real-time financial dashboards enable continuous expense evaluation by providing up-to-the-minute transaction data, allowing businesses to identify spending trends and anomalies instantly. This dynamic approach contrasts with monthly reviews by enhancing accuracy and responsiveness in managing budgets and controlling costs.

Monthly Retrospective Reports

Monthly retrospective reports provide comprehensive expense evaluations by aggregating data across the entire month, enabling identification of spending patterns and budget deviations with historical context. These reports enhance financial accuracy and strategic planning by offering detailed insights that real-time analytics, which focus on immediate data, may overlook.

Transactional Data Pulse

Real-time analytics provide continuous insights into transactional data pulse, enabling immediate identification of spending patterns and abnormal expenses. Monthly reviews, while helpful for comprehensive expense summaries, lack the immediacy required to detect and respond to financial anomalies as they occur.

Adaptive Budget Alerts

Adaptive Budget Alerts enhance expense management by providing real-time analytics that enable immediate identification of overspending, unlike traditional monthly reviews that delay insights until the period ends. This proactive approach allows businesses to dynamically adjust budgets and control expenses more effectively, reducing the risk of budget overruns.

Temporal Spend Analysis

Monthly reviews provide a comprehensive overview of expense patterns, allowing for trend identification and budget adjustments over time. Real-time analytics enable immediate detection of anomalies and quicker decision-making by monitoring temporal spend fluctuations as they occur.

Instantaneous Expense Classification

Instantaneous expense classification leverages real-time analytics to categorize expenditures as they occur, enhancing accuracy and efficiency compared to traditional monthly reviews. This immediate processing enables proactive budget adjustments and minimizes financial discrepancies through timely insights.

Rolling Budget Windows

Rolling budget windows enable real-time analytics to provide continuous expense evaluation, allowing businesses to adjust financial plans dynamically based on up-to-date data. Monthly reviews, while helpful for retrospective analysis, lack the agility offered by rolling windows that integrate real-time expense monitoring and forecasting.

Micro-Moment Expense Tracking

Micro-moment expense tracking leverages real-time analytics to provide immediate insights into spending behavior, enabling businesses to identify cost anomalies and optimize budgets instantly. Monthly reviews, while comprehensive, lack the immediacy of micro-moment data, often delaying critical expense adjustments and impacting financial agility.

Monthly Review vs Real-Time Analytics for expense evaluation. Infographic

moneydiff.com

moneydiff.com