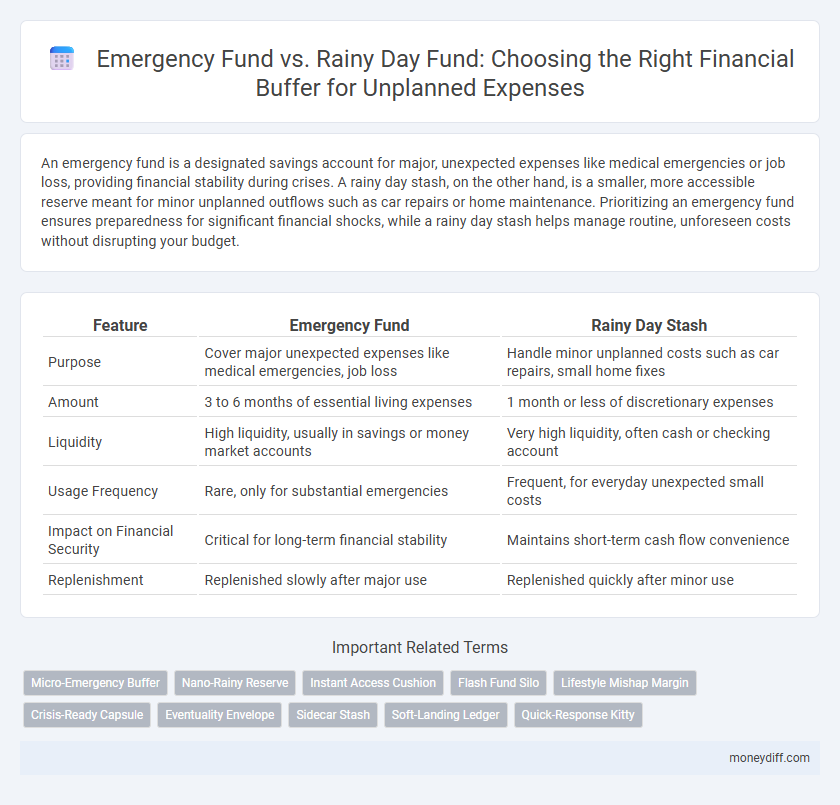

An emergency fund is a designated savings account for major, unexpected expenses like medical emergencies or job loss, providing financial stability during crises. A rainy day stash, on the other hand, is a smaller, more accessible reserve meant for minor unplanned outflows such as car repairs or home maintenance. Prioritizing an emergency fund ensures preparedness for significant financial shocks, while a rainy day stash helps manage routine, unforeseen costs without disrupting your budget.

Table of Comparison

| Feature | Emergency Fund | Rainy Day Stash |

|---|---|---|

| Purpose | Cover major unexpected expenses like medical emergencies, job loss | Handle minor unplanned costs such as car repairs, small home fixes |

| Amount | 3 to 6 months of essential living expenses | 1 month or less of discretionary expenses |

| Liquidity | High liquidity, usually in savings or money market accounts | Very high liquidity, often cash or checking account |

| Usage Frequency | Rare, only for substantial emergencies | Frequent, for everyday unexpected small costs |

| Impact on Financial Security | Critical for long-term financial stability | Maintains short-term cash flow convenience |

| Replenishment | Replenished slowly after major use | Replenished quickly after minor use |

Understanding Emergency Funds and Rainy Day Stashes

Emergency funds serve as a dedicated financial reserve designed to cover significant unplanned expenses such as medical emergencies or job loss, typically amounting to three to six months of living costs. Rainy day stashes are smaller, more flexible savings set aside for minor unexpected costs like car repairs or household maintenance. Both play crucial roles in comprehensive expense management by providing financial security and reducing reliance on credit during unforeseen outflows.

Key Differences Between Emergency Funds and Rainy Day Savings

Emergency funds are designed to cover major unplanned expenses such as job loss, medical emergencies, or urgent home repairs, typically amounting to three to six months of living expenses. Rainy day savings are smaller, more accessible reserves for minor, short-term unplanned costs like car repairs, minor medical bills, or unexpected utility expenses. The key difference lies in the purpose and scale: emergency funds provide financial security during significant crises, while rainy day stashes handle everyday unplanned outflows without disrupting the primary budget.

When to Use an Emergency Fund vs a Rainy Day Stash

Emergency funds are designed for significant unplanned expenses such as medical bills, car repairs, or job loss, providing a financial safety net for serious emergencies. Rainy day stashes cover smaller, less urgent costs like minor home repairs or unexpected travel, offering quick access to cash without impacting long-term savings. Prioritize using the emergency fund for major financial disruptions and reserve the rainy day stash for routine or predictable unplanned expenses.

How Much to Save in Each Fund

An emergency fund should ideally cover three to six months' worth of essential expenses, providing a financial safety net for major unplanned outflows such as job loss or medical emergencies. In contrast, a rainy day stash for minor unplanned expenses, like car repairs or home maintenance, typically requires one to two months' worth of discretionary spending. Allocating savings based on these guidelines ensures liquidity without overcommitting resources, balancing preparedness with financial flexibility.

Building Your Emergency Fund Step-by-Step

Building your emergency fund step-by-step involves setting aside three to six months' worth of essential expenses to cover unplanned outflows such as medical emergencies or major car repairs. Prioritize consistent monthly contributions into a high-yield savings account to ensure liquidity and growth over time. Distinguishing this from a rainy day stash, which covers smaller unexpected costs like minor home repairs or urgent travel, helps maintain financial stability during larger crises.

Creating a Rainy Day Stash for Minor Expenses

Creating a rainy day stash involves setting aside small, easily accessible funds to cover minor unplanned expenses such as car repairs, medical co-pays, or home maintenance. This financial buffer prevents the disruption of your budget by addressing costs that fall below the threshold of an emergency fund, which is reserved for major, unexpected outflows like job loss or significant medical emergencies. Regular contributions to a rainy day fund help maintain financial stability without dipping into long-term savings or credit.

Common Mistakes in Managing Unplanned Expenses

Common mistakes in managing unplanned expenses include confusing an emergency fund with a rainy day stash, leading to insufficient financial preparedness. Emergency funds should cover major unexpected costs like medical emergencies, while rainy day funds address smaller, less urgent expenses. Mixing these funds often results in inadequate reserves, causing financial strain during true emergencies.

Where to Keep Your Emergency and Rainy Day Funds

Keep your emergency fund in a high-yield savings account or money market account to ensure quick access while earning interest. Store your rainy day stash in a more liquid but less interest-bearing account, such as a checking account or a low-minimum savings account, for easier withdrawal during minor unplanned expenses. Prioritizing liquidity and accessibility helps balance growth potential with immediate availability for unplanned outflows.

Strategies for Replenishing These Funds After Use

Replenishing an emergency fund requires a disciplined budget allocation, prioritizing a fixed monthly amount until the target balance is restored to cover unexpected expenses such as medical emergencies or urgent home repairs. A rainy day stash, often smaller and more flexible, can be replenished more quickly by redirecting discretionary spending or bonuses to ensure readiness for minor unplanned outflows like car repairs or seasonal expenses. Both strategies emphasize consistency in contributions and adjusting savings goals based on recent withdrawals to maintain financial resilience.

Tips for Making Your Money Work in Both Accounts

Maximize the potential of your emergency fund by prioritizing at least three to six months' worth of essential living expenses, ensuring a robust safety net for major financial crises such as job loss or medical emergencies. Maintain a separate rainy day stash with a smaller balance dedicated to minor, unexpected costs like car repairs or home maintenance, accessible without penalty or delay. Automate contributions to both accounts by setting up recurring transfers from your paycheck or checking account to build savings consistently and avoid depleting funds intended for critical needs.

Related Important Terms

Micro-Emergency Buffer

A Micro-Emergency Buffer is a small, readily accessible fund designed to cover minor unplanned expenses, bridging the gap before tapping into a larger Emergency Fund or Rainy Day Stash. This buffer ensures immediate liquidity for unexpected costs like minor car repairs or medical copays, preventing disruptions to long-term savings goals.

Nano-Rainy Reserve

The Nano-Rainy Reserve offers a compact, highly liquid solution for unplanned expenses, bridging the gap between an emergency fund and a rainy day stash by providing immediate access to small, short-term cash needs. Unlike traditional emergency funds that cover major financial crises, the Nano-Rainy Reserve prioritizes nimble cash flow for minor, unexpected outflows, enhancing financial resilience without tying up large capital.

Instant Access Cushion

An emergency fund serves as a crucial instant access cushion designed to cover significant unplanned outflows such as medical emergencies or job loss, typically encompassing three to six months of living expenses. In contrast, a rainy day stash handles smaller, more frequent unexpected costs like car repairs or home maintenance, ensuring liquidity without tapping into long-term savings.

Flash Fund Silo

Emergency funds serve as a dedicated financial buffer for major unplanned expenses like medical emergencies or job loss, ensuring long-term stability. Rainy day stashes, or Flash Fund Silo, target smaller, short-term outflows such as minor repairs or unexpected bills, enabling quick access without depleting emergency reserves.

Lifestyle Mishap Margin

An emergency fund is a larger financial cushion designed to cover significant unplanned expenses such as medical bills or job loss, ensuring long-term lifestyle stability. In contrast, a rainy day stash handles smaller, unexpected outflows like minor car repairs or household mishaps, providing a lifestyle mishap margin for day-to-day disruptions.

Crisis-Ready Capsule

A Crisis-Ready Capsule is a robust emergency fund designed to cover essential expenses during significant financial disruptions, typically amounting to three to six months of living costs. Unlike a Rainy Day Stash, which addresses smaller, unexpected expenses, the Crisis-Ready Capsule provides comprehensive financial security against prolonged income loss or major emergencies.

Eventuality Envelope

An Emergency Fund is a designated savings reserve for significant unexpected financial setbacks, typically covering three to six months of essential living expenses, while a Rainy Day Stash addresses smaller, short-term unplanned outflows such as minor car repairs or medical co-pays. The Eventuality Envelope system optimizes financial preparedness by categorizing funds into specific envelopes, ensuring clear allocation for both major emergencies and everyday unforeseen expenses.

Sidecar Stash

A Sidecar Stash functions as an agile financial buffer designed specifically for unplanned outflows that exceed typical Emergency Fund capacities, offering immediate access without compromising long-term savings. This targeted allocation complements traditional Rainy Day Stashes by covering sporadic, urgent expenses such as unexpected car repairs or medical bills, enhancing overall financial resilience.

Soft-Landing Ledger

Soft-Landing Ledger recommends prioritizing an Emergency Fund with three to six months of essential expenses to cover significant unplanned outflows, while a Rainy Day Stash handles smaller, unexpected costs like minor car repairs or medical bills. Maintaining both accounts ensures comprehensive financial resilience by addressing varying scales of financial emergencies without disrupting long-term savings goals.

Quick-Response Kitty

Quick-response kitty acts as an immediately accessible rain cloud for unplanned expenses, offering a shorter-term, smaller reserve compared to a fully-funded emergency fund designed to cover months of living costs. Strategically, maintaining both ensures financial resilience by addressing sudden minor setbacks swiftly while reserving emergency funds for significant, prolonged crises.

Emergency Fund vs Rainy Day Stash for unplanned outflow. Infographic

moneydiff.com

moneydiff.com