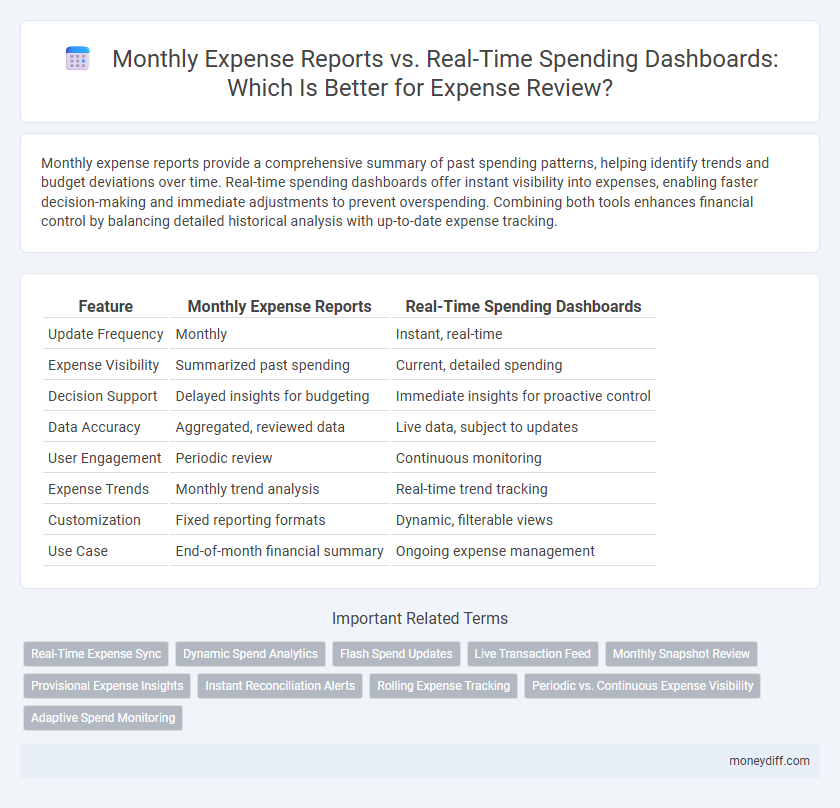

Monthly expense reports provide a comprehensive summary of past spending patterns, helping identify trends and budget deviations over time. Real-time spending dashboards offer instant visibility into expenses, enabling faster decision-making and immediate adjustments to prevent overspending. Combining both tools enhances financial control by balancing detailed historical analysis with up-to-date expense tracking.

Table of Comparison

| Feature | Monthly Expense Reports | Real-Time Spending Dashboards |

|---|---|---|

| Update Frequency | Monthly | Instant, real-time |

| Expense Visibility | Summarized past spending | Current, detailed spending |

| Decision Support | Delayed insights for budgeting | Immediate insights for proactive control |

| Data Accuracy | Aggregated, reviewed data | Live data, subject to updates |

| User Engagement | Periodic review | Continuous monitoring |

| Expense Trends | Monthly trend analysis | Real-time trend tracking |

| Customization | Fixed reporting formats | Dynamic, filterable views |

| Use Case | End-of-month financial summary | Ongoing expense management |

Understanding Monthly Expense Reports

Monthly expense reports provide a comprehensive summary of all financial transactions within a specific period, enabling businesses to track spending patterns and identify budget deviations. These reports consolidate data from various departments to offer detailed insights into cost allocations and recurring expenses. Understanding monthly expense reports facilitates strategic decision-making by highlighting areas for cost savings and improving financial accountability.

The Rise of Real-Time Spending Dashboards

Real-time spending dashboards revolutionize expense review by providing immediate visibility into transaction data, enabling businesses to detect anomalies and control budgets more effectively than traditional monthly expense reports. These dashboards utilize up-to-date financial metrics and integrate with corporate credit card systems, offering granular insights that enhance decision-making processes. The rise of advanced analytics and cloud-based solutions drives this shift, empowering organizations to optimize cash flow management and reduce overspending in real time.

Benefits of Monthly Expense Reports

Monthly expense reports provide a comprehensive summary of all financial activities within a specific period, enabling detailed analysis and accurate budget tracking. They facilitate compliance with accounting standards and support strategic planning through historical data insights. Monthly reports also allow businesses to identify spending patterns, control costs effectively, and prepare for audits with documented financial transparency.

Advantages of Real-Time Expense Tracking

Real-time spending dashboards provide immediate visibility into financial transactions, enabling quicker identification of overspending and budgeting adjustments. Unlike monthly expense reports that consolidate data post-factum, real-time tracking enhances accuracy by capturing transactions as they occur, reducing errors and omissions. This immediacy supports proactive financial management and improved control over cash flow.

Key Differences: Monthly Reports vs Real-Time Dashboards

Monthly expense reports provide comprehensive summaries and trend analyses over fixed periods, allowing detailed review of aggregated data and budget comparisons. Real-time spending dashboards offer immediate visibility into expenditures, enabling swift identification of anomalies and informed decision-making on a day-to-day basis. The key difference lies in the time sensitivity and granularity: monthly reports excel in strategic planning with historical insights, while real-time dashboards prioritize operational control through up-to-the-minute expense tracking.

Data Accuracy and Timeliness Comparison

Monthly expense reports offer comprehensive summaries but often suffer from delayed data updates, leading to potential accuracy issues due to outdated information. Real-time spending dashboards provide instantaneous data visibility, enhancing timeliness and enabling more accurate tracking of expenses as they occur. The immediacy of real-time dashboards improves decision-making by reducing lag between expense occurrence and review, while monthly reports rely on periodic data consolidation that may overlook recent transactions.

User Experience: Convenience and Accessibility

Monthly expense reports offer a structured summary of spending, enabling users to review past financial activities with detailed categorizations, but they may lack immediacy and real-time accuracy. Real-time spending dashboards enhance user experience by providing instant access to current financial data, allowing for immediate adjustments and more proactive budget management. Both tools improve convenience and accessibility, yet real-time dashboards offer a dynamic interface that better supports timely decision-making and personalized expense tracking.

Budgeting Impact: Retrospective vs Proactive Control

Monthly expense reports provide a retrospective view of spending, enabling organizations to analyze past financial behavior and identify patterns that inform future budgeting decisions. Real-time spending dashboards offer proactive control by delivering instant visibility into expenses as they occur, allowing for immediate adjustments and preventing budget overruns. Combining both tools enhances overall budget management by balancing historical insights with dynamic, real-time monitoring.

Integration with Other Money Management Tools

Monthly expense reports provide a comprehensive summary of spending patterns, but real-time spending dashboards offer seamless integration with budgeting apps and bank accounts for instant tracking. This integration enhances accuracy by automatically syncing transactions, reducing manual data entry errors. Real-time dashboards facilitate proactive expense management through continuous updates and alerts, improving financial control over monthly budgets.

Choosing the Right Expense Review Method for Your Needs

Monthly expense reports provide a comprehensive summary of past transactions, ideal for detailed analysis and budgeting adjustments over time. Real-time spending dashboards offer immediate visibility into expenses, enabling quick decision-making and proactive cost control. Selecting the right expense review method depends on whether you prioritize historical accuracy for strategic planning or dynamic monitoring for instant financial management.

Related Important Terms

Real-Time Expense Sync

Real-time spending dashboards provide instant visibility into expenses, enabling more accurate and timely budget adjustments compared to monthly expense reports that often delay actionable insights. Real-time expense sync ensures continuous tracking and updates of transaction data, reducing errors and improving financial control for businesses.

Dynamic Spend Analytics

Dynamic spend analytics in real-time spending dashboards provide instant visibility into transaction patterns, enabling quicker identification of anomalies and spending trends compared to traditional monthly expense reports. Utilizing up-to-the-minute data, businesses can optimize budget management and improve financial decision-making with enhanced accuracy and agility.

Flash Spend Updates

Flash Spend Updates provide immediate insights into daily transactions, enabling businesses to detect anomalies and manage budgets proactively. Monthly expense reports offer comprehensive overviews but lack the agility and immediacy of real-time spending dashboards crucial for dynamic financial control.

Live Transaction Feed

Real-time spending dashboards featuring a live transaction feed provide instant visibility into expenses, allowing for immediate identification of anomalies and better cash flow management compared to monthly expense reports. These dashboards enhance accuracy and decision-making by continuously updating transaction data as purchases occur, eliminating delays inherent in periodic reporting.

Monthly Snapshot Review

Monthly expense reports provide a comprehensive snapshot of overall spending patterns, enabling businesses to analyze trends and identify cost-saving opportunities over a fixed period. This approach facilitates detailed budget reconciliation and financial accountability by consolidating transactions into a clear, period-specific summary.

Provisional Expense Insights

Monthly expense reports provide aggregate provisional expense insights that help identify spending trends over time, while real-time spending dashboards offer immediate visibility into provisional expenses to enable swift budget adjustments and prevent overspending. Combining these tools enhances financial accuracy by balancing retrospective analysis with dynamic, up-to-date expense monitoring.

Instant Reconciliation Alerts

Instant reconciliation alerts in real-time spending dashboards provide immediate notifications on discrepancies or budget overruns, enabling swift corrective actions and more accurate expense tracking. Monthly expense reports lack this timely insight, often delaying the identification of errors and hindering proactive financial management.

Rolling Expense Tracking

Rolling expense tracking enables continuous monitoring of financial outflows, providing real-time spending dashboards with up-to-date insights that enhance accuracy and responsiveness compared to traditional monthly expense reports. This dynamic approach allows businesses to identify and address budget variances immediately, optimizing cash flow management and improving fiscal decision-making.

Periodic vs. Continuous Expense Visibility

Monthly expense reports provide periodic visibility by summarizing spending data at set intervals, enabling retrospective analysis of budget adherence and cost management. Real-time spending dashboards offer continuous expense visibility, allowing immediate tracking and adjustment of expenditures to enhance financial control and prevent overspending.

Adaptive Spend Monitoring

Monthly expense reports provide aggregated data for periodic financial analysis, while real-time spending dashboards enable adaptive spend monitoring by offering instantaneous visibility into expenditures, facilitating prompt budget adjustments and improved expense control. Integrating real-time dashboards enhances responsiveness to spending trends, minimizing overages and supporting dynamic financial decision-making.

Monthly expense reports vs Real-time spending dashboards for expense review. Infographic

moneydiff.com

moneydiff.com