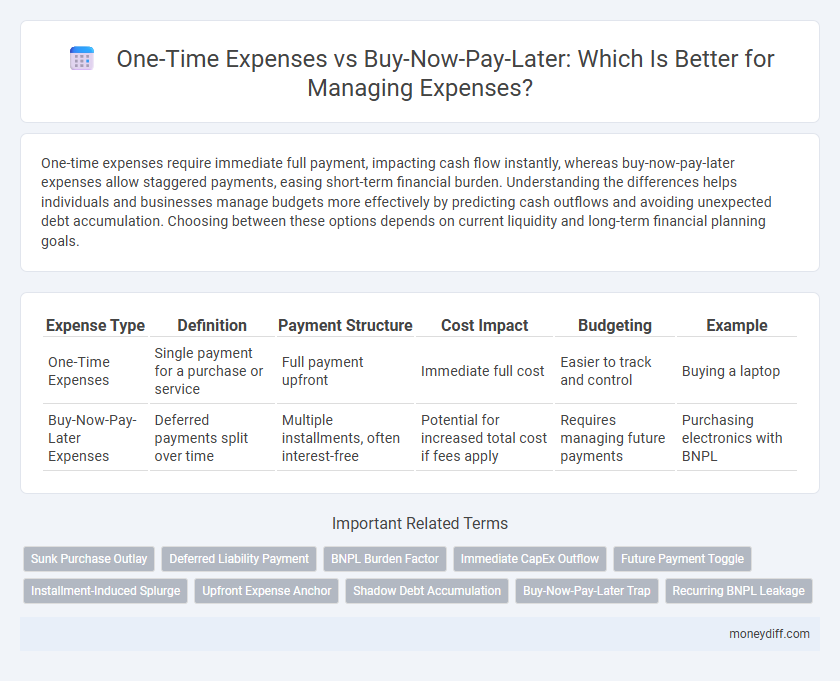

One-time expenses require immediate full payment, impacting cash flow instantly, whereas buy-now-pay-later expenses allow staggered payments, easing short-term financial burden. Understanding the differences helps individuals and businesses manage budgets more effectively by predicting cash outflows and avoiding unexpected debt accumulation. Choosing between these options depends on current liquidity and long-term financial planning goals.

Table of Comparison

| Expense Type | Definition | Payment Structure | Cost Impact | Budgeting | Example |

|---|---|---|---|---|---|

| One-Time Expenses | Single payment for a purchase or service | Full payment upfront | Immediate full cost | Easier to track and control | Buying a laptop |

| Buy-Now-Pay-Later Expenses | Deferred payments split over time | Multiple installments, often interest-free | Potential for increased total cost if fees apply | Requires managing future payments | Purchasing electronics with BNPL |

Understanding One-Time Expenses in Personal Finance

One-time expenses in personal finance refer to singular, non-recurring costs such as home repairs, medical bills, or major appliance purchases, which typically require upfront payment. Unlike Buy-Now-Pay-Later (BNPL) expenses that allow deferred payments over time, one-time expenses impact immediate cash flow and require precise budgeting to avoid financial strain. Properly managing one-time expenses is essential for maintaining liquidity and preventing unexpected debt accumulation in personal financial planning.

The Rise of Buy-Now-Pay-Later (BNPL) Models

Buy-Now-Pay-Later (BNPL) models have surged in popularity, reshaping consumer spending by allowing purchases to be paid in installments rather than a single upfront payment. Unlike traditional one-time expenses, BNPL spreads costs over time, improving cash flow management and often increasing purchasing power. The BNPL industry's growth is driven by technological advances, seamless integration at checkout, and consumer demand for flexible payment solutions.

Cash Flow Impact: One-Time vs BNPL Expenses

One-time expenses require immediate payment, causing a direct and significant reduction in cash flow at the point of purchase, which can strain short-term financial resources. Buy-Now-Pay-Later (BNPL) expenses spread the cost over multiple installments, mitigating the immediate cash outflow but potentially increasing total expenditure due to fees or interest. Managing cash flow effectively involves balancing the upfront impact of one-time payments against the deferred financial obligations and risks associated with BNPL options.

Interest and Hidden Costs of BNPL Purchases

One-time expenses involve a single payment with no additional fees, making them straightforward to budget. Buy-Now-Pay-Later (BNPL) options often carry hidden costs such as high interest rates or late fees that can significantly increase the total expense if payments are missed. Understanding the true cost of BNPL purchases requires careful examination of interest charges, repayment terms, and potential penalties to avoid unexpected financial burdens.

Budgeting Strategies for One-Time Payments

One-time expenses require careful budgeting to avoid cash flow disruptions, emphasizing the importance of setting aside funds in advance or using savings specifically earmarked for these irregular costs. Unlike buy-now-pay-later expenses that spread payments over time and affect monthly budgets incrementally, one-time payments demand immediate full coverage, making accurate expense forecasting critical. Effective strategies include tracking historical spending patterns, prioritizing essential purchases, and maintaining an emergency fund to absorb unexpected financial impacts.

Managing Debt Risks with Buy-Now-Pay-Later Options

Managing debt risks with buy-now-pay-later (BNPL) expenses requires careful budgeting and awareness of interest rates that can surpass traditional credit cards. Unlike one-time expenses paid upfront, BNPL allows spreading payments over time, but missed installments can lead to penalties and increased debt load. Prioritizing timely payments and assessing total repayment costs ensures BNPL usage does not escalate financial liabilities.

Psychological Effects: Immediate vs Deferred Spending

One-time expenses create a strong psychological impact due to immediate payment, which often causes greater awareness of the cost and can lead to more cautious spending behaviors. Buy-now-pay-later (BNPL) schemes defer financial pain by breaking payments into smaller installments, reducing the salience of the expense and potentially encouraging higher spending and impulsive purchases. This deferred spending effect often diminishes the psychological restraint associated with immediate payment, resulting in a greater risk of overspending and increased financial stress over time.

Which Is Better for Big Purchases: Lump Sum or BNPL?

One-time expenses require paying the full amount upfront, ensuring immediate ownership and avoiding interest or fees, which is beneficial for buyers with available cash flow. Buy-Now-Pay-Later (BNPL) allows spreading payments over time without interest if paid within the agreed period, enhancing affordability for large purchases but risking debt accumulation if payments are missed. Choosing between lump sum and BNPL depends on personal financial discipline, cash availability, and the terms of the BNPL plan for big-ticket items.

Tracking and Controlling Monthly Spending with BNPL

One-time expenses require upfront payment and are easier to track within a monthly budget, providing clear visibility into cash flow. Buy-Now-Pay-Later (BNPL) expenses spread the cost over several months, which can obscure the total spending and complicate accurate tracking. Effective control of monthly spending with BNPL demands detailed monitoring of installment schedules and cumulative liabilities to avoid overspending and manage debt responsibly.

Long-Term Financial Health: Choosing the Right Expense Approach

One-time expenses involve immediate full payment, ensuring clear budgeting and avoiding future debt, which supports long-term financial stability. Buy-now-pay-later options spread costs over time, increasing short-term affordability but potentially leading to higher overall expenses due to interest or fees. Evaluating personal cash flow and financial goals is crucial for selecting the expense method that sustains healthy credit and minimizes long-term financial risks.

Related Important Terms

Sunk Purchase Outlay

One-time expenses represent a sunk purchase outlay with immediate financial impact, requiring full payment upfront and reducing available capital at the time of acquisition. Buy-now-pay-later expenses defer cash outflow but do not alter the initial sunk cost, which is recognized when the obligation is incurred despite staggered payments.

Deferred Liability Payment

One-time expenses require immediate full payment, impacting cash flow instantly, whereas buy-now-pay-later expenses create deferred liability payments, allowing companies to manage cash flow by spreading costs over a set period. Deferred liabilities from buy-now-pay-later options increase long-term financial obligations and require careful budgeting to avoid liquidity issues.

BNPL Burden Factor

One-Time Expenses require immediate full payment, resulting in a clear upfront cost, while Buy-Now-Pay-Later (BNPL) expenses spread the financial burden over multiple installments, often increasing the total repayment amount due to added fees or interest. BNPL's burden factor can lead to higher overall expenses and potential cash flow challenges, making it crucial to assess the hidden costs and payment terms before opting for deferred payment plans.

Immediate CapEx Outflow

One-time expenses require an immediate capital expenditure outflow, impacting cash flow at the point of purchase, whereas buy-now-pay-later expenses distribute payments over time, reducing initial cash burden but potentially increasing total cost due to interest or fees. Businesses must evaluate immediate CapEx impact versus long-term financial obligations when choosing between these expense options.

Future Payment Toggle

One-time expenses require immediate full payment, while Buy-Now-Pay-Later (BNPL) expenses allow for deferred payments, activating the Future Payment Toggle to schedule and track upcoming financial obligations. Utilizing the Future Payment Toggle enhances cash flow management by providing clear visibility of pending BNPL commitments alongside current expenditures.

Installment-Induced Splurge

One-time expenses require immediate full payment, limiting impulsive spending, whereas buy-now-pay-later expenses often encourage installment-induced splurge by spreading payments over time, increasing the risk of overspending. The psychological effect of smaller, manageable installments can mask the true cost, driving consumers to purchase more than initially intended.

Upfront Expense Anchor

One-time expenses require full payment upfront, ensuring clear budgeting and immediate financial impact, whereas buy-now-pay-later expenses allow deferred payments, spreading costs over time but potentially increasing overall expense due to interest or fees. Prioritizing upfront expense clarity aids in accurate cash flow management and prevents hidden financial liabilities.

Shadow Debt Accumulation

One-time expenses require immediate full payment, minimizing the risk of shadow debt accumulation, whereas buy-now-pay-later expenses spread payments over time, often obscuring total costs and leading to untracked, hidden debt that can inflate financial liabilities. Consumers should prioritize recognizing buy-now-pay-later commitments as part of their overall expense management to avoid underestimated shadow debt buildup.

Buy-Now-Pay-Later Trap

Buy-Now-Pay-Later (BNPL) expenses often lead to a debt trap as consumers accumulate multiple deferred payments, resulting in increased financial strain and potential late fees. Unlike one-time expenses paid upfront, BNPL schemes can encourage overspending by masking true costs and disrupting budget management.

Recurring BNPL Leakage

One-time expenses offer clear budget visibility with no ongoing financial obligation, while Buy-Now-Pay-Later (BNPL) plans often lead to recurring BNPL leakage, where small, frequent payments accumulate unnoticed, undermining long-term financial stability. Monitoring BNPL's recurring fees and interest is crucial to prevent unexpected expense growth and maintain accurate cash flow management.

One-Time Expenses vs Buy-Now-Pay-Later Expenses for Expense Infographic

moneydiff.com

moneydiff.com