Household expenses typically include recurring costs such as rent, utilities, groceries, and maintenance fees that are essential for daily living. Shared economy expenses often involve variable costs like ride-sharing fares, short-term rentals, and subscription services that provide flexible access to goods and services without ownership. Understanding the differences in these expense categories helps individuals budget more effectively and optimize spending based on lifestyle needs.

Table of Comparison

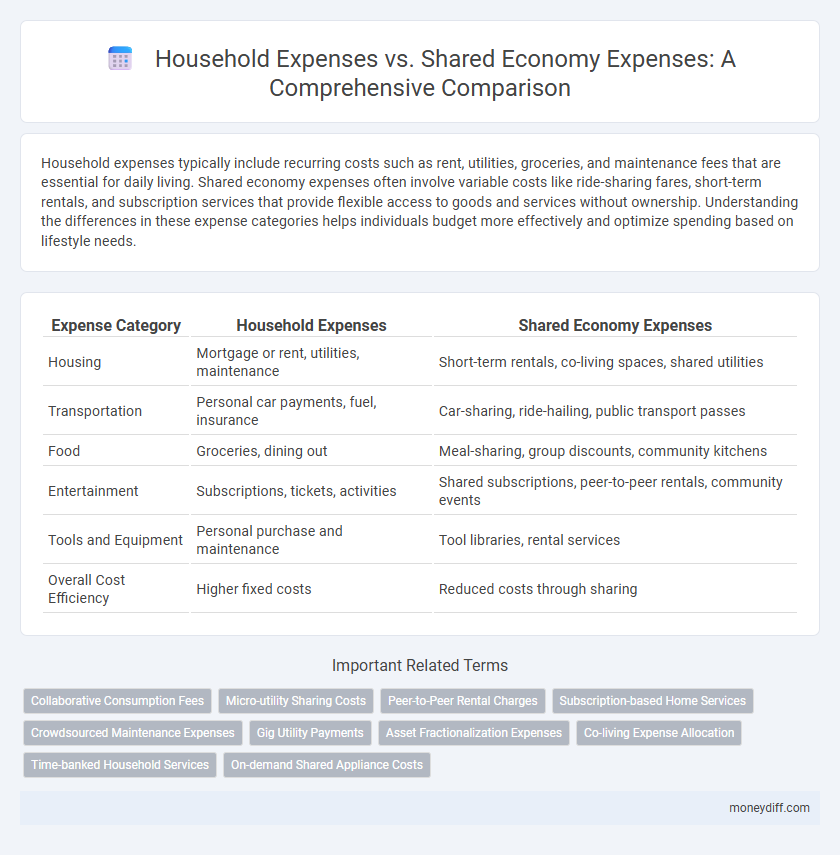

| Expense Category | Household Expenses | Shared Economy Expenses |

|---|---|---|

| Housing | Mortgage or rent, utilities, maintenance | Short-term rentals, co-living spaces, shared utilities |

| Transportation | Personal car payments, fuel, insurance | Car-sharing, ride-hailing, public transport passes |

| Food | Groceries, dining out | Meal-sharing, group discounts, community kitchens |

| Entertainment | Subscriptions, tickets, activities | Shared subscriptions, peer-to-peer rentals, community events |

| Tools and Equipment | Personal purchase and maintenance | Tool libraries, rental services |

| Overall Cost Efficiency | Higher fixed costs | Reduced costs through sharing |

Understanding Household Expenses: Definitions and Types

Household expenses encompass all costs incurred to maintain a home, including utilities, groceries, rent or mortgage payments, and maintenance fees. These expenses differ from shared economy expenses, which involve costs shared among multiple users in services like ride-sharing or accommodation rentals. Understanding the definitions and types of household expenses is essential for effective budgeting and financial planning within individual or family households.

The Rise of the Shared Economy: What Does It Mean for Expenses?

The rise of the shared economy significantly alters household expenses by shifting costs from individual ownership to shared access, reducing large upfront payments and ongoing maintenance fees. Services like ride-sharing, home-sharing, and tool rentals allow users to pay only for what they use, increasing financial flexibility and lowering average monthly expenses. This transformation promotes efficient resource allocation, but also requires households to adapt budgeting strategies to variable, usage-based expenses rather than fixed costs.

Comparing Fixed vs Variable Costs in Households and Sharing Platforms

Household expenses typically consist of fixed costs such as mortgage or rent, utilities, and insurance, providing predictable monthly outflows, while shared economy expenses often involve variable costs tied to usage, like rideshare fares or short-term rentals, which fluctuate based on demand. Fixed household costs contribute to budgeting stability but lack flexibility, whereas shared economy expenses offer dynamic pricing that can result in savings or surges depending on availability and market conditions. Analyzing these differences helps consumers optimize spending by balancing consistent household bills with adjustable shared economy services for cost-efficiency.

Cost-Benefit Analysis: Traditional Ownership vs Shared Use

Household expenses typically involve fixed costs such as mortgage or rent, utilities, maintenance, and insurance, which can accumulate significantly over time. Shared economy expenses, like car-sharing or co-working spaces, often offer lower variable costs, reducing financial burden through pay-per-use models and increased asset utilization. A cost-benefit analysis reveals that traditional ownership provides stability and long-term asset control, whereas shared use maximizes flexibility and minimizes idle resource expenses.

How the Shared Economy Impacts Monthly Household Budgets

Shared economy services like ride-sharing, home-sharing, and peer-to-peer rentals can significantly reduce monthly household expenses by offering more cost-effective alternatives to traditional ownership and services. These platforms promote budget flexibility by enabling households to pay only for what they use, lowering fixed costs related to transportation, lodging, and everyday goods. Consequently, integrating shared economy options into household budgets often leads to optimized spending patterns and improved financial management.

Strategies to Track and Manage Shared Economy Expenses

Effective strategies to track and manage shared economy expenses include using dedicated apps like Splitwise or Tricount that facilitate transparent expense sharing and automated calculations among participants. Establishing clear agreements on cost distribution and regularly updating expense records help prevent misunderstandings and ensure equitable contributions. Integrating shared economy expenses into a household budget allows for comprehensive financial oversight and better control over overall spending.

Savings Potential: Sharing Resources vs Individual Purchases

Household expenses typically involve individual purchases for utilities, groceries, and maintenance, often leading to higher overall costs due to limited economies of scale. Shared economy expenses leverage resource sharing, such as carpooling, co-working spaces, and bulk buying, which significantly enhance savings potential by distributing costs among multiple users. This collaborative consumption model reduces redundant spending and maximizes the value of shared assets, offering notable financial benefits compared to solo household expenditures.

Hidden Costs: Risks and Fees in Shared Economy Participation

Household expenses typically involve predictable costs such as mortgage, utilities, and groceries, whereas shared economy expenses include hidden fees and variable risks that can significantly impact overall spending. Participation in platforms like Airbnb or Uber exposes users to unpredictable cancellation fees, service charges, and potential liability costs that traditional household budgeting often overlooks. Understanding these hidden costs is crucial for accurately assessing the true financial burden of engaging in the shared economy.

The Role of Technology in Managing Shared and Household Expenses

Technology streamlines the management of both household and shared economy expenses through digital budgeting tools and expense tracking apps that enable real-time monitoring and automated categorization. Platforms like Splitwise and Venmo simplify bill splitting, ensuring transparency and accuracy among roommates or service users, while smart home devices integrate utility data for precise household expense forecasting. These advancements reduce manual errors, promote financial accountability, and facilitate seamless expense reconciliation across diverse living and sharing arrangements.

Tips for Balancing Household and Shared Economy Spending

Balancing household expenses with shared economy spending requires careful budgeting and prioritization of essential costs like rent, utilities, and groceries against flexible services such as ride-sharing or home rentals. Tracking monthly expenditures with apps that categorize both personal and shared economy costs helps identify spending patterns and areas for savings. Establishing clear spending limits and regularly reviewing shared economy subscriptions can prevent overspending while maintaining financial stability.

Related Important Terms

Collaborative Consumption Fees

Collaborative consumption fees often reduce household expenses by enabling shared access to goods and services, minimizing individual costs through platforms like ride-sharing, tool rentals, and co-working spaces. These shared economy expenses streamline budgeting by allocating fees proportionally among participants, fostering cost efficiency and sustainability in everyday spending.

Micro-utility Sharing Costs

Household expenses typically cover fixed costs such as rent, utilities, and groceries, while shared economy expenses emphasize micro-utility sharing costs like ride-sharing fees, coworking space usage, and subscription-based services. Micro-utility sharing reduces individual financial burden by allocating costs based on actual consumption, optimizing budget flexibility in modern household financial planning.

Peer-to-Peer Rental Charges

Household expenses primarily include fixed costs like rent, utilities, groceries, and maintenance, while peer-to-peer rental charges in the shared economy offer flexible, short-term access to assets such as cars, tools, and accommodations, often reducing upfront financial burdens. These peer-to-peer charges enable cost-efficient resource sharing, impacting traditional household expense patterns by shifting from ownership to usage-based spending models.

Subscription-based Home Services

Subscription-based home services, such as streaming platforms, security systems, and cleaning services, often lead to higher household expenses when managed individually compared to shared economy models that distribute costs among multiple users. Leveraging shared economy platforms for these subscriptions can reduce per capita spending and optimize budget efficiency within residential communities.

Crowdsourced Maintenance Expenses

Household expenses typically include routine costs such as utilities, groceries, and maintenance, whereas shared economy expenses often involve crowdsourced maintenance fees distributed among users of shared assets like co-working spaces or shared vehicles. Crowdsourced maintenance expenses reduce individual financial burdens by pooling resources for repairs and upkeep, enhancing cost-efficiency and promoting communal responsibility.

Gig Utility Payments

Household expenses typically include fixed costs such as rent, utilities, and groceries, whereas shared economy expenses for gig utility payments emphasize flexible, usage-based charges aligned with on-demand services like shared housing or coworking spaces. Tracking gig utility payments within the shared economy requires real-time monitoring of electricity, water, and internet usage to optimize costs and ensure equitable expense distribution among users.

Asset Fractionalization Expenses

Household expenses typically cover full ownership costs such as mortgage payments, utilities, and maintenance, whereas shared economy expenses focus on asset fractionalization, where costs are divided among multiple users to reduce individual financial burden. This model optimizes resource utilization by allowing shared access to assets like cars or vacation homes, significantly lowering per-person expenditure compared to traditional household ownership.

Co-living Expense Allocation

Household expenses in co-living arrangements often involve fixed costs like rent, utilities, and groceries, which require precise allocation to ensure fairness among residents. Shared economy expenses, such as subscription services and communal amenities, demand transparent tracking and proportional distribution based on usage to optimize budget management in co-living settings.

Time-banked Household Services

Time-banked household services reduce traditional household expenses by allowing members to exchange services based on time instead of money, promoting cost-efficiency and community collaboration. This shared economy model minimizes reliance on cash transactions, lowers overall expenditure, and optimizes resource utilization within households.

On-demand Shared Appliance Costs

On-demand shared appliance costs in the shared economy model significantly reduce household expenses by enabling users to access high-cost appliances only when needed, eliminating the burden of full ownership. This approach optimizes budget allocation by transforming fixed appliance expenses into variable, usage-based costs, enhancing financial flexibility for households.

Household Expenses vs Shared Economy Expenses for Expense Infographic

moneydiff.com

moneydiff.com