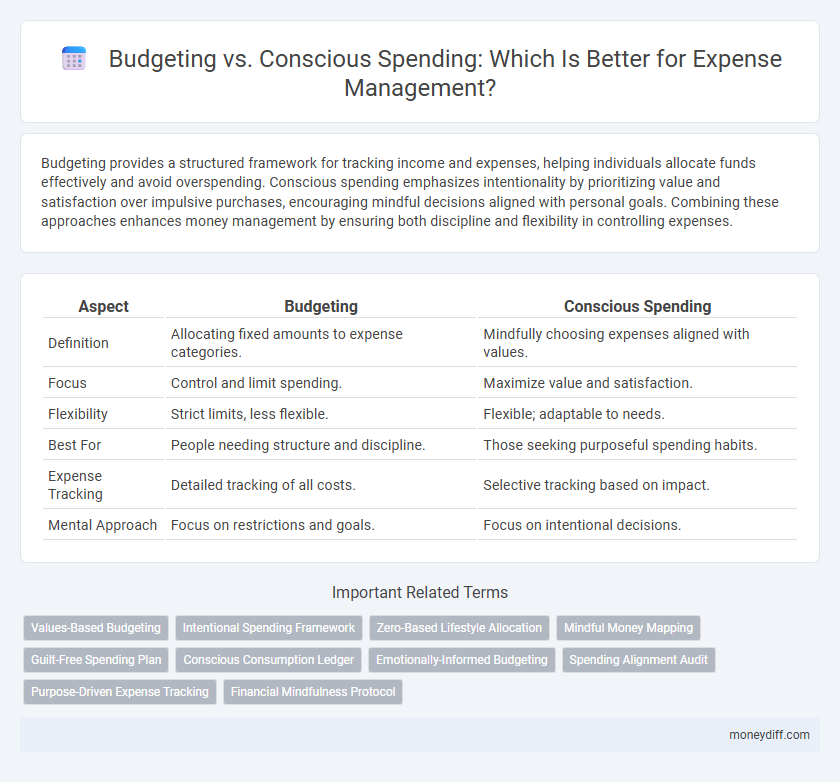

Budgeting provides a structured framework for tracking income and expenses, helping individuals allocate funds effectively and avoid overspending. Conscious spending emphasizes intentionality by prioritizing value and satisfaction over impulsive purchases, encouraging mindful decisions aligned with personal goals. Combining these approaches enhances money management by ensuring both discipline and flexibility in controlling expenses.

Table of Comparison

| Aspect | Budgeting | Conscious Spending |

|---|---|---|

| Definition | Allocating fixed amounts to expense categories. | Mindfully choosing expenses aligned with values. |

| Focus | Control and limit spending. | Maximize value and satisfaction. |

| Flexibility | Strict limits, less flexible. | Flexible; adaptable to needs. |

| Best For | People needing structure and discipline. | Those seeking purposeful spending habits. |

| Expense Tracking | Detailed tracking of all costs. | Selective tracking based on impact. |

| Mental Approach | Focus on restrictions and goals. | Focus on intentional decisions. |

Understanding Budgeting: A Traditional Approach

Budgeting involves creating a detailed plan that allocates income to various expense categories to control spending and achieve financial goals. It emphasizes tracking every dollar and setting strict limits to avoid overspending, often using spreadsheets or apps for accuracy. This traditional approach prioritizes discipline and foresight to maintain financial stability and prevent debt.

What is Conscious Spending?

Conscious spending is a money management approach that prioritizes intentional and value-driven purchases over strict financial limitations. Unlike traditional budgeting, which allocates fixed amounts to expense categories, conscious spending encourages individuals to evaluate the true worth and impact of each expense. This method fosters financial freedom by aligning spending habits with personal values and long-term goals.

Key Differences Between Budgeting and Conscious Spending

Budgeting involves setting specific financial limits and allocating funds across categories to control expenses, while conscious spending emphasizes mindful decision-making aligned with personal values and priorities. Budgeting relies on structured plans and tracking tools to avoid overspending, whereas conscious spending encourages evaluating purchases based on their true impact and long-term satisfaction. Both approaches aim to improve money management, but budgeting is more rigid and quantitative, whereas conscious spending is flexible and qualitative.

Benefits of Budgeting for Money Management

Budgeting provides a structured framework for tracking income and expenses, enabling precise control over financial resources and preventing overspending. It helps identify spending patterns and allocate funds toward savings and essential needs, promoting long-term financial stability. Establishing a budget supports goal-setting and disciplined money management, reducing financial stress and enhancing overall economic well-being.

Advantages of Conscious Spending Techniques

Conscious spending techniques prioritize aligning purchases with personal values, leading to greater financial satisfaction and reduced impulse buying. This approach enhances awareness of spending habits, promoting better control over discretionary expenses and long-term savings growth. By focusing on purposeful expenditure, individuals can achieve improved money management and avoid the rigidity often associated with traditional budgeting.

Common Challenges in Budgeting

Common challenges in budgeting include underestimating expenses, rigid categories that don't account for lifestyle changes, and lack of motivation to track every transaction. Overspending in discretionary areas and ignoring small, frequent purchases often derail budgets, leading to financial stress. Conscious spending encourages awareness and intentionality in money use, helping individuals align spending habits with personal values to overcome these budgeting pitfalls.

How to Practice Conscious Spending Effectively

To practice conscious spending effectively, track your expenses meticulously and prioritize purchases that align with your core values and long-term financial goals. Implement regular reviews of your spending habits to identify unnecessary expenses and allocate funds toward meaningful experiences or essential needs. Utilize budgeting tools that emphasize mindful allocation rather than strict restrictions, fostering a balanced approach to money management.

Budgeting Tools vs. Conscious Spending Tools

Budgeting tools offer structured frameworks for tracking income and expenses, enabling users to allocate funds to specific categories and monitor financial goals. Conscious spending tools emphasize mindfulness, helping individuals evaluate the value and purpose of each purchase to reduce impulsive buying and increase overall satisfaction. Combining budgeting software like YNAB or Mint with spending mindfulness apps enhances financial discipline and promotes sustainable money management strategies.

Choosing the Right Method for Your Financial Goals

Budgeting provides a structured framework with predefined spending limits that helps track expenses and ensures savings targets are met. Conscious spending emphasizes mindful purchases aligned with personal values, prioritizing quality over quantity to enhance financial satisfaction. Selecting the right method depends on individual financial goals, whether maximizing savings with strict budgets or fostering intentional expenditures through conscious spending habits.

Integrating Budgeting and Conscious Spending for Optimal Results

Integrating budgeting with conscious spending enhances money management by promoting financial awareness and intentional allocation of resources. Budgeting provides a structured framework for tracking income and expenses, while conscious spending encourages prioritizing purchases that align with personal values and long-term goals. Combining these strategies optimizes financial discipline, reduces impulsive spending, and fosters sustainable wealth growth.

Related Important Terms

Values-Based Budgeting

Values-based budgeting aligns financial decisions with personal priorities, enhancing intentional money management and reducing impulsive expenses. Conscious spending emphasizes awareness of purchases, promoting deliberate allocation of resources to maximize satisfaction and long-term financial well-being.

Intentional Spending Framework

The Intentional Spending Framework emphasizes aligning expenses with core values and long-term goals rather than rigid budgeting constraints, fostering mindful financial decisions that enhance personal satisfaction. Conscious spending encourages prioritizing meaningful expenditures and reducing waste, optimizing money management through deliberate choice rather than strict budget adherence.

Zero-Based Lifestyle Allocation

Zero-Based Lifestyle Allocation enhances money management by ensuring every dollar is purposefully assigned, eliminating waste through precise budgeting aligned with conscious spending habits. This method promotes financial clarity and control, balancing expenses with intentional priorities for sustainable economic well-being.

Mindful Money Mapping

Mindful Money Mapping enhances money management by aligning spending habits with personal values, promoting conscious spending rather than rigid budgeting. This approach fosters intentional financial decisions that reduce impulsive purchases and optimize resource allocation for long-term goals.

Guilt-Free Spending Plan

A guilt-free spending plan emphasizes prioritizing conscious spending by allocating funds toward meaningful expenses without rigid budget restrictions, thereby reducing financial stress and promoting mindful money management. This approach encourages intentional choices that align with personal values, fostering a balanced relationship with money while maintaining overall financial health.

Conscious Consumption Ledger

Conscious Consumption Ledger emphasizes intentional spending by tracking purchases aligned with personal values, promoting mindful money management over rigid budgeting. This approach enhances financial awareness and prioritizes meaningful expenses, leading to sustainable habits and improved financial well-being.

Emotionally-Informed Budgeting

Emotionally-informed budgeting integrates personal values and emotional triggers into financial planning, enhancing commitment to spending limits and reducing impulsive purchases. This approach fosters a healthier relationship with money by aligning budgets with individual motivations and emotional well-being, leading to more sustainable money management.

Spending Alignment Audit

Spending Alignment Audits compare budgeted amounts to actual expenditures, identifying areas where spending aligns or deviates from financial goals. This process enhances money management by promoting conscious spending, ensuring resources support priorities and prevent unnecessary expenses.

Purpose-Driven Expense Tracking

Purpose-driven expense tracking enhances money management by focusing on conscious spending rather than rigid budgeting, allowing individuals to align expenditures with their core values and financial goals. This method prioritizes intentional financial decisions, resulting in more meaningful control over personal finances and reduced impulsive purchases.

Financial Mindfulness Protocol

Budgeting establishes strict financial limits, while conscious spending within the Financial Mindfulness Protocol emphasizes intentional choices aligned with personal values to enhance money management. This approach fosters awareness of spending habits, promoting financial well-being through mindful allocation of resources.

Budgeting vs Conscious spending for money management. Infographic

moneydiff.com

moneydiff.com